Beyond Nissan's Financial Dip: A Glimpse of an Emerging Offensive

![]() 12/16 2024

12/16 2024

![]() 668

668

Introduction

When financial figures decline, some may succumb to despair, while others see it as an opportunity for resurgence. Can you predict which scenario applies to Nissan and the broader Japanese automotive landscape?

History often repeats itself.

Japanese automakers, a formidable force in the global automotive industry, are currently navigating familiar challenges.

Just as in the 1980s, the US-Japan auto trade war, famously dubbed the "Second Pearl Harbor Incident," culminated in Japan's "voluntary export restraints" on automobiles.

In 2009 and 2015, Toyota and Honda, respectively, faced scandals in the US over "unintended acceleration" and "Takata airbag defects," prompting global recalls of tens of millions of vehicles.

Yet, every industrial or political downturn has failed to defeat Japanese automakers. Today, Japanese, German, French, Korean, and other automakers face the pressure of simultaneous transformation – since 2019, the wave of new energy and intelligence has swept through the automotive industry, impacting traditional giants alike.

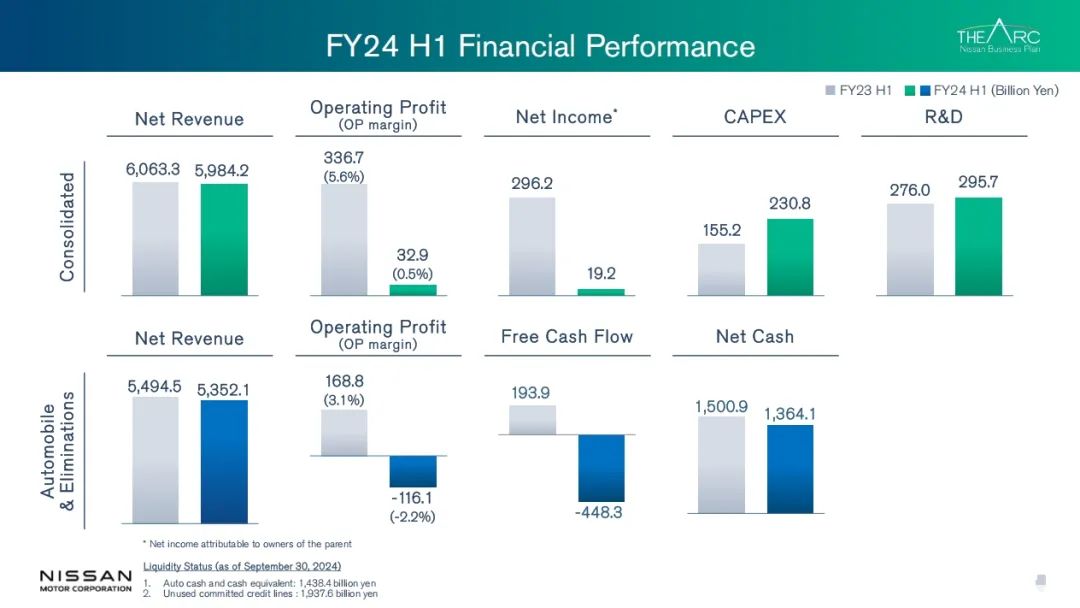

Volkswagen faced the dilemma of closing its German plants for the first time, and Stellantis CEO Carlos Tavares resigned early. Nissan's latest financial report has drawn criticism: for the first half of fiscal year 2024 (April to September), revenue was 5.98 trillion yen, a slight decrease of 1.3%; some were surprised by the 93.5% drop in net profit, despite the amount still reaching 19.223 billion yen.

It's misleading to suggest that Nissan isn't under pressure, but how should we gauge the extent of this pressure? When financial figures decline, some may sink into despair, while others may see it as a springboard for resurgence. Can you predict which scenario applies to Nissan and Japanese automakers in general?

A closer inspection with financial acumen reveals that fluctuations in net profit are not uncommon. Non-recurring gains and losses, accumulated provisions, or high or low comparison bases can significantly alter profit amounts and margins.

The more critical factors lie in two areas:

First, other key financial indicators, such as cash flow. For contemporary enterprises, liquidity stagnation is more alarming than losses.

Second, the allocation of profits. If it's directed towards periodic, massive investments in R&D, manufacturing, and distribution, it signifies preparation for future growth.

As a global automaker with cumulative sales exceeding 100 million, Nissan has weathered numerous storms. However, some observers mistakenly believe that a "90% drop in profit" is more alarming than a "loss."

Conversely, seasoned industry observers understand that many automakers experience profit declines or significant losses during their growth phases yet remain resilient. Nissan's steep profit decline in its financial report also hints at an impending offensive.

Ultimately, the first step before aiming and shooting an arrow is to "pull back" the bow.

Minor setbacks are not fatal; there's no need to retreat

Admittedly, Nissan's recent financial report isn't stellar. However, the operations of the automotive industry are far more complex than school exams.

Bearish views may focus on three dimensions: declining global sales, reduced profits, and negative free cash flow.

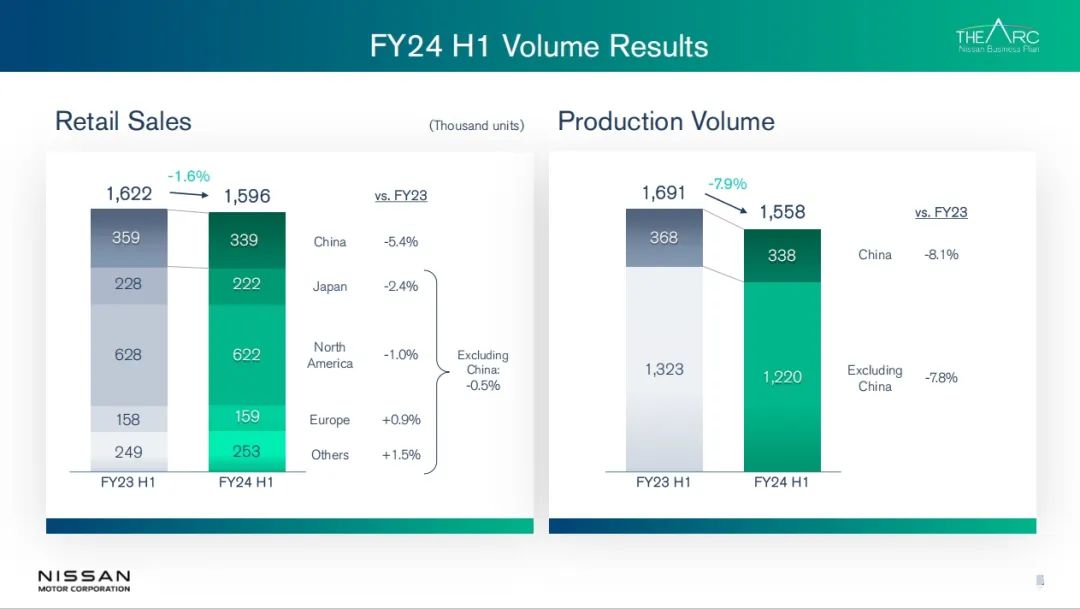

First, the decline in global sales is mainly due to slowing sales in major markets. This is particularly evident in the two largest new car markets globally – China and the US. From April to September 2024, China's auto sales experienced a maximum decline of 14.3%, while the US market declined by 2.7%, and Japan's domestic sales fell by 2.4%. This resulted in a 3.8% year-on-year decline in Nissan's global sales during the same period.

However, from a comparative perspective, Nissan's 3.8% global sales decline isn't alarming.

In fact, Nissan's sales decline in the US market was lower than the global average, with the Rogue (corresponding to the Qashqai in China) ranking among the top ten best-selling cars, selling over 189,000 units by September 2024 alone. In the European market, Nissan's Qashqai and Juke continued their strong momentum, with the Qashqai model consistently ranking at the top of UK sales.

Now, let's examine profits.

Regionally, the profit hub of the US has been in turmoil. The entire US auto market has seen high car loan interest rates and unprecedented default rates, coupled with Nissan's slow model replacement in North America and the adoption of promotional measures such as price reductions and interest-free loans. If last year's first half saw North America contribute 241.3 billion yen in profits, accounting for 70% of the company's total, this year turned into a loss of 4.1 billion yen.

Furthermore, the substantial expenditures on electrification and intelligence, coupled with Nissan's preparation for the next wave of product offensives, will increase costs, adversely affecting profits for the year – yet, it's a long-term positive development.

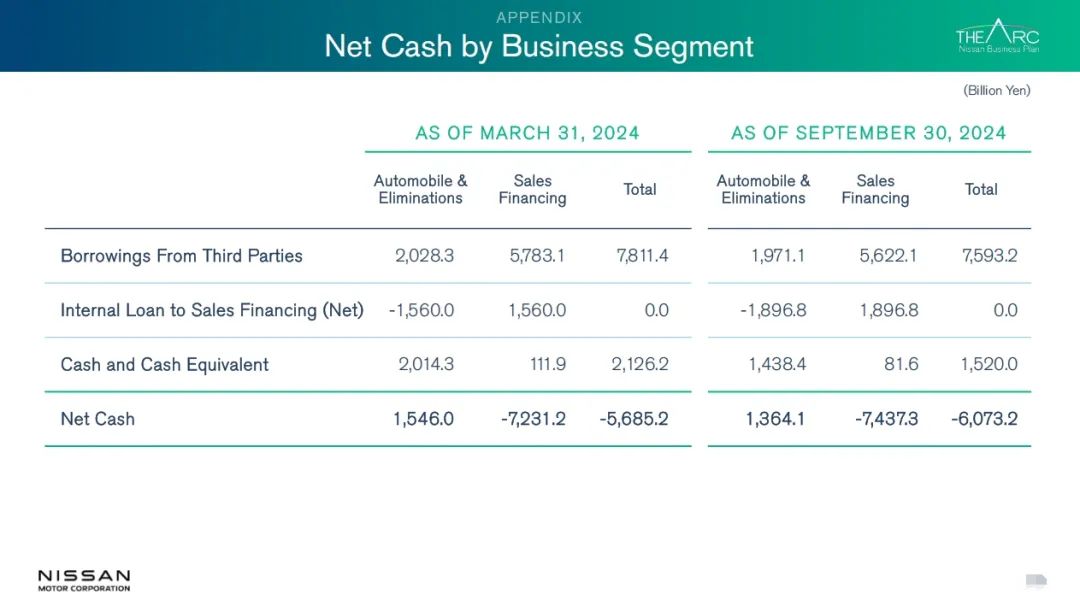

The reasons for a company's negative free cash flow include rapid corporate development, market competition and sales declines, improper cost control, investment activities, financial management issues, and external environmental factors. For Nissan, while "negative free cash flow" may cause concern, Nissan's overall cash position remains sound.

Nissan's net cash in its automotive business remains at a robust level of 1.3 trillion yen. Furthermore, the company's liquidity position is also good, with 1.9 trillion yen in unused committed lines and 1.4 trillion yen in cash equivalents.

At an annual consumption rate of 600 billion yen, Nissan can maintain operations for over a year with its existing 1.4 trillion yen in cash alone, and with unused committed lines, it can even sustain operations for up to five and a half years.

As Nissan Motors spokesperson Shiro Nagai stated, Nissan has sufficient liquidity and "multiple funding sources" to repay debts over the next five years, including currently available liquidity, automotive cash flow, dividends from its profitable sales financing business, and new bond issuances.

In summary, while Nissan is indeed facing a crisis, minor setbacks are not fatal, and there's no need to retreat.

It's worth mentioning that Nissan faced an even more severe crisis in the 1990s, incurring losses. However, with capital injection and cost control, especially the leadership of "cost killer" Carlos Ghosn, Nissan successfully turned the situation around.

Today, Nissan CEO Makoto Uchida is working to prevent further deterioration of the company's balance sheet, while resisting pressure from activist investors and seeking to revitalize the brand.

Always crouching to leap

'Japanese businessmen are the most cautious in the world,' wrote Maryann Keller in 'Collision Course: The Race to Dominate the World Auto Industry in the 21st Century.'

Even during the 1980s and 1990s, when Shoichiro Toyoda led Toyota to new heights, Nissan's Hisataka Kume enjoyed comparable prestige in the industry. While Shoichiro Toyoda represented the aggressive expansion of Japanese automakers, Hisataka Kume was more conservative, resembling Toyota's current philosophy.

Under this conservative and enduring mindset, when Japanese automakers adopt a "low profile," it could signify either true defeat and withdrawal or a period of energy storage, aiming for a comeback.

Take Toyota, the elder of Japanese automakers, as an example.

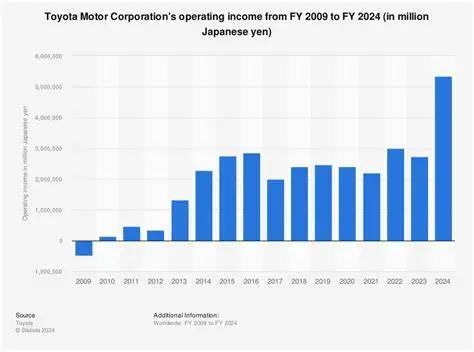

It was only after entering the 21st century that Toyota became the Toyota we know today: steady, conservative, and comprehensive. However, in the fiscal years 2009-2010 and 2016-2017, Toyota's profits experienced two significant declines.

In the fiscal year 2009-2010, the "unintended acceleration" scandal severely impacted Toyota's finances, with the costs of compensation and recalls of tens of millions of vehicles eroding all of Toyota's profits.

Why the fiscal year 2016-2017? This can be attributed to two main factors: 940 billion yen (approximately 57 billion yuan) from currency fluctuations and 530 billion yen (32.1 billion yuan) from increased expenses.

Where did the increased expenses come from? Those familiar with Toyota and Japanese automakers will easily recall a name – TNGA, the cornerstone of Toyota's current decade.

Starting from 2015, Toyota began preparing for the TNGA architecture, with 2016-2017 being the years of most concentrated investment. This concept was even introduced to China in 2017, and the power of TNGA was demonstrated in the eighth-generation Camry in 2018.

Therefore, profit declines in fiscal years like Toyota's 2016-2017 were investments for subsequent years' growth.

Toyota is not an exception.

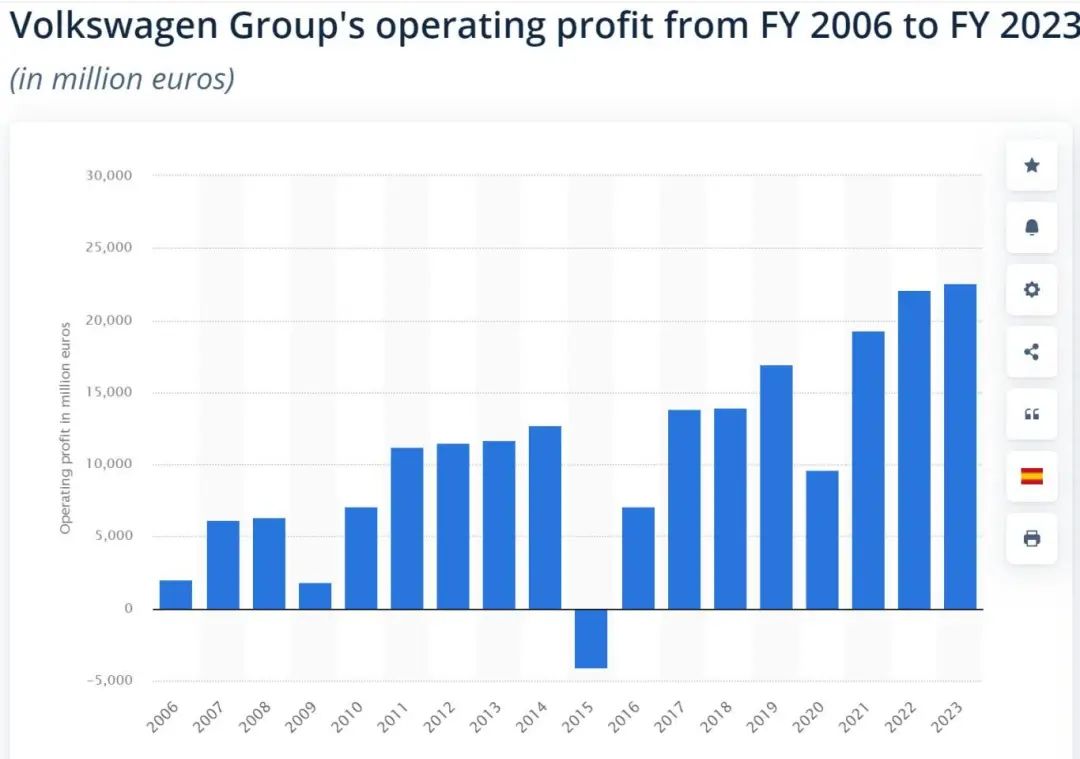

Volkswagen, a rival comparable in size to Toyota, experienced sharp profit declines or even losses in 2009, 2015, and 2020.

In 2009, besides the "turmoil" of Volkswagen's and Porsche's mutual takeover attempts, it was also related to the early R&D and manufacturing investments in the MQB modular platform launched in 2012. In 2015, besides the "Dieselgate" compensation, it was also due to the astronomical budget for the MEB platform. The profit decline in 2020 was due to the impact of the pandemic and then-CEO Herbert Diess's decision to invest billions in intelligence.

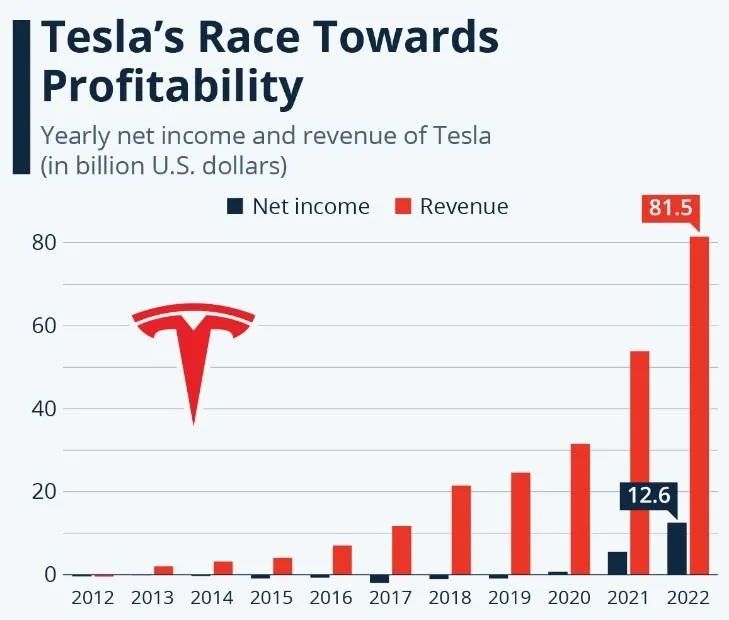

Even new-energy vehicle makers can't escape the rule of "crouching before leaping."

Taking Tesla's financial reports as an example, the more severe loss rates occurred in 2012 (Model S mass production) and 2015-2017 (preparing for Model 3 mass production and the construction of Gigafactories). Each large expenditure caused unsightly financial figures for the year but ensured smooth subsequent development.

Isn't Nissan currently exhibiting a similar pattern?

Nissan's current situation is akin to that of Chinese new-energy automakers a few years ago, both in a rapid development stage and investing heavily externally. In other words, burning cash furiously. This is for Nissan's new four-year strategic plan, "The Arc Nissan Ambition 2030," aimed at accelerating the transition to electric drive, enhancing corporate value, and strengthening comprehensive global competitiveness.

In 2021, Nissan announced that it would invest 2 trillion yen (17.59 billion USD) over the next five years to accelerate automotive electrification and launch all-solid-state battery models by 2028. According to incomplete statistics, over the past year, Nissan has undertaken the following investments:

Nissan invested over 400 million USD in Fisker's truck platform, gaining access to Fisker's EV pickup platform.

Nissan will invest up to 600 million euros in Renault's Ampere division.

Nissan continues to heavily invest in its plant in Sunderland, UK, to ramp up production of the new Leaf electric vehicle.

Nissan Egypt signed a 45 million USD investment agreement to produce a third model locally at its plant.

Nissan will invest approximately 150 billion yen in the production of automotive lithium iron phosphate batteries.

Nissan plans to invest over 400 billion yen in battery capacity.

Nissan recently announced plans to invest over 700 million USD in the production of its popular Kicks model in Aguascalientes, Mexico.

Nissan announced it would invest billions of dollars in its Sunderland plant to produce new Qashqai, Juke, and Leaf models.

Nissan will invest an undisclosed amount in ChargeScape.

Renault-Nissan will invest 600 to 700 million USD to establish India as an export hub.

When Nissan's previous product slowdown and stagnant electrification plans hindered its current development, it chose to bear the burden rather than skimp on "investing in the future." In short, Nissan is currently in a transition period between old and new eras.

Through these investments, Nissan has taken a leading position in high-capacity automotive battery technology and has clearly stated its intention to apply this technology to mass-produced models. Meanwhile, in the exploration of autonomous driving technology, including key areas such as artificial intelligence, Nissan has also maintained remarkable progress and competitiveness.

Through these measures, Nissan has not only sown abundant seeds of hope for the future but is also fully prepared for the upcoming harvest season.

The new test is whether it can rebound

For Nissan, the upcoming year 2025 will undoubtedly be etched as a decisive chapter in its long history. Faced with the harsh reality of declining sales, mounting debt burdens, and intensifying competition in the electric vehicle sector, this once-glorious automaker stands at an unprecedented survival challenge.

In this battle for survival, Nissan's path to victory will depend on its ability to make brave and forward-looking decisions, build a solid network of strategic alliances, and secure strong government support to jointly withstand the industry's winter and navigate this turbulent period of uncertainty.

In November, Nissan shocked the industry with a bombshell announcement – laying off approximately 9,000 employees globally and announcing a significant 20% reduction in production capacity to 4 million units. This move not only reflects Nissan's profound reflection on the current market situation but also demonstrates its determination to survive by taking drastic measures.

In refining its global footprint, Nissan has not only consolidated production bases in Thailand and elsewhere but also scaled back its US market output by roughly 20%. Additionally, European market sales have seen a notable decline, prompting a corresponding 20% reduction in UK factory production. These painful decisions underscore Nissan's urgent need to optimize resource allocation and elevate production efficiency. They also represent a strategic shift aimed at bolstering the company's resilience against risks by streamlining operations and focusing on core competencies.

In the face of industry shifts, Nissan recognizes the paramount importance of speed. Consequently, the company has announced plans to shorten its new car development cycle to just 30 months. This measure is designed to expedite product iterations and swiftly respond to evolving market demands, particularly in the realm of new energy vehicles.

In China, the world's largest market for new energy vehicles, Nissan intends to intensify its investment in such models, particularly in promoting plug-in hybrid electric vehicles (PHEV) and e-POWER technology. This strategy aims to secure a prominent position amidst the burgeoning wave of green transportation. This series of actions not only evidences a keen understanding of market trends but also embodies Nissan's profound insight into future mobility paradigms.

Amid financial pressures, Nissan has embarked on a comprehensive internal reform. CEO Makoto Uchida voluntarily accepted a 50% pay cut, with other senior executives following suit, underscoring the leadership's commitment to weathering the storm alongside employees.

Makoto Uchida has made it clear that reforming the internal management structure is a top priority. The goal is to establish a nimble system capable of swiftly adapting to market changes, particularly in the realm of electric and new energy vehicles. To this end, Nissan has introduced the new role of "performance officer," filled by the experienced Guillaume Cartier. His appointment marks a fresh start for Nissan in its quest for efficiency and efficacy.

In the vital Chinese market, Stephen Ma, Nissan's current Chief Financial Officer, will assume the role of Chairman of the Nissan China Management Committee and continue to report directly to Makoto Uchida. Leveraging his extensive experience in global enterprise management and profound understanding of the Chinese market, Stephen Ma will spearhead the formulation of long-term strategies aligned with the Chinese market and enhance local operations.

External collaborations have also become a linchpin in Nissan's revitalization efforts. The company has announced plans to deepen its ties with Renault, Mitsubishi, and Honda, exploring strategic partnership opportunities in technology and software services. By pooling resources and complementing each other's strengths, they aim to bolster their overall competitiveness. Makoto Uchida emphasized that unity and cooperation are essential for Nissan to regain its growth trajectory, ultimately building a resilient company capable of weathering market fluctuations and spearheading automotive technology innovation.

Identifying stable investors remains a cornerstone of Nissan's survival strategy. As Renault gradually reduces its stake in Nissan, the latter has actively sought new partners to fill the void. Both financial institutions and companies like Honda, which share a common vision for electric vehicle development, could become pivotal supporters in Nissan's future endeavors.

This step is pivotal for Nissan, not just in terms of capital infusion but also for strategic synergy and long-term development stability.

The upcoming 12 to 14 months will be crucial for Nissan's survival. The company must ensure it secures cornerstone investors while steadfastly advancing its electric vehicle strategy, implementing effective cost control measures, and maintaining stability amidst heightened global economic uncertainty.

Despite the challenging road ahead, Nissan's rich heritage and strategic initiatives offer a glimmer of hope. Through continuous self-innovation and external collaborations, Nissan is poised to rise from the ashes in this automotive industry reshuffle, once again demonstrating its strength and vision as an industry leader.

In conclusion, while Nissan's transformation journey is fraught with challenges, each step embodies hope and dedication for the future. In this battle for survival, Nissan is practically demonstrating the profound meaning of "cultivating new opportunities amidst crises and forging new horizons amidst changes." Its narrative will serve as a valuable inspiration for courage, innovation, and collaboration within the automotive industry and beyond.