Volkswagen's Dual Strategy: A Global Odyssey

![]() 12/26 2024

12/26 2024

![]() 613

613

Author | Luke Patey

Source | The Wire China

Compiled by | Yang Yuke

Edited by | Li Guozheng

Produced by | Bangning Studio (gbngzs)

Nestled in Dresden, eastern Germany, Volkswagen's 'Transparent Factory' stands as a beacon, showcasing the brand's innovative prowess. This sleek, glass-clad structure invites customers to witness the magic of automobile manufacturing firsthand.

However, on a dreary November day in 2024, the hum of the electric vehicle model ID.3's automated assembly line masked deeper concerns within the factory. Weeks prior, 150 workers protested Volkswagen's plans for mass layoffs, a 10% pay cut, and the closure of at least three German plants.

Volkswagen management argues that high production costs and low productivity in Germany necessitate drastic measures. By 2025, the company aims to slash costs by approximately $5 billion in the German market.

Rumors suggest the Dresden Transparent Factory may be among those slated for closure, prompting outrage from local unions and politicians. The union deemed the announcement "embarrassing and brazen," while local leaders warned that the factory's closure would leave a deep scar on Dresden.

After 70 hours of tense negotiations, Volkswagen and the union reached a compromise on December 20, 2024, averting a large-scale strike. Volkswagen agreed to keep 10 German factories operational and extend employment guarantees until 2030. In return, workers accepted reduced bonuses and scaled-back production at five factories.

Volkswagen also announced a comprehensive overhaul of its German operations, including a 700,000-vehicle production cut and over 35,000 layoffs by 2030. The Golf hatchback will relocate from Wolfsburg to Mexico, while electric vehicle production at the Transparent Factory will cease in 2025, though the factory will remain open and explore 'alternative solutions.'

Volkswagen's governance structure requires a two-thirds majority approval from its 20-member supervisory board for significant factory decisions. This safeguard could derail ambitious plans.

Analyst Patrick Hummel of UBS noted in a December 20 report that the "lukewarm" compromise might not impress the market, as it fell short of Volkswagen's initial cost-saving goals.

Closing German factories would mark a first in Volkswagen's nearly 90-year history. In early December, around 100,000 workers struck at nine German plants. As Germany's largest employer, Volkswagen supports nearly 300,000 jobs through brands like Porsche and Audi.

London-based analyst Stephen Reitman of Bernstein Research observed, "Volkswagen must address high costs, but unions and politicians will resist excessive layoffs and closures."

Thousands of miles away in China, Volkswagen pursues a drastically different strategy. CEO Oliver Blume refers to China as Volkswagen's "second home." Despite belt-tightening measures in Germany, Volkswagen announced a $2.7 billion investment in Hefei, Anhui Province, to expand electric vehicle production and innovation centers.

This move signals a shift, ending decades of European car development before Chinese introduction. In 2023, Volkswagen collaborated with Chinese EV maker XPeng on two models and acquired a 5% stake for $700 million. Later that year, Volkswagen invested $2 billion to acquire a 60% stake in Beijing-based autonomous driving firm Horizon Robotics.

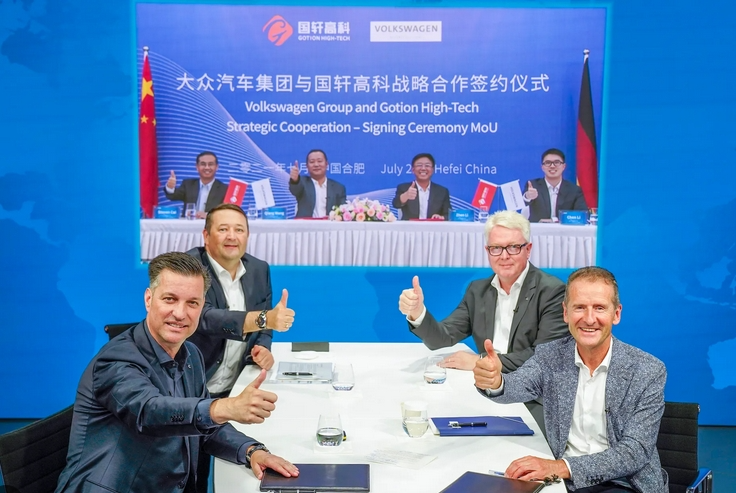

In 2020, Volkswagen invested $2 billion to increase its stake in Volkswagen (Anhui) Co., Ltd. and acquired a quarter stake in Chinese battery manufacturer Guoxuan High-Tech Co., Ltd.

A Volkswagen spokesperson highlighted, "The Chinese market drives global automotive innovation. Car digitization, AI-driven cockpits, and autonomous driving evolve at a pace unimaginable to Europeans."

China, the world's largest automotive market and exporter, produced around 30 million vehicles in 2023. As the epicenter of the EV industry, China manufactured 8.6 million EVs in 2023, nearly seven times Germany's output.

Some analysts argue that automakers like Volkswagen cannot afford to miss Chinese trends and innovations. China has become a crucible for global competitiveness.

However, as Blume acknowledged, Volkswagen's dual strategy of offensive moves in China while restructuring in Germany is risky.

Many foreign firms question whether China's slowing economy justifies risks in an increasingly challenging business environment. As China transitions to EVs, foreign automakers face Chinese competitors, and foreign brand market share in China has plummeted from 53% to 33% in July 2023.

General Motors' sales in China have nose-dived by 56% since 2020, prompting a $5 billion write-down. Ford's Chinese sales have tanked by 70%, leading CEO Jim Farley to reposition China as a trend-watching post rather than an expansion market.

In 2023, Japanese automaker Mitsubishi Motors abandoned Chinese production, while French automaker Stellantis Group shuttered its last Jeep factory in China in 2022.

Volkswagen has also faced setbacks. After dominating the Chinese market for 40 years, Volkswagen lost its lead in 2023, with market share dropping to 10%. Domestic newcomer BYD surpassed Volkswagen with a 12% share (BYD's lead has since widened). In 2024, Volkswagen reported its first quarterly equity loss in China in 15 years.

Yet, Volkswagen remains resolute. Xing Lei, co-founder of the China EVs and More podcast, noted, "Volkswagen's doubled investment and commitment to China's ecosystem are unique among foreign automakers."

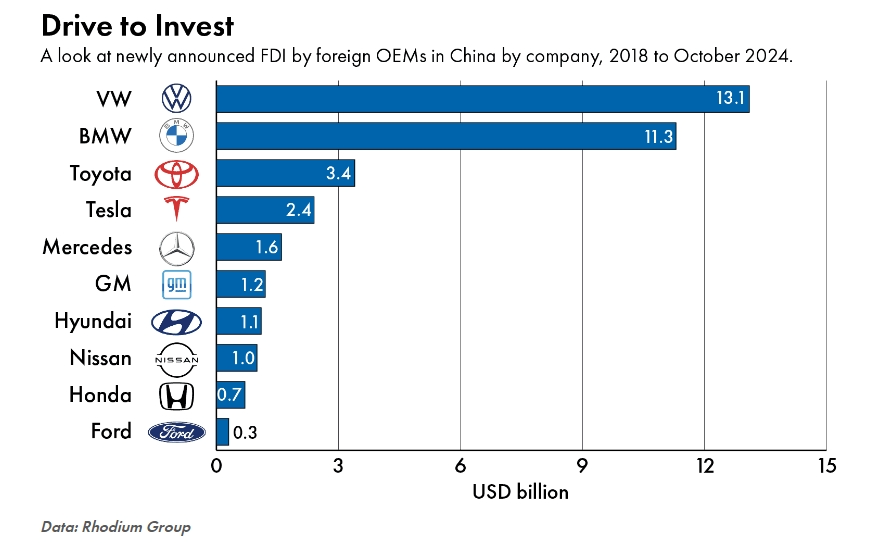

Research by Rhodium Group revealed Volkswagen invested over $13 billion in China from 2018 to October 2024, four times Toyota's and 11 times General Motors' investments.

Volkswagen's 'In China, For China' strategy focuses on local partnerships, cost efficiency, and innovation. While Blume hasn't promised a utopian future in China, initial signs suggest this strategy could maintain Volkswagen's competitiveness. Despite overall sales declines, Volkswagen's EV sales surged 27% year-on-year in the first three quarters of 2024.

Volkswagen emphasizes product quality, safety, and reliability. A spokesperson stated, "In dynamic markets like China, new products hit shelves quickly. These values are crucial for long-term customer trust."

However, Volkswagen's ambitions in China may clash with its reputation in Germany and the EU. Geopolitical analyst Xie Yanmei of Gavekal Research observed, "Companies outsource to China for its advanced, innovative, and efficient supply chain. But European policymakers aim for decarbonization, growth, innovation, employment, income, and value-added."

Most experts believe European automakers still aspire to leverage China's efficient production and export supply chains – 'Made in China, for the world.'

Gregor Sebastian, a senior Rhodium Group analyst, noted, "If you're a cost-conscious company hoping to expand amid Chinese competition, leveraging Chinese suppliers and technology for external markets makes sense."

However, interpreting geopolitical divisions' global economic signals is complex. Using China as a manufacturing, technology, and know-how hub to enhance global competitiveness now seems limited. Volkswagen finds itself fighting on multiple fronts.

As Chinese EV makers like BYD expand overseas, Volkswagen, Europe's largest company, must compete in both its 'second home' and 'native home.'

Jens Eskelund, President of the European Union Chamber of Commerce in China, warned, "The greater risk isn't just the collapse of Europe's core champions in China; it's their potential destruction worldwide."

Sinicization

When the Transparent Factory opened, it embodied distinct German craftsmanship.

Designed by Dresden-based architect Gunter Henn, the factory's groundbreaking ceremony featured then-Chancellor Gerhard Schröder, Volkswagen's long-time chairman Ferdinand Piëch, and Saxony's Governor Kurt Biedenkopf.

Volkswagen maintains deep ties with these families and the German government. The Porsche-Piëch family holds a majority stake, while Lower Saxony owns 11% and one-fifth of voting shares, influencing the supervisory board.

In late 2001, the factory produced the luxury sedan Volkswagen Phaeton. Piëch boasted, "Here, you'll witness the finest craftsmanship and cutting-edge technology." The Phaeton, designed to rival Mercedes-Benz and BMW, featured Canadian maple and German swamp oak floors, with 'almost entirely hand-assembled' vehicles.

German engineers equipped the Phaeton with powerful engines and components from a diverse German supply network, including Bosch and ZF. However, sales of this $100,000 luxury car stagnated, peaking at over 11,000 units in 2011 before ceasing production in 2016 with a total of 80,000 units sold.

By 2017, Volkswagen's EV transition was underway, and the Transparent Factory shifted to the MEB platform. While German factories still supply components, critical parts now rely heavily on Asian technology.

For instance, Volkswagen EVs often use battery packs from South Korea's LG Chem but increasingly source from Chinese giants CATL and Guoxuan High-Tech (China controls 70% to 85% of battery manufacturing components, despite competition from Korean and Japanese manufacturers).

This dependency deepens with the Dresden assembly line's robotic arms made by Bavarian firm Kuka, acquired by Chinese appliance maker Midea for $5 billion in 2016, sparking uproar in German corporate circles.

Volkswagen was a trailblazer in the Chinese market. In the early 1980s, it became the first automaker to venture into China, playing a pivotal role in establishing a modern automotive industry there. By the late 1990s, the German automaker had captured half of the Chinese market, with the Santana and Jetta models alone accounting for four-fifths of the entire passenger car market.

This dominance shifted at the turn of the century, as Toyota, General Motors, and other foreign automakers rushed into the rapidly growing Chinese market, which was expanding at an annual rate of 25%.

Volkswagen was caught off guard and swiftly lost about 30% of its market share. However, by introducing new models and establishing low-cost production lines in China, Volkswagen managed to retain a critical 20% market share. In 2009, China emerged as the world's largest automotive market, and profits surged for Volkswagen.

Arndt Ellinghorst, an analyst at QuantCo who has extensively studied Volkswagen and the global automotive industry, noted, "Volkswagen enjoyed a decade-long dominance in the Chinese market, with minimal competition from Chinese brands. Its sales and profits soared, ushering in a period of prosperity."

According to estimates by Evercore ISI, in 2016, Volkswagen's profits in China accounted for 49% of its global total, double those of General Motors and 20% higher than those of German rivals Mercedes-Benz and BMW. Similarly, a 2021 report by Bernstein revealed that China contributed nearly 50% of Volkswagen's total revenue and cash flow.

While Volkswagen often sells more cars in the European Union annually than in China, experts emphasize that profit margins are significantly higher in China. This is particularly true for luxury brands like Porsche and Audi, where Volkswagen commands a high premium for imported products and earns billions from licensing, royalties, and auto parts in China.

Beatrix Keim, director of the Center for Automotive Research (CAR), a private-sector research institute in Germany, explained that China's overall lower costs further enhance profit margins. "Wages, energy, supplier, and distribution costs in China are still lower than in Germany," Keim said.

Volkswagen's higher costs in Europe and the United States stem from a specific incident. In 2015, an investigation by the U.S. Environmental Protection Agency (EPA) revealed that software installed in various Volkswagen models had been deliberately programmed to activate emission controls only during laboratory tests, not in daily use. Nitrogen oxide emissions from these models were sometimes 40 times the permitted levels.

The fines, settlements, and buybacks resulting from the "dieselgate" scandal cost Volkswagen $38 billion and continue to rise.

Ellinghorst commented, "It was a significant setback, but Volkswagen recovered quickly." This recovery was largely due to China. As Volkswagen executives struggled with a public relations nightmare at home, they found solace in double-digit sales growth in China. In 2017, Volkswagen even declared itself the world's largest automaker.

Sebastian (RDI) noted, "For years, there has been a prevailing view in Germany that profits earned in China ultimately kept Stuttgart and Wolfsburg afloat."

However, Thomas Puls, a senior economist at the German Institute for Economic Research (IW), believes that Volkswagen's success in the Chinese market allowed it to blindly invest in capacities that lacked economic sense. For instance, the Transparent Factory in Dresden was described as "a political project that would have dragged on too long without the influx of profits from China."

Ellinghorst added that, in addition to subsidizing meaningless projects, revenue from China also distracted company executives from addressing a significant challenge—Volkswagen's unique governance structure. Due to the joint majority voting rights of the union and the German state of Lower Saxony in the company's supervisory board, Volkswagen's ability to make far-reaching strategic decisions at critical moments remains limited.

Reitman (Bernstein) agreed, stating, "I've been covering Volkswagen since 1985, and while everything seems to have changed, it also feels familiar." He recalled that in the early 1990s, the German automaker announced significant cost-cutting measures to address increasing competition from Japanese manufacturers.

At the time, Volkswagen did not lay off one-third of its German workforce as planned. Instead, in 1994, it committed to not laying off any workers until 2029, reaching an agreement with influential unions to reduce the weekly workweek and implement cost-saving and productivity-enhancing measures, such as using a common chassis to produce more models.

The tug-of-war between Volkswagen and its unions persists. Reitman noted, "After more than 30 years, Volkswagen still has too many employees."

However, unlike in the past, Volkswagen has become highly dependent on a single market since around 2010.

Ellinghorst explained, "A company like Volkswagen, dominated by politicians and unions from a governance perspective, will always treat solving problems as an 'alternative' strategy. China acts as a sweet medicine that fuels this addiction, but it poses a significant long-term risk due to Volkswagen's unbalanced global footprint."

Now, the rapid rise of BYD and other Chinese electric vehicle competitors threatens Volkswagen's position. In a recent earnings call, Volkswagen reported that a decline in Chinese sales in the first three quarters of this year contributed to a 31% overall decline in its global profits.

Digitization

How can Volkswagen turn the situation around? Analysts point out that Volkswagen's failure to keep pace with the development of electric vehicle software is a critical challenge that must be overcome.

Former CEO Herbert Diess was well aware of the importance of software: In 2020, he launched a new software subsidiary, Cariad, and invested over $12 billion as part of a broader transformation into an electric vehicle company. "Software offers tremendous opportunities for economies of scale," Diess said.

However, Reitman revealed that Cariad ultimately became a multi-billion-dollar "bureaucratic monster" with clunky software and delayed progress.

In the spring of 2021, sales of the ID.4 in China were mediocre—slightly over 1,200 units in two months, compared to over 6,600 units for the Tesla Model Y during its Chinese debut. It was reported that Volkswagen's joint venture in China even proposed that employees purchase the struggling ID.4 to boost sales.

Reitman commented, "Volkswagen is lagging behind in software and providing features favored by Chinese consumers."

Cariad's failure contributed to Volkswagen's poor performance in the Chinese electric vehicle market. Coupled with Diess's conflict with labor representatives over mass layoff proposals, the CEO was ousted in July 2022.

To this day, Volkswagen is still considered a lightweight in software: This year, consulting firm Gartner ranked Volkswagen 13th in its Digital Performance Index, far behind companies like Tesla, NIO, and XPeng. Only Ford, General Motors, and BMW ranked among the top ten traditional automakers.

"Traditional automakers don't know how to handle software," Xing Lei said. "In contrast, many founders and CEOs of new forces in China come from the IT field, bringing the smartphone mindset to electric vehicle production."

Keim (CAR), who has worked in marketing for Volkswagen and BMW in the Chinese market for many years, offered straightforward advice on competing with local electric vehicle brands: "Sinicize. Meet the needs of Chinese drivers and digitize cars through reliable and fast software updates."

Volkswagen now appears to be adopting this strategy, forming a new partnership with XPeng to reduce complexity and develop an independent electrical architecture and software collaboration for its electric vehicles in China.

Analysts say that Volkswagen's shift is to focus less on "what the car can do" and more on "what you can do in the car," involving starting with new code that is smoother and faster than its past iterations.

"Chinese consumers are not very concerned about the powertrain," Ellinghorst said. "But they care deeply about how the car connects with everything on their phones. A German engineer designs cars around engines, while a Chinese engineer designs cars around mobile devices."

However, Volkswagen is not relying solely on the views of Chinese engineers.

Most notably, Volkswagen invested nearly $6 billion in California-based electric vehicle manufacturer Rivian, its most ambitious move outside of China.

Rivian is known in the United States for producing electric pickup trucks and SUVs. However, for Volkswagen, this American upstart is crucial for its technology.

Unlike traditional automakers, Rivian ranks high on Gartner's list of digital automakers, even surpassing most Chinese automakers (Tesla ranks first). Similar to Volkswagen's joint venture with XPeng in China, Volkswagen and Rivian plan to develop an electrical architecture and software platform for new electric vehicle models by 2026.

This year, Volkswagen also acquired a 20% stake in U.S. battery manufacturer QuantumScape, further increasing its presence in the United States. QuantumScape develops solid-state batteries, which may reduce dependence on the Chinese supply chain.

Just as in China, Volkswagen has not committed to forming new strategic advantages globally through billions of dollars in transactions in the United States. For example, its $2.6 billion investment in the autonomous driving technology of Argo AI, an American company, was unsuccessful.

But analysts say this strategy of "forking" the global investment and technology ecosystem is a shrewd calculation.

"There's a big bet in China," Xing Lei said. "And there's also a big bet outside China."

Russian Nesting Dolls

Ensuring that all these "bets" run smoothly seems like a task only for the most seasoned gamblers.

Ilaria Mazzocco, deputy director and senior researcher at the Center for Strategic and International Studies, said that as the electric vehicle industries in China and the West increasingly overlap, it's difficult to distinguish which companies are Chinese and which are not.

She said, "It's like a set of Russian nesting dolls with different levels of investment."

For example, Volkswagen-backed Guoxuan High-Tech is also investing in Europe through Slovakia-based battery manufacturer Inobat. With ambitious production plans in and around the European Union, Inobat intends to leverage its technical partnership with Guoxuan High-Tech to supply Volkswagen and other companies.

Then there's the Swedish brand Volvo Cars. Since 2010, the brand has been majority-owned by Zhejiang Geely Holding. While Volvo still produces in its hometown of Gothenburg, that acquisition has allowed the Chinese automaker to transform its brand in a (Nordic) Scandinavian style in China while still advancing production of its iconic Volvo brand in the United States and other international markets.

Just on December 10, Stellantis announced the formation of a new joint venture with Chinese battery manufacturer Contemporary Amperex Technology Co. Limited (CATL), with each party holding a $4.3 billion stake, to build a large battery factory in Spain.

Some analysts say that this "nesting" creates competitive opportunities for both sides: China's electric vehicle advantages will undoubtedly play a role in foreign markets, but Chinese electric vehicle manufacturers must also adapt to local preferences.

Keim noted, "The potential disadvantage of Chinese cars is that they are too digital for European consumers."

A Volkswagen spokesperson said, "The preferences of young and tech-savvy Chinese consumers are vastly different from those of European consumers, whose average age for purchasing electric vehicles is about 20 years older."

While Volkswagen can benefit from understanding and controlling both European and Chinese consumers simultaneously, serving as a bridge between the two may be more challenging. Firstly, in terms of manufacturing and new model development, the so-called 'China Speed' is partially enabled by the low wages and long working hours of Chinese automotive workers.

Geopolitics will also hinder Volkswagen's opportunities to expand Chinese technology to its global operations, particularly in electric vehicle software and autonomous driving data.

Washington's increasing trade barriers and potential data restrictions on Chinese electric vehicles have already significantly contributed to decoupling in the electric vehicle era. The return of the 'America First' agenda and incoming U.S. President Donald Trump's new tariffs will only exacerbate Volkswagen's growing cost issues.

A spokesperson for the German Association of the Automotive Industry said that most cars exported from the EU to the US contain software or hardware from China, which may expose them to US government bans. The proposed rules from the US Department of Commerce target connected vehicles that have 'sufficient nexus with China or Russia'.

A Volkswagen spokesperson said that such geopolitical obstacles are precisely the reason why 'we develop local strategies in major global markets' – such as the investment in Rivian.

However, geopolitics are also crucial for Volkswagen.

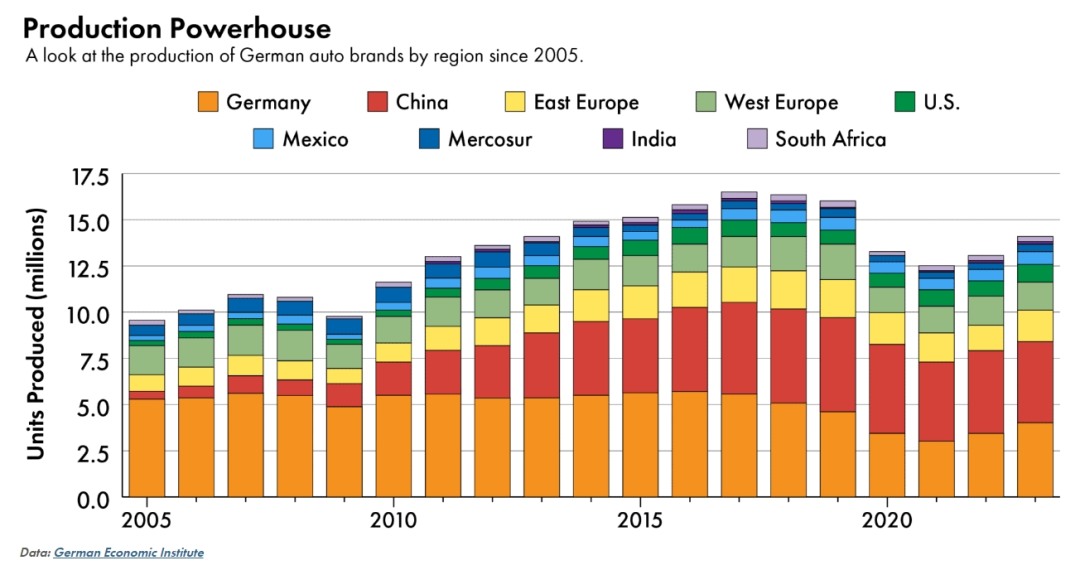

Germany's automotive industry continues to represent 5% of the nation's overall economy, employing directly close to 800,000 Germans. Nonetheless, the German Institute for Economic Research (IW) contends that the golden era of the automotive industry has concluded, with both production and export figures in decline. The institute's latest research reveals that by 2023, Germany's total passenger car production will mirror levels from 1985, while exports will revert to 1998 standards.

Notably, Volkswagen is planning layoffs in Germany, and significant automotive component suppliers such as Bosch and ZF have also announced thousands of job cuts, despite their intentions to establish new electric vehicle component factories in China.

These measures have immediate consequences: German brands now manufacture more cars in China than domestically (in 2023, less than 30% of their total sales were produced in Germany). Xing Lei observed, "Over the past few years, we've witnessed the emergence of several compelling Chinese component manufacturers, posing a potential disruption to traditional Tier 1 suppliers."

Sebastian (RDI) added, "In the realm of automotive electronics and braking systems, numerous foreign suppliers still dominate the market. If Volkswagen suddenly adopts Chinese braking systems, it would signify a significant leap forward."

To date, the German government has supported Volkswagen and other German brands in their Chinese endeavors, adhering to a proud tradition of market ideology. "Many German politicians and policymakers hold a dogmatic view regarding free trade and open competition," noted Xie Yanmei.

German Chancellor Olaf Scholz even reprimanded his coalition partners for voting against EU tariffs on electric vehicles.

"The German business community views tariffs as protectionist, and protectionism is detrimental to our export model, which is somewhat of a societal consensus," added Jürgen Matthes, a senior economist at IW. "Perhaps this is ingrained in our genes."

However, the layoff announcements from German automakers and component suppliers, coupled with their new investments in China, might shake even the most steadfast beliefs.

With German elections approaching in February next year, Scholz has urged Volkswagen not to close any plants in Germany. Simultaneously, he has extended support to the automotive industry by promoting tax relief and introducing new subsidies across Europe to boost electric vehicle sales.

German automakers also seek protection. A survey conducted by Matthes found that 80% of German companies believe it is at least somewhat justified for the European Commission to impose countervailing duties on electric vehicles made in China due to market distortion by China.

Nonetheless, tariffs might not suffice to halt the sales growth of Chinese brands like BYD and Volvo in the European market. Despite the overall decline in the EU electric vehicle market this year, BYD's sales doubled in October compared to the same period last year (in contrast, Chinese-made electric vehicles may actually be barred from the US market due to tariffs and restrictive barriers).

BYD and other Chinese brands are also taking strategic measures in the EU, selling increasing numbers of hybrid models to circumvent new electric vehicle tariffs. They are making significant inroads into third markets like Brazil and Mexico, eroding traditional brands' market share.

To date, low prices and software have fueled the popularity of Chinese brands, but many Germans believe that after catching up digitally, Germany's long-accumulated competitive advantage in the 'driving experience' may yield dividends.

As a spokesperson for the German Association of the Automotive Industry explained, this requires harmonizing all individual systems within the vehicle to create a cohesive overall experience, making the entire vehicle feel like it was crafted from a single mold.

For Volkswagen, instead of relying solely on problematic Transparent Factories to produce unchanging products, it has invested billions of dollars in new technologies and production capacities across different geopolitical regions. Whether this German automaker can maintain its strength in the coming decades will hinge on how effectively it integrates all activated components into a single, cohesive model.

Returning to the Transparent Factory in Dresden, while rumors circulate that ID.3 production might soon cease, there are also whispers of a new e-Golf model utilizing Rivian's architecture and software being produced – one day, this electric golf might roll off the Volkswagen assembly line in Germany.

(This article is compiled from The Wire China, with some images sourced from the internet)