Will Huawei replicate another auto company worth RMB 100 billion?

![]() 11/27 2024

11/27 2024

![]() 652

652

Huawei moves, igniting JAC.

On November 26, HarmonyOS Intelligent Driving's "ZunJie" ( Zunjie ) was launched, featuring various top-tier configurations. Prior to this, JAC Motors' share price had already surged, with its total market value exceeding RMB 100 billion during the year, even surpassing its former partner NIO.

With Thalys preceding it, JAC, now 60 years old, aims to re-enter the automotive circle by closely collaborating with Huawei.

【ZunJie Launches, Share Price Doubles】

"Surpassing Rolls-Royce," Yu Chengdong's passionate call-out made ZunJie one of the most talked-about car models recently.

Named "ZunJie S800," this model is priced between RMB 1 million and RMB 1.5 million, with a length exceeding 5.4 meters. It is the first to use the Tuling Dragon platform, featuring a galaxy-style light strip design and a dual-tone silver and purple color scheme, all highlighting its ultra-luxury positioning. Unlike WenJie, XiangJie, and ZhiJie, ZunJie is clearly targeting Rolls-Royce.

News of ZunJie first emerged from a conversation.

On July 15, at Huawei's Songshan Lake European Town, a high-level conversation took place between Yu Chengdong and popular livestreamer Dong Yuhui.

During the conversation, Yu Chengdong revealed an upcoming move by HarmonyOS Intelligent Driving—Huawei's fourth smart car brand, ZunJie, would be a collaboration with JAC. This model will directly compete with ultra-luxury brands like Maybach and Rolls-Royce, priced above RMB 1 million.

On November 14, HarmonyOS Intelligent Driving's official Weibo account announced that ZunJie would make its debut at the 2024 Guangzhou Auto Show. Earlier reports indicated that the two parties would jointly enter the million-yuan sedan and MPV markets, producing through JAC's X6 platform with an annual production capacity of 35,000 units.

As various pieces of information about ZunJie continue to surface, JAC's share price has soared, rising 70% in the past two months. From its year-to-date low to the high on November 12, it surged 3.3 times, with a market value exceeding RMB 100 billion, ranking ninth among domestically listed auto companies (as of November 12) and even surpassing its former partner NIO.

The Chinese million-yuan luxury car market has long been dominated by foreign brands, with Bentley, Rolls-Royce, Maybach, BMW 7 Series, Mercedes-Benz S-Class, and Porsche being the top players in this segment.

Due to technological gaps, lack of experience, and insufficient brand recognition, few Chinese auto companies have challenged this status quo. The true game-changer was BYD's Yangwang U8, which once topped domestic sales of million-yuan luxury cars, making rivals like the Mercedes-Benz GLS, Maybach, Cayenne, and BMW 7 Series "look up" in admiration. Its ability to turn in place and walk on water garnered significant attention.

▲Source: Yiche Bang

BYD's best-selling Qin PLUS has an average selling price of RMB 130,000, while the Yangwang U8 has a landing price of RMB 1,221,600. Selling one Yangwang U8 is equivalent to selling ten Qin PLUS. Since its launch, BYD has earned over RMB 10 billion from Yangwang U8, significantly enhancing its brand image.

The Chinese luxury car market was once defined by foreign brands, but in the era of new energy vehicles, slow-transforming foreign brands have shown signs of decline in the ultra-high-end market. Porsche, Ferrari, Aston Martin, and Maserati have seen declines in sales in China, providing opportunities for Chinese brands to overtake.

With the success of Yangwang U8, HarmonyOS Intelligent Driving is undoubtedly one of the most capable players in the race to challenge the million-yuan luxury car market.

【The Next Thalys?】

With Huawei's full support, Xiaokang Automobile has transformed into Thalys and is now a leading player in China's new energy vehicle industry, with a market value exceeding RMB 200 billion, second only to BYD and Great Wall Motors.

Following Thalys' success, JAC Motors has injected enormous imagination into the capital market.

Huawei's "car manufacturing" strategy is divided into the Hi mode and the Smart Selection mode, the latter being the current HarmonyOS Intelligent Driving. With the launch of ZunJie, HarmonyOS Intelligent Driving's "Four Realms" layout has become clear:

JAC + Huawei—ZunJie, positioned as a million-yuan executive luxury car, competing with Bentley, Rolls-Royce, and Maybach;

BAIC + Huawei—XiangJie, creating luxury cars priced between RMB 400,000 and RMB 500,000, targeting the BMW 5 Series and Mercedes-Benz E-Class;

Thalys + Huawei—WenJie, offering new energy intelligent SUVs priced between RMB 250,000 and RMB 500,000;

Chery + Huawei—ZhiJie, introducing youthful coupe-style new energy vehicles priced between RMB 200,000 and RMB 300,000.

Compared to the others, "Four Realms" each have distinct positions, with varying models and target market segments. ZunJie, created by JAC, is undoubtedly the highest-specification among the "Four Realms."

Currently, Thalys is the most successful within HarmonyOS Intelligent Driving. In particular, WenJie M9 broke through the BBA blockade, ranking first in sales of passenger vehicles priced above RMB 500,000 for six consecutive months, completely reshaping the market landscape.

▲Source: Yiche Bang

According to Thalys' sales report for the first nine months, with sales of 369,417 vehicles, the profit per vehicle reached RMB 10,930, marking a significant turnaround. Performance also surged, with earnings of RMB 4.038 billion in the first three quarters of this year, a year-on-year increase of 276.02%.

This indicates that the "Smart Selection" model has matured, becoming a model for cross-industry collaboration between auto companies and ICT enterprises, potentially smoothing the path for future collaborations with JAC.

ZunJie's ultra-high-end positioning suggests that Huawei will provide the highest-level and most advanced autonomous driving technology and intelligent cockpit system, marking a new era for Huawei's "car manufacturing."

Compared to popular and mid-sized cars, super luxury cars boast astonishing profitability. In the first half of this year, Ferrari earned a profit of RMB 5.998 billion from just 7,000 vehicles sold, with a profit of a staggering RMB 851,400 per vehicle.

If ZunJie becomes a dark horse as hoped, JAC will likely escape its current predicament.

Moreover, currently, Huawei only collaborates with four auto companies. Yu Chengdong previously stated, "Many auto companies want to collaborate with us, but Huawei doesn't have the resources to partner with others."

Currently, Thalys has become a template. Coupled with the active trading in the A-share market recently, JAC's share price has embarked on a pre-celebratory victory.

【Glory Gone, Turnaround Difficult】

On May 20, 1964, Chaohu Auto Parts Factory was established and later officially named JAC Motors, becoming Anhui's first automobile enterprise.

Over 60 years, JAC has witnessed and driven the rise of China's automotive industry, but past glory does not guarantee future success.

"Commemoration is about looking back, but also about creating the future.""

In 2004, on JAC's 40th anniversary, then-Chairman Zuo Yanan said that entering its forties, JAC must transition from being "alternative" to "mainstream." Continuing to focus primarily on commercial vehicles could lead to marginalization.

To this day, this warning still applies to JAC.

In the battle to transition from commercial to passenger vehicles, JAC briefly shone with the Refeng S3 and Refeng S2, even outshining brands like Haval and Geely. However, this momentum was short-lived. Poor design imitation and quality control led to a sharp decline in reputation, and Refeng was soon forgotten.

With difficulty in making breakthroughs in independent research and development, the new leadership turned to collaboration. In 2016, JAC partnered with NIO to become its contract manufacturer; a year later, it joined forces with Volkswagen to establish "JAC Volkswagen," China's third joint venture with Volkswagen, launching the new brand SOL E20X, which failed to make a significant impact.

In 2020, Volkswagen acquired JAC's 50% stake in JAC Volkswagen for EUR 1 billion, increasing its shareholding to 75%, forming an absolute controlling stake.

JAC Volkswagen was renamed Volkswagen (Anhui), with JAC's name being omitted, shattering dreams of returning to the mainstream market through Volkswagen.

Its collaboration with NIO also expired this year, but this "contract manufacturing" model, where JAC served as a subcontractor, did not save it. Statistics show that JAC, which "worked for" NIO, earned RMB 3 billion between 2018 and 2022. In 2023, it sold two factories to NIO, realizing a cash-out of RMB 4.5 billion.

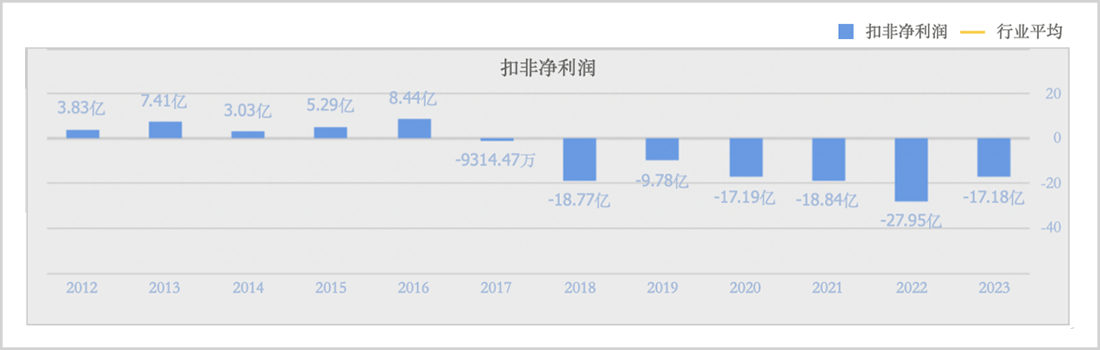

However, JAC has incurred non-deductible losses for seven consecutive years. Notably, during these seven years, it also received government subsidies totaling RMB 7.665 billion.

▲JAC Motors' non-deductible profit and loss, Source: iFinD, Company Financial Report

"With Volkswagen on one hand and NIO on the other," JAC failed to escape its predicament. In the first three quarters of this year, profit growth was primarily driven by asset disposals, with a non-deductible loss of RMB 231 million.

After parting ways with NIO, JAC returned to its original state, with auto sales declining this year, with only slight improvements in pickup trucks and multi-purpose commercial vehicles.

From its product mix, JAC remains a non-mainstream auto company, focusing on commercial vehicles like trucks, pickup trucks, and buses, with passenger vehicles concentrated in SUVs. The "strong in commercial, weak in passenger" imbalance has always been JAC's Achilles' heel.

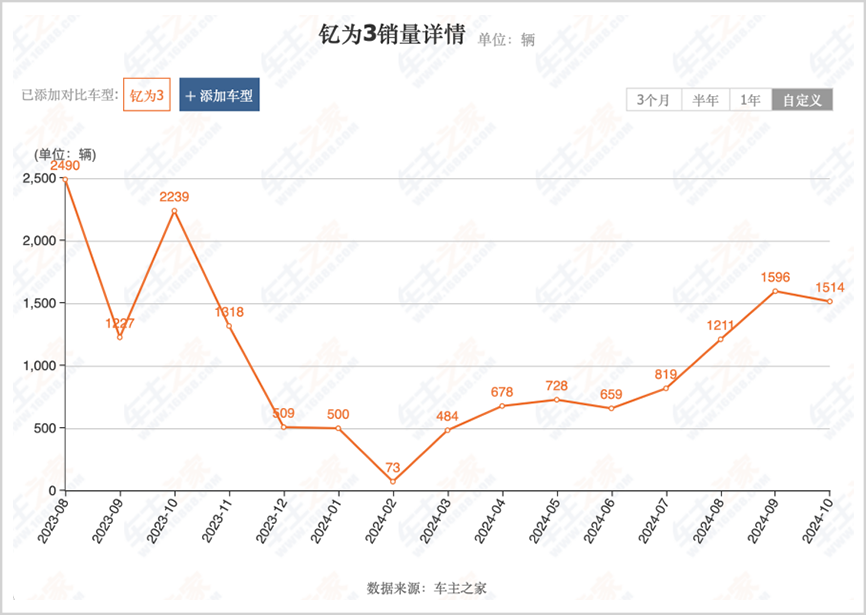

Especially in the transition to new energy vehicles, JAC's YIWEI brand was seen as "the hope of the village," but its products target the A0-class electric vehicle market, struggling with innovation and low quality. Relying on such a miniature vehicle for a turnaround is extremely difficult, especially in a market where the Hongguang MINI sells over 30,000 units per month.

Although Xiaokang previously focused on microvans, it was able to completely transform after collaborating with Huawei, giving JAC considerable confidence.

However, establishing a firm foothold in the million-yuan luxury car market will not be easy. On the one hand, luxury car owners place great emphasis on brand image, and JAC obviously lacks a luxury car gene and manufacturing experience. On the other hand, while luxury cars have high unit prices, sales volumes are inherently low, making it difficult to achieve economies of scale.

Furthermore, domestic auto companies' attempts at high-end transformation towards luxury cars have largely failed. Yangwang U8 initially impressed but later faltered, currently selling around 260 units per month. Its successor, Yangwang U9, could not continue the miracle, selling fewer than 20 units in October.

Tesla's three-step strategy first introduced expensive and high-end products (Roadster) to establish its premium brand image but ultimately relied on cost-effective, best-selling models for profit.

Currently, JAC is in its twilight years. Although its alliance with Huawei has caused its share price to soar, its foundation remains unstable. If ZunJie fails to meet expectations, a share price collapse could occur at any moment.

Disclaimer

This article involves content related to listed companies, based on the author's personal analysis and judgment of information publicly disclosed by the listed companies in accordance with legal requirements (including but not limited to interim announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice. Market Value Watch bears no responsibility for any actions taken based on this article.

——END——