Sober Reflections Amidst the AI Frenzy: Trillions Pour In—Bubble or New Era?

![]() 10/29 2025

10/29 2025

![]() 589

589

This week’s capital markets have been more thrilling than a sci-fi blockbuster. Nokia, the brand once synonymous with 'nut-cracking' durable phones, saw its stock surge 22% in a single day thanks to NVIDIA's $1 billion AI investment—prompting exclamations that even 'antiques' can soar on AI’s tailwinds.

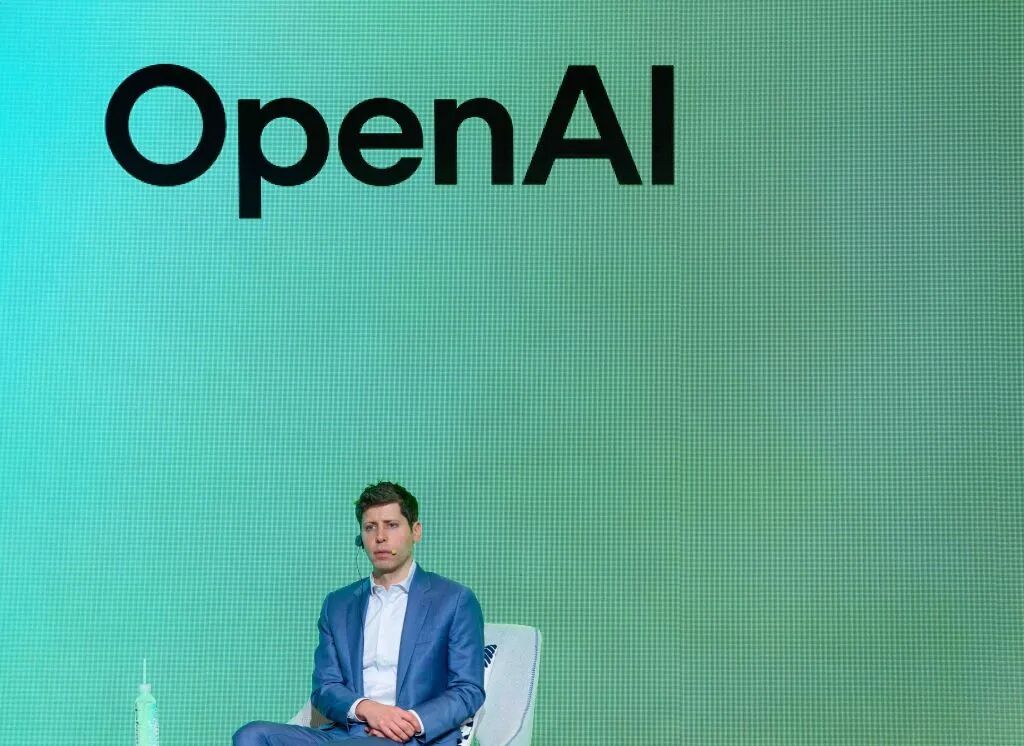

Even more staggering: Microsoft’s early $13+ billion investment in OpenAI now values the company at $135 billion—triple Iceland’s annual GDP. With OpenAI’s restructuring complete, the AI giant founded to 'benefit humanity' now stands on the threshold of a $500 billion valuation.

A Magical Realism of Valuation vs. Revenue

U.S. stocks have rocketed to new heights this week, with the S&P 500, Dow, and Nasdaq repeatedly smashing all-time records. Tech stocks dominate: NVIDIA surged nearly 5% in a day, Microsoft climbed ~2%, and Apple and Microsoft both briefly topped $4 trillion in market cap.

But beneath this euphoria, sobering data tells a different tale.

OpenAI’s post-restructuring structure reveals a nonprofit foundation holding just 26% equity, while Microsoft’s 27% stake makes it the largest single shareholder. This company, valued like a multinational titan, generated only $4.3 billion in revenue in H1 2025—yielding a valuation-to-revenue ratio exceeding 116x, unimaginable in traditional industries.

Global AI venture capital hit $121.9 billion in H1 2025, accounting for 53% of total VC funding. Yet MIT reports that 95% of AI firms have yet to generate commercial returns, creating a bizarre cycle of 'investment frenzy, muted payoffs.'

More alarming is the 'empty industrial chain' phenomenon. Of the $400 billion invested globally in AI infrastructure, 37% circulates within the supply chain itself. This fragile ecosystem risks cascading collapse if any link breaks.

Nokia’s 'Second Act': Transformation or Hype?

When NVIDIA announced its Nokia investment, nostalgic fans cheered, 'My youth is back!' But this Nokia is not the old phone king—now a telecom equipment provider. The $1 billion will fund its AI initiatives, with both firms vowing to co-develop 6G technology.

Nokia’s pivot is bold, but whether it’s a true business transformation or a capital market stunt remains to be seen. Interestingly, as capital rushes into AI, gold has entered correction territory—spot and futures prices both fell below $4,000. This 'abandon gold, chase AI' trend may signal boundless faith in tech revolutions.

OpenAI’s Restructuring: Straying from Its Mission?

OpenAI finalized its restructuring Tuesday, becoming a for-profit entity controlled by a nonprofit. This legal saga, spanning nearly a year, has concluded.

Under the new structure, the nonprofit OpenAI Foundation will oversee the for-profit OpenAI Group. The foundation holds 26% of the equity, Microsoft ~27% (valued at $135 billion), and the remaining 47% belongs to other investors and employees.

This design seems clever, addressing OpenAI’s R&D funding needs while preserving its 'humanitarian' ethos. But cracks emerge under scrutiny.

The 2019 profit cap mechanism ('100x maximum returns') was replaced with 'dynamic adjustments' in this restructuring, opening loopholes for higher profit distributions under the public benefit corporation framework.

Microsoft’s deep entanglement underscores capital’s sway. Under the new deal, OpenAI will purchase $250 billion worth of Azure cloud services, while Microsoft gains rights to its model IP until 2032—even if OpenAI achieves AGI.

Elon Musk’s persistent objections may not be baseless. The OpenAI co-founder, whose $97.4 billion acquisition bid was rejected, argues that 'commercialization violates founding principles.' While the foundation claims decision-making power, its 26% stake seems inadequate to resist capital’s demand for short-term returns.

Chip Giants Profit from AI’s 'Water Sellers' Boom

The AI craze isn’t just sustaining algorithm firms—it’s fattening hardware makers. SK Hynix just reported a 62% Q3 operating profit surge to KRW 11.38 trillion (~$7.94 billion), an all-time high.

As NVIDIA’s primary memory chip supplier, SK Hynix rides soaring AI-driven demand—akin to selling shovels during the Gold Rush while miners’ fortunes vary.

Nvidia’s market cap topped $4 trillion with a 51x P/E ratio; Supermicro’s stock tripled in a year, briefly exceeding 800x P/E. These figures defy traditional valuation frameworks.

Even PayPal jumped on the bandwagon, announcing a deal to embed its services in ChatGPT. Clearly, no one wants to miss this AI wave.

Bubble or New Era? Market Divisions Deepen

Despite the frenzy, doubts persist. Bank of America surveys reveal AI bubbles as investors’ top 'tail risk,' while Goldman Sachs insists AI will add $20 trillion to the U.S. economy.

This split reflects differing views on 'value realization timelines.' Ark Invest’s Cathie Wood remains bullish: 'If our AI projections are correct, we’re at the dawn of a technological revolution.'

Yet two trends are clear:

1. Infrastructure investment returns are fading. 2025 tech giant capex rose 40% YoY, but Wall Street is offloading cooling, chip, and other peripheral assets. This aligns with tech history: enablers benefit first, but value ultimately settles in applications.

2. Vertical integration is key to breakthroughs. Unlike OpenAI’s 'broad approach,' DeepSeek rapidly penetrates verticals via low-cost strategies. Tencent boosted ad matching precision with AI, driving a 20% revenue jump; Alibaba’s AI products saw seven consecutive quarters of triple-digit growth. These cases prove AI’s value is shifting from 'spectacle' to 'problem-solving.'

As capital fever cools, AI’s true face may emerge. OpenAI’s restructuring, like a stone tossed into AI’s lake, ripples far beyond the company.

Behind its $500 billion valuation lies capital’s AGI obsession; its $4.3 billion revenue underscores tech’s grounding challenges. If AI truly transforms the world, we should all be beneficiaries, not just spectators. After all, technology’s ultimate worth lies in improving ordinary lives.