The EU cancels tariffs, and the price war in the automobile industry loses momentum to restart

![]() 11/27 2024

11/27 2024

![]() 610

610

In one year, many Chinese automakers have experienced a rollercoaster ride from heaven to hell and back to heaven.

For example, if SAIC Motor had not known about the impending agreement between China and Europe on new energy vehicle tariffs for electric cars, the MG brand it acquired in the UK would have lost its ability to sell in the European market due to the combined tariff rate of 47.6%. Losing sales in the European market would practically mean withdrawing from the automotive market.

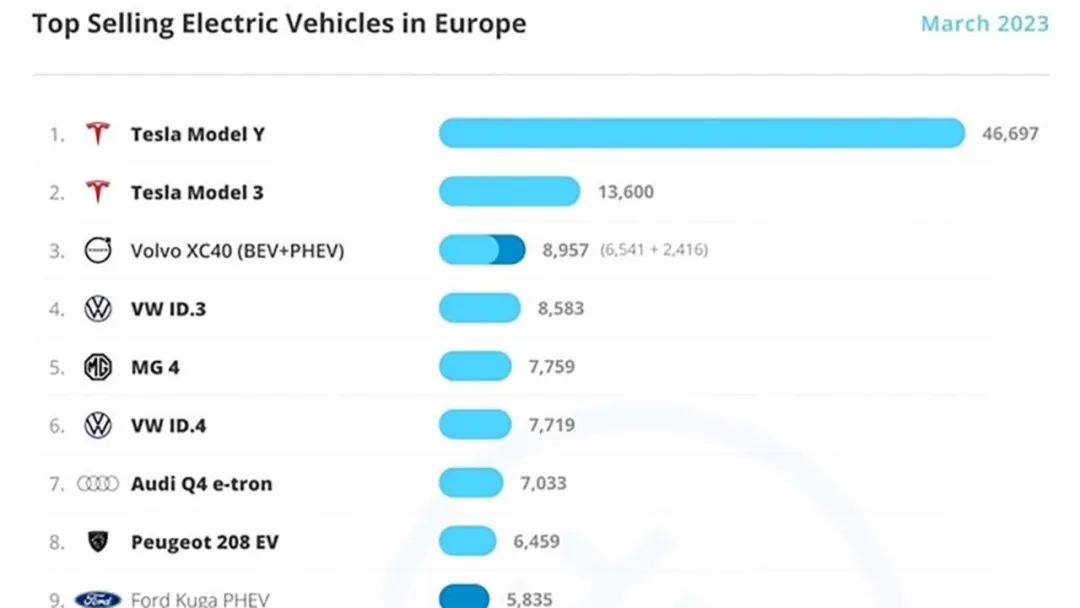

In 2023, MG sold 840,000 vehicles globally, with nearly 380,000 sold in 16 developed markets such as Western Europe and Australia. If the EU continued to increase tariffs on Chinese new energy vehicles, MG's best-selling model, the MG4 EV with an average price of 30,000 euros, would quickly lose competitiveness. Currently, the average price of similar models in the EU market is around 35,000 euros, directly nullifying MG's primary advantage.

Of course, MG is just one example. After more than a year of tug-of-war and public opinion battles from 2023 to the present, other automakers such as BYD, Geely's Lynk & Co and ZEEKR, as well as the rapidly rising NIO and many others aiming to break into the European market, have also suffered damage.

The main reason why automakers are accelerating their overseas expansion is self-evident: competition in the Chinese automotive market is too fierce. To secure more profits and opportunities, they must venture into blue ocean markets.

Cancel tariffs? What does China and Europe each have to offer?

This time, it's not just a rumor but a direct statement from officials of relevant institutions.

According to a foreign media report on November 23, Bernd Lange, chair of the European Parliament's trade committee, revealed in a recent interview with German TV station NTV that the EU and China are close to reaching a solution to cancel the additional import tariffs on electric vehicles from China. In other words, the additional tariffs will be lifted.

Furthermore, this news has been corroborated by multiple authoritative media outlets. CCTV's new media platform Yuyuantantan reported in November that China and Europe have reached a technical consensus on the price commitment framework and agreement implementation mechanism.

Notably, on November 24, 2024, Chery Automobile also launched production of its first model at a joint venture factory in Spain.

In other words, based on messages from all official and semi-official channels, once more specific details are finalized, the previous tariff war will come to an end. Chinese automakers can continue to seek to expand their market share in Europe, and even the combined sales of BYD, Geely, and MG could potentially exceed 500,000 vehicles per year.

Another positive aspect is that Chinese auto parts suppliers can also accelerate their overseas expansion. For example, Contemporary Amperex Technology Co. Limited (CATL) has secured over 40% of the battery supply for European automakers, while BYD's Fudi Battery and Guoxuan High-Tech, in which Volkswagen has invested, are also making significant strides. This is the core advantage of China's automotive industry on a global scale.

Therefore, if tariffs are ultimately canceled, it will be a tangible benefit for China's automotive industry. However, the question of why the EU is willing to make this concession is worth deeper consideration.

Cases of mutual tariff increases have occurred frequently recently, including but not limited to imports of poultry, meat, dairy products, and alcoholic beverages from Europe, as well as rumors of increased tariffs on high-displacement luxury cars.

From these perspectives alone, the value is not equal. On one hand, Chinese electric vehicles, priced at a minimum of 20,000 euros and expected to sell 500,000 units annually, are being exported. On the other hand, the output value on the other side is not commensurate.

All these changes are expected to stem from a new round of technological cooperation. Starting in late November, multiple media outlets reported the same news: According to a November 19 report by the Financial Times, the EU plans to use "market access" and subsidies for battery development as conditions in exchange for Chinese automakers building factories in Europe and "sharing intellectual property rights."

An EU official told the media that the subsidy program is currently a pilot and may expand to other EU subsidy schemes in the future. The next day, the Global Times wrote an article titled "GT Voice: No need to let reported ‘tech transfer’ disrupt China-EU ties," which literally translates to "there is no need to let reported technology transfers disrupt China-EU relations."

In fact, the stance of such media outlets also indirectly corroborates the accuracy of the core information. However, from this perspective, the next phase between China and Europe will likely involve more cooperation than confrontation. The so-called sharing of intellectual property rights can not only be understood as the EU learning from Chinese battery technology but also as joint development of related products and industries.

Therefore, it can be interpreted not only as a transaction of technology but also as sharing and cooperation in technology. Considering the new global situation and the inauguration of the new U.S. president in late January 2025, the EU clearly needs more cooperation to gain new leverage.

A positive aspect for consumers is that it will be difficult for price wars to restart. According to Yuyuantantan's report, two core pieces of information are that a consensus has been reached on the price commitment framework and agreement implementation mechanism. In other words, Chinese electric vehicles sold in Europe will have a minimum selling price set according to the relevant agreement, rather than being determined solely by the automakers' wishes.

In fact, in January 2024, BYD initiated a price war simultaneously in China and Germany. According to German automotive newspapers, BYD reduced prices in Germany by up to 15%. Specifically, BYD lowered the prices of the Atto 3 (Yuan PLUS), Dolphin, and Seal. After the price reduction, the starting price of the Atto 3 was below 40,000 euros, lower than major competitors like the Tesla Model Y (around 45,000 euros) and Volkswagen ID.4 (around 43,900 euros), and even lower than the Volkswagen ID.3.

The reason BYD had such a significant impact on the German automotive market, prompting a media response, was essentially due to the substantial price reductions. During the same period, as Germany announced the early cancellation of the 3,000-euro electric vehicle subsidy, Tesla and Volkswagen reduced prices to boost sales. While competitors' reductions were around 3,000 euros, BYD offered reductions exceeding 7,000 euros on popular models, creating a significant impact and providing new insights into the extent of the damage to Chinese automakers.

Of course, there is no deep connection between multinational business and the daily lives of ordinary people. For Chinese consumers like you and me, the greater significance lies in understanding the underlying logic and making informed decisions about our consumption behavior.

The reason why Chinese automakers are going overseas and why global automakers choose to expand overseas after establishing a firm footing locally is the same: they have developed corresponding technological and product advantages, enabling them to explore second and third battlegrounds to secure more profits and build stronger moats and vitality for their brands. At the same time, research and development costs are shared by the global market, maximizing industrial scale and cost reduction, which is the foundation for the survival and success of companies like Mercedes-Benz, BMW, Volkswagen, and Ferrari.

A successful and typical example of a Chinese automaker is undoubtedly Chery Automobile. Although Chery Automobile is not publicly listed and does not need to disclose financial data, simple calculations reveal that continuous investment in technological research and development is its primary source of strength. In 2023, Chery sold a total of 1.881 million vehicles, with 937,000 exported, accounting for nearly 50% of total sales. For 21 consecutive years, Chery has ranked first in passenger vehicle exports among Chinese brands, with an overseas user base of 3.35 million.

In many communication sessions with Chery Automobile, its executives often cite an example: Chery's success in going overseas is based on quality and technological advancement, not on competing on price. This year, an executive from Chery's EXEED brand revealed that "EXEED Starway has been exported to over 20 countries, with nearly 30,000 units sold overseas as of June this year, with an average selling price of 550,000 yuan in foreign markets."

The reason Chery Automobile can proudly declare that despite the challenging automotive market, opportunities still exist is essentially because, in a global context, it does not need to be confined to a single market to compete solely on price.

Many other automakers share the same logic as Chery or aspire to achieve similar results.

However, in the latest discussion about the EU canceling tariffs, the statement that "China can commit to providing electric vehicles to the EU at the lowest possible prices" is expected to have a chain reaction on China's automotive market and car prices in 2025.

For example, according to an official announcement in May this year, BYD's entry-level model, the Seagull, is expected to be launched in Europe in 2025. This news has put significant pressure on other European automakers.

Given the then-current tariff rates and meeting European standards, BYD executives expected the European price of the Seagull to be below 20,000 euros. The European market price of the Seagull is almost double its domestic price. However, despite the price doubling, the BYD Seagull still has a price advantage compared to local small electric vehicles in Europe.

Compared to models like Renault in the European market that offer similar configurations, the Seagull is still thousands of euros more expensive. However, a new mandatory pricing system may be introduced, which means that the price competitiveness of the Seagull will decrease, and on the other hand, its originally planned sales target will need to be adjusted downward due to the price increase.

Therefore, without the combination of a low price and large-scale production, the profit generated will also decrease. In other words, as automakers aim for a global strategy, with decreasing revenue, the difficulty of reigniting a price war in the most competitive domestic market will increase, and the intensity of such a war will decrease.

After all, having aces and bullets up one's sleeve is the key to long-term competition.

In fact, since the second half of 2024, as the global automotive consumption scale begins to shrink, we can see around us that more and more price wars are following subsidy policies such as trade-ins, far removed from the direct capital injections by automakers to intensify price wars and price reductions in 2023.

Final Thoughts

There are many typical examples. For instance, in the latest financial report of XPeng Motors, the best-selling low-priced XPeng MONA M03 did significantly increase sales figures but also directly lowered the overall average transaction price, without yielding good profit data. It still relies on high-profit models like XPeng P7+ with outstanding intelligent driving technology advantages to achieve loss prevention and even subsequent profitability.

The overall situation is largely set. The next point of contention between China and Europe in terms of tariffs will undoubtedly be round after round of negotiations on the "minimum selling price of Chinese electric vehicles," which will simultaneously affect whether Chinese and European consumers will be caught in a new round of intense price wars, making it an unavoidable primary issue.