Next year, China's auto market will only become more suffocating

![]() 12/02 2024

12/02 2024

![]() 587

587

Introduction

Introduction

The grand finale for determining the final landscape is gradually unfolding.

Last week, two events left a deep impression on me.

First, Li Bin, CEO of NIO, released a company-wide letter on the company's 10th anniversary. Besides thanking all employees for their contributions and numerous users for their support, he also sounded a warning with honest advice, which is often unpalatable but beneficial.

"We are currently in the most intense and brutal phase of the qualification race in the smart electric vehicle industry. In two or three years, only a few outstanding companies will survive. Facing higher-dimensional competition, we cannot have any weaknesses and cannot expect a quick victory. To qualify for the finals, we must do two things: maintain our original aspirations and focus on action."

The second event occurred with BYD, the absolute "big boss" in China's auto market.

For some reason, an email regarding its request for suppliers to reduce prices circulated widely on the internet. The email was titled "BYD Passenger Vehicle Cost Reduction Requirements for 2025" and was signed by He Zhiqi, Executive Vice President of BYD Group and Chief Operating Officer of Passenger Vehicles.

Instantly, it sparked discussions. Some believed it was an industry norm, while others saw it as a signal for an intense "price war."

As an observer, combining the above points, the central message that resonates most deeply is: "If this year's China auto market has already pressured all participants, then next year's overall market is destined to become even more suffocating."

It is certain that the qualification race has ended, the elimination round is nearing its conclusion, and the grand finale for determining the final landscape is gradually unfolding. Precisely based on this background, the following paragraphs aim to discuss my two predictions.

Independent brands are unstoppable

Often, I ponder a question: Why, despite the intense internal competition in China's auto market this year, sales have still shown a thriving scene with rising prices?

Focusing on the reasons behind this, the first is undoubtedly the strong support from policy levels, which greatly stimulated consumers who were holding onto their money to make purchases. In contrast, with the efforts of major OEMs, the diverse and affordable product offerings also played a significant role.

In other words, the overall experience of "cars" has become increasingly better, and their prices have become more affordable. China's auto market has smoothly transitioned from a "seller's market" to a true "buyer's market."

In this process, the primary contributor on the list of accomplishments is undoubtedly the powerful rise of independent brands. Through continuous efforts, efficient iterations, and transformative changes, they have gradually gained an "unstoppable" momentum.

As evidence, let's take the October sales results as an example. According to statistics from the China Association of Automobile Manufacturers, independent brands sold a total of 1.931 million passenger vehicles, accounting for 70.1% of total passenger vehicle sales, an increase of 10.4 percentage points year-on-year.

Yes, you read that right; it officially marks a milestone moment, surpassing 70% with great strides.

Correspondingly, the gradual decline in the market share of joint ventures in China is already a foregone conclusion. Continuing with the example of January to October this year, the data for German, American, Japanese, and Korean brands were only 14.9%, 6.5%, 11.2%, and 1.6%, respectively. Among them, the "collapse" of Japanese brands was particularly evident, while American and Korean brands faced severe situations.

This reminds me of a previous analysis: "In this hail of bullets, the first joint venture brand to be in jeopardy is the maladjusted French brand, followed by the Korean and American brands that adhere to the cost-effective route. Next, the Japanese brand, which focuses on economic and low consumption, will encounter significant troubles. The German brand, due to the presence of BBA and Volkswagen, has the thickest 'health bar' but is far from its former glory."

Currently, combining trends, this analysis undoubtedly aligns well with reality.

Regarding next year, I boldly predict that the territory of joint venture brands will further be infiltrated and seized by independent brands. After stably surpassing 70% in sales share, the latter will continue to aim for 75% or even 80%, which is not an unachievable probability.

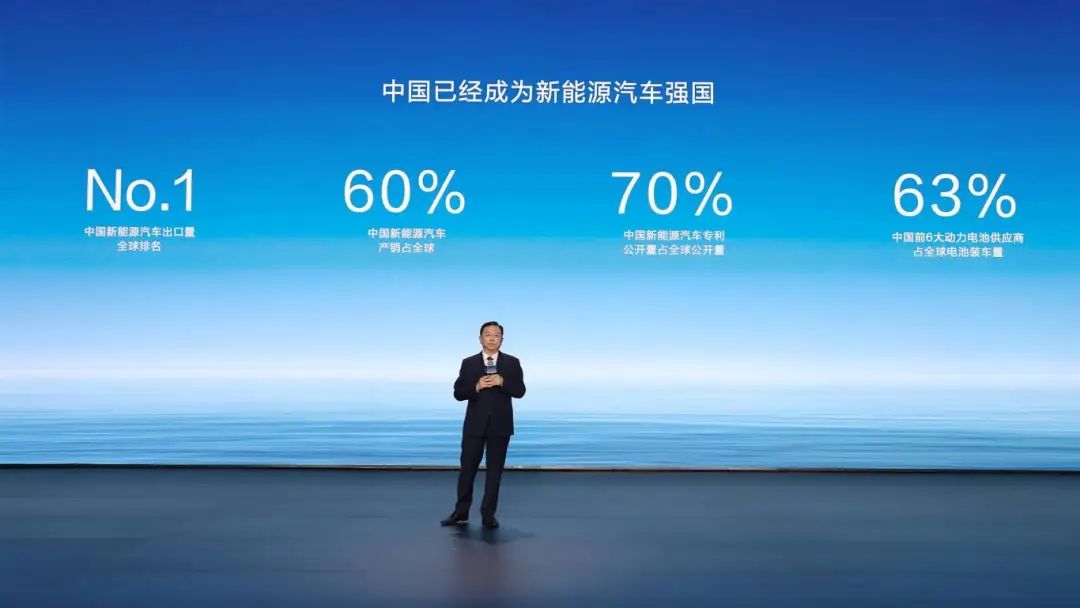

After all, borrowing from Wang Chuanfu, Chairman of BYD, who stated as early as 2023, "In the next 3 to 5 years, joint venture brands will drastically shrink from the current 40% to 10%, and these 30% will be filled by independent brands."

Previously, this might have seemed overly optimistic. However, after this year's baptism, I gradually realize that the speed at which China's auto market is "changing" is even faster than expected.

Especially considering that after surpassing the 4 million annual sales milestone, BYD will continue to push towards higher goals. Behind it, Geely, Chery, Changan, and other outstanding brands are also expanding their territories with all their might, frantically launching new models across various segments and price ranges.

Therefore, I cannot help but worry for joint venture brands. Although I don't want to be overly pessimistic, the situation is what it is. In the era of traditional fuel vehicles, the days of making easy money are indeed gone forever. To stay in the game and continue harvesting, they must lower their expectations, learn humbly, and actively adapt.

Otherwise, withdrawing from China's auto market is just a matter of time.

New energy vehicles: overcoming difficulties

"The monthly penetration rate of new energy vehicles will surely surpass the 50% mark."

At the beginning of this paragraph, I once again quote a prediction made by Wang Chuanfu earlier this year. At that time, although the share of traditional fuel vehicles was still shrinking, the saying "even a dead camel is bigger than a horse" still held true, giving them a certain lead, which led to much criticism.

However, what no one anticipated was the ferocity of China's auto market's electrification transformation, which truly surprised everyone. The acceptance of new energy vehicles by the public is surging at a rocket-like speed.

Little did we know that just as the second half began, the retail penetration rate of new energy vehicles surpassed the 50% mark for the first time in July. The glaring results speak for themselves; this time, Wang Chuanfu did not break his promise.

Even more reassuring is that in the following months of August, September, and October, this key data remained above 50%. For the ongoing month of November, according to predictions from the China Passenger Car Association, it will still reach 53.3%. As for the final month of December, considering that manufacturers need to boost sales, there will surely be no surprises.

In summary, the inflection point has arrived, and there is no dispute about it.

By now, attentive readers may have noticed that the retail penetration rate of new energy vehicles did not continue its explosive growth throughout the second half of the year. After surpassing the 50% mark, it seemed unable to climb higher. In other words, it feels like a dynamic equilibrium has been reached with traditional fuel vehicles.

Investigating the reasons, on the one hand, it may be due to the self-devaluation of the latter, allowing some products to return to the sight of potential customers; on the other hand, trade-in incentives and replacement subsidies this year also motivated many owners who were not interested in new energy vehicles to continue investing in traditional fuel vehicles.

However, in my heart, I am still very confident that "this temporary dynamic equilibrium will be quickly broken, and the protagonist of this paragraph will overwhelmingly push the corresponding retail penetration rate to the next level, possibly even surpassing the 60% mark in a single month."

As for the confidence behind this, on the one hand, it certainly comes from witnessing the change in cognition among many potential customers. The "mind war" initiated by new energy vehicles has apparently achieved a phased victory.

On the other hand, it comes from gradually learning about the strategic guidelines and development plans of various brands. The main theme of "electrification" is already set in stone, and one after another "green license plate" will come like a storm.

In any case, both internally and externally, the conditions for a complete explosion are in place.

Additionally, it must be understood that if in the past few years, the penetration of new energy vehicles was mainly concentrated in first-tier cities and coastal cities, then with the gradual enrichment of plug-in hybrid and extended-range products, the "bridgeheads" of lower-tier cities and inland cities are also being captured one by one.

In this process, OEMs that solely bet on pure electric technology next year will likely experience pain for an extended period. In contrast, brands with two wings will taste the sweetness of the times.

As I conclude this article, I would like to mention that the large-scale popularization of new energy vehicles in China's auto market should be divided into two stages.

First, it is undoubtedly the replacement of traditional fuel vehicles. Currently, more than half of the game has been played, and the outcome has become irreversible. The ranking will soon be finalized.

The second stage is the revolution of smart electric vehicles over ordinary new energy vehicles. Currently, the seeds have just taken root and are on the eve of abrupt changes.

This is precisely why there is chaos, a red ocean, and intense "price wars." In short, it's still the same saying: "Wake up! Next year's China auto market will be even more suffocating."