Losing 100,000 yuan per car sold, is Li Bin of NIO panicking?

![]() 11/25 2024

11/25 2024

![]() 577

577

NIO has the highest unit price among electric vehicles, but why is its profitability inferior to that of XPeng and Li Auto?

Written by: Lao Xie

Edited by: Chen Jiying

On the evening of November 20, NIO released its third-quarter financial report and delivery data. In Q3 2024, revenue amounted to 18.673 billion yuan, a 2% decrease year-on-year compared to Q3 2023, with a net loss of 5.142 billion yuan, representing an 11% year-on-year decline. From January to September this year, the cumulative revenue reached 46.028 billion yuan, a 19.5% increase year-on-year, while the cumulative net loss was 15.525 billion yuan, roughly the same as the previous year.

In terms of deliveries, 61,855 vehicles were delivered in Q3, an 11.6% increase over the previous year. Among them, 61,023 were under the NIO brand and 832 under the NIO Lido brand, with NIO continuing to dominate sales. From January to September this year, a total of 149,281 vehicles were delivered, a 35.7% increase year-on-year. NIO's sales growth rate is not low. In the first three quarters of this year, the cumulative wholesale sales of new energy vehicles in China increased by 32.5%. The sales growth rate of industry leader BYD was 32%, while NIO's sales growth rate was slightly higher than the industry average.

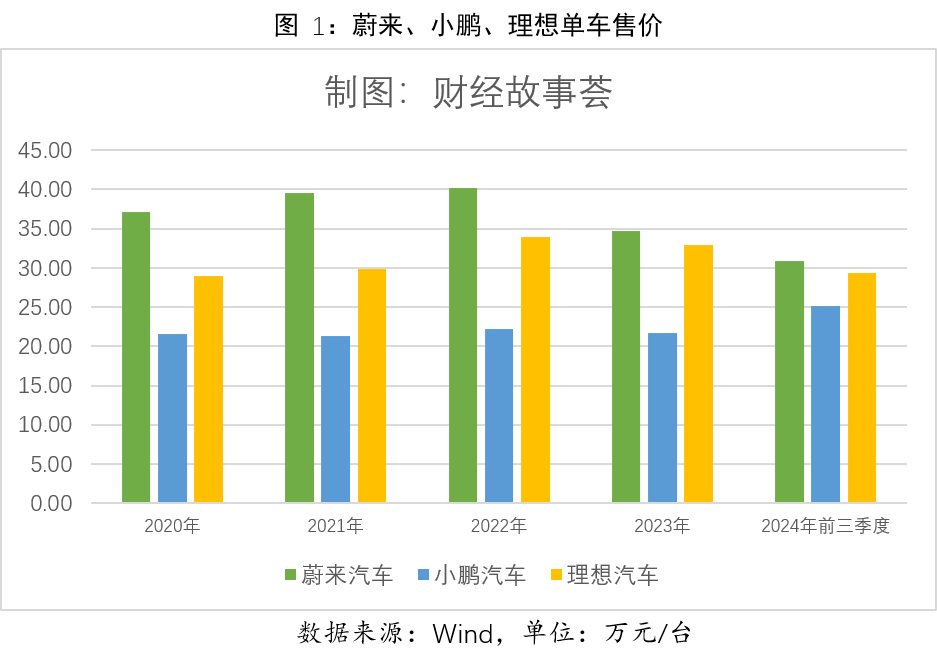

From the perspective of the average sales price per vehicle, NIO's average price is 308,300 yuan per vehicle, compared to 251,200 yuan for XPeng and 293,100 yuan for Li Auto, both of which are also positioned in the mid-to-high end market. NIO's average price is higher than both XPeng and Li Auto.

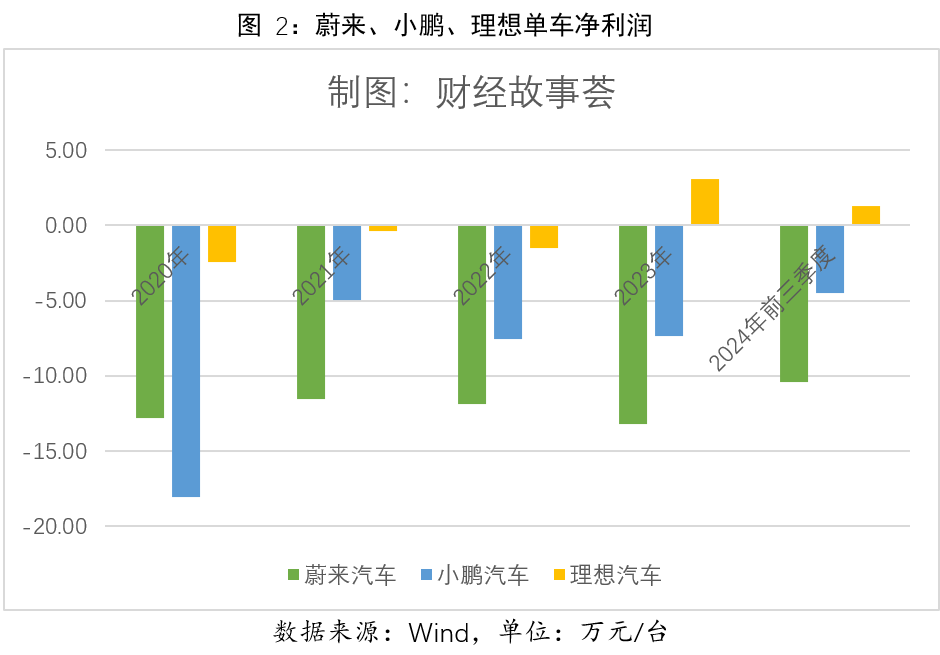

However, when considering the net profit per vehicle, NIO's net profit is -104,000 yuan per vehicle, indicating a loss of 104,000 yuan per sale. In comparison, XPeng loses 45,300 yuan per vehicle sold, while Li Auto earns a net profit of 13,200 yuan per vehicle sold. NIO's net profit per vehicle is significantly worse than the other two companies.

NIO's sales volume is not poor, nor is the average selling price low. So, why does it have an annual loss exceeding 10 billion yuan? This article attempts to dissect NIO's financial indicators from the perspectives of cost and expenses and compare them with XPeng and Li Auto, which started on the same footing.

I. Sales and revenue are not poor, but depreciation and costs erode profits

Breaking down the financial report, net profit = gross profit - expenses - non-recurring gains and losses - taxes. Disregarding taxes and non-recurring gains and losses, net profit is mainly affected by gross profit and expenses. Gross profit = operating revenue - operating costs. Analyzing the size and source of gross profit involves examining NIO's revenue and costs.

In terms of revenue sources, NIO's operating revenue for the first three quarters was 46 billion yuan, while XPeng and Li Auto's revenues were 24.76 billion yuan and 100.18 billion yuan, respectively. Although NIO's revenue is lower than Li Auto's, it is still significantly higher than XPeng's. However, for gross profit in the first three quarters, NIO, XPeng, and Li Auto recorded 4.18 billion yuan, 3.52 billion yuan, and 20.68 billion yuan, respectively. NIO's gross profit is only slightly higher than XPeng's, while Li Auto's gross profit far exceeds the other two.

NIO's revenue was 21.3 billion yuan higher than XPeng's, but its gross profit was only 660 million yuan more. It is evident that NIO's operating costs are much higher than XPeng's. Operating costs generally include production costs and fixed asset depreciation. The differences in car configurations and production costs between NIO and XPeng are insufficient to explain such a large disparity. A significant factor contributing to the cost difference lies in fixed asset depreciation and amortization.

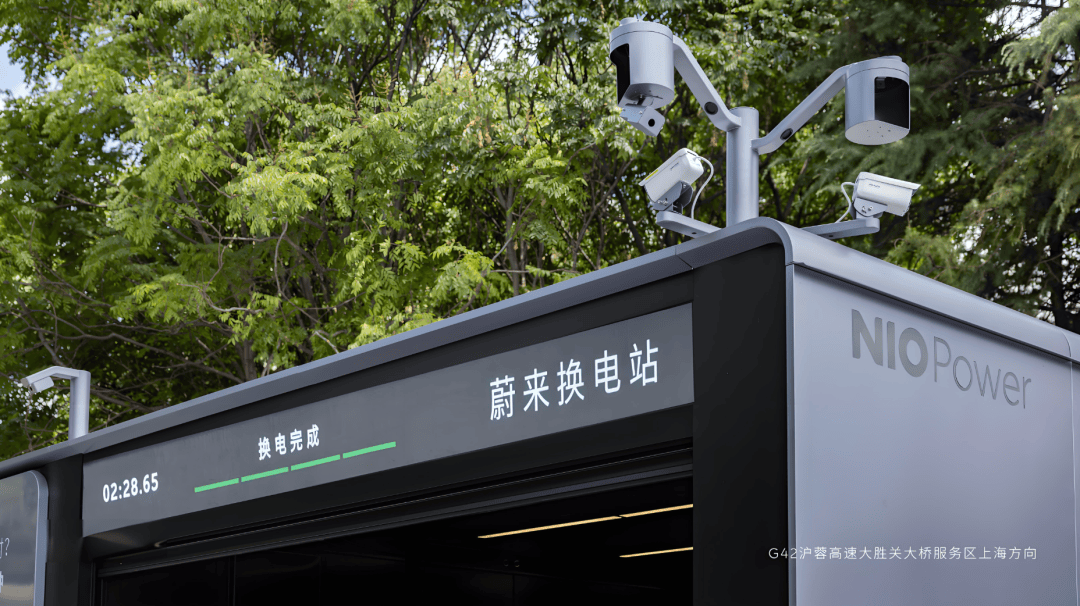

As is well-known, NIO has invested heavily in its battery swapping business. Since the first battery swapping station became operational in 2018, as of November this year, NIO has deployed 2,679 battery swapping stations nationwide. Although NIO has not disclosed independent financial data for its battery swapping business, industry estimates suggest that the average investment cost for NIO's fourth-generation battery swapping stations ranges from 2 to 3 million yuan. Earlier generations (1-3) had even higher battery and investment costs. The total investment cost for over 2,000 battery swapping stations should exceed 10 billion yuan.

From the perspective of fixed assets, as of the end of last year, NIO's fixed assets amounted to 24.847 billion yuan, while XPeng's were only 10.954 billion yuan. Despite similar sales volumes, NIO's fixed assets exceeded XPeng's by 13.8 billion yuan. Even when compared to Li Auto, NIO's fixed assets are larger. Last year, Li Auto sold 376,000 vehicles, more than double NIO's sales, yet its fixed assets at the end of the year were only 15.7 billion yuan, nearly 10 billion yuan less than NIO's. Although the capacity utilization rates of the three companies differ, and detailed fixed asset information such as production facilities is unavailable, a rough estimate of the over 10 billion yuan difference in fixed assets can be attributed to the fixed assets accumulated through the battery swapping business.

For manufacturing companies, inefficient assets invested can become a heavy burden on costs, requiring both operating expenses and fixed asset depreciation.

In this year's third-quarter financial report, none of the three companies disclosed the amount of fixed asset depreciation and amortization. According to last year's annual report data, NIO's total fixed asset depreciation and amortization expenses amounted to 4.907 billion yuan at the end of 2023, while XPeng's were only 2.107 billion yuan and Li Auto's were 1.805 billion yuan. NIO's depreciation and amortization expenses were nearly 3 billion yuan higher than those of XPeng and Li Auto. Without such a heavy burden of fixed asset depreciation, NIO's cost pressure would be significantly reduced. When converting fixed assets to sales per vehicle, the fixed assets invested behind each vehicle sold by NIO amount to 15.53 million yuan, compared to 7.82 million yuan for XPeng and 4.25 million yuan for Li Auto. The depreciation expense allocated to each vehicle sold by NIO is as high as over 30,600 yuan, while that of XPeng is only 15,000 yuan and Li Auto's is only 4,800 yuan.

From the perspective of gross profit per vehicle, in the first three quarters of this year, NIO, XPeng, and Li Auto's gross profit per vehicle was 28,000 yuan, 35,700 yuan, and 60,500 yuan, respectively. Despite leading in average sales price per vehicle, NIO lags behind in gross profit per vehicle due to its high costs. Delving deeper, the depreciation and amortization expenses arising from substantial fixed assets erode gross profit.

II. High sales and R&D expenses result in a loss of up to 100,000 yuan per vehicle

From gross profit to operating profit, there are two major filters: selling expenses and R&D expenses, on which NIO spends more than its peers.

Taking chip research and development, a key focus area, as an example, in September 2023, NIO unveiled its first self-developed lidar main control chip, the NX6031, at the Innovation Day. At the 2024 Innovation Day, NIO announced the successful tape-out of the Shenji NX9031, a 5NM autonomous driving chip. NIO has become the first domestic automaker to independently research and develop both autonomous driving chips and lidar chips. Both projects involve billions of yuan in investment.

In terms of R&D expenses, NIO invested 9.4 billion yuan in the first three quarters of this year, while XPeng invested only 4.45 billion yuan and Li Auto, with annual revenue exceeding 100 billion yuan, invested 8.66 billion yuan in R&D. Allocated to each vehicle, NIO's R&D expense per vehicle is as high as 63,000 yuan, compared to 45,200 yuan for XPeng and only 25,000 yuan for Li Auto.

NIO not only invests heavily in R&D but also in sales and administrative expenses. NIO's 174 user centers worldwide are located in urban landmarks, occupying large areas with luxurious decorations, providing customers with an excellent user experience and to some extent promoting sales growth. However, this comes at a cost of sales expenses far exceeding the industry average.

In the first three quarters of this year, NIO's sales and administrative expenses amounted to 10.86 billion yuan, compared to 4.6 billion yuan for XPeng and 9.15 billion yuan for Li Auto. Converted to sales costs per vehicle, NIO's sales expense per vehicle is as high as 72,800 yuan, compared to 46,600 yuan for XPeng and 26,800 yuan for Li Auto. NIO's sales expenses per vehicle are much higher than those of XPeng and Li Auto.

Lagging behind XPeng and Li Auto in gross profit per vehicle indicators and surpassing them in R&D and sales expenses per vehicle only exacerbates the net profit disparity.

III. Is turning a profit by 2026 credible?

During the Q3 2024 financial report performance exchange meeting, NIO's delivery guidance for the fourth quarter was 72,000 to 75,000 vehicles, a year-on-year increase of 43.9% to 49.9%. Revenue guidance for the fourth quarter ranged from 19.68 billion yuan to 20.38 billion yuan, a year-on-year increase of 15.0% to 19.2%. The sales guidance target is higher than the targets achieved in the first three quarters of this year, while the revenue guidance target is close to the revenue growth rate achieved in the first three quarters. The optimism about sales growth stems from expectations for the sub-brand NIO Lido.

During the recent Guangzhou Auto Show, Ai Tiecheng, President of NIO Lido, revealed sales figures for their latest product, the L60. He stated that orders for the L60 far exceeded expectations, with production orders extending into the first quarter of next year. The company plans to accelerate store openings and expand sales channels, aiming to achieve an average monthly sales target of 20,000 vehicles next year.

At this exchange meeting, NIO Chairman Li Bin pledged, "NIO is confident in achieving a 100% increase in sales next year" and "NIO will work towards achieving full-year profitability by 2026."

However, regarding the profitability node, Li Bin has changed his stance multiple times. As early as NIO's 2021 financial report conference call, Li Bin stated publicly that "NIO hopes to achieve full-year profitability in 2024." Now, this profitability target has been delayed by two years.

Currently, NIO recognizes the importance of improving gross profit margins. In the third quarter of this year, NIO's vehicle gross margin was 13.1%. NIO plans to increase its overall gross margin to 15% in the fourth quarter and gradually optimize it to reach 20% by next year, based on the 15% target.

Currently, the gross margin of the NIO Lido brand is only in the single digits. By 2025, the basic target for NIO Lido's gross margin is 10%, gradually increasing to 15%.

If NIO Lido can indeed meet its sales targets, and with the addition of NIO's third brand, "Firefly," to its product matrix, the scale effect of production and sales will increase, potentially spreading out fixed asset depreciation expenses and R&D costs per vehicle. This is likely to significantly improve cost and expense indicators.

Leading NIO out of the quagmire of losses as soon as possible is also a phased priority for Li Bin.

After all, as former Chinese richest man and fellow dreamer of new energy vehicles, Wang Jianlin once said that a business that does not make money is immoral. Wang Jianlin's investment alongside Dong Mingzhu, the iron lady of Gree Electric Appliances, in the new energy enterprise Yinlong New Energy has likely failed.