“Honda-Nissan-Mitsubishi” Alliance: As Strategic as Zhuge Liang?

![]() 12/25 2024

12/25 2024

![]() 617

617

Introduction

A Chinese proverb may not necessarily apply to Japanese automakers.

Carlos Ghosn, the former CEO of Nissan, expressed extreme pessimism about the Nissan-Honda alliance and its underlying motivations, labeling it a desperate move rather than a pragmatic decision. He believed that it would be challenging to find synergies between the two companies due to their lack of complementarity, overlapping markets, similar product lines, and nearly identical brands.

Of course, it's plausible that Ghosn harbors some hostility towards his former employer. Indeed, both Ghosn and the wider public are largely skeptical about this "merger" between Honda and Nissan. Both companies are under pressure from the slow development of new energy technologies and shrinking markets, necessitating accelerated innovation and the launch of more technologically advanced products.

Furthermore, even Honda CEO Toshihiro Mibe has stated that this potentially multi-billion-dollar deal is a response to "the rise of Chinese power" and the driving force behind the plan. A "counterattack" strategy must be formulated by 2030, or they risk being outpaced by competitors.

With six years left until 2030, six years in the Chinese automotive market is sufficient for three new technological iterations, leaving little opportunity for foreign brands.

The current situation is that the growing electric vehicle market has gradually been dominated by Chinese-made electric vehicles, posing a significant threat to some globally renowned automakers. All foreign brands, including Honda and Nissan, face a common challenge: how to navigate China, the world's largest automotive market.

Competition in the Chinese market is intensifying, and many automakers are struggling to keep up. Lower labor and manufacturing costs make local enterprises more flexible and able to sell products at lower prices than foreign counterparts, making them more attractive to consumers. In response, the global automotive industry is consolidating, and we will see more such collaborations, both strategic and necessary.

At the beginning of this century, over a third of Honda and Nissan's global car sales came from China. However, this year, their sales in China are only about half of what they were five years ago. This "merger" could be seen as an opportunity for these three companies, including Mitsubishi, to share resources and compete with other electric vehicle competitors such as Tesla and BYD.

Desolate Japanese Cars

Despite weekends typically being a busy time for car sales, Dongfeng Nissan 4S stores across the country are unusually quiet, with only a few customers visiting. Of the nine carefully displayed cars in the store, seven still rely on traditional gasoline power, while the remaining two are hybrid models; electric vehicles are completely absent.

This scene underscores the severe lack of "hot-selling models" faced by Nissan in the Chinese market, far exceeding the severity seen in other markets.

As one of the world's largest automotive markets, China is undergoing a profound energy transformation, with new energy vehicles such as electric vehicles and plug-in hybrid vehicles emerging prominently, accounting for nearly 40% of new car sales, the highest proportion among major global economies.

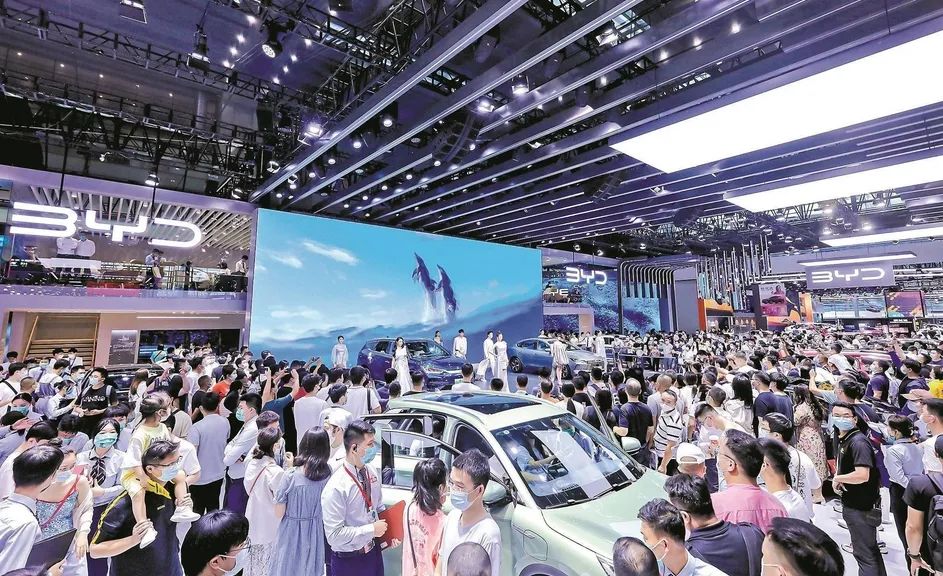

In this transformation, BYD, as a leader in the new energy vehicle field, has performed particularly impressively. From January to November 2024, BYD sold approximately 3.76 million vehicles, an increase of 40% year-on-year, all of which were new energy vehicles. Compared to 2019, sales have increased eightfold.

In contrast, Japanese automakers Honda and Nissan appear to be struggling. Honda's sales in China declined by 31% year-on-year to 740,000 units; Nissan's sales fell by 11% to only 620,000 units. If this trend continues, the annual sales of these two Japanese giants are likely to halve compared to 2019, revealing their struggles amidst the new energy wave.

An executive from a large Japanese automaker admitted that BYD's aggressive strategy to seize market share has gradually caused Japanese and European automakers to lose ground in the fierce market competition.

Faced with this dilemma, Honda has decided to take action, planning to significantly reduce its gasoline car production capacity in China to 960,000 units by the end of this fiscal year while announcing layoffs of thousands of employees. Although Honda has been trying to promote electric vehicles in the Chinese market since 2022, its electric vehicle sales have failed to pick up in a market where cost-effectiveness is paramount.

Nissan is in an even more difficult situation. In 2021, based on optimistic expectations of a rapid rebound in market demand, Nissan increased its annual production capacity in China by 30% to 1.8 million units, a much larger expansion than that of Toyota and Honda during the same period. However, market demand did not rebound as expected, leading to overcapacity.

Despite continuous sales declines, Nissan set ambitious mid-term plans in March this year, aiming to achieve annual sales of 1 million units in China by fiscal year 2026. However, the harsh reality forced Nissan CEO Makoto Uchida to announce a strategy adjustment in November, effectively abandoning the original sales target and acknowledging the need to re-examine market positioning.

Additionally, due to continued poor performance, Nissan is considering closing some factories to reduce costs. Both Honda and Nissan produce through joint ventures with local Chinese enterprises, but coordinating with partners to optimize processes and improve efficiency is particularly complex.

It's noteworthy that, according to surveys, Japanese consumers have a low willingness to purchase Chinese-made electric vehicles, with only about 10% indicating they would consider it, while up to 90% of consumers in the Chinese market are willing to accept domestically produced electric vehicles. This data disparity reveals the enormous challenge faced by Japanese automakers in breaking the monopoly of local brands in the Chinese market.

"Even with business integration, it will be difficult to reverse the trend of shrinking market share," said a senior figure in the Chinese automotive industry when commenting on Honda and Nissan's adjustment plans. This is not only a summary of the current predicament faced by these two Japanese automakers but also a true portrayal of the difficult transformation path faced by traditional automakers amidst industry changes.

Reasonable Idea, Difficult Execution

Despite Honda and Nissan proposing the idea of achieving seven synergies through cooperation, aiming to enhance competitiveness through measures such as common vehicle platforms, integrated R&D, integrated procurement, improved operational efficiency, integrated sales and financial functions, and establishing an intelligent and electric human resource base, the feasibility of these measures may be limited in the Chinese market.

It's important to note that Honda has two joint ventures in China, Dongfeng Honda and Guangqi Honda, while Nissan's partner in China, Dongfeng, is a different state-owned enterprise from Guangqi. Therefore, considering the actual development of Dongfeng Honda, Guangqi Honda, and Dongfeng Nissan in the Chinese market, the implementation effect and feasibility of this idea still face various challenges and doubts.

Firstly, regarding the idea of achieving economies of scale through common vehicle platforms, although theoretically able to reduce costs, practical implementation faces many challenges. Although Dongfeng Honda and Guangqi Honda belong to the Honda system, there are differences in their model layouts and market strategies, while Dongfeng Nissan has entirely different brand genes and product characteristics.

In fact, there are many highly overlapping products under these three automakers: Civic/Xingge/Sylphy in the compact sedan market, Inspire/Accord/Teana in the midsize sedan market, XR-V/Binzhi/Qashqai in the compact SUV market, and CR-V/Haoying/X-Trail in the midsize SUV market, among others.

To achieve common vehicle platforms, not only would it require huge technical modifications and production line adjustments but may also affect the market acceptance and brand image of existing models. More importantly, Chinese consumers' demand for diversity and personalization in automobiles is increasing, and common platforms may fail to meet this trend, leading to declining sales.

Moreover, both Honda and Nissan face a significant "gap": strong products or technologies in PHEV/REEV (plug-in hybrid/range-extended electric vehicle) and BEV (battery electric vehicle). Although Honda has PHEV and Nissan has e-power, neither has made significant achievements in sales or reputation in the Chinese market. This gap is difficult to fill in the short term.

Secondly, the idea of integrating R&D functions to improve development capabilities and achieve cost synergies also faces difficulties. Honda is renowned for its advanced engine technology and hybrid system, while Nissan has unique advantages in electric vehicles and intelligent driving. Integrating R&D functions means overcoming technical barriers, cultural conflicts, and management challenges, which is not an overnight process and may inhibit the original innovation vitality of each company.

Additionally, differences in R&D culture and processes between different companies may affect integration effectiveness, leading to decreased R&D efficiency and increased costs. More importantly, the Chinese market has an increasingly urgent demand for new energy vehicles and intelligent driving technology, requiring companies to increase R&D investment in these areas rather than simply pursuing the integration of R&D functions.

In terms of procurement function integration, although it can theoretically enhance supply chain competitiveness, practical operations may face supply chain disruptions and quality control issues. Dongfeng Honda, Guangqi Honda, and Dongfeng Nissan have established relatively stable supply chain systems in the Chinese market. Furthermore, different companies may have different requirements and standards for suppliers, and integrating these would require unifying standards and quality management systems, which is also a formidable task.

Moreover, the Chinese market's supply chain is complex and volatile, with regional differences, supplier relationships, and cost control all affecting integration effectiveness. The supplier networks and procurement systems established by the three joint ventures over the years are difficult to effectively integrate in the short term and may suffer from friction and uncertainty during the integration process, leading to compromised supply chain stability and affecting production and delivery.

Although improving operational efficiency is crucial for achieving cost synergies, the differences in production processes, management systems, and corporate cultures among the three companies make it challenging to simply superimpose efficiency gains. Especially in the Chinese market, rapidly changing market demand, policy environments, and consumer preferences require enterprises to be highly flexible and responsive, while large-scale integrations often come with temporary declines in efficiency and increased costs.

The integration of sales and financial functions may seem to bring economies of scale, but in reality, the three companies have significant differences in sales channels, market strategies, and financial planning. After integration, balancing the interests of all parties, unifying sales strategies, and optimizing financial structures will be enormous challenges. Especially in a competitive market with diverse consumer demands, wrong sales strategies and financial decisions can quickly lead to market share loss.

Finally, establishing an intelligent and electric human resource base aligns with industry trends, but the three companies have their unique strengths in talent reserves, skill structures, and training systems. Simple integration may lead to talent loss, skill mismatches, and low team morale. The transformation towards intelligence and electrification requires long-term investment and continuous cultivation, rather than a one-time integration.

It can be said that while the seven synergy ideas proposed by Honda and Nissan seem reasonable in theory, considering the actual situation of Dongfeng Honda, Guangqi Honda, and Dongfeng Nissan in the Chinese market, their implementation difficulty and effectiveness are questionable.

What Do Chinese Partners Think?

The merger between Honda and Nissan will undoubtedly be shocking news for their long-term partners in China, Dongfeng Motor and GAC Group. This not only has the potential to reshape the equity structure of joint ventures but may also profoundly impact operating costs, market competition, sales, and financial management.

In terms of equity structure, historical mergers in the automotive industry, such as the Daimler-Chrysler merger, have led to changes in the equity structure of their global partners.

Should Honda and Nissan amalgamate, they are likely to forge a new holding structure, posing challenges to Dongfeng and GAC's equity stakes and influence within their joint ventures. If the newly formed entity opts to restructure its equity or introduce fresh strategic investors, Dongfeng and GAC might need to reassess their positioning and earnings expectations within these ventures.

In terms of operational costs, while a merger theoretically promises economies of scale, practical implementation often entails intricate integration processes. For instance, the merger between General Motors and Fiat involved extended supply chain integration, factory reorganization, and personnel adjustments, leading to additional costs and a temporary dip in production efficiency.

For Dongfeng and GAC, a Honda-Nissan merger could entail similar integration hurdles, such as production line adjustments, supplier substitutions, and potential employee training and placement issues, all of which may temporarily elevate the joint ventures' operational costs.

Regarding market competition and sales, the merged Honda-Nissan entity would theoretically boast enhanced R&D capabilities and a broader product portfolio, bolstering its competitiveness in global and Chinese markets. However, historical precedents indicate that mergers do not automatically translate into sales growth.

For example, while the Renault-Nissan Alliance initially achieved synergies, it later grappled with inconsistent market strategies and blurred brand identities. For Dongfeng and GAC, how the merged entity positions itself in the Chinese market, coordinates product lines, and allocates marketing resources will directly impact the joint ventures' sales and market standing.

In terms of financial risk, the uncertainty inherent in the merger process poses the greatest threat. The attempted Ford-Mazda merger, albeit unsuccessful, exposed issues like imprecise financial assessments and significant cultural disparities, imposing considerable financial strain and market turmoil on both parties.

Post-merger, the new company might adjust its financial policies, including profit distribution, investment decisions, and capital structure, with direct or indirect ramifications on Dongfeng and GAC's financial health. Moreover, management disarray, low employee morale, and potential market response uncertainties during the merger process represent financial risks that Dongfeng and GAC must closely monitor and prepare for.

Undeniably, a Honda-Nissan merger presents both an opportunity and a significant challenge for Dongfeng Motor and GAC Group. They must vigilantly monitor the merger's progress, actively participate in post-merger integration, and devise agile response strategies to ensure the joint ventures' stable operation and long-term growth.

This involves maintaining close communication with the merged entity to secure a favorable shareholding structure and revenue distribution, proactively planning to control and optimize operational costs, actively participating in shaping market competition strategies, and establishing a robust financial risk management system to address potential uncertainties and challenges.

The crux of cost reduction and efficiency enhancement lies in boosting productivity.

Amidst the global automotive industry's upheaval, the Honda-Nissan merger negotiations represent another pivotal move for companies navigating fierce market competition. This development mirrors profound industry shifts and underscores the common challenges confronting global automakers, particularly in the increasingly competitive Chinese market.

As the world's largest automotive market, China is undergoing unprecedented market structural transformations. The rise of new energy vehicles, particularly pure electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), has seen their penetration exceed half of new car sales, heralding the Chinese automotive market's electrification era. Meanwhile, domestic brands have garnered the favor of three-fifths of consumers, reaching an all-time high and exerting immense pressure on international brands.

General Motors has incurred profit losses due to declining Chinese market share, prompting significant expense provisions. In contrast, Volkswagen aims to navigate its predicament by closing factories, implementing large-scale layoffs, and increasing Chinese market investments to re-establish its market position.

In this transformation, Tesla, a pioneer in electric vehicles, has successfully ignited Chinese consumers' enthusiasm for EVs. Simultaneously, domestic companies like BYD have swiftly emerged as industry leaders due to their prowess in battery technology, cost control, and connected vehicle technology.

Facing this competitive landscape, Honda and Nissan recognize that a merger based solely on traditional gasoline vehicle operations is insufficient to reverse the tide, especially amidst rapid technological advancements. Despite their market size advantage, a single enterprise struggles to fully address the rapid development of smart cars and electrification. While a merger offers economies of scale, it also brings challenges like cultural integration and product overlap.

To maintain competitiveness in the Chinese market, Volkswagen has adopted an aggressive localization strategy, increasing the use of Chinese components, shortening development cycles, and reducing costs. It has invested billions in local enterprises to acquire cutting-edge technology, emphasizing that international automakers must deeply integrate into the Chinese market and collaborate closely with Chinese partners to secure a foothold in the electrification and intellectualization wave.

Should the Honda-Nissan merger materialize, it is anticipated to compete with Chinese local automakers on scale through resource integration. However, to genuinely enhance competitiveness, efforts must focus on technological innovation, brand differentiation, and market response speed. Toshihiro Mibe's assertion that merger benefits won't be significant until 2030 implies that during this period, Japanese automakers must accelerate their transformation; otherwise, they risk being overtaken or even eliminated by emerging forces like BYD.

For decades, Honda, Nissan, General Motors, Volkswagen, and other foreign brands have dominated and exploited the Chinese market, showing no fear of Chinese competitors encroaching on their territory. However, within just four years, the rapid development of electric and plug-in hybrid vehicles in China has reshaped the global automotive industry, catching foreign brands off guard.

Whether competing against new energy vehicle companies like BYD and Tesla or aiming to surpass China, a powerhouse in electric vehicles, Honda, Nissan, and other foreign auto giants require capital, expertise, and scale—significant investments entailing substantial funds for battery and software development, along with robust supply chains.

This is no longer a game of internal combustion engine supremacy; it's an entirely different ballgame. The merged Honda-Nissan will confront the same dilemma: striving to regain market share or witnessing an already diminished position shrink further. While mergers often make theoretical sense, implementing them in practice is far from straightforward. It will take several years to ascertain the success of this merger.