Hyundai Seizes Hidden Advantages

![]() 12/23 2024

12/23 2024

![]() 497

497

In the tumultuous third quarter of 2024, the global automotive industry underwent drastic changes, with Chinese automakers achieving remarkable success in transitioning to new energy vehicles. The rise of domestic alternatives in the Chinese market significantly impacted the performance of all global automakers. Despite protective measures by overseas automotive giants to safeguard their developed markets, they could not prevent a sharp decline in their overall performance.

The decline was severe, and among those still outperforming the industry were either electric vehicle companies or automakers with minimal presence in the Chinese market.

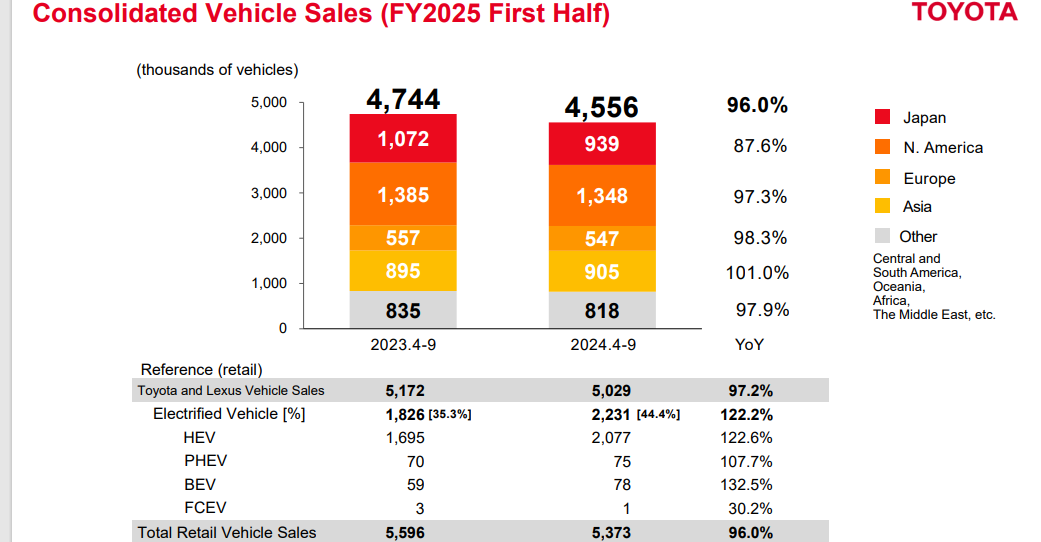

Toyota's profits also declined sharply, primarily due to exchange rate fluctuations. However, Toyota's non-operating profit remained around 4-5 billion, indicating a relatively stable performance. As the industry leader, Toyota remains unshaken compared to its long-time rival Volkswagen and other luxury German automakers, as well as fellow Japanese automakers Honda and Nissan.

Notably, outside Germany, Japan, and the United States, Hyundai's profits did not plummet drastically, positioning it among the top three performers. The Hyundai Kia Automotive Group is not fully consolidated, with Hyundai owning a 34% stake in Kia Motors, which generated a profit of $1.56 billion in Q3 2024.

If consolidated, the cumulative profit of the Korean automotive group comprising Hyundai and Kia should exceed $3.1 billion, higher than that of General Motors and second only to Toyota.

Korean cars have often been overshadowed, considered substitutes for Japanese cars. However, compared to Japanese automakers, Korean cars, despite lacking historical and technological accumulation, benefit from Korea being the world's second-largest battery producer, providing a solid foundation for electrification capabilities.

While their competitiveness may not be as strong as China's, Korean automakers now only have Hyundai-Kia, eliminating the need to consider domestic competition. Their focus on globalization is an often-overlooked advantage.

Amidst the electrification trend and the US automotive market's exclusionary policies towards non-allies, Korean companies are capitalizing on the situation to secretly reap benefits.

I. The Rise of Korean Cars

Both Hyundai and Kia started their businesses during World War II, accumulating more experience than the Chinese automotive industry. However, Korea has never been recognized as an automotive power. Compared to Europe, America, and Japan, Korea lags behind technologically, having long engaged in imitation rather than innovation. High-end and performance models were not feasible, nor were they as economical as Japanese cars.

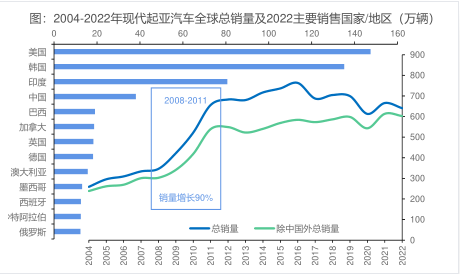

After the Asian financial crisis in 1998, decades of effort by Korean automakers still could not catch up with Germany, the United States, and Japan. Kia faced insolvency, prompting the Korean government to order Hyundai to acquire it. The two became one entity, with Hyundai owning 50% of Kia but operating independently under different brands. Even today, Hyundai holds a 34% stake in Kia. As a result, Korea is left with only one automotive giant, and its domestic market has entered a monopoly phase, focusing on global business.

Korean cars have long had a poor image, positioned as substitutes for Japanese cars, selling at cheaper prices but lacking the economic efficiency and durability of Japanese models. This led to Korean cars' early retreat from the Chinese market, where high-end brands are prioritized, and the cost-performance race is dominated by domestic Chinese brands.

Therefore, during the third quarter's industry-wide performance decline, Hyundai Kia, like General Motors, escaped unscathed due to its early exit from the Chinese market.

Since 2019, Hyundai Kia's market share in China has accelerated its decline, falling below 1% this year. With cumulative sales of 182,000 vehicles in the first three quarters and a relatively low average price, revenue in China is expected to be around 20 billion yuan. Compared to the nearly 1.4 trillion yuan revenue of the Hyundai Kia Group, even if China's revenue were to drop to zero, it would have minimal impact on the company.

In contrast, Japanese and German companies have suffered significant losses due to their large market share in China. A decline in sales in the Chinese market can lead to a group revenue drop of over 10% or more. In the low-margin automotive industry, even a slight decline in revenue can lead to a significant profit collapse.

Like Samsung, although it was early eliminated from the Chinese market, Hyundai Kia has been able to maintain its performance relatively unaffected by globalization. The Hyundai Kia Automotive Group has seen year-over-year sales growth outside of China, ranking among the top in non-Chinese sales growth. It can be said that Hyundai Kia is heading in the right direction.

Developed markets in Europe and the United States contribute significantly to this growth. After the 2008 financial crisis, economic factors led the United States to promote smaller displacement vehicles, with Japanese and Korean automakers capturing most of the benefits. As a result, the US began to fall behind in the global automotive industry.

Against the backdrop of the US economy shifting from real to virtual, the cost of car repairs has increased yearly, further strengthening the preference for durable vehicles. Japanese and Korean cars have ultimately become the largest automotive category in the United States.

Currently, Hyundai Kia ranks among the top three in global automobile sales. Since other companies, except Stellantis, still have a significant market share in China, Hyundai Kia's global sales have the potential to further narrow the gap with leading companies.

Therefore, de-emphasizing the Chinese market earlier has become an advantage. Observing its structure, North America and Europe account for 49% of its market, essentially making it a European and American automaker.

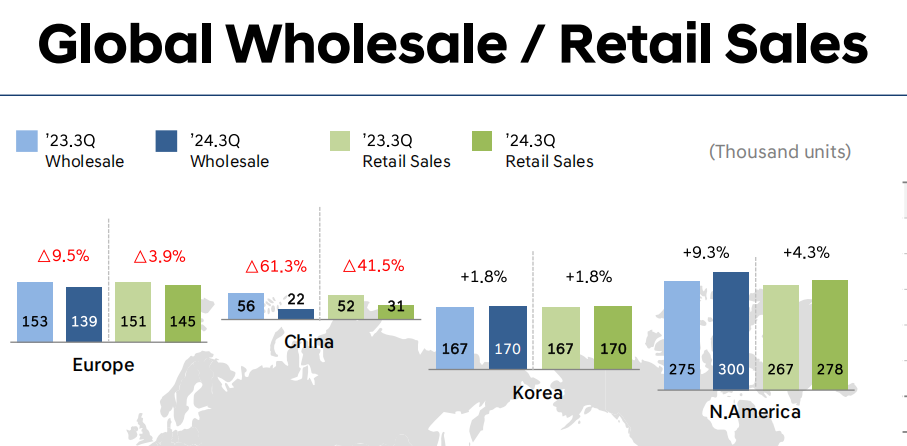

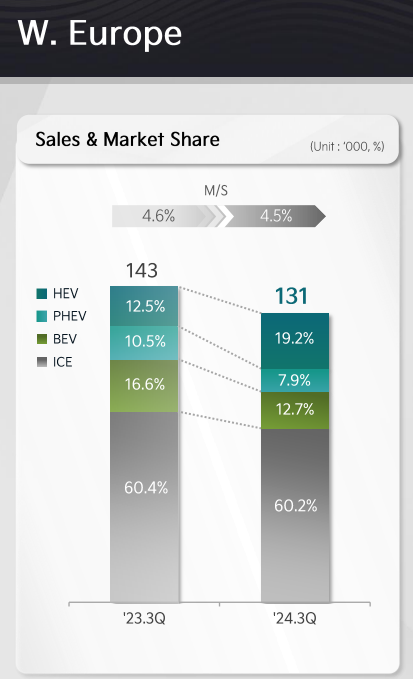

This year, Hyundai Kia has continued to see considerable growth in North America, with a rate exceeding 10%, while Europe has declined by 9.5%. Economic conditions in other regions are poor, leading to an overall market decline, which has affected the company's sales. This may reflect that European automakers have seen a significant decline in their Chinese market share but are unable to make changes. To compensate, these automakers can most easily recover lost sales in their home markets. Therefore, Hyundai Kia's European operations face future challenges.

It is also noteworthy that the Korean market is almost monopolized, with Hyundai Kia occupying 90% of the domestic market. This is roughly equivalent to the entire European export ratio, making it the most solid foundation for Hyundai Kia's sales. High-end German brands struggle to sell, while Japanese cars are more economical and durable, making Koreans prefer domestic brands.

In Japan, nearly 80% of cars are domestic, and 70% of cars in Germany are European. The United States is no longer an automotive power, and the political complexities behind the dominance of Japanese and Korean cars are not discussed here.

The most embarrassing situation is in China, where domestic brands have the lowest market share among automotive powers, at 56%, indicating that 44% are foreign brands. Japan and Korea exhibit stubborn patriotic consumption patterns, whereas Chinese consumers do not share the same nationalistic sentiment.

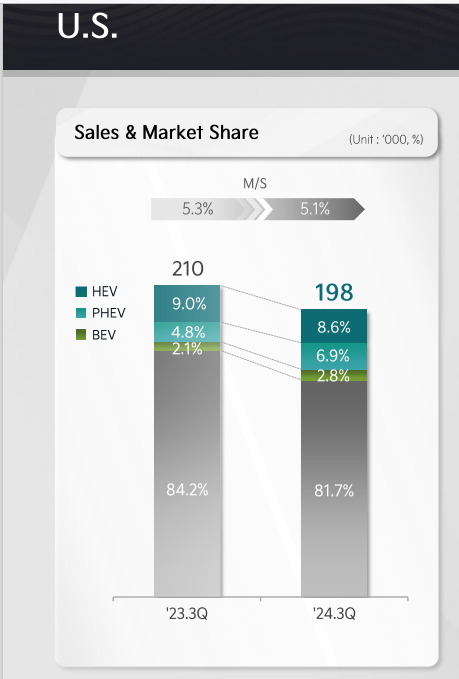

In the US market, Hyundai's largest, it is also the most profitable globally. After Donald Trump took office, he threatened to impose a 100% tariff to prevent Chinese companies from profiting in the US. Given the current market share, the unspoken message is that Japanese and Korean companies will continue to make significant profits.

II. The US Market: PHEV as the Key

Given this favorable environment, Hyundai Kia must outperform American and Japanese automakers in North America to expand its market share. This brings us back to the point made at the beginning of this article: the potential advantages of electrification.

Currently, the penetration rate of electric vehicles in the US is 10%, with little growth this year. Pure electric vehicle penetration has stagnated, as evidenced by Tesla's low growth rate in the US. The US terrain and the ratio of oil to electricity prices determine that electrification is dominated by hybrid vehicles. This year, Japanese and Korean automakers, with their strong hybrid technology, have seen decent growth. For example, despite an overall sales decline for Toyota this year, hybrid vehicle sales have increased by nearly 20%.

From Kia's data, the electrification ratio is lower than Toyota's near 40%, at around 20%. However, it is crucial to note that PHEV (Plug-in Hybrid Electric Vehicle) growth has been rapid.

The difference between PHEV and HEV (Hybrid Electric Vehicle) lies in the battery size. HEV uses electricity at low speeds and an engine at high speeds, achieving optimal fuel economy. However, the small battery has limited power and capacity, preventing kinetic energy recovery. After China's Dmi technology breakthrough, HEV's engine advantage at high speeds was leveled, and its fuel economy was surpassed by China's PHEV. As vehicles evolve towards full intelligence and autonomous driving, which require electricity, the PHEV route becomes even more correct.

PHEV features a larger battery and a fuel tank, represented by BYD's Dmi. Additionally, extended-range electric vehicles (EREVs) are also considered PHEVs, featuring a large battery and fuel tank but lacking an engine, which compromises fuel economy at high speeds. Companies like Li Auto, AITO, and NIO, which also employ this technology, are experiencing high growth.

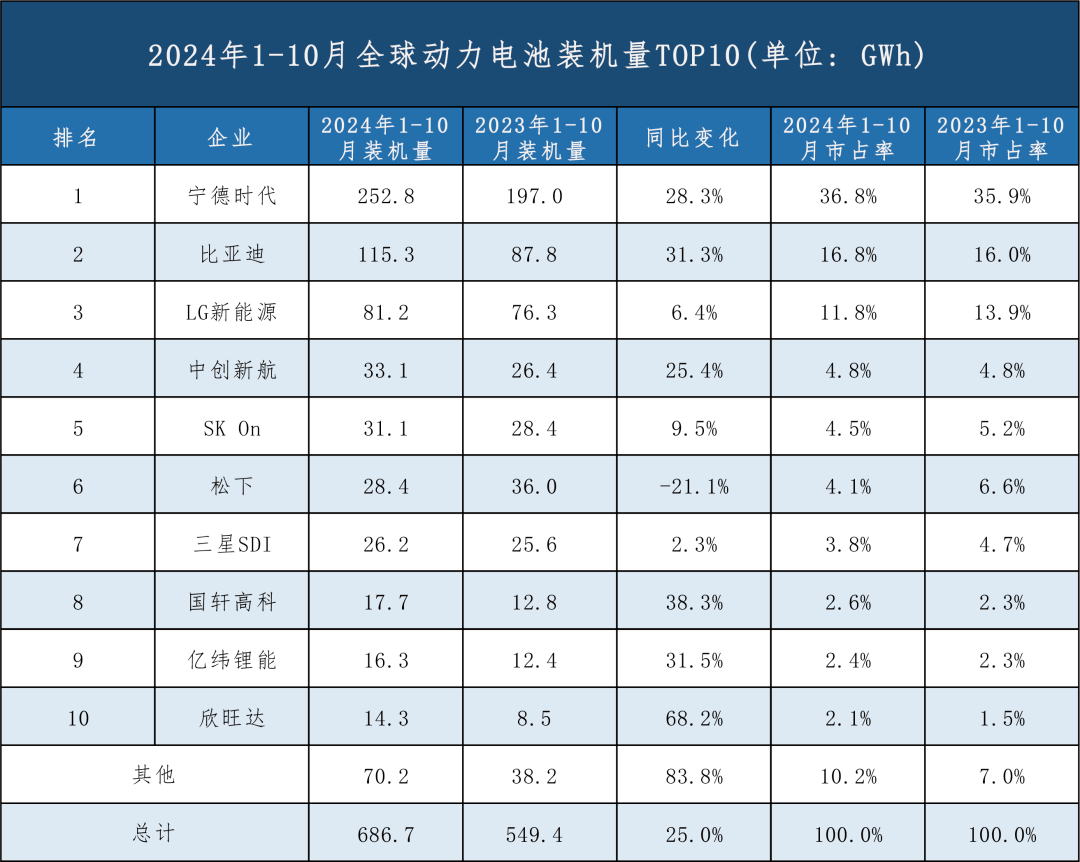

The global acceleration of electrification is actually led by China's PHEV technology, which has enabled China to take the lead in electric vehicle penetration.

Japanese automakers also sell HEVs in China, but their sales have collapsed mainly because their prized fuel economy has been defeated. Currently, PHEV is the route with the lowest energy consumption, suitable for countries where oil is either more or less expensive than electricity.

HEV technology, with a light battery and heavy emphasis on the engine, has long been dominated by Japan. Hyundai also possesses this technology, albeit not as proficiently, ranking second globally.

Compared to Chinese companies in PHEV technology, Korea lags behind. However, Chinese cars are blocked by high tariffs in the US. Japanese HEVs cannot compete, and American automakers like Ford and GM want to develop PHEVs but rely heavily on batteries from CATL, BYD, LG, and SK. The first two fear tariffs, while the latter two are Korean companies. Tesla, on the other hand, does not produce hybrids.

From this perspective, Hyundai seems to be in a favorable position. With US tariff protection, it can capture a significant share of the North American market and utilize its relative battery advantage to potentially gain market share from Japanese and American automakers amidst the electrification wave. Compared to other automotive giants, Korean automakers currently face the fewest problems.

Of course, this logic of reaping benefits is based on the assumption that Chinese automakers' overseas expansion will be disrupted by various political factors and that Hyundai will proactively choose the PHEV route.

Observing the European market, Kia's electrification rate remained unchanged year-over-year, with a decline in PHEV share and an increase in HEV sales. Mainly, European automakers are also focusing on PHEVs for electrification, with many PHEV models from BMW and Volkswagen. Hyundai does not face direct competition in this segment.

Technologically, the comparison is German PHEV < Korean HEV < Japanese HEV < Chinese PHEV. Korea has yet to choose the right direction, opting only to follow growth with HEV vehicles. Hyundai Kia has the capability to position its PHEVs between Japanese and Chinese models, but whether it can adhere to this direction remains questionable.

Unfortunately, BYD has already begun to enter Europe in full force and is breaking through the final tariff barrier by establishing local factories. Following BYD, the entire Chinese automotive industry is expected to follow suit. Modern automakers may realize that the time window for aggressively promoting PHEVs in the short term is closing. However, the US market still offers hope for this strategy.

Conclusion

Therefore, amidst the conflict between China and the US and the intertwined electrification and intelligence of the automotive industry, even if the Chinese automotive industry has advanced technology, it cannot dominate the world completely. Globally, it seems that Korea's Hyundai Kia faces the fewest logical problems and has the best chance of survival.

Another tragic reality is that in 2023, Hyundai and Kia's combined operating profit totaled 113 billion yuan, surpassing the combined profit of all Chinese automakers, which hovered around 50 billion yuan. Despite being perceived as an imitator, Korea has managed to secure a top-three position in global sales rankings and is on the brink of becoming the second most profitable automaker. If German and Japanese automakers were to merge, their combined data would undoubtedly eclipse that of Hyundai and Kia. However, China's performance as an automotive powerhouse remains unacceptable.

The crux of the issue lies in the dearth of patriotism among Chinese consumers. Even though Korean cars might not rival Japanese cars in durability, economy, or performance, Koreans prefer to invest more in domestic brands. Kia's 90% market share monopoly in Korea is unparalleled globally, allowing its management to focus solely on globalization without being encumbered by domestic market strategies. In contrast, Chinese automakers' annual profit of 50 billion yuan is hindered by numerous loss-making enterprises. Excessive internal competition leaves them with little time to focus on global expansion.

Nevertheless, China's automotive industry has the potential to consolidate and expand its lead in electrification. Perhaps the more pessimistic we are now, the more optimistic the future holds. Assuming that the Chinese market can achieve an 80-90% domestic share and cease internal competition to focus on the global market, the upside potential is immense. Korea, with its small market of less than 2 million annual sales, pales in comparison to China's nearly 24 million annual vehicle sales. Companies nurtured in such a market no longer lag significantly behind traditional automotive powers like Japan, Germany, Korea, and the US in technological advancement. As a result, the profit margin for China's automotive industry in the future could surpass the current 113 billion yuan severalfold. This, however, necessitates the concerted efforts of both Chinese consumers and automakers.