Geely's ZEEKR and Lynk & Co. integration marks a turning point in China's multi-brand auto strategy

![]() 11/21 2024

11/21 2024

![]() 473

473

Author | Shen Tianxiang

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

Geely Automobile has entered a new phase of strategic transformation, and Geely's multi-brand strategy has also entered a new adjustment cycle.

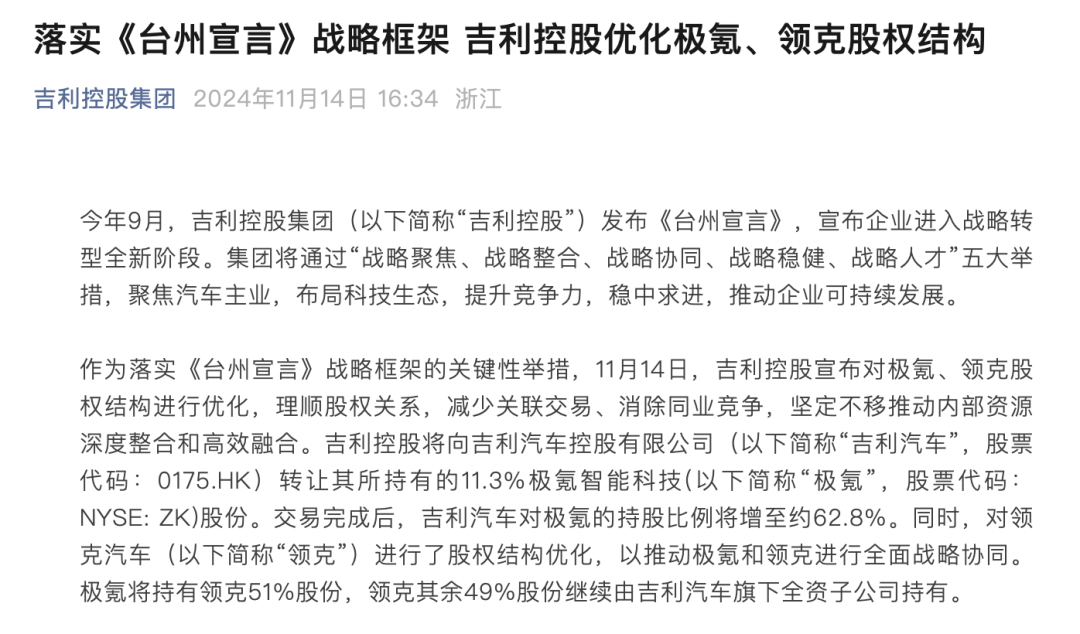

On November 14, 2024, the day before the Guangzhou Auto Show, Geely Holding announced the optimization of the shareholding structures of ZEEKR and Lynk & Co., promoting comprehensive strategic synergy between the two brands.

This is part of a significant turning point in Geely's new energy business.

According to official news, Geely Holding transferred 11.3% of its shares in ZEEKR Intelligence Technology (stock code: NYSE:ZK) to Geely Automobile Holdings Limited (stock code: 0175.HK).

After the transaction, Geely Automobile's shareholding in ZEEKR will increase to approximately 62.8%. At the same time, the shareholding structure of Lynk & Co. was optimized, with ZEEKR acquiring a 51% stake, while the remaining 49% continues to be held by a wholly-owned subsidiary of Geely Automobile.

Lynk & Co. was originally a joint venture established by Geely Holding, Geely Automobile, and Volvo Cars, with the former holding 20% of the shares, Geely Automobile holding 50%, and Volvo Cars holding 30%.

In this transaction, Volvo Cars announced that it would sell its 30% stake in Lynk & Co. to ZEEKR; Geely Holding transferred its 20% stake in Lynk & Co. to ZEEKR; and ZEEKR ultimately achieved a 51% stake in Lynk & Co. through capital increases.

'The reason for acquiring Geely Holding's shares is that the parent company's mission as a shareholder of both companies has been fulfilled. Meanwhile, the cooperation between Geely Automobile and Volvo also requires strategic adjustments. Volvo has completed its mission as a shareholder of Lynk & Co. at this stage,' said Gui Shengyue, CEO and Executive Director of Geely Automobile Holdings Limited, at the third-quarter financial report meeting.

Although Volvo has exited its equity relationship with Lynk & Co., it will continue to provide support and assistance to Lynk & Co.'s development overseas, particularly in Europe. Since last year, Lynk & Co.'s sales in Europe have been fully cooperative with Volvo.

Gui Shengyue believes that the integration of ZEEKR and Lynk & Co. has five main benefits.

Firstly, it eliminates intra-industry competition. Secondly, it complements brand positioning and enhances product mix. Thirdly, it unifies product architecture and realizes complementary R&D capabilities. Fourthly, it complements sales networks and expands user reach. Fifthly, it achieves economies of scale and continuously promotes cost reduction and efficiency enhancement.

What the outside world cares most about is how the two brands will differentiate and operate.

In response, An Conghui, President of Geely Holding Group and CEO of ZEEKR Intelligence Technology, said, 'In terms of branding, the two brands will definitely maintain a dual-brand strategy and remain relatively independent in the market after their merger. The two brands have clear and distinct positioning in terms of price and values, enabling maximum market coverage.'

In terms of products, there will also be differentiation. ZEEKR focuses on medium and large vehicles, while Lynk & Co. targets small and medium vehicles. Specifically, Lynk & Co. focuses on pure electric vehicles for small cars and hybrid vehicles for medium cars; ZEEKR focuses on pure electric vehicles for medium cars and hybrid vehicles for large cars.

Two Declarations

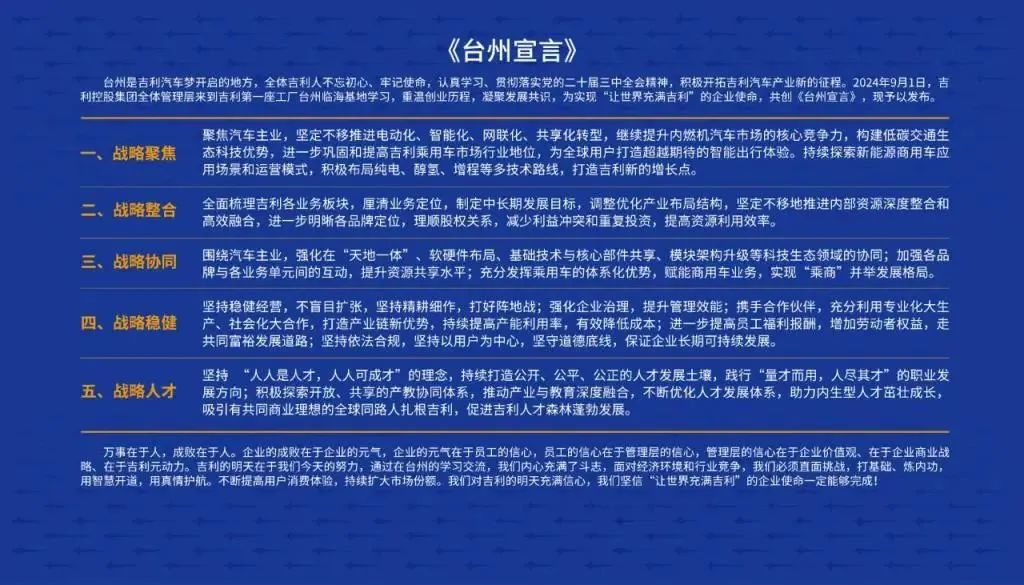

Two months ago, Geely Holding issued the 'Taizhou Declaration,' announcing that the enterprise had entered a new phase of strategic transformation. This declaration represents a development consensus reached after Geely Holding Group conducted a strategic review in response to the new global economic situation and industry competition landscape.

The core content is that Geely will focus on its main automotive business, deploy technological ecosystems, enhance competitiveness, and make steady progress through five initiatives: strategic focus, strategic integration, strategic synergy, strategic robustness, and strategic talent development, to accelerate the realization of its corporate mission of 'making the world full of Geely.'

The declaration proposes, 'Comprehensively reviewing Geely's various business segments, clarifying business positioning... promoting in-depth integration and efficient fusion of internal resources, further clarifying brand positioning, streamlining equity relationships, reducing conflicts of interest and duplicate investments, and improving resource utilization efficiency.'

The integration of ZEEKR and Lynk & Co. is a key initiative to implement the 'Taizhou Declaration.'

Li Shufu, Chairman of Geely Holding Group, believes that the 'Taizhou Declaration' is equally important to Geely as the 'Ningbo Declaration' issued in 2007.

The 'Ningbo Declaration' was a significant milestone in Geely Automobile's development history.

Before 2007, most Chinese brands, including Geely Automobile, adopted extensive development strategies, primarily relying on cost advantages to attract consumers by offering lower-priced vehicles.

At that time, Geely Automobile relied on its 'old trio' of Meiri, Haoqing, and Youliou, and sales doubled. However, Li Shufu believed that with the acceleration of globalization and intensified competition, relying on price wars would inevitably lead to development bottlenecks.

To further improve product quality, Geely Automobile decided to phase out production lines for these models and instead introduce new, technologically advanced models. It developed the 1.8L CVVT engine with independent intellectual property rights, which was first installed in the Vision model.

On May 18, 2007, the Geely Vision was launched. Li Shufu, at the engine plant of the Ningbo base, announced to over 100 dealers from across the country, 'Geely has entered a period of strategic transformation, shifting from 'selling cheaply' to 'leading in technology.'

Subsequently, the 'old trio' was phased out of the market, replaced by the 'new trio' of Vision, Jingle, and Freecruiser. Immediately thereafter, drawing on the successful multi-brand operations of foreign companies and combining its own characteristics, Geely planned three sub-brands—Global Eagle, England, and Dihao—after a series of research and analysis.

However, after several years of development, the first multi-brand attempt ended in failure. In 2014, Geely announced the cancellation of sub-brands, implementing a single Geely brand while entering a new phase of strategic transformation. It released the 3.0 Premium Car Strategy and proposed the brand mission of 'building premium cars for everyone.'

In these years, Geely Automobile has fully implemented the 'Ningbo Declaration,' achieving technological and brand advancements.

For example, in 2009, it acquired Australia's DSI Automatic Transmission Company, the world's second-largest automatic transmission company; in 2010, it invested and acquired Swedish luxury brand Volvo Cars; and in 2013, it wholly acquired the UK's LEVC, helping to enhance its core technology, component R&D system, and quality.

It is precisely because of these initiatives that Geely has launched popular premium models such as Boyue and Borui, and jointly developed the CMA and SPA architectures with Volvo, giving birth to Lynk & Co. and ZEEKR...

Even now, the 'Ningbo Declaration' continues to play a crucial role. Even as the industry generally engages in price wars, Geely Automobile refuses to follow suit, opting instead for high quality and fighting for high value, adhering to its commitment to building premium cars.

Today, with the powerful R&D, technological, and channel capabilities of the entire Geely Automobile Group, Geely's high-quality premium electric vehicle—Geely Galaxy—stands out in the new energy era.

After the issuance of the 'Taizhou Declaration,' the positioning of each brand under the Geely Automobile Group will become increasingly clear, continuously seeking synergistic development while expanding market share in various segments.

ZEEKR is positioned as a global luxury technology brand, covering the high-end luxury market with its brand tonality of luxury, excellence, and technology.

Lynk & Co. is positioned as a global mid-to-high-end new energy brand, covering the mid-to-high-end market with its brand tonality of trendiness, sports, and individuality.

Geely Galaxy and China Star are positioned as mainstream brands, covering the mainstream market with their brand tonality of practicality, quality, and safety.

According to the plan, ZEEKR and Lynk & Co. will strengthen synergy in technology, products, supply chains, manufacturing, marketing and services, and international market expansion, aiming to enhance technological innovation capabilities and stimulate economies of scale. The goal is to transform ZEEKR and Lynk & Co. into a leading global high-end luxury new energy automobile group with annual production and sales of millions by the end of 2026.

Thus, the 'Taizhou Declaration' has become a turning point for Geely Automobile's new energy business to take off.

The Industry Enters a Period of Integration

Over the past two years, Geely Automobile has been integrating its supply chain and SQE, achieving notable results. With the equity relationships streamlined, integration efficiency will improve.

After the issuance of the 'Taizhou Declaration,' Geely Automobile initiated multiple integration actions.

On October 9, Gan Jiayue, CEO of Geely Automobile Group, announced at the launch of the Geely Galaxy Star Wish that Geometry would be merged into the Galaxy brand. This was the first step in implementing the 'Taizhou Declaration.'

On October 21, Geely Automobile announced the acquisition of Ningbo Passenger Vehicles, significantly reducing related-party transactions within Geely Automobile.

On November 14, Geely Automobile acquired the ZEEKR shares held by its parent company, integrating Lynk & Co. with ZEEKR.

Media reports also revealed that Radar, the new energy pickup truck brand under Geely Holding Group (parallel to Geely, ZEEKR, and other brands), will be integrated into Geely Automobile Group. Additionally, Geely will continue to promote the integration of LEVC (E-verge) and Geely Galaxy.

To some extent, the timing of the issuance of the 'Ningbo Declaration' and the 'Taizhou Declaration' is similar—both occurred during periods of global economic turbulence and automotive industry transformation.

'Relying on a favorable external environment, Geely Automobile has continuously expanded over the past few decades. Now, to adapt to the general trend, it must streamline operations, focus resources, and form a concerted effort to enhance competitiveness through integration centered on its main business,' said Li Shufu when issuing the 'Taizhou Declaration.'

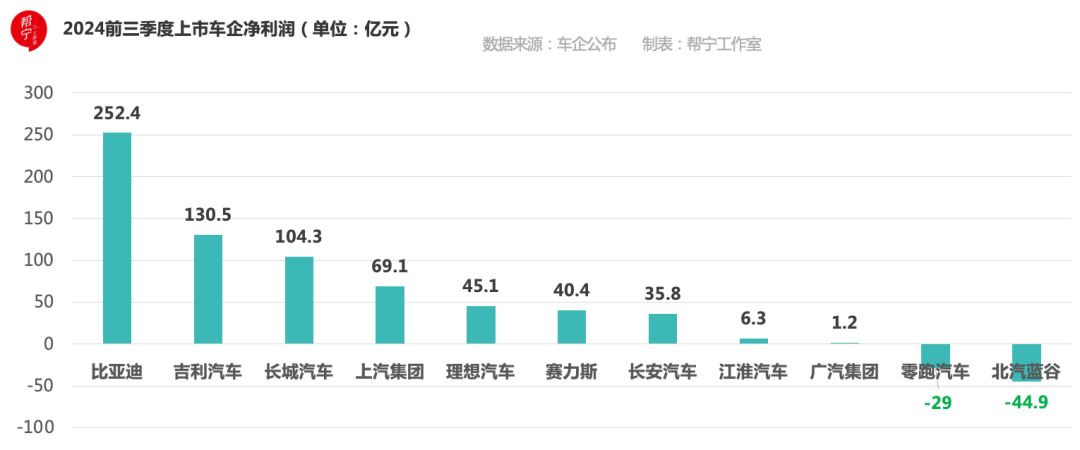

In the first three quarters of this year, Geely Automobile's cumulative profit attributable to shareholders was 13.05 billion yuan, a year-on-year increase of 358%. Cumulative net profit attributable to shareholders was 6.13 billion yuan, a year-on-year increase of 115%.

Moreover, for Geely Automobile, the most significant aspect of the third-quarter financial report was the turnaround in the new energy segment. According to Gui Shengyue, under Hong Kong accounting standards, ZEEKR is no longer loss-making, and the new products in the Geely Galaxy series were profitable upon launch.

Looking at the entire industry, there are not many enterprises that have achieved profits of tens of billions, and even fewer have profitable new energy segments. Of course, for Geely Automobile to fully achieve a transition to new energy, turning a profit is only the first step towards success.

Currently, to achieve ultimate victory, automakers must rely on technological and cost advantages. As Gan Jiayue said, 'Competition among enterprises is essentially competition among products, and competition among products is competition on cost, which ultimately boils down to competition on technology.'

Chinese automotive brands are entering the new energy market with multi-brand strategies. Unlike the fuel vehicle market, new energy represents the best opportunity for Chinese automotive brands to overtake competitors and move upwards. However, there are various issues in multi-brand development, such as duplicate investments, resource waste, and internal product consumption.

Admittedly, the ideal state for a well-managed multi-brand strategy should involve resource sharing to significantly reduce costs.

As early as 2022, Great Wall Motors conducted a brand integration, returning to 'One Great Wall,' including integrating product brands into three marketing organizations in China: the first combining WEY and Tank, the second combining ORA and Saloon, and the third combining Haval and Pickup.

This year, Great Wall Motors integrated again. Early this year, media reports revealed that Great Wall Motors planned to relaunch the Saloon brand and integrate it under the WEY brand, but there have been no significant actions to date. In early October, the ORA Auto App announced that it would cease operations by the end of this year and migrate to the Great Wall Motors App. There are also reports that ORA may be integrated into the Haval brand in the future.

On October 25, GAC Group announced that its headquarters would relocate to Panyu Auto City, where GAC Trumpchi, GAC Aion, and GAC R&D Institute are located, on November 2 this year. This move aims to strengthen the management and operation of its independent brands.

Simultaneously, three departments were established—Product Headquarters, Finance Headquarters, and Procurement Headquarters—with the reform fully completed by January 1, 2025. Each functional department will be merged or divided based on actual circumstances, ensuring the relatively independent operation of Aion while maximizing organizational consolidation and streamlining processes to enhance efficiency and reduce costs.

On October 28, Feifan Automobile, under SAIC Group, returned to SAIC Roewe after 'flying solo' for three years. Feifan Automobile's 'R' logo will assume the role of the premium series within the Roewe brand, with the two brands deeply integrating in R&D, sales, services, and other areas.

There are some similar integrations. For example, in August last year, Dongfeng Motor Corporation announced a major management system adjustment to its Dongfeng self-owned passenger vehicle business, with headquarters directly operating and the group integratedly managing three major product series brands under the "Dongfeng" brand, including Dongfeng Fengshen, Dongfeng eπ, and Dongfeng Nano.

After the early-stage multi-brand expansion, Chinese auto brands are currently undergoing integration and focus. The multi-brand strategy has shifted from a period of rapid expansion to a period of contraction, and automakers are placing greater emphasis on coordinated development to reduce internal friction and waste.

In fact, the multi-brand strategy was originally an experiment. After testing, automakers make reasonable integrations based on the current situation. This does not mean that the multi-brand strategy has failed or that it is being abandoned. At this stage, the multi-brand strategy is still one of the important means for Chinese auto brands to explore upwards.