Looking at the November results of new forces, you'll know who doesn't need a year-end sprint

![]() 12/03 2024

12/03 2024

![]() 550

550

The competition in new energy sales in November is still lively.

As the year-end approaches, marking the beginning of the 2025 market landscape, the new force market in November continues to show a trend of sustained improvement with some local resistance.

Who will continue to stand out, and who will be left behind? Let's analyze it.

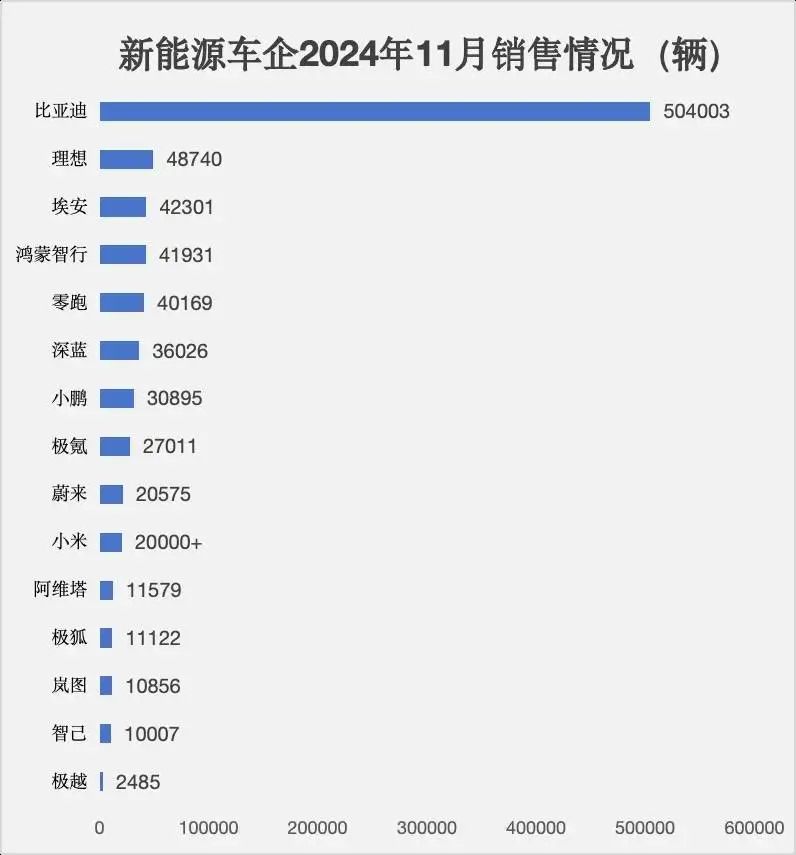

Data Source: Automaker Reports

Despite the negative feedback caused by the supplier's need to reduce prices by 10%, BYD still holds an absolute advantage in sales, with 504,000 vehicles sold in November, a year-on-year increase of 67.2%.

In terms of specific brands and models, BYD Dynasty/Ocean sold 485,178 vehicles in November, a year-on-year increase of 68.2%; Fangchengbao sold 8,521 vehicles; Denza sold 10,022 vehicles; and NIO sold 302 vehicles.

BYD's sales advantage is evident, but can it be a once-and-for-all solution? In fact, it's not the case. Geely Xingyuan, Yinhe E5, Xingjian, XPeng MNA03, and NIO Ledo L60 will all compete with BYD's high-volume models like Seagull, Dolphin, and Song.

Among the new forces, Lixiang is still the leader in internet car manufacturing, but its deliveries have fallen below 50,000. Hongmeng Zhixing and Aion continue to maintain deliveries above 40,000.

Huawei's four-wheel drive technology has everyone on edge, especially the Zunjie model, raising questions about whether it will break Rolls-Royce's monopoly in the luxury sedan market.

Regarding Aion, with sales of 42,301 vehicles in November, frankly speaking, considering the current intensity of the 100,000-200,000 yuan segment, maintaining such a stable number is not bad. However, it may be best described as "glamorous on the surface, but fraught with internal crises."

Nevertheless, Leap Motor set a record for monthly deliveries, exceeding 40,000 for the first time. Reading this, some may wonder why this new force in car manufacturing has suddenly gained momentum.

Regarding the conclusion, I would like to borrow an analysis from a friend: "I feel that its rise is partly due to the support of this year's replacement subsidy policy; partly because its products are all well-rounded and have made no mistakes; and partly because there have not been too many outrageous promotional operations."

Furthermore, in the "30,000 vehicles" segment, Deep Blue and XPeng dominate.

Deep Blue delivered a total of 36,026 new vehicles in November, emerging as the vanguard leading the electrification transformation of the entire Chang'an Group. Compared to Avatar within the same group, Deep Blue needs more progress to support Chang'an's autonomous business.

XPeng delivered a total of 30,895 new vehicles in November, crossing the 30,000-vehicle threshold for the first time in its history.

Specifically, XPeng MONA M03 delivered over 10,000 vehicles consecutively in its first three months on the market; XPeng P7+ delivered over 7,000 vehicles in just 23 days. The two new models combined delivered over 17,000 vehicles in November, accounting for half of XPeng's total deliveries.

The 20,000-vehicle sales range does not offer many surprises, but it is worth celebrating as it signifies crossing the dangerous zone for car manufacturing.

Thanks to the strong sales of the Zeekr 007X, Zeekr's sales continued to rise in November, approaching 30,000 vehicles. However, Zeekr has recently encountered battery issues. Some Zeekr 001 owners have reported issues such as slower charging speeds and inaccurate battery level indications. In response, Zeekr announced on December 1 that it will launch a battery health check campaign for all Zeekr 001 WE 86 vehicles. If abnormal battery health is detected, customers will receive a free replacement battery.

NIO delivered 20,575 new vehicles in November, marking the seventh consecutive month with sales exceeding 20,000. Among them, the NIO brand continued its strategy of increasing gross margin and stabilizing the market in November, delivering 15,493 new vehicles, while the Ledo brand delivered 5,082 new vehicles.

Xiaomi has not yet disclosed specific delivery figures, only stating that deliveries of the Xiaomi SU7 exceeded 20,000 in November. From the official bar chart, it can be seen that November's deliveries increased month-on-month.

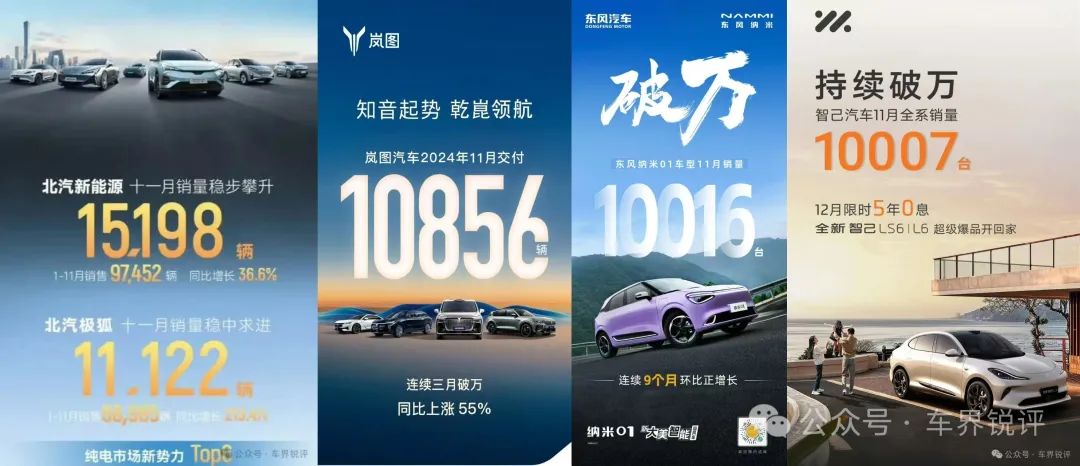

Those with sales exceeding 10,000 vehicles are basically part of the national team.

Currently, survival is not much of an issue, but some data seem far-fetched, aimed solely at crossing the 10,000-vehicle threshold. Taking a step back would lead to a precipice, while taking a step forward would bring prosperity.

Therefore, BAIC ARCFOX, Lantu , Dongfeng Yipai, and IM Motors must continue to work hard as they are the pillars and faces of their respective groups.

Looking at Geely's sales, some say that Nezha will become it in the future.

Even though the helmsman, Xia Yiping, is actively promoting the company on various social media platforms, the brand only delivered a "pitiful" 2,485 vehicles in November.

Without exaggeration, the two models currently on sale, Geely 01 and Geely 07, are not without highlights in terms of product strength. However, the 200,000-300,000 yuan pure electric segment they target is highly competitive, leaving little room for them to share the pie.

As for the leaders, the landscape is becoming increasingly clear.

Chery excels in overseas exports and is expanding its domestic presence, with continued progress in pure electric models.

Geely thrives in both fuel and pure electric segments. With strategic contraction, its advantageous brands will become stronger, while its disadvantaged brands will basically disappear.

Great Wall is likely to become a "small but beautiful" enterprise. Currently, Tank is its face, but it is difficult to maintain the basic market for Haval.

Judging from the sales figures of major automakers in November, the market share is gradually being replaced by hybrid, extended-range, and pure electric vehicles, leading to a situation where the strong get stronger and the weak get weaker. Especially with state subsidies, new energy vehicle sales in December should reach new highs, and automakers fully transitioning to new energy will be unstoppable!

Even more brutal is that automakers are embarrassed to release sales reports if their sales do not exceed 10,000 vehicles, especially facing the year-end target assessment in December.

The reality is that grim...