In addition to being full of 'chicken soup', Li Bin's internal letter also reveals NIO's arduous tasks

![]() 11/27 2024

11/27 2024

![]() 460

460

This year can be said to be NIO's least 'sincere' year, with only the new NIO ET7 mid-cycle refresh model (excluding sub-brands like Letao) launched from the beginning of the year to present.

Facing fierce market competition, NIO, which adheres to the high-end pure electric vehicle market, has realized that it must attract as many consumers as possible to emerge victorious. Therefore, NIO's focus this year has gradually shifted from NIO itself to the development of sub-brands Letao and Firefly, as well as expanding the energy replenishment system – the launch of Letao L60 and the 'Power Up Every County' plan have already been announced. Although NIO has not released many new products this year, its market presence has not been low.

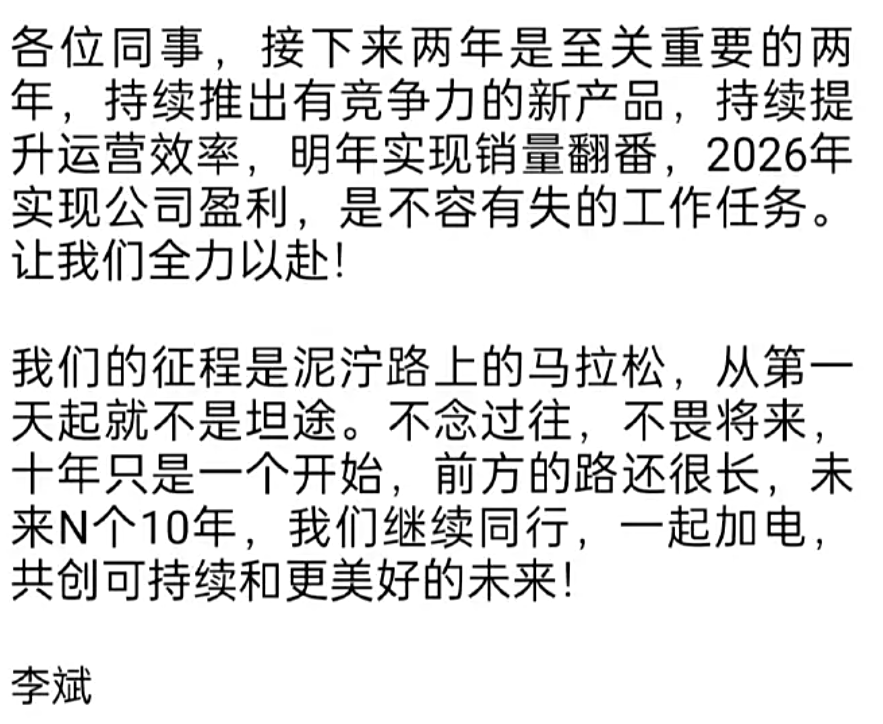

Screenshot: Li Bin's internal letter

On the 10th anniversary of the brand's inception, NIO founder Li Bin sent an internal letter to all employees. The letter is rich in 'chicken soup,' emphasizing how to 'stay true to one's original aspirations' and 'focus on action.' Relatively speaking, the work tasks proposed at the end are very noticeable: doubling sales next year, achieving company profitability by 2026, and demanding 'there is no room for error'.

Beyond the empty talk, NIO faces arduous tasks

The automotive supply chain is long, and car manufacturing is a task that requires 'focused action' and sustained investment over a long period. However, NIO's long-term task is one more than that of other automakers – the very costly energy replenishment system.

In late August, NIO officially announced the 'Power Up Every County' plan, which simply put, aims to provide energy replenishment facilities, including charging piles and battery swapping stations, in every county. Through seven years of charging and swapping layout, NIO has established a total of 4,124 charging stations and 2,702 battery swapping stations, as well as a high-speed battery swapping network covering 7 longitudinal and 6 horizontal major urban agglomerations, with a cumulative total of over 58.61 million battery swaps.

Screenshot: NIO

Frankly speaking, no automaker's energy replenishment system surpasses NIO's at present. Even Tesla, which has also been in the field for a long time, does not reach the breadth of NIO's energy replenishment system. However, it must be acknowledged that NIO has paid a significant financial price for this.

Yang Chao, NIO's assistant vice president, revealed that it still costs around 1.5 million yuan to build a fourth-generation battery swapping station. According to plans, NIO will build 1,000 battery swapping stations this year. Combining the data from December 31, 2023 (2,316 stations) and the data displayed on the official website (2,702 stations), we find that NIO has built 386 battery swapping stations this year.

Although this figure is still far from the goal of 1,000 stations, NIO has already invested at least 579 million yuan for this purpose, not to mention additional investments in charging piles, marketing, operations, etc.

According to the latest third-quarter financial report, NIO delivered a record number of vehicles, with increases in revenue and gross profit margin for complete vehicles. However, the net loss for the third quarter reached 5.06 billion yuan, an 11% year-on-year increase, indicating that the cost of energy replenishment is still higher than the returns. To achieve 'Power Up Every County,' NIO also launched the 'Power Up Partner' plan, inviting other partners to join the construction of the energy replenishment system. However, in Electric Car News' view, NIO's investment still accounts for the majority, and future investments in the energy replenishment system will only increase, with costs even becoming unbearable for NIO.

To recoup costs through the energy replenishment system, in Electric Car News' view, there is primarily one method: getting more new energy vehicle owners to use NIO's energy replenishment system. However, achieving this requires the assistance of other companies.

Video screenshot: NIO live stream

At this stage, NIO's charging piles are actually open to other new energy vehicle brands. However, as more automakers vigorously expand their energy replenishment systems, the advantage of NIO's charging piles is gradually declining, making it even more important to popularize the battery swapping model.

From the consumer's perspective, more energy replenishment facilities mean greater convenience. As long as new energy vehicles remain mainstream, there is a need for continuous investment in energy replenishment systems. Moreover, battery swapping may be a better way to replenish energy, as it can be completed within minutes and keep the power battery in a relatively healthy state.

The battery swapping alliance led by NIO has currently collaborated with automakers such as Changan, Geely, JAC, and Chery on battery swapping standards, technology, service network construction, and operation.

The spring of battery swapping has arrived, but NIO's winter has not yet passed.

Image source: NIO

Electric Car News understands that, among the battery swapping alliance, automakers other than NIO, such as Changan and Geely, have developed slowly in the field of battery swapping. Although Changan and Geely have begun to apply battery swapping technology from the shared ride-hailing market to the private user market, Geely's battery swapping models, such as the Raylan 7 and Raylan, have not achieved good market sales. Changan recently released official images of the Changan Aoyun 520, which has the ability to complete battery swapping in 2 minutes, but it remains to be seen whether it will be well-received by the market.

Relying on partners to make battery swapping stations profitable is a huge test of NIO's ability to delay gratification. It might be better for NIO to rely on itself to achieve the goals of 'doubling sales next year and achieving company profitability by 2026.'

Letao falls short of expectations, can Firefly succeed?

Yes, when Electric Car News says 'relying on NIO itself,' it actually means relying on Firefly and Letao. Of course, this does not mean that NIO cars are not selling well, but rather that they have reached the upper limit of sales and product line development.

Leaving aside the NIO ET9, which has been up for pre-sale for nearly a year, NIO has launched a total of eight products. From the current sales data, the brand's main sales drivers are still the '5 Series' (NIO ET5T and NIO ET5) and '6 Series' (NIO ES6 and NIO EC6), with the cumulative sales of the '7 Series' models and NIO ES8 accounting for only about 10%.

Image source: NIO

In addition, NIO's product prices are stable above 290,000 yuan, and the target audience is not that mainstream. Moreover, its comprehensive strength is not at the top level in the market, but its product attributes are very clear, and its technical advantage in battery swapping is truly unique. Therefore, NIO has a stable monthly sales volume of about 20,000 vehicles, but there is no longer much room for sales growth. The NIO ET9, with a pre-sale price of 800,000 yuan, obviously cannot contribute much to increasing sales.

In other words, the heavy responsibility of doubling sales naturally falls on the two sub-brands, Firefly and Letao.

However, Electric Car News must point out that Letao's first model, Letao L60, was originally intended to capture market share from Tesla Model Y. However, in October, Letao L60 only sold 4,319 units, while Tesla Model Y sold over 40,000 units. Undoubtedly, this sales gap is far below official expectations.

Image source: Electric Car News photography

Admittedly, Letao L60 excels in various aspects such as configuration and energy replenishment system compared to Tesla Model Y, and can further lower the threshold for car purchase through the BaaS program. However, Letao is still a new brand with relatively low brand recognition and channel coverage. Even with NIO's backing, it is not easy to attract a wide range of consumers.

There is no denying that if NIO were a traditional automaker, Letao L60's sales figures would likely be much higher. To double sales next year, Firefly will likely have an even heavier sales task than expected.

It has been confirmed that Firefly's first model will continue to adopt the 'chargeable and swappable' technical route, but other information is still highly confidential, with only spy shots currently available for preview.

Image source: Motors

Judging from the spy shots, Firefly's model may be positioned as a small or compact SUV. As a medium SUV, Letao L60 has a starting price of 209,900 yuan, so it can be affirmed that Firefly's model price range may be within 200,000 yuan.

A cheaper NIO model does have the ability to attract more consumers. However, while ensuring the 'chargeable and swappable' technical route and the brand's intelligent advantages, the price point at which Firefly's model can reach will largely determine its sales ceiling.

After all, consumer groups with a car purchase budget of around 100,000 yuan are quite sensitive to brand, configuration, and price. Frankly speaking, it is unrealistic to compare Firefly's brand power with traditional automakers. In the end, it will come down to key configurations and prices.

Two goals, either of which is difficult to achieve

Almost abandoning product line updates for NIO vehicles after one year and launching two brand-new sub-brands seems to be a unique approach taken only by NIO at present.

To truly achieve Li Bin's vision of 'doubling sales next year and achieving company profitability by 2026,' launching two sub-brands is indeed crucial, as these brands have a broader audience.

However, judging from the performance of Letao's first model, L60, market acceptance does not seem as good as expected. This not only fails to help the brand share the sales pressure but may also require significant time to make up for the brand's initial marketing and system construction investments.

As for 'achieving company profitability by 2026,' Electric Car News reserves judgment for now. Whether a brand can be profitable depends on whether its invested projects yield significant returns. Considering NIO's two major segments – automotive business and energy replenishment system business – NIO's current limitations have already emerged. Whether it will be profitable in 2026 will depend on the popularity of Letao and Firefly's products.

According to the 'Power Up Every County' plan, NIO aims to establish charging and battery swapping stations in most regions of the country by 2026. In other words, NIO's investment in the energy replenishment system will drop sharply in 2026, and it will start to generate profits from the energy replenishment system at the same time.

Since investment will decrease and revenue-generating ability will increase, it will not be as difficult for NIO to achieve profitability in 2026. The key lies in when it can fill the pre-2026 losses.

Image source: NIO

Of course, it's still a bit early to say all this. NIO will announce Firefly and related plans next month, so let's look forward to the surprises NIO has in store.

(Cover image source: NIO)

Source: Leitech