Capital Increase and Super Hub: The Dual-Engine Leap of Guangzhou Baiyun International Airport

![]() 12/31 2025

12/31 2025

![]() 605

605

Source | Yuan Media Group

At the end of 2025, under the southern skies of China, a grand narrative of scale, capital, and the future unfolds at Guangzhou Baiyun International Airport.

Two closely intertwined pivotal events have collectively set in motion the upgrade of this core hub in the Greater Bay Area: the official commissioning of the T3 Terminal and fifth runway—the core of the Phase III expansion with a total investment of 53.77 billion yuan—has opened up new physical space; this was swiftly followed by a private placement of nearly 1.6 billion yuan by the controlling shareholder, injecting robust cash flow into the airport's operations.

This expansion is not merely about increasing the airport's capacity; it represents a crucial strategic move for the Guangdong-Hong Kong-Macao Greater Bay Area to ascend from being a 'world factory' to a 'global market' and an 'innovation hub.'

01

A 'Vote of Confidence' from the Controlling Shareholder and the Cornerstone of Performance

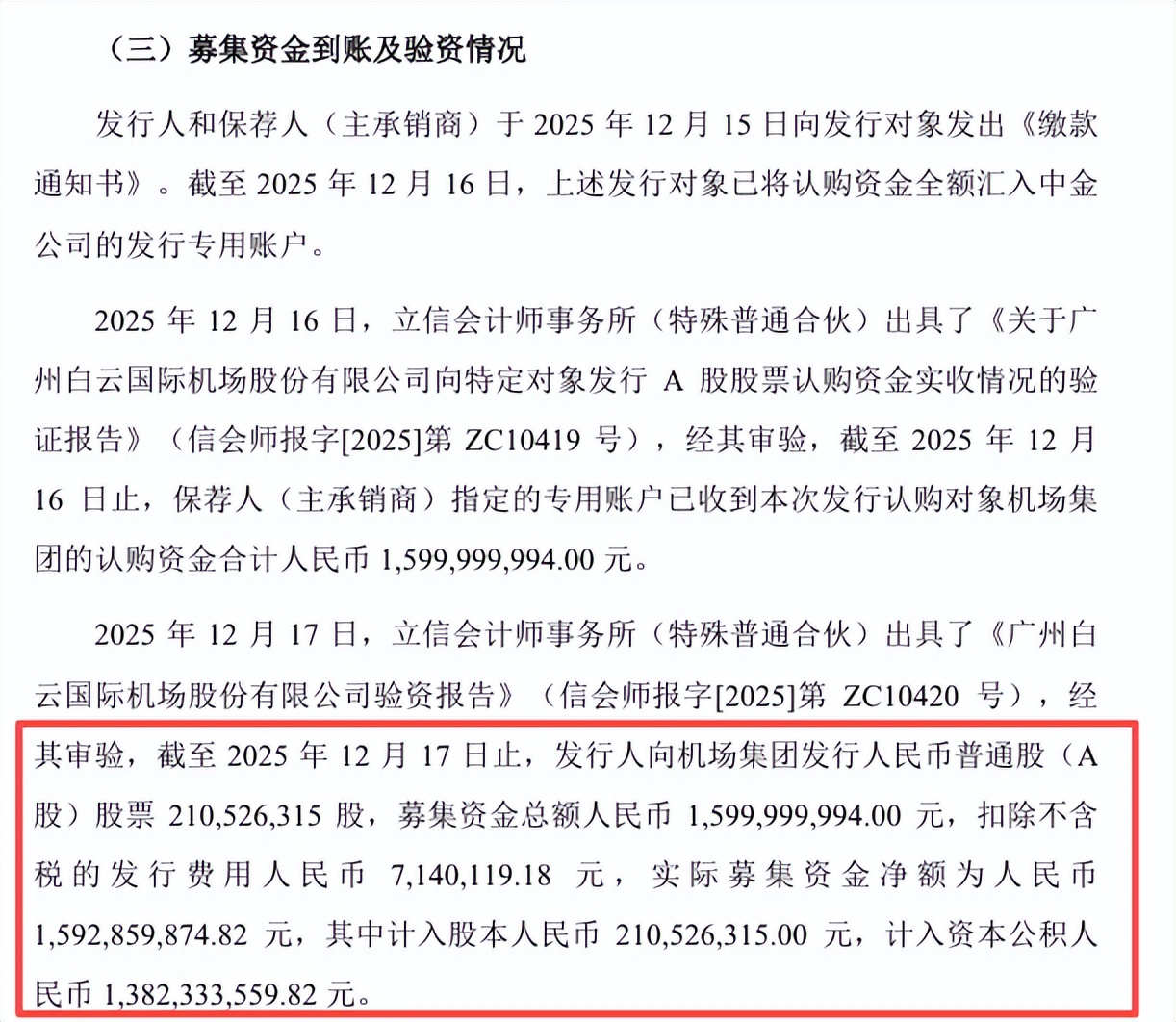

The current private placement of shares to specific investors represents a concentrated 'bet' by the controlling shareholder, Guangdong Airport Management Corporation, with nearly 1.6 billion yuan in real money. This arrangement, where the controlling shareholder fully subscribes in cash and locks in the shares for 18 months, is seen in the capital market as the strongest signal of confidence. It avoids the uncertainties introduced by external shareholders and underscores the controlling shareholder's deep recognition of the listed company's current valuation and development path.

Image Source: Guangzhou Baiyun International Airport Announcement

The proceeds from this private placement are explicitly designated for 'supplementing working capital.' For the listed company, which is on the verge of a major infrastructure upgrade, this is a strategically astute move.

The commissioning of the T3 Terminal signifies an exponential increase in operational scale and management complexity. From equipment maintenance and personnel operations to handling various scenarios during the passenger traffic ramp-up period, ample working capital is essential as a safety cushion. This move is akin to fully fueling a giant ship poised for a long voyage, ensuring financial stability and operational flexibility during the expansion phase.

More profoundly, this move optimizes the listed company's asset-liability structure, laying a financial foundation for potentially acquiring larger-scale high-quality assets from the controlling shareholder, such as those related to the Phase III expansion project, in the future.

This confidence is built on a solid foundation of performance recovery.

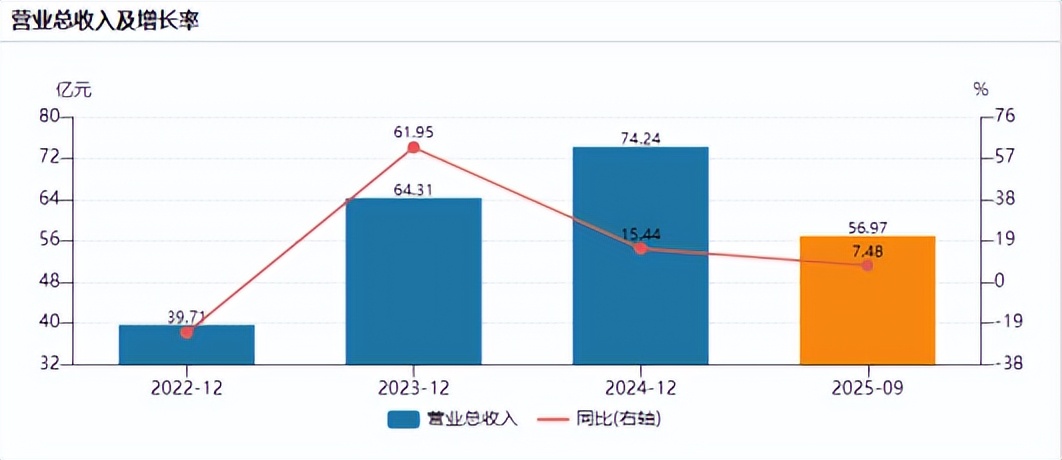

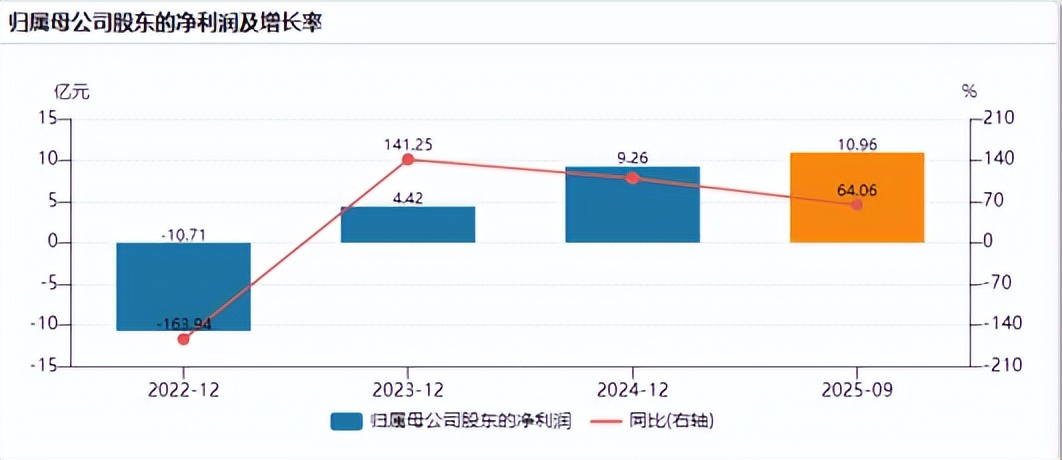

According to the company's 2024 annual report, Guangzhou Baiyun International Airport has demonstrated a comprehensive recovery in its operations, with core business indicators reaching all-time highs. The net profit attributable to the parent company for the year was 926 million yuan, representing a significant year-on-year increase of 109.51%.

Image Source: Wind

Entering 2025, the growth momentum has continued. In the first half of the year, the company achieved revenue of 3.726 billion yuan, with a net profit attributable to shareholders of the listed company reaching 750 million yuan, representing a year-on-year increase of 71.32%. This strong performance provides the backbone for the current capital operation, and the infusion of capital will further solidify this growth trajectory.

02

A Physical Leap from 'Traffic Hub' to 'World-Class Platform'

If the private placement strengthens the 'physique,' then the commissioning of the T3 Terminal and fifth runway on October 30, 2025, represents a transformative 'physical' reshaping. Guangzhou Baiyun International Airport has officially entered a new era of ultra-large-scale operations with 'three terminals and five runways,' becoming the first airport in China's civil aviation sector to operate five commercial runways simultaneously.

According to data released by Guangzhou Baiyun International Airport, the opening of the T3 Terminal has set multiple benchmarks, pointing towards a world-class status. The airport's recent design capacity can accommodate an annual passenger throughput of 120 million and a cargo and mail throughput of 3.8 million metric tons; its ultimate capacity is planned to support 140 million passengers and 6 million metric tons of cargo and mail.

The impact of the hardware upgrade was immediate. Just over a month after commissioning, on December 17, 2025, Guangzhou Baiyun International Airport achieved a historic milestone—its annual passenger throughput exceeded 80 million for the first time, officially joining the global '80-Million-Passenger Club.' Among this, international passenger volume surpassed 16.6 million, with international business surging by over 19% year-on-year, demonstrating strong international hub appeal.

Image Source: Guangzhou Baiyun International Airport Official Account

From a transportation endpoint to a 'three-dimensional heart.' The T3 Terminal is far from a traditional airport terminal; it is designed as a colossal integrated transportation hub combining 'air, rail, and road.' Below it, plans are in place to introduce six high-speed rail lines, five intercity railways, and two metro lines, aiming to achieve 'zero-transfer, integrated' connectivity for passengers. This means Guangzhou Baiyun International Airport is evolving from an endpoint in the aviation network into a 'transportation heart' that connects the Greater Bay Area and radiates across southern China. The concurrent opening of Guangzhou Baiyun International Airport East Station has made air-rail intermodal transportation a reality, allowing passengers to reach Guangzhou South Station directly from the airport in just 30 minutes.

In design, the T3 Terminal embodies the concepts of 'cloudy mountains, pearl waters, and the flower crown of the flower city,' integrating cultural characteristics of Lingnan. It is also the first in China's large-scale hubs to fully apply BIM intelligent construction, achieving digital management throughout the lifecycle from design to operation and maintenance. Innovative facilities such as a panoramic aviation viewing platform herald the arrival of a more intelligent and humanized era of modern airport operations.

03

Regional Synergy: A New Chapter of 'Co-opetition' in the Greater Bay Area Airport Cluster

The leapfrog development of Guangzhou Baiyun International Airport must be understood within the broader narrative of the Guangdong-Hong Kong-Macao Greater Bay Area's ambition to create a world-class airport cluster. In 2025, the expansion of core airports in the Greater Bay Area has been highly synchronized: the full operation of Hong Kong Airport's third runway system and the enable (commissioning) of Shenzhen Airport's third runway, along with the commissioning of Guangzhou Baiyun International Airport's T3, have collectively staged an 'infrastructure competition' for the future skies.

According to projections by the Airports Council International (ACI), by 2035, the demand for air passenger transport in the Guangdong-Hong Kong-Macao Greater Bay Area is expected to reach 420 million. The long-term planned total capacity of the three major hubs in Guangzhou, Shenzhen, and Hong Kong aligns with this projection. Against this backdrop, the unique advantages of Guangzhou Baiyun International Airport are becoming increasingly clear:

Comprehensive transportation gateway. With its unprecedentedly strong air-rail intermodal transportation capabilities, Guangzhou Baiyun International Airport is poised to become the core 'traffic converter' serving the Greater Bay Area and connecting the national hinterland.

International freight and advanced manufacturing services hub. With an ultimate planned cargo and mail capacity of 6 million metric tons and the emerging complete airport-related industrial chain encompassing aircraft maintenance, bonded logistics, and cross-border e-commerce, it has become a crucial node for ensuring the security and efficiency of the high-end manufacturing supply chain in the Greater Bay Area.

In the future, the airport cluster in the Greater Bay Area will need to pursue more refined differentiated layouts in terms of high-quality international routes and high-end freight resources, and achieve greater breakthroughs in 'soft connectivity' areas such as airspace resource coordination and customs clearance facilitation, to generate a '1+1+1>3' cluster effect.

04

From 'Airport Operations' to 'Ecosystem Construction'

Standing on the dual heights of capital and hardware, the future vision of Guangzhou Baiyun International Airport extends far beyond traditional aviation business scope, evolving along a clear path towards becoming a constructor of platform-based hub economies and airport-related industrial ecosystems.

The core financial logic in the short term (1-3 years) revolves around value revaluation under the expectations of operational integration and asset injections. During this phase, the capital market will focus on the efficiency and quality of the T3 Terminal's capacity ramp-up. Safe, stable, and efficient operations are the financial foundation for realizing the monetization of design capacity. The key point of interest lies in how the newly added slot resources will be converted into a more profitable international route network, particularly high-quality routes to regions under the 'Belt and Road Initiative' and the RCEP, which directly relates to the marginal improvement of aviation business revenue.

The greatest value catalyst undoubtedly lies in how and when the assets related to the Phase III expansion project under the controlling shareholder will be injected into the listed company. This potential capital operation will be a crucial financial event for optimizing the asset structure, enhancing shareholder equity, and definitively opening up long-term growth space. Market valuations are expected to undergo a systematic revaluation under this expectation.

The focus in the medium term (3-5 years) will shift to traffic monetization and the elevation of business models. As passenger and cargo traffic reach new heights and achieve structural optimization, the company's growth engine will significantly transition from relying on aviation business to tapping into the vast potential of non-aviation business. The vast high-quality commercial spaces, advertising resources, and high-end service scenarios created by the T3 Terminal will become key variables for profit growth.

A more profound transformation lies in the company's role extending from an 'infrastructure provider' to an 'airport-related industrial platform operator.' A modern airport-related economic ecosystem, centered around the airport and integrating aviation logistics, aircraft maintenance, bonded services, and cross-border commerce, will begin to take shape. At this point, financial performance will not only be a function of passenger traffic but also a comprehensive result of its traffic monetization capabilities and industrial synergy effects. Profit margin structure and revenue stability are expected to undergo fundamental improvements.

The long-term vision (5+ years) points towards ecosystem leadership and the consolidation of strategic node value. By then, Guangzhou Baiyun International Airport will transcend its status as a mere transportation hub and evolve into a core engine driving the development of northern Greater Bay Area and a node for global resource allocation. Through the deep integration of 'port, industry, and city' development, its radiating effects will drive urban renewal and industrial upgrading in surrounding areas, ultimately catalyzing the emergence of a globally competitive aviation metropolis.

Its financial value will be deeply embedded in regional economic appreciation, and its valuation benchmark will partially shift from the traditional price-to-earnings (P/E) model to a premium assessment based on its controlled ecological niche, scarce hub resources, and irreplaceable network effects. This will support its transformation from a cyclical growth stock into a 'core asset' with a solid moat, representing the Greater Bay Area in global competition and safeguarding supply chain resilience.

This evolutionary path clearly outlines the three-act value growth journey of Guangzhou Baiyun International Airport, from pursuing 'traffic scale' to excavate (unearthing) 'traffic value,' and ultimately controlling the strategic high ground of 'ecological hub.'

Today, with the private placement finalized, the T3 Terminal taking off, and the historic breakthrough of 80 million passengers, a new starting point has been marked for Guangzhou Baiyun International Airport. The capital support from the controlling shareholder provides financial resilience to navigate through cycles; the hardware epic of 'five runways and three terminals' and the soaring passenger traffic data have opened up a vast sky towards becoming a world-class aviation hub.

Clearly, the era of the super hub has arrived.

Some images are sourced from the internet. Please inform us for removal if there is any infringement.