Is Stellantis Group Headed for a 'Breakup'? Did Carlos Tavares Mislead?

![]() 10/29 2025

10/29 2025

![]() 692

692

Whether it's a downturn in performance, whispers of brand divisions, or strategic indecisiveness in the U.S., Chinese, and European markets, all signal Stellantis Group's challenges and adaptations amidst the electrification revolution.

When whispers of the 'disintegration' of Stellantis Group, the world's fourth-largest automaker, surfaced from the lips of its former CEO, shockwaves reverberated through the automotive sector.

Recently, ex-Stellantis CEO Carlos Tavares hinted at the possibility of the group's breakup, though this notion stems from his newly penned book, 'Pilot in the Storm,' crafted during his leisure time at home.

In the book, he voiced concerns that 'the delicate balance between Italy, France, and the United States might be destabilized.' He speculated that Chinese automakers might snap up European operations, while the U.S. division could reclaim control over brands like Chrysler and Jeep. Nonetheless, he believed that a split could boost competitiveness for all involved, particularly in the U.S. market.

Irrespective of the veracity of Tavares' claims, the Stellantis Group is indeed navigating a rough patch.

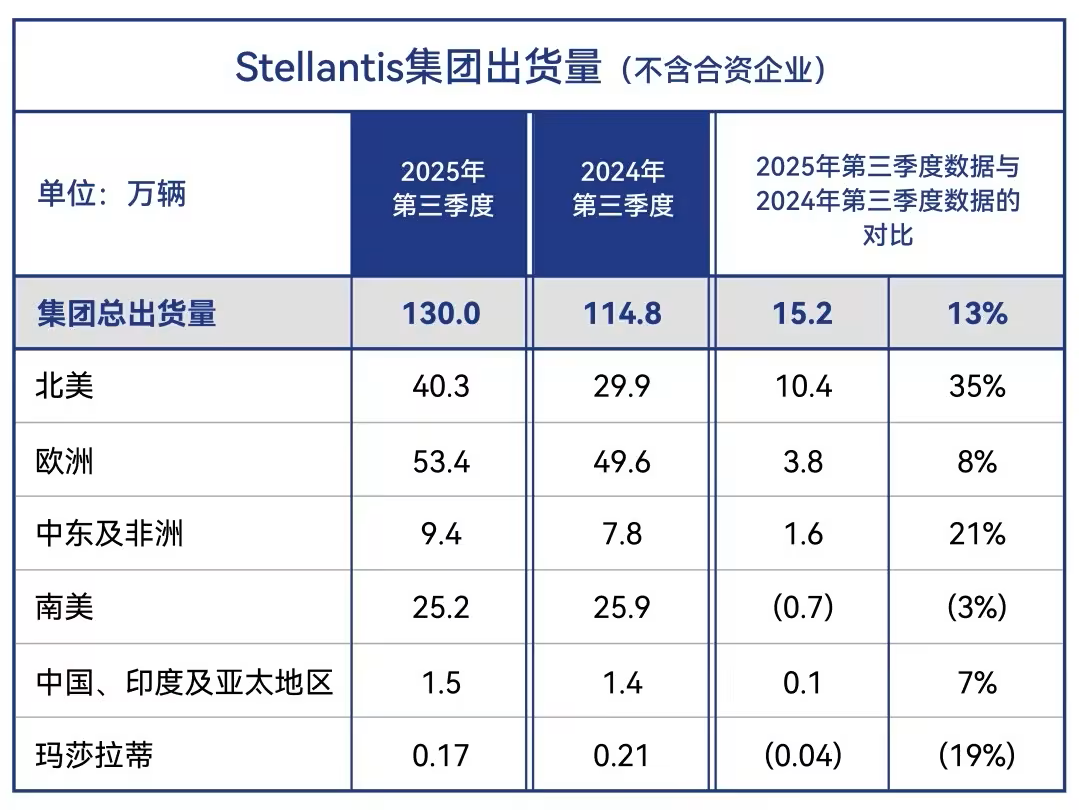

Data indicates that in the first half of 2025, the Stellantis Group witnessed a significant performance slump, with revenue hitting €74.3 billion (roughly RMB 615 billion), marking a 13% year-on-year decrease; a net loss of €2.3 billion (approximately RMB 19 billion), compared to a net profit of €5.6 billion (around RMB 46.4 billion) in the same period the previous year.

In terms of sales, the Stellantis Group globally sold 2.69 million vehicles in the first half of this year, an 8% year-on-year drop, with several brands facing recurring rumors of being 'put up for sale.'

Under such circumstances, Tavares' 'disintegration' speculation certainly fuels wild conjecture.

An Unbalanced Strategy

In truth, Tavares' remarks carry a certain weight.

Previously, Tavares' interventions not only swiftly transformed the PSA Group, owner of the Peugeot, Citroën, and DS brands, from a loss-making entity into one of the industry's most profitable automotive brands but also led to the subsequent acquisition of Opel and Vauxhall.

Within a year, these two brands, which had been hemorrhaging money for two decades, returned to profitability. Capitalizing on their soaring stock prices, Tavares also orchestrated the merger of PSA and FCA, a move that greatly pleased the French at the time.

Thus, Tavares questions whether French interests will be adequately protected after his departure. He wrote, 'After I step down, I am uncertain whether the French interests I have always valued... will continue to be vigorously upheld.'

From his vantage point, the equilibrium of interests among Italy, France, and the United States has been disrupted.

For instance, the Stellantis Group is heavily investing in the U.S. market.

According to informed sources, the group plans to pour approximately $10 billion into the United States, aiming to refocus on this market pivotal to its profits.

Informed sources reveal that, in addition to funds of a similar magnitude earmarked earlier this year, the automaker might announce an additional investment of around $5 billion in the coming weeks. They stated that this multi-year investment could be channeled into factories, including restarts, hiring, and new model development, involving states such as Illinois and Michigan.

The Stellantis Group is focusing on reviving Jeep's former glory, considering new investments in the Dodge brand (potentially launching a new Dodge V8 muscle car), and even involving the Chrysler brand in the long run. However, they also noted that related negotiations are ongoing, no final decisions have been made, and investment amounts and target projects may still shift.

This new spending reflects efforts by CEO Antonio Filosa, who assumed office in May, to recalibrate investment layouts across regions.

Echoing the practices of companies across various industries announcing sizable investment plans in the United States, the Stellantis Group's move aims to garner support from U.S. President Trump and mitigate tariff impacts. In August, Hyundai Motor Group announced it would hike its U.S. investments by $5 billion by 2028, bringing the total to $26 billion; several large European pharmaceutical companies have also pledged billions in new spending.

Externally, it is believed that under Tavares' leadership, the Stellantis Group witnessed a significant market share decline in the U.S. and European markets due to a series of strategic missteps. Now, Filosa is striving to stabilize the group while also navigating the impacts of Trump's tariff policies.

These efforts have started to bear fruit, with the company's U.S. market deliveries rising in the third quarter, boosting investor confidence with this positive news on Thursday.

Unlike Tavares, the new CEO has commenced trimming investments in some European markets, including deciding to withdraw support for a hydrogen vehicle project jointly undertaken with Michelin and Faurecia Group. According to recent reports, the Stellantis Group is also contemplating selling its car-sharing business, Free2Move.

Earlier this year, the company engaged McKinsey & Company to provide strategic consulting for the Maserati and Alfa Romeo brands. However, Stellantis has repeatedly denied plans to sell Maserati.

The Stellantis Group's heightened focus on the U.S. market has raised eyebrows among European unions, as the group currently grapples with overcapacity issues in the European market. Due to sluggish demand for models like the Alfa Romeo Tonale SUV and Fiat Panda, the Stellantis Group has temporarily halted production at eight of its European factories.

At the end of last year, the Stellantis Group unveiled an ambitious production plan for the Italian market, but its realization now seems remote.

Rekindling Old Ties

In contrast to Tavares' increasingly distant stance toward China, the Stellantis Group has been extending olive branches to revive its relationship with Dongfeng Group since the beginning of this year.

In February, Stellantis Group Chairman and Ferrari Chairman John Elkann visited China with the aim of 'learning from China' to accelerate the group's electrification transformation, tackle global market competition, and advance its new energy business development in China.

Subsequently, Filosa made an urgent visit to China shortly after taking office and held talks starting July 30 with Dongfeng Motor Group Chairman Yang Qing and relevant leaders from the Wuhan Economic Development Zone. 'The Stellantis Group will deepen cooperation with Hubei, work hand in hand with Dongfeng Motor to accelerate the new energy transition, strive to produce more outstanding products in the automotive manufacturing sector, and achieve mutual benefit, win-win results, and sustainable development,' Filosa stated.

Following that, among the Stellantis Group's brands, Peugeot Global CEO Alain Favey and Citroën Global CEO Xavier Chardon also made an urgent visit to Wuhan and Dongfeng Motor in August to inspect China's new energy vehicles, charging networks, and the entire ecological chain.

Analysts believe that the密集 (intensive) visits by Stellantis Group's top brass to the Chinese market starkly contrast with the strategies of Tavares' era. The new management clearly recognizes that without a solid foothold in the Chinese market, it would be arduous to truly realize its global electrification transformation strategy.

Indeed, the Stellantis Group urgently needs to enhance its performance in the Chinese market to alleviate performance pressures.

Just this month, rumors surfaced that top brass from the Stellantis Group have reached a preliminary cooperation intention with Dongfeng Group. Both parties plan to deepen collaboration based on the existing PSA brands, leveraging the platforms and technologies of the VOYAH and MHERO brands to further extend cooperation to the development of off-road vehicle models under the Jeep brand.

Rumors indicate that regarding the cooperation between the Jeep brand and Dongfeng Group, the Stellantis Group is no longer seeking absolute control but is willing to adopt a 'Joint Venture 2.0' model akin to that of Chery and Jaguar Land Rover: the French side will lead styling and chassis tuning, preserving French automotive design genes; the Chinese side will lead core electrification technologies such as the three electric systems (battery, motor, electronic control), intelligent cockpits, and autonomous driving. Both parties plan to launch the first off-road vehicle in the first quarter of 2027, compressing the development cycle to 18 months, aligning with the pace of China's new energy vehicle startups.

Industry insiders believe, 'If the rumors hold true, Jeep's pursuit of cooperation with Dongfeng can be viewed as a rational act of self-preservation. Electrifying off-road vehicles must harness China's supply chain; otherwise, they won't even have a seat at the table by 2027. Dongfeng possesses the MHERO and VOYAH platforms, capable of providing a one-stop solution for the three electric systems, chassis, and verification.'

Notably, on October 28, Dongfeng Motor Group announced a personnel adjustment, stating that Lu Haitao, the group's spokesperson and Deputy Director of the Strategic Planning Department, will return to Dongfeng Motor Corporation (DPCA) to serve as General Manager. In this adjustment, he will retain his position as Deputy Director of the Strategic Planning Department and his communication responsibilities with the Stellantis Group, fully overseeing DPCA's daily operations and management.

It can be said that one of Lu Haitao's future core tasks will encompass promoting deeper cooperation with the Stellantis Group, securing more technological and product support for DPCA, and addressing shortcomings in electrification and intelligence.

Undoubtedly, when whispers of the Stellantis Group's 'disintegration' emerged from Tavares' new book, the fate of the world's fourth-largest automaker became the most pressing enigma in the automotive industry. Whether it's a downturn in performance, whispers of brand divisions, or strategic indecisiveness in the U.S., Chinese, and European markets, all reflect Stellantis Group's challenges and adaptations amidst the electrification revolution.

From Tavares' concerns over French interests to new CEO Filosa's 'America First' investments; from overcapacity in European factories to tentative handshakes restarting cooperation with China's Dongfeng Group, every move by the Stellantis Group impacts the nerves of the global automotive market.

However, crises also harbor opportunities. If the 'Joint Venture 2.0' model between Jeep and Dongfeng can materialize, French vehicles might harness China's supply chain to secure a position in the electrified off-road vehicle sector. Lu Haitao's return to DPCA might signal Stellantis' 'second venture' in the Chinese market.

In the future, will Stellantis be reborn through disintegration, or will it become a pawn in globalization's chess game? The answer might lie in the hands of Chinese automakers.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion.

-END-