2024: Tesla's Fall from Grace Triggers Collapse of Foreign Brands in China

![]() 01/07 2025

01/07 2025

![]() 597

597

XinNengYuanQianZhan (ID: xinnengyuanqianzhan) Original

Full text: 2957 words, Reading time: 9 minutes

Recently, Tesla has been engulfed in online rumors while its offline stores have remained relatively quiet, with sales staff communicating primarily via mobile phones.

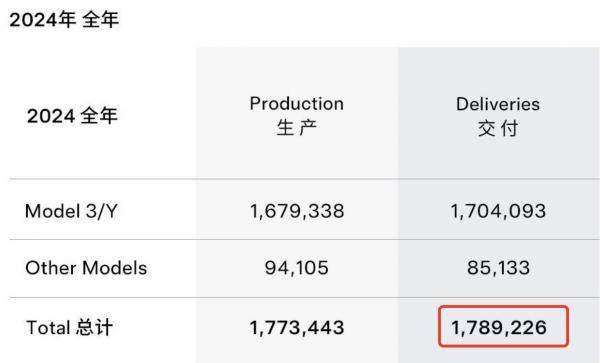

Lacking new products, Tesla lost its former dominance in 2024, delivering 1.7892 million vehicles—a 1.1% decrease from 2023, marking its first year-on-year sales decline in a decade. Despite setting a record for vehicle deliveries in the Chinese market, Tesla failed to outperform the overall market, with its market share shrinking to 5.4%, a drop of 2.4 percentage points from 2023.

Clearly, Tesla's sales performance in 2024 fell short of market expectations, leading to a sharp drop in its share price on January 2, local time, eroding $575.2 billion in market value.

Foreign automakers and some joint ventures have faced similar, if not more severe, challenges. Sales of BBA vehicles in China declined by around 10% year-on-year, while Maserati and Aston Martin saw their sales halved. Porsche, rumored to be facing mass layoffs due to declining sales, has closed multiple stores, and the situation is expected to worsen in 2025.

Even Tesla, once a standout performer, could not withstand the pressure, and foreign brands now stand on the brink of collapse in the Chinese market. Can the new Tesla Model Y, which the market holds high hopes for in 2025, bring about a miracle?

1. During Tesla's lull, consumers rush to buy the current Model Y

At the beginning of 2025, there were daily updates on the progress of the new Model Y, with rumors circulating that it would be available on the official website on January 1. However, nearly a week has passed, and the official announcement is still for the current Model Y.

This wave of discussion originated from spy shots of the new Tesla Model Y driving on a rainy highway, captured by an overseas netizen and uploaded to social media. The spy shots revealed the new Model Y's front and rear still covered in camouflage, but other body parts were clearly visible.

Image/Spy shots of the new Model Y

Source/Screenshot from XinNengYuanQianZhan

However, this is not the first time the new Model Y has garnered such attention online.

In August 2024, LatePost exclusively reported that Tesla planned to deliver the new Model Y in 2025, featuring a 5-seater "Juniper" version and a 7-seater version tailored for the Chinese market. The former was expected to be delivered in the first quarter of 2025, while the latter was expected in the fourth quarter.

Image/Juniper spy shots

Source/Screenshot from XinNengYuanQianZhan

Through conversations with several Tesla sales staff, it has become virtually certain that Tesla will launch two versions of the Model Y in 2025.

One is indeed a mid-cycle refresh of the Model Y for the global market, while the other, a China-exclusive model, is not a 7-seater but a three-row, six-seater.

Regarding more detailed parameters and configuration information of the new Model Y, Tesla sales staff have a uniform response: there is no official news, and they have not received any emails. However, according to their personal analysis, the changes in the new Model Y will mainly be cosmetic, including the removal of the column shifter in favor of a touch-sensitive gearshift. Other interior features, intelligent driving capabilities, and range will not change significantly, as the current Model Y's ambient lighting and chips have already been upgraded.

Price is the topic they are most willing to discuss. "The new Model Y will increase in price by 30,000 to 40,000 yuan at the sales end, and the speculated 6-seater long-range all-wheel-drive version may be 20,000 yuan more expensive than the 5-seater version." Additionally, the 10,000 yuan final payment discount and 5-year interest-free financing will be eliminated.

It is understood that production of the current Model Y is still ramping up, as its sales remain robust under the stimulus of "historical lows" in pricing.

Image/Current Model Y

Source/Screenshot from XinNengYuanQianZhan

Xiaoli (pseudonym), who works in a new first-tier city, has been closely following the Tesla Model Y. After weighing the pros and cons of the new and old models and considering his financial situation, he felt that buying the current model was the right choice. However, the problem is that the configuration he wants is not currently available, and he needs the sales staff to help secure it. Zhang Lili (pseudonym), who visited a Tesla store last weekend, also felt the enthusiasm of consumers for the current Model Y. As the sales staff was browsing the internal network to confirm the configuration with her, almost simultaneously, the car was booked by someone else.

In 2023, Tesla sold over 1.2 million Model Y vehicles globally, making it the world's best-selling car. According to media estimates, the Model Y will continue to be the best-selling passenger car model globally in 2024.

2. Can the new Model Y save Tesla after its fall from grace?

Undoubtedly, judging from Tesla's sales in China, it remains a formidable player, but its growth momentum has significantly slowed compared to the past.

In 2023, Tesla sold a total of 1.81 million pure electric vehicles, an increase of 38% over the 1.31 million sold in 2022. Although this growth rate slowed down compared to 2021, it did not hinder Tesla from setting a sales target of 2.2 million vehicles for 2024.

However, reality dealt a harsh lesson to Tesla.

In 2024, Tesla delivered only 1.789 million vehicles globally, with a target achievement rate of only 81.33%. Not only did it fall short of the previously set annual sales expectations, but it also sold 57,000 fewer vehicles than the 1.846 million sold in 2023.

Image/Tesla's global delivery data for 2024

Source/Screenshot from XinNengYuanQianZhan

From a market segment perspective, the Chinese market remains Tesla's primary growth market.

According to official Tesla data, in 2024, Tesla sold over 657,000 vehicles domestically, a year-on-year increase of 8.8%, setting a new record. Tesla's Shanghai Gigafactory delivered 916,000 vehicles in 2024, accounting for over 50% of Tesla's global deliveries.

However, judging from Tesla's development in the Chinese market, while the sales figure of 657,000 vehicles does indeed set a new record, its current advantage in growth rate and market share has completely vanished.

In 2021, Tesla's market share in China's pure electric vehicle segment reached an all-time high of 16.6% but has since declined steadily. In 2023, this market share dropped by 8.2% to 7.8%, and by November 2024, it had fallen to 7.4%.

Image/Tesla's pure electric vehicle market share was 16.6% in 2021

Source/Screenshot from XinNengYuanQianZhan

Slowing growth is a direct factor in the sudden drop in market share. In 2024, Tesla's sales in China increased by only 8.8% year-on-year. However, during the same period, independent brands such as Thalys, which relies on the success of the AITO brand, saw a year-on-year growth rate exceeding 180%, while Zeekr grew by 87% and NIO by 38.7%.

The sales miss also directly impacted Tesla's share price. After disclosing its sales figures for the entire year of 2024, Tesla's share price plummeted by 6%.

Li Ming (pseudonym), a new middle-class individual living in a first-tier city, was one of the earliest owners of the Tesla Model Y. In mid-2024, when considering replacing his car, Li Ming removed the Model Y from his list of potential options.

"Actually, I've never been too satisfied with the interior and comfort of the Model Y. The reason I chose the Model Y initially was partly due to Tesla's brand allure and partly because five or six years ago, independent brands were still lacking."

Li Ming candidly stated that Tesla and independent brands have now switched places in his heart. "I've lost my fascination with Tesla and have become a fan of independent brands such as Xpeng, NIO, Xiaomi, and Zeekr, which are now my alternative brands."

When asked if the launch of the new Model Y in the first quarter of 2025 would change his purchasing intention, Li Ming said he didn't have much expectation.

"In comparison, independent brands can better meet my needs in terms of price, configuration, and intelligence. More importantly, independent brands excel in localized services, better catering to the actual needs of domestic consumers."

3. The collapse of foreign automakers across the board

Tesla's sales decline not only signifies its fall from grace in the Chinese market but also reflects, to some extent, the overall collapse of foreign brands in the domestic market in the era of electric vehicles.

In 2024, once-dominant joint venture brands in the domestic market seemed to encounter unprecedented challenges.

This year, leading luxury brands including BBA and Porsche have all experienced difficult times. Especially in October 2024, when BMW's first global 5S store closed due to severe financial pressure, dealers across the country reported significant pressure and cash flow disruptions. Within just one month, Tianjin's largest Audi 4S store had to close due to similar issues, and other stores such as Fuzhou Zhongbao and Fujian Xingdebao also shut down.

The data directly reflects the decline of former luxury car giants like BBA. In the third quarter of 2024, BMW Group's sales in China fell by 29.8% to 147,700 units; Mercedes-Benz sales declined by 13% year-on-year to 170,000 units; and Audi sales dropped by 19.63% to approximately 157,500 units. The net profits of these three brands during the same period fell by 84%, 54%, and 91%, respectively.

For leading luxury brands, 2024 was undoubtedly a bleak year. However, compared to second-tier luxury brands, this bleakness seems somewhat fortunate.

Throughout 2024, brands including Volvo, Cadillac, Land Rover, Jaguar, and Infiniti experienced nearly all-round decline. According to data from the China Passenger Car Association, Cadillac sales declined by 37.0% year-on-year from January to September, while Jaguar sales fell by 28.8% and Chang'an Lincoln by 7.7%.

Image/Sales data of some luxury manufacturers in 2024

Source/Screenshot from XinNengYuanQianZhan

In this context, Tesla can be said to be the only brand that remained popular among Chinese consumers in the electric vehicle era of 2024.

However, although Tesla once enjoyed immense popularity in the Chinese market during the electric vehicle era, with the rise of domestic competitors, the Tesla Model Y has lost its so-called irreplaceability.

For example, the Ledo L60 directly competes with the Model Y and has advantages in terms of price, range, and energy consumption. Zeekr 7X strives to become a benchmark in the pure electric SUV market in terms of technology, safety, and sales. The HiPhi R7, a collaboration between Huawei and Chery, has an advantage in smart experience due to Huawei's intelligent driving and cabin system.

Image/Ledo L60, Zeekr 7X, HiPhi R7

Source/Screenshot from XinNengYuanQianZhan

Additionally, models such as the AITO 07 and IM Motors LS6 compete with the Model Y in design and performance. The Xpeng G6 is strictly benchmarked against the Model Y in terms of styling, size, and power, aiming to surpass the Model Y in the 250,000 yuan pure electric SUV market segment.

Image/AITO 07, IM Motors LS6, Xpeng G6

Source/Screenshot from XinNengYuanQianZhan

Although none of the aforementioned models have surpassed the Tesla Model Y in terms of individual efficiency, the fact that Tesla's global sales declined for the first time in 2024 indicates that independent brands have posed a significant threat to Tesla.

In 2025, foreign automakers may find it increasingly difficult to stand out in the domestic market.