Horizon Robotics Exits the 'Greenhouse Effect'

![]() 12/13 2024

12/13 2024

![]() 554

554

In 2012, when Mo Yan won the Nobel Prize in Literature, the media sought Liu Zhenyun's reaction. Liu quipped, "It's my brother's wedding night. How do you expect me to feel?"

The media wasn't merely stirring up trouble. Shortly before Mo Yan's Nobel Prize for "Frog," Liu Zhenyun had triumphantly edged out Mo Yan's "Frog" to win the prestigious Mao Dun Literature Prize with his "One Sentence Outweighs Ten Thousand," securing an overwhelming majority of votes.

Gu Weihao, a fan of the culture depicted in "The Three-Body Problem," may not be concerned with such matters, but this doesn't diminish the fact that Horizon Robotics finds itself in a situation akin to Liu Zhenyun's "One Sentence Outweighs Ten Thousand" – emerging from Great Wall Motors with a solid foundation, the outside world is eagerly anticipating Horizon Robotics' entry into the automotive market. Before it has significantly penetrated the vehicle sector, Horizon Robotics is boldly proclaiming itself firmly in the "first place in mass-produced autonomous driving in China."

Horizon Robotics should rightly be the "coolest kid" in the commercialization of assisted driving, but as we now see, the situation is vastly different:

Pony.ai and WeRide have gone public, ushering in a new phase of commercialization. On its fifth anniversary, Horizon Robotics issued a statement: the autonomous driving market has also entered a critical competitive period. Any slight lapse in focus will cause us to fall behind, and challenges will emerge endlessly.

There have been numerous reports of personnel optimization: In late November, rumors circulated that Horizon Robotics had initiated an optimization plan, to which Horizon Robotics responded that it was "undergoing normal organizational restructuring."

On the order front, the intelligent driving orders for the all-new WEY Blue Mountain SUV have shifted to another intelligent driving supplier, Yuanrong Qixing. In November 2024, Great Wall Motors also led the C round of financing for Yuanrong Qixing, injecting $100 million into the company.

Faced with competitors entering new stages one after another, I wonder if Horizon Robotics, at this moment, feels the same way as Liu Zhenyun: "It's my brother's wedding night. How do you expect me to feel?"

// The 'Harsh Winter' of Autonomous Driving and the 'Greenhouse Effect' of Horizon Robotics

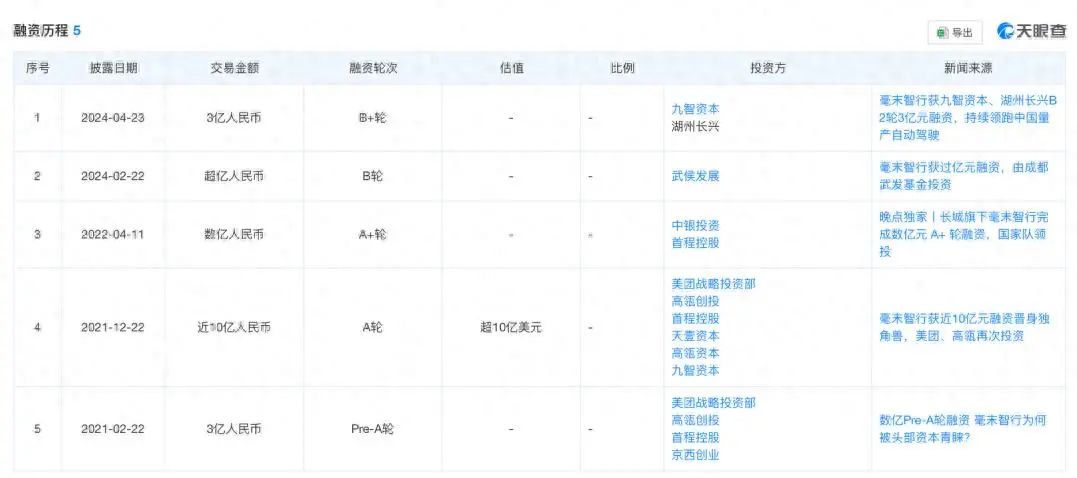

In 2019, Great Wall Motors' intelligent driving department spun off to form Horizon Robotics. According to the financing history on Tianyancha APP, besides Great Wall Motors being the actual controller, companies and institutions such as Meituan, Shougang Fund, and Hillhouse Capital have all participated in Horizon Robotics' financing.

With so many 'sugar daddies' supporting it, it can be said that Horizon Robotics was born with a 'golden spoon'.

Out of the myriad of startup companies in the autonomous driving sector, I would argue that only two were truly born with a golden spoon: one is Luobo Kuaipao, and the other is Horizon Robotics.

Luobo Kuaipao has already glimpsed the dawn of profitability in a single city, and the Robotaxi sector is gradually gaining robustness. However, Horizon Robotics somehow seems a bit 'underwhelming'.

As the industry's 'first in mass production,' Horizon Robotics' HPilot intelligent driving system has been deployed in over 20 vehicle models, all of which are manufactured by Great Wall Motors. Although Horizon Robotics has also signed contracts with other OEMs, there doesn't seem to be much publicly disclosed progress.

In terms of products, in 2023, Horizon Robotics released the second-generation HPilot intelligent driving system, including a 3,000 yuan-level high-speed mapless NOH, a 5,000 yuan-level city memory driving and memory parking product, and an 8,000 yuan-level city full-scenario mapless NOH product. The product line looks quite complete. Moreover, with the continuous rollout of business backed by Great Wall Motors, Horizon Robotics can be considered a relatively successful autonomous driving company, if not the one that has gone the furthest in commercialization.

At the very least, in 2023, when the autonomous driving industry was seeking commerce and survival space, Horizon Robotics did not lack achievements.

If we say that stable orders from Great Wall Motors have created a 'comfort zone' for Horizon Robotics, then compared to companies like Pony.ai and WeRide, which have been constantly fighting in the market for survival, Horizon Robotics feels like it is deeply entrenched in the 'greenhouse' of commercialization, while Pony.ai and WeRide are in the 'life-or-death' struggle of autonomous driving commercialization.

Take Pony.ai as an example. Pony.ai was once a leader in L4, but when the market's valuation logic for autonomous driving changed, non-commercial L4 became obsolete. Later, they were forced to switch to L2++, with a group of software engineers being pressured by the market to do engineering work.

When the market direction changes, the strategy of autonomous driving companies must also change accordingly. Their R&D direction, organizational structure, and product capabilities must keep pace with market iterations.

As a result, Pony.ai, which kept up with the changes, went public, not only operating a fleet of over 250 Robotaxis but also cooperating with multiple OEMs such as Toyota, BAIC, GAC, and FAW. Similarly, WeRide, which also went public, cooperated with Uber overseas, with autonomous driving services landing in Abu Dhabi, achieving a revenue scale of 150 million yuan in the first half of the year.

An insider in the autonomous driving industry told the Internet community, "The demand side of the current autonomous driving industry has completely changed. L2++ solution products are all competing on price. When DJI's low-cost solution emerged, the market direction actually shifted. Instead, Huawei, Yuanrong, and Pony.ai, which focus on advanced autonomous driving, were able to quickly rise to prominence. It's because the end market has been well-educated, and OEMs' demands are also more inclined towards advanced autonomous driving."

Horizon Robotics is not without opportunities to deploy advanced autonomous driving.

At the Chengdu Auto Show in August 2022, Horizon Robotics stated that the first model to feature City NOA would be the Great Wall WEY Mocha DHT-PHEV LiDAR version, expected to be delivered in the fourth quarter of that year. Although the Mocha DHT-PHEV was later launched, City NOA intelligent driving was not activated.

After the 'delayed delivery' of advanced autonomous driving on the Mocha, at the 9th Horizon AI DAY at the end of last year, Horizon Robotics also stated that the 'Blue Mountain' equipped with City NOA would meet everyone in the first quarter of 2024.

As we all know, the intelligent driving orders for the all-new Blue Mountain SUV from WEY recently went to Yuanrong Qixing, and even Great Wall Motors led the C round of financing for Yuanrong, somewhat hedging its bets.

From Horizon Robotics' perspective, losing the order for advanced autonomous driving is indeed regrettable.

On the one hand, last year, they were overly confident about deploying advanced autonomous driving, thinking that securing orders from their sibling company was a sure thing. On the other hand, they did not expect Great Wall Motors to choose Yuanrong instead of them. There are even unconfirmed rumors in the market that Wei Jianjun personally tested and chose Yuanrong.

Why did Horizon Robotics lose the order for the Blue Mountain? It may be because their advanced autonomous driving product is not refined enough.

// Where is the Way Out for Horizon Robotics?

How can it break free from the shackles of the 'greenhouse'? Optimizing the organizational structure may be just one step, and more importantly, it needs to return to refining technology and products. For example, one of the hottest keywords in the advanced autonomous driving industry right now is 'end-to-end intelligent driving'.

In March of this year, Gu Weihao, CEO of Horizon Robotics, expressed this view: "End-to-end will definitely be an important direction in the future, but it won't come so soon. I think it will take a few years of development."

We won't judge whether this is right or wrong. Let's look at a few things:

At this year's Guangzhou Auto Show, Lei Jun revealed that Xiaomi's 'end-to-end' full-scenario intelligent driving will begin delivering the pioneer version in December of this year.

The Senior Vice President of Ideal Auto's Product Department stated that Ideal's 'end-to-end' + VLM 'parking spot to parking spot' function has already been rolled out for test drives at stores nationwide.

Xiaopeng Motors CEO He Xiaopeng announced that they will initiate testing of the 'parking spot to parking spot' intelligent driving solution...

'In terms of covering higher-level cities (NOA), Horizon Robotics may have initially taken a relatively conservative approach,' said Tan Jian, Executive Vice President of the Great Wall WEY brand, during the Guangzhou Auto Show.

On Great Wall Motors' side, full-scenario NOA has been launched nationwide, but Horizon Robotics' City NOA has not yet been activated. In addition, Great Wall Motors has signed the 'Intelligent Ecological Cooperation Agreement' with Huawei, and there are rumors in the market that Momenta has obtained a model order for Great Wall's end-to-end solution.

What does this mean? OEMs are already 'racing ahead' on the path of end-to-end intelligent driving. In other words, in the race to deploy end-to-end advanced autonomous driving, OEMs have already crossed the starting line, while Horizon Robotics may just be approaching it.

Objectively speaking, whether it's losing the Blue Mountain order or Great Wall Motors 'leaving a backdoor,' it is understandable. After all, the current automotive market is highly competitive, and OEMs have a very low fault tolerance rate, which leads to increasingly demanding requirements for suppliers. Recently, BYD requested a 10% price reduction from its suppliers, which is a microcosm of this trend.

The same is true for autonomous driving manufacturers, which also have a very low fault tolerance rate. Horizon Robotics, which is backed by a major company, can be considered to have a relatively high fault tolerance rate. However, after losing the order for advanced autonomous driving on the Blue Mountain, the situation has become somewhat delicate.

'When we internally select suppliers, technical ability ranks first, followed by cost. Even for our own businesses, if the technology is not up to par, we still have to choose third-party suppliers because the competition is too fierce, and there is simply no room for error,' said a friend from an OEM. 'As a supplier, if there is a slight deviation in your technical route, you need to adjust in a timely manner. However, the market window period is too narrow for enough time. Even if you make adjustments, competitors may have already captured the market.'

Some say that Horizon Robotics' personnel optimization is due to internal adjustments and reflections after losing the Blue Mountain order. In the view of the Internet community, whether it's optimization or adjustment, the most critical thing is to solve problems.

The most pressing issue facing Horizon Robotics is to refine advanced autonomous driving products and further develop its own end-to-end intelligent driving products as soon as possible.

Moreover, Horizon Robotics also needs enough time to adjust its team, adapt to the new organizational structure, and then focus on advanced autonomous driving products.

Intelligent driving enterprises are essentially supply chain enterprises, and ultimately, they must rely on products to speak. To turn the tide in business, they must rely on technological catch-up and solid application deployment to gradually achieve commercialization. Commercialization in autonomous driving is a race against the speed of product iteration and the ability to scale. If your product is one generation behind, it may be difficult to truly enter the next stage of market competition.

For end-to-end intelligent driving, at this stage, everyone is competing on the completion of solutions, pursuing fewer takeovers. However, in the next stage, it may become a competition of cost and scale, similar to the current L2 market. Whoever secures more OEM orders will have a cost advantage.

From Great Wall Motors' perspective, investing hundreds of millions but not receiving sufficient financial returns and even delaying their own product rhythm for advanced autonomous driving solutions is unacceptable. Looking back with hindsight, if Horizon Robotics had advanced autonomous driving technology to offer, they would still have a fighting chance backed by Great Wall Motors.

However, at present, in terms of mass production of City NOA intelligent driving, Horizon Robotics is already a generation behind the top players. As for whether there is an opportunity for a comeback in the future, it depends on whether there are projects and whether they can scale up.

'It's already difficult for second-tier intelligent driving manufacturers. If they can't secure projects, maintaining the team may become a challenging task. Even if they can obtain vehicle manufacturer orders, whether their mass-produced products can generate profits is another matter. Some manufacturers, although backed by major OEMs, may not necessarily have an 'iron rice bowl.' Securing new projects and then mass-producing them is the only way to truly turn the tide,' said a friend who works at a vehicle supplier.

In October of this year, it was reported that Wei Jianjun, Chairman of Great Wall Motors, had recently temporarily suspended Horizon Robotics' Hong Kong IPO plan internally. Later, Zhang Kai, Chairman of Horizon Robotics, debunked the rumor, saying, 'There are no plans to suspend the Hong Kong IPO, and it is still ongoing.' He also revealed that the IPO would take place in 2025.

So, is there a chance for Horizon Robotics to launch its IPO in 2025?

Truthfully, a company's IPO timeline isn't swayed by a single lost order. Furthermore, Horizon Robotics has laid substantial groundwork for its IPO. Earlier this year, the company successfully completed two consecutive funding rounds. In February, Horizon Robotics secured over 100 million yuan in Series B1 funding, followed by 300 million yuan in Series B2 funding in April. With everything in place, it is evident that Horizon Robotics' listing plans are progressing smoothly.

Nevertheless, despite Great Wall Motors' investment in Yuanrong, Horizon Robotics remains its major shareholder and a "beloved child." In contrast, other autonomous driving enterprises invested in by Great Wall Motors are akin to "adopted children." Ultimately, the objective of fostering these "adopted children" is to bolster the "beloved child." Will there be any new collaborative efforts between Horizon Robotics and Yuanrong in the future? It's certainly something to anticipate.

Lastly, I extend my best wishes to Horizon Robotics for a successful and swift public listing.