4 Months, 3 Mentions of Anti-Cutthroat Competition: Will the January Price War be Halted?

![]() 12/26 2024

12/26 2024

![]() 630

630

Judging from various signs, Tesla is poised for a major move in January, but the price war in 2025 is unlikely to be as intense as in previous years.

The saying "Every year is a tough year, but every year passes" underscores the reality that many accumulated issues must be addressed as the new year begins. In the last decade of robust global economic growth, there have never been as many significant developments as we have seen from 2024 to 2025.

"We've almost cleared out our old inventory. Orders for the Model Y are still coming in, but we're intentionally limiting them," said the latest feedback from Tesla stores.

Since December, Tesla-related news has shifted from isolated events to a cohesive narrative. First, there was the trial production of new models at the Shanghai factory, followed by the successful offline production of these new models. Then, Tesla officially announced at least two new models for 2025: a lower-priced Model Q, estimated to cost around RMB 140,000, and a refreshed Model Y. The latest developments include nearly sold-out inventory at various stores, the daily production capacity of the new Model Y increasing to 200 units, and Tesla officially extending a RMB 10,000 discount on final payments for one month, but now only specific models qualify for the discount.

Given Tesla's customary practice of launching new vehicles and major policies every January, the stage is now set for the launch of the new Model Y, awaiting only its official release. Tesla has been the catalyst sparking the price war in the Chinese auto market for three consecutive years.

However, the 2025 price war presents several new variables.

With three mentions of anti-cutthroat competition in four months, will the price war continue?

There are two main variables. First, major companies' collective actions indicate they can no longer compete fiercely. For instance, in December alone, there were several significant developments, such as Honda, Nissan, and Mitsubishi forming a new alliance due to their inability to compete fiercely and needing mutual support.

After a decade of rumors about local production, it was reported that Lexus will indeed establish a wholly-owned factory in China by 2027. Additionally, there are rumors of further integration moves between FAW-Toyota and GAC Toyota in China.

Second, at the national level, there have been two consecutive mentions of anti-cutthroat competition within 2024. In late July, a directive meeting made clear instructions to strengthen industry self-discipline and prevent "cutthroat" malicious competition. On August 1, the "Regulations on the Review of Fair Competition" officially came into effect, targeting unfair local competition.

Just before December, the Economic Work Conference proposed a comprehensive rectification of "cutthroat" competition.

With three mentions within four months, many outsiders anticipate this may serve as a signal to restrict price wars in the automotive industry. However, the relevant provisions and wording suggest that the focus is not on anti-cutthroat but rather anti-"cutthroat-style" competition.

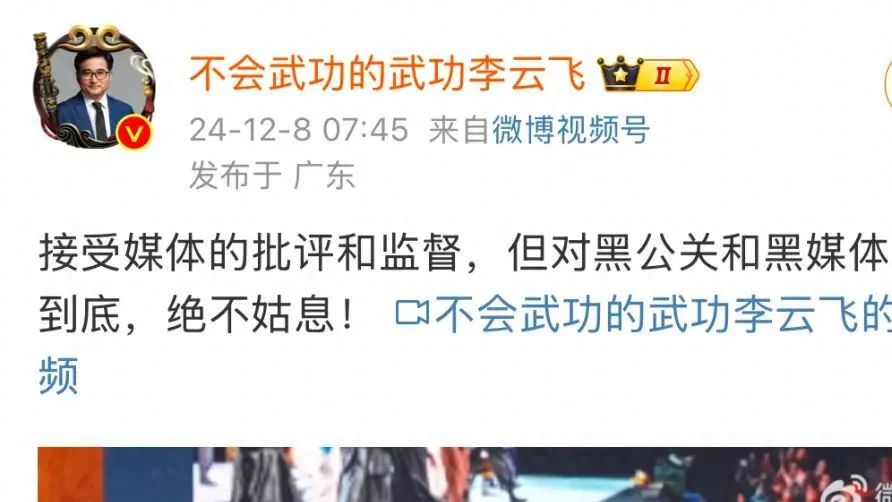

There's a subtle difference between the two, with significantly different meanings. Anti-cutthroat aims to control the intensity of competition, while anti-"cutthroat-style" competition allows full competition but demands openness and fairness, discouraging underhanded tactics like malicious price cuts, water armies (online shills), and black PR.

Will this end the auto price war? The answer is no. Many automotive founders, bosses, and executives have publicly stated in 2024 that 2025 will be a decisive battle or the beginning of one. This implies automakers have already completed structural preparations like new model technology R&D and launches, with new vehicles entering the market in 2025. Economic laws cannot be violated, and new technologies will inevitably replace old ones, a trend no one can stop.

New moves by several giants indicate many aspects of elimination will continue to accelerate in 2025. For example, one year after committing to intelligent driving, BYD will soon unleash full intelligent driving capabilities, including end-to-end solutions, lidar, urban NOA, and highway NOA, for all vehicles priced above RMB 300,000, following the launch of the 2025 Tengshi D9.

This means second-tier luxury brands like Volvo, Cadillac, and Lexus, which haven't announced any intelligent driving plans for 2025, will be squeezed out of their market space. Additionally, BYD plans to invest in DJI's intelligent driving technology and develop in-house computing power of 80 TOPS, potentially equipping vehicles priced under RMB 100,000 with highway NOA intelligent driving capabilities and those priced under RMB 200,000 with urban NOA capabilities due to optional lidar in the BYD Han.

This will undoubtedly further erode sales of leading gasoline vehicle brands or force them to continue lowering prices. For instance, the current limited-time price of the 380TSI Passat is already below RMB 140,000, and classic models from Honda, Nissan, and Toyota that once sold for over RMB 150,000 now start at under RMB 120,000.

Another example is Geely, which will introduce new technology for high-end 2.0T plug-in hybrid models. This technology will be applied to new SUV models Lynk & Co. will launch to compete with AITO Askev and Li Auto L9. In this scenario, if Geely uses a 2.0T plug-in hybrid at the same price and size, similar products using a 1.5T range extender will be at a disadvantage and either need to lower prices or upgrade their technology.

There will be many similar new vehicles and technological applications, all pointing to the same conclusion: the auto price war will not stop in 2025. However, what can be controlled is how much and how prices will drop.

Who and what will be targeted?

The directive on anti-"cutthroat-style" competition is straightforward and can be broadly divided into three directions:

1. Selling cars at a loss will be investigated and controlled.

2. Various rankings, rhythmic speech (provocative or misleading statements), and unfounded smears against automakers and the automotive industry will be investigated and controlled.

3. Various homogeneous and undifferentiated products may be investigated and controlled.

These points are the consensus reached after communicating with many automaker executives following relevant policy announcements in December. The first point is primarily controllable, the second point is less controllable, and the third point is difficult to resolve.

Selling cars at a loss is currently the greatest harm to the automotive industry and consumers. Although many automakers constantly emphasize booming sales figures to gain market discourse power, high sales volumes do not necessarily translate into high profits. Even comments from celebrities like Yu Chengdong have revealed the industry's common new practice of "losing money first and making money later."

Not long ago, at the price announcement event for the Zhidian R7 range-extended version, Yu Chengdong said, "Selling the Zhidian R7 at its current price will only make Mr. Yin bleed." With a guidance price range of RMB 249,800-289,800, Chery will lose RMB 10,000-30,000 on each car sold. The business strategy is to become profitable once sales of the Zhidian R7 increase in the future.

In other words, most automakers now expect to lose money on new car sales in the early stages to help the cars gain market footing. As sales gradually increase and mass production begins, costs can be significantly reduced, leading to profitability later on.

In 2024, this is no longer an under-the-table operation. Even Zhu Jiangming, the boss of Zero Run Auto, announced at a press conference that "upcoming new cars will be priced lower than the previous ones." In the first half of 2024, with the launch of BYD Qin L and Seal 06, as well as the subsequent release of the Glory Edition, BYD has resolutely implemented its annual strategy of "electric vehicles priced lower than gasoline vehicles," one of their core KPIs.

Therefore, excessively low pricing or policies are expected to be regulated. However, regulating automakers' free pricing is very difficult. Many obvious examples illustrate this. After Zeekr and Lynk & Co. merged to form a technology group, Zeekr focused on upward development, while Lynk & Co. took on sales volume. As a result, the Zeekr X was rebranded as the Lynk & Co. Z20. When it was recently launched, the price range of RMB 135,900-150,900 was over RMB 13,000 lower than its Zeekr-era pricing. This is a market behavior that is difficult to stop.

Similarly, Chery's recently launched Fengyun A8L C-DM follows the same logic, with a price range of RMB 109,900-149,900 targeted directly at BYD Qin L's price range of RMB 99,800-139,800. Another example is Geely's recent success in quickly capturing the market with the strategy of "BYD Seagull pricing, BYD Dolphin space, range, and configuration." The above examples will certainly not be isolated cases in 2025.

Competition will undoubtedly continue, but a significant variable is how Tesla will compete. If Tesla sets a lower price for the new Model Y while enhancing its range, configuration, intelligent driving capabilities, and other aspects, the entire anti-"cutthroat-style" competition effort will be ineffective.

Due to the Model Y's devastating impact, automakers encircled by it this September were forced to lower prices due to pressure, further impacting the lower-priced market. However, if Tesla prices the new Model Y competitively, similar to how it priced the refreshed Model 3, the Chinese auto market may have a slightly easier time for a while.

The second point is that there will likely be a crackdown on water armies and governance of various rankings, such as weekly rankings. Whether this will be effective depends on whether frequent comparisons and attacks on competing models from similar automakers are still allowed at press conferences. Like the first point, this also involves whether to intervene in market laws.

Points to note include whether the new round of new car launches by Hongmeng Zhixing or the launch of Li Auto's pure electric SUV series will maintain the same tone as before. If the tone becomes softer, it proves that it starts to have an effect.

As for the third point, which is the hardest to manage, is the high degree of product homogeneity. In the last batch of new car declarations to the Ministry of Industry and Information Technology this year, the release of the Deep Blue S09 directly triggered a sarcastic comment from a Li Auto executive on social media, sparking heated discussions about plagiarism.

In the current market, many new cars from Jietu resemble those from Li Auto, and some new cars from Chery share similarities with those from BYD. More and more automakers aim for rapid sales growth and quick consumer recognition. Recall that the plagiarism lawsuit between Landwind and Land Rover lasted a full six years before a verdict, indicating many difficult and unclear factors are involved.

Postscript

The foreseeable outcome is that the price war in the automotive industry will reach new

Nonetheless, competition will escalate in other market segments. Currently, it is evident that automakers' comprehensive strategies for 2025, encompassing models such as the AITO M8, Zunjie S800, NIO ET9, Changan Qiyuan C798, and the revamped XPeng P7, are all directed towards expanding in the high-end market.

The underlying trend suggests that while price wars may not be fought within the traditional boundaries, they will reach a new level of intensity beyond those confines.