Employees Face Tough Job Market: Is Mercedes-Benz's Struggle in China to Blame?

![]() 12/12 2024

12/12 2024

![]() 582

582

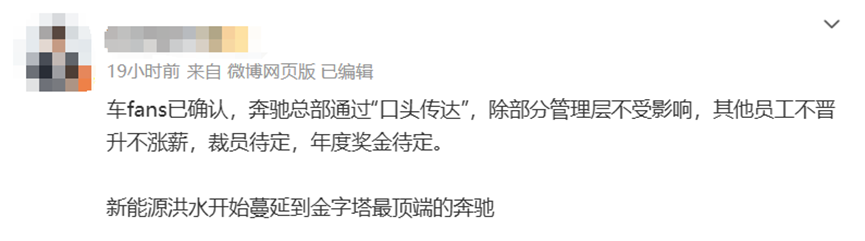

Recently, an automotive blogger revealed that "Mercedes-Benz headquarters has verbally informed employees of a new policy: no promotions and no salary increases. Additionally, layoffs and year-end bonuses remain uncertain."

This news sparked immediate and heated discussions among netizens. One user commented, "It seems inevitable. The three-pointed star is currently the least affected luxury brand."

Another user exclaimed, "Even Mercedes-Benz, the 'king' of luxury cars, can't hold on anymore."

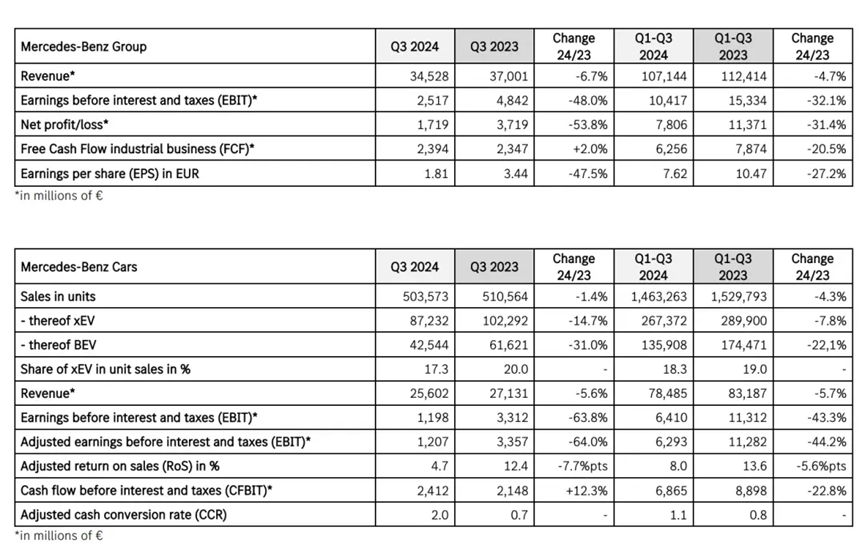

Currently, the authenticity of the report regarding "Mercedes-Benz employees facing no promotions, no salary increases, and uncertain year-end bonuses and layoffs" remains debatable. However, it is undeniable that Mercedes-Benz has experienced a downturn in the market since 2024. A Mercedes-Benz spokesperson previously stated, "We plan to implement cost-cutting measures amounting to billions of euros each year over the next few years." On October 24, Mercedes-Benz released a third-quarter financial report that was worse than expected. The report revealed that revenue for the quarter reached €34.528 billion (approximately RMB 264.902 billion), a year-on-year decline of 6.7%, with net profit at €1.719 billion (approximately RMB 13.188 billion), a significant year-on-year decrease of 53.8%. Specifically, Mercedes-Benz's core passenger car division reported revenue of €25.6 billion, a year-on-year decrease of 5.6%, with adjusted EBIT at €1.2 billion, a substantial year-on-year decrease of 64%.

Mercedes-Benz officials attributed the decline in performance to factors such as product mix adjustments, increased product sales expenses, higher model modification costs, and intensified competition in the Chinese market. Notably, while notifying employees verbally, Mercedes-Benz clarified that some management levels would not be affected by the policy adjustments. The breaking blogger explained, "This is because they adhere to Mercedes-Benz's global performance evaluation standards."

This indirectly confirms that the poor performance in the Chinese market may be the reason behind Mercedes-Benz's announcement of a series of policies, including no salary increases and no promotions. Analyzing Mercedes-Benz's global sales in the third quarter, the North American market performed best with sales reaching 96,400 vehicles, a year-on-year increase of 29%. The Asian market led the decline, with sales of 226,300 new vehicles in the third quarter, a year-on-year decrease of 9%. Notably, in the Chinese market, Mercedes-Benz sold 170,700 vehicles in the third quarter, a year-on-year decrease of 13%, making it the single market with the largest decline globally for Mercedes-Benz in the third quarter. In the first 10 months of 2024, Mercedes-Benz sold a total of 462,754 new vehicles in the Chinese market, a year-on-year decrease of 7%.

Regarding specific models, in the first 10 months, the Mercedes-Benz C-Class sold 134,490 units, while the E-Class sold 114,606 units. In the SUV segment, the GLC sold 112,924 units, and the GLB sold 43,444 units. Among the new energy models, although the EQE SUV had the best sales, it only sold 6,605 units in the first 10 months; the EQB and EQA sold only 3,070 and 2,387 units, respectively, indicating a bleak market performance.

In recent years, the "price war" in the domestic automotive market has intensified, with more automakers resorting to price cuts to compete for market share. Against this backdrop, luxury automakers led by Mercedes-Benz have also had to join the price war to boost sales. However, significant discounts have not led to substantial sales growth for BBA but have further exacerbated dealerships' operational difficulties. Previously, relevant media reported that "Changsha's largest Mercedes-Benz 4S store has withdrawn from the network and is being rebuilt as a Huawei AITO store." In October, BMW's first global 5S store, Beijing Xingdebao, announced its closure due to a broken funding chain. Subsequently, Audi's largest 4S stores in Tianjin and Beijing also announced closures and ceased sales.

Today, the trend towards electric and intelligent connected vehicles is irreversible. High-end luxury automakers led by Li Auto, AITO, NIO, Tesla, and others are continuously growing, with their product lineups and quality continuously improving. However, compared to domestic automakers, the electrification transformation of traditional luxury automakers has lagged behind, with fuel vehicles still dominating. As the fuel vehicle market shrinks, the market share of traditional luxury automakers is severely compressed.

Fortunately, traditional luxury automakers have realized this and have announced their transition to electrification. In September this year, Mercedes-Benz announced plans to jointly invest over RMB 14 billion with its Chinese partner to further enrich its localized product lineup. According to the plan, starting from 2025, Mercedes-Benz will successively launch new pure electric long-wheelbase CLA models, China-exclusive long-wheelbase GLE SUVs, and new luxury pure electric MPVs based on the VAN.EA platform in China. Notably, the long-wheelbase GLE SUV will be developed and led by the Chinese team, with a focus on enhancing rear-seat comfort and smart technology configuration. Furthermore, Mercedes-Benz is also promoting the introduction and application of the MB.EA-m platform dedicated to mid-size electric vehicles. In the future, Beijing Benz Automotive will produce pure electric C-Class sedans (code-named V520) and pure electric sedans (code-named V540) based on this platform.

From the above, it is evident that Mercedes-Benz is determined to accelerate its electrification transformation in China. However, it should also be noted that competition in the domestic automotive market is increasingly fierce, making it crucial for Mercedes-Benz to launch its electric products sooner rather than later.

(Images sourced from the internet. If there is any infringement, please delete them immediately)