NIO, with cumulative losses exceeding RMB 100 billion, stages another annual drama: Profitability expected in 2026!

![]() 12/04 2024

12/04 2024

![]() 593

593

Omni-media Matrix Distribution Automotive Digital Full Industry Chain

As early as the end of 2022, Li Bin expressed hope that NIO would achieve breakeven by 2024. However, just half a year later, Li Bin pushed back the breakeven timeline by a year. Now, the profitability timeline has been postponed for the third time.

Written by / Li Yue

Produced by / Jieche Technology

NIO's (NIO.NYSE/09866.HK) profitability timeline has been postponed for the third time! 'Losses will gradually narrow in 2025, and profitability is expected in 2026,' said Li Bin, founder, chairman, and CEO of NIO, during the company's recent third-quarter earnings call.

Financial reports show that NIO's third-quarter revenue was RMB 18.674 billion, a year-on-year decrease of 2.06%; net loss was RMB 5.06 billion, an 11% year-on-year increase in the loss margin, marking the third time this year that quarterly losses have exceeded RMB 5 billion. Rough estimates show that from 2018 to the third quarter of this year, NIO's cumulative losses have exceeded RMB 100 billion.

As early as the end of 2022, Li Bin expressed hope that NIO would achieve breakeven by 2024. However, just half a year later, Li Bin pushed back the breakeven timeline by a year. Now, the profitability timeline has been postponed for the third time.

Judging from the profitability of several mainstream new-energy vehicle makers, NIO is in the most difficult situation. Data shows that NIO's third-quarter loss was 2.8 times that of Xpeng and 7.33 times that of Leapmotor, while Lixiang's third-quarter net profit was RMB 2.814 billion, marking eight consecutive quarters of profitability.

1

Average vehicle price continues to decline

Pressure to increase gross margin

NIO delivered a total of 61,855 new vehicles in the third quarter, including 832 Lido vehicles, setting a new record high with a year-on-year increase of 11.6%. However, along with the sales growth, NIO's average vehicle price has continued to decline.

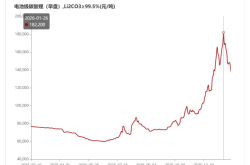

In the third quarter, NIO's average vehicle price was RMB 270,000, lower than the RMB 278,900 and RMB 273,300 in the first and second quarters of this year, respectively, and a decrease of nearly 16% compared to RMB 320,000 in 2023.

NIO's development strategy shares similarities with Tesla's, establishing a brand image through high-end positioning and emphasizing the advantages of battery swapping services to create differentiated competitive advantages.

However, with the emergence of other powertrain types on the market, such as Lixiang's extended-range vehicles and BYD's super hybrid models, as well as the successive launch of high-end models from various brands, NIO's appeal has gradually diminished, forcing it to engage in a price war in the third quarter of this year.

In September, NIO offered discounts of RMB 8,000 to RMB 10,000 on its main brand vehicles, with actual terminal subsidies reaching nearly RMB 30,000 (through partner purchase channels) and showroom subsidies as high as RMB 36,000. Additionally, the optional fund increased from RMB 8,000 per vehicle in August to RMB 20,000 per vehicle in September. In October, NIO attempted to cancel some promotional activities but had to intensify promotions later in the month due to a significant decline in orders.

While this pricing strategy temporarily boosted NIO's sales, it had a direct impact on its gross margin. Financial reports show that NIO's automotive gross margin was 13.1% in the third quarter. Among them, the second brand Lido, which is still in the early stages of ramp-up production and offered more user benefits during the early launch phase, currently has a gross margin in the single digits. In contrast, Lixiang did not adopt a 'low-profit, high-volume' model in the third quarter, adhering instead to a high-price, high-value strategy and responding to industry competition through a series of high-quality services. During the same period, Lixiang sold 152,800 new vehicles, a year-on-year increase of 45.4%, with a vehicle gross margin of 20.9%.

During the earnings call, Li Bin stated, 'We are confident that we can increase the gross margin to 15% in the fourth quarter, and the gross margin of the NIO brand will reach 20% next year.' However, in the industry's view, even if the second brand Lido sees a significant increase in sales next year, due to its low gross margin, the pressure to increase NIO's overall gross margin will remain high, even as sales volumes grow.

2

While free cash flow turns positive

Debt remains high

It can be seen that after NIO's third-quarter financial report was released, 'positive free cash flow' became the focus of its communication. Indeed, with unsatisfactory revenue and net profit, this positive indicator became the only notable achievement NIO could showcase.

It is undeniable that positive free cash flow reflects, to a certain extent, the enhanced stability and liquidity of NIO's financial position. However, it cannot be ignored that this indicator should be considered in conjunction with the asset-liability ratio.

'Free cash flow' refers to the cash flow remaining after a company deducts taxes, capital expenditures, and increases in working capital, which is primarily used to pay debts, dividends, investments, or other purposes.

As of September 30, 2024, NIO's cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits totaled RMB 42.2 billion, while its total liabilities reached RMB 87.918 billion, resulting in an asset-liability ratio of 84.5% (the highest since 2021), with net assets of only RMB 16.07 billion. During the same period, Lixiang's total liabilities were RMB 87.79 billion, with an asset-liability ratio of 56.70% and net assets of RMB 67.031 billion; Xpeng's total liabilities were RMB 44.408 billion, with an asset-liability ratio of 58.10% and net assets of RMB 32.027 billion.

As everyone knows, when the asset-liability ratio is too high, it may lead to a risk of capital chain disruption when a company's cash flow is insufficient, making it unable to repay debts in a timely manner and potentially leading to bankruptcy. Additionally, both banks and investors have certain requirements for the asset-liability ratio, and a high ratio may further increase a company's financing costs. Judging from NIO's asset-liability ratio, it is well above the normal range of 40%-60% in the automotive industry, indicating significantly higher financial pressure compared to peers.

In the third quarter of this year, NIO incurred a net loss of RMB 5.06 billion, marking the fourth consecutive quarter with losses exceeding RMB 5 billion since the fourth quarter of 2023. During these four quarters, NIO's cumulative losses amounted to RMB 20.658 billion. On the one hand, there are long-term losses, and on the other hand, there is a need to repay huge debts. NIO, which has always relied on external financing, has reached a critical juncture where it must turn losses into profits.

3

Annual sales target difficult to achieve

Multi-brand strategy questioned

At the beginning of this year, NIO lowered its 2024 sales target to 230,000 vehicles. Currently, it is highly likely that NIO will not meet its annual target.

Data shows that NIO delivered approximately 149,300 vehicles in the first three quarters of this year, representing a 65% completion rate of the annual target. On the day the third-quarter report was released, NIO provided guidance for the fourth quarter: deliveries are expected to range from 72,000 to 75,000 vehicles, a year-on-year increase of 43.9% to 49.9%; revenue is expected to range from RMB 19.68 billion to RMB 20.38 billion, a year-on-year increase of 15.0% to 19.2%.

It can be seen that even if sales reach the upper limit of 75,000 vehicles in the fourth quarter, NIO's annual sales will only be 225,000 vehicles.

It is crucial to note that whether NIO can achieve the sales target set in the fourth-quarter guidance hinges on the delivery of its second brand, Lido, and whether its production capacity and orders can maintain stable growth. Lido's first model, the Lido L60, was officially delivered at the end of September, targeting the RMB 200,000 market segment and carrying the responsibility for NIO's push towards scale.

According to industry sales data from the China Passenger Car Association and other sources, Lido L60 sold 832 and 4,319 vehicles in September and October 2024, respectively. According to insiders from the Lido brand, as of November 14, Lido had delivered just over 7,000 vehicles in total.

Since the launch of the new vehicle, NIO has mentioned the 'explosion' of orders for Lido on multiple occasions. However, due to the slow ramp-up of production capacity, the sluggish delivery schedule has been controversial. The actual sales volume falls far short of the rumored orders of over 30,000 within 72 hours of launch, over 60,000 within five days, and 45,000 locked orders. Considering competitive models in the same price range, such as Tesla Model Y, Zeekr 001, Xpeng G6, Lixiang L6, BYD Song Pro DM-i, and Denza N7, Lido L60 does not have a clear advantage.

In addition to Lido, Li Bin revealed during the earnings call that NIO would unveil the first model of its third brand, 'firefly,' at the December NIO DAY and commence deliveries in the first half of 2025.

It is reported that Firefly is positioned in the high-end compact car market, similar to BMW's MINI brand. According to NIO's plan, the Lido and Firefly sub-brands not only undertake the task of increasing sales volume but are also the core models for NIO's global expansion. Li Bin believes that using two or three brands to target different user groups is currently a successful brand strategy.

The multi-brand strategy itself is unobjectionable, and companies like BYD and Geely also adopt this approach. 'However, typically, sub-brands are launched only after the parent brand has gained market recognition and achieved a certain sales volume or scale.

These sub-brands stand on the shoulders of the parent brand's success, replicating proven experiences while refining and organizing based on different user groups and positioning. In the high-end new energy vehicle market, NIO has not been able to maintain its leading edge, let alone in the 'red ocean' below RMB 200,000,' pointed out an industry insider. Obviously, NIO has not yet reached the desired scale and influence, and the prospects for its sub-brands are therefore fraught with uncertainties.

Looking ahead to 2025, NIO has set a delivery growth target of 100% year-on-year, with annual sales expected to reach approximately 450,000 vehicles. Li Bin stated that as sales double in 2025, NIO's overall operations will continue to show positive growth, and the company expects to narrow its losses, with the goal of achieving profitability by 2026. A familiar scenario, a familiar promise, just replayed every year.