Porsche's Staff Layoffs: A Sign of Challenges from New Energy Vehicles?

![]() 12/27 2024

12/27 2024

![]() 575

575

Recent news of layoffs at Porsche hints at an uncomfortable situation for the iconic global luxury car manufacturer.

Porsche has long captivated sports car enthusiasts worldwide with its exhilarating speed and passion. Models like the classic 911, the SUV Cayenne, and the sports sedan Panamera have solidified Porsche's position in the global luxury car market through consistent acceleration and exceptional handling.

Notably, the Porsche 911 once achieved 19 consecutive victories at the 24 Hours of Le Mans, with its engine roaring at 108 decibels when fully throttled. However, in the electric era, these once thrilling performances have begun to lose their allure, appearing somewhat outdated amidst the rapid advancements in electric vehicles.

In essence, Porsche's current challenges stem from its direct collision with the electric age.

In 2022, as the domestic new energy market surged, Porsche's sales in the Chinese market declined for the first time, falling by 2.5%. In 2023, Porsche delivered 79,300 vehicles in China, a year-on-year decrease of 15%. This downward trend continued into the first quarter of 2024, not only in China but globally. The first-quarter financial report revealed that Porsche's global sales were 77,640 units, a year-on-year decrease of 4%.

Competing with new energy vehicle brands seems to be an inevitable fate for all luxury car brands, with Porsche now following in the footsteps of BBA.

What has Porsche endured in recent years?

Perhaps layoffs are not Porsche's biggest embarrassment. In the first three quarters of this year, Porsche's global revenue was 28.56 billion euros, a year-on-year decrease of 5.2%, with operating profit plummeting by 41% to 974 million euros. It is reported that Porsche China also plans to reduce the number of dealers from the current 154 to around 100 by the end of 2026, closing about 54 stores.

From being a highly coveted symbol of wealth to facing embarrassing layoffs and store closures, what exactly has Porsche experienced in recent years?

Currently, Porsche primarily sells five gasoline-powered models: Panamera, 718, Macan, Cayenne, and 911, along with two electric vehicles: Taycan and the mid-size Macan EV. However, in 2024, global sales of the Taycan, once a beacon of Porsche's electrification transformation, plummeted by 50%.

Data shows that from January to September this year, Porsche sold only over 14,000 Taycan vehicles. In comparison, leading new energy vehicle companies achieve such sales figures in a single month. The rivalry between luxury car brands and new energy brands has persisted since the latter's inception, but gradually, new energy brands are no longer blindly taunting Porsche and Rolls-Royce.

Instead, these luxury car brands with declining sales are occasionally pulled into competition with new energy brands, especially in the Chinese market. According to Dongwu Securities, in 2023, the sales volume of the luxury car market above 300,000 yuan in China reached 2.98 million units, with domestic brands gradually enriching their supply side by leveraging their electrification advantages.

The rise of the new energy market has logically become the main "excuse" for Porsche's decline.

It is undeniable that since new energy brands began to focus on the high-end market, the sales of traditional luxury cars have been continuously impacted. Brands like AITO M9, BYD U8, and even Xiaomi's car, nicknamed "Mishijie," have become formidable competitors, pressuring Porsche's sales.

Public data shows that since its launch at the end of last year, AITO M9 has accumulated deliveries close to 200,000 units, with an average sales price exceeding 500,000 yuan, directly competing with Porsche Macan. As a result, the starting price of Porsche Macan has dropped from 500,000 to 360,000 yuan. Similarly, the cumulative sales of BYD U8 also exceed 7,000 units.

Currently, there are only three luxury cars in China with monthly sales exceeding 1,000 units: Mercedes-Benz S-Class, Maybach S-Class, and Porsche Panamera. BYD U8 was only launched in September last year, and its sales exceeded 1,500 units in the second month after its launch.

When new energy brands collectively aimed to compete with Rolls-Royce or Porsche, there was external ridicule. However, in reality, high-end new energy vehicles have great potential in the consumer market. Even troubled brands like HiPhi, which peaked at 1,000 units per month in sales, achieved figures that traditional luxury brands have struggled to match for years.

But is Porsche's downturn entirely due to changing times and market shifts? Not necessarily.

The global consumption downturn has severely impacted brands like Porsche, which occupy the space between luxury and ultra-luxury cars. Taking the domestic market as an example, Porsche's primary customer base in China has always been the middle class. Porsche has also released a survey report indicating that the average annual household income of its Chinese owners is approximately 3 million yuan.

However, the spending power of the middle class has experienced significant fluctuations in recent years.

In 2023, most new middle-class consumers adopted a cautious attitude towards spending, with 44.5% experiencing minor fluctuations. Data from the China Passenger Car Association (CPCA) shows that ultra-luxury imported car sales accelerated their decline in the first three quarters of this year, with cumulative sales growth sliding by 60%. Behind the overall weakness in ultra-luxury car sales lies a temporary slowdown in purchasing power among ultra-high-end consumer groups.

Moreover, Porsche faces many internal contradictions.

Previously, to meet sales targets in the Chinese market, Porsche China pressured dealers with inventory, leading to dealer complaints and "forcing" headquarters to intervene. Popular models like the Cayenne and Macan went without updates for six to seven years, and performance enhancements, crucial for tech products, stagnated.

Rome wasn't built in a day, and perhaps the symptoms of Porsche's challenges began to emerge at that time.

Even today, Porsche is actively regrouping. This includes further promoting the electrification process, adding technical departments, integrating resources, and promoting positive word-of-mouth. Perhaps layoffs are part of this strategy. Porsche has begun to self-reflect because one day, the external environment will stabilize, revealing the automaker's own flaws.

Is the "standard of luxury cars" being rewritten globally?

When it comes to the decline of luxury car brands, Porsche is not alone. In recent years, the struggles of BBA have been evident, but brands like Maserati, Ferrari, Lamborghini, Bentley, and Rolls-Royce have also experienced varying degrees of decline. The latest data from the CPCA shows that from January to August this year, Maserati and Aston Martin sold 840 and 199 vehicles in China, respectively, with year-on-year declines of 74% and 47%, respectively.

Additionally, sales of McLaren, Rolls-Royce, Lamborghini, Ferrari, and Bentley fell by 88%, 40%, 37%, 29%, and 27%, respectively. Notably, the cooldown in luxury car brands is not limited to the Chinese market; globally, these brands that were once synonymous with fame, wealth, and status have shrunk to varying degrees.

Data shows that in the first half of 2024, Maserati's global shipments were only 6,500 units, a year-on-year decline of over 50%, with an adjusted loss exceeding 82 million euros. As early as 2023, Bentley's global and Chinese market sales both declined. In the first half of 2024, Ferrari's sales only grew by 2.7%.

Conversely, brands like BYD U8, Lixiang L9, NIO ES8, AITO M9, Zeekr 001, and Avita 11 are aggressively entering the Chinese market while also making their presence felt globally. Taking the Middle East, a region abundant with luxury cars, as an example, in January, Chery's Starway competed with traditional luxury automotive brands like Lexus, BMW, Mercedes-Benz, Audi, and Infiniti in the region.

It is reported that the average sales price of Starway vehicles in the Middle East market exceeds 300,000 yuan. In the UAE market, the sales volume of Starway Yaoguang accounted for over 40% of total sales. At the end of last year, BYD's new flagship showroom opened in Dubai Festival City Mall. XPeng Motors announced a strategic partnership with Ali & Sons, a dealer group in the UAE. Zeekr officially debuted in four Middle Eastern countries.

In the era of internal combustion engines, luxury cars were defined by mechanical craftsmanship, interior design, lines, and engines. However, in the electric era, the standards for evaluating luxury cars have shifted. Intelligent driving, range, vehicle-to-machine interconnection, and cabin entertainment have become central to the luxury car experience.

Behind this change, which deserves to be recorded in automotive history, lies the continuation of the original intention and philosophy of luxury car brands. Luxury car brands have always represented a consumer lifestyle and values beyond their cultural connotations. Currently, environmental awareness and smart living are deeply ingrained globally.

According to a 2023 global survey by PwC, 80% of consumers are willing to pay a premium for environmental protection. The 2023 Global Sustainability Report shows that 23,000 consumers worldwide within the survey scope are willing to pay an average premium of 12% for eco-friendly products. To some extent, new energy vehicles have become a tangible manifestation of a global consumer lifestyle.

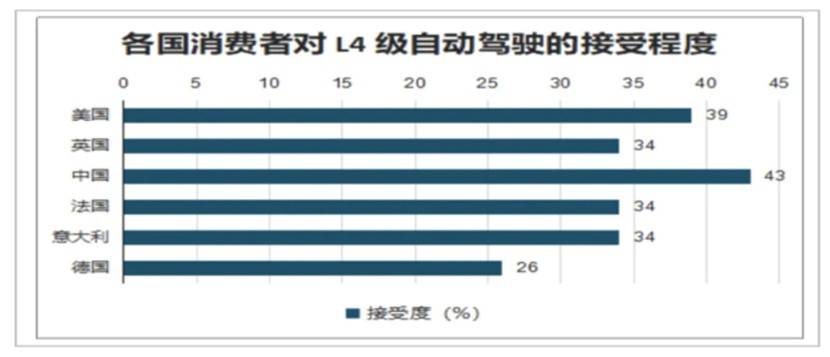

Moreover, the technological intelligence advocated by new energy vehicles is also popular in the global market. Data shows that by the end of 2024, the global smart car market is expected to exceed 1.5 trillion dollars, accounting for over 50% of new car sales. The 2023 Global Automotive Consumer Survey reveals that advanced autonomous driving technology is gradually gaining recognition from more consumers, especially in China and the United States, where L4-level autonomous driving is highly anticipated.

Various signs indicate that new energy vehicles and traditional luxury cars are directly competing. With the changing times, the former is gradually stealing the limelight from the latter, thereby altering the definition of luxury cars.

The reluctance and counterattack of 'Porsches'

Overall, the luxury car market will evolve but will not regress due to the demise of any one brand. McKinsey predicts that from 2021 to 2031, the annual compound growth rate of the global luxury car market will still be as high as 8% to 14%. This means that before the next wave of luxury car consumption frenzy arrives, automakers cannot afford to slacken in the slightest.

Despite being "outshone" year after year, traditional luxury car brands are unwilling to cede their former market and status. Currently, luxury car brands such as BBA, Porsche, Bentley, and Rolls-Royce, which symbolize old money, are seizing every opportunity to recover.

In terms of electrification and intelligence, traditional luxury car brands have their own plans. As one of the most affordable luxury car brands, BBA was not late in realizing the importance of electrification. In 2023, BMW sold approximately 330,600 pure electric vehicles, a year-on-year increase of 92.2%. Porsche announced that it aims to achieve 80% of new car sales from pure electric models by 2030 and will invest over 20 billion euros in the research and development of electrification and digital technology.

Rolls-Royce once stated that it would only produce fully electric vehicles by the end of 2030. Although the impact of these plans may not be immediately significant in the short term, luxury car companies, as masters of technology and craftsmanship in the global automotive manufacturing field, may still have untapped potential.

Moreover, there are already successful cases of electrification within the luxury car brand camp, such as "Lotus," one of the world's three top sports car brands founded in 1948. In 2023, Lotus achieved revenue of $679 million with a gross margin of 15%. In the fourth quarter, revenue was $361 million, a quarter-on-quarter increase of 92%.

In 2023, Lotus delivered a cumulative total of 6,970 vehicles, with electric models accounting for 63% of total deliveries. The company's fourth-quarter deliveries increased by nearly 110% quarter-on-quarter to 3,749 units. It is reported that Lotus's single-quarter gross margin has reached 19%, a remarkable figure in the new energy sector.

Public data shows that Lotus was the first of the world's three top sports car brands to announce a comprehensive transition to electrification and intelligence. By 2023, Lotus's total electric vehicle deliveries had exceeded 60%. This company seems to have foreshadowed the resurgence of global luxury car brands in the electric era.

In addition, while keeping up with the pace of the times, luxury car brands like Porsche, whose glory has faded, are also reshaping the exclusivity and scarcity behind their brands. This is an unavoidable aspect in high-end consumer circles. Differentiation and individuality drive the prosperity of new energy luxury cars at present. Today, recreating personalized consumption has become the primary task for brands like Porsche.

Last year, despite a significant decline in global sales, Bentley still achieved an annual operating profit of 589 million euros.

The reason is that in 2023, three-quarters of Bentley's global customers chose customized services provided by the Mulliner personalized customization department, a 43% year-on-year increase from 2022. Rolls-Royce has also begun to focus on customization services. A Phantom priced at 20 million yuan includes 8 million yuan in customization fees, which is deeply loved by top consumers.

However, the consumer market never looks back. It remains uncertain how much time prestigious brands like Porsche have to rewrite their myths. As numerous new energy vehicle companies boldly proclaim their aspirations to become the next big thing, Rolls-Royce only commenced production of its first electric vehicle, the Spectre, last summer. During a new car launch event, Elon Musk bluntly stated that his vehicle would not lag behind a Porsche 911, even if carrying one on its back.

The wheel of time turns relentlessly, and companies that once shined brightly, even those considered "Porsches," are often ruthlessly left behind.

Dao Zong You Li, formerly known as Wai Da Dao, is a new media outlet in the internet and technology industry. This is an original article, and any form of reproduction without retaining the author's relevant information is strictly prohibited.