Cornered Beasts: The Strategic Maneuvers and Hidden Strengths of Japanese Auto Brands

![]() 01/09 2025

01/09 2025

![]() 586

586

When analyzing multinational automakers, a pivotal criterion is their market weight across different regions. Unlike German automakers, North America will remain the cornerstone for Japanese automakers at least until early 2025, accounting for the lion's share of sales, sunk capital, and serving as their primary source of revenue and profit. However, with the inauguration of the Trump administration in the United States, the next four years brim with uncertainty. Japanese automakers must now confront the specter of a "tariff war," deepen their roots in the Chinese market, shift some production capacity to Europe and South America, and fiercely compete with Chinese brands in Southeast Asia.

Nevertheless, their tenure in the Chinese market is growing increasingly challenging, while sales and profits in European and American markets are also on the decline. It is precisely for self-preservation that Japanese automakers have been actively maneuvering on the global market chessboard at the end of the year. As we look ahead to the new year, how should they position their pieces in the global market, and can their strategic layout and hidden strengths turn the tide? To address these questions, we must analyze and assess the common traits and respective advantages and disadvantages of the three major players: Toyota, Honda, and Nissan.

In 2024, the global strategy of Japanese multinational automakers encompasses capital mergers and acquisitions, technological collaborations, and the reorganization of global resources and capacities. Judging from their current actions, the hidden strengths of Japanese automakers share certain similarities, such as forming joint ventures to cut costs and enhance efficiency, developing novel technologies and products, and researching solid-state battery technology to narrow the time cost gap with Chinese competitors. They also emphasize their traditional QDR (Quality, Durability, Reliability) reputation to stabilize the fuel vehicle market and ensure funds for transformation. Additionally, they seek outstanding new component enterprises for the supply chain while simultaneously developing new technologies and assemblies focused on intelligent driving.

Of course, the obstacles to future transformation and breakthroughs for Japanese automakers also share similarities. For instance, their disadvantage in software development stems from the outsourcing strategic layout (Fabless Layout) adopted by the United States in the 1990s, which subcontracted advanced process chip technology to Taiwan and South Korea, while only subcontracting electronic component and chemical coating technology to Japan. Coupled with Japan's recent misguided industrial strategies, they have failed to seize the opportunities presented by electric vehicles, resulting in a lagging position.

The collaboration between Honda and Nissan is driven by both the pressure from Fujitsu's acquisition attempt and the behind-the-scenes push from Japan's Ministry of Economy, Trade, and Industry, objectively verifying the weakened competitiveness of Japanese automotive giants. The alliance mechanism of the supply chain "Association for Advancement" is a significant advantage for Japanese automakers. Many component enterprises, such as Dentsu, Alpine, and Toyota Boshoku, have been supply partners for decades, sharing prosperity and adversity. However, in the wave of electric vehicles and intelligent driving, where new cars are often replaced every three to four months, the advantages under high-frequency competition have vanished, ultimately leading to the lock-in of OEMs' bargaining power. Furthermore, the reform of Japan's traditional lifetime employment system is sluggish, and the labor gap caused by the "declining birthrate" cannot be bridged. Large-scale salary cuts and layoffs contradict Japanese traditional corporate culture and ethnic cognition and are also restricted by the government, making implementation even more challenging. Consequently, the comprehensive response capabilities of Japanese automakers pale in comparison to those of Chinese brand competitors, and there are numerous constraints on cost control.

▍Toyota's Persistence and Change

Toyota has made numerous technological advancements in 2024, including accelerating the pursuit of BEV and intelligent driving technology through collaborations with Chinese OEMs such as BYD and GAC, as well as Chinese intelligent connected vehicle suppliers like Pony.ai. For example, Toyota prominently launched the upcoming bZ3C and Bozhi 3X models at the Shanghai Import Expo in November 2024, announcing that these vehicles, jointly developed with Chinese partners, will be equipped with the latest intelligent driving assistance systems and smart cabins, providing users with a safer and more comfortable driving experience and offering customers a brand-new value proposition. Its L4-level assisted driving system was also unveiled at the same time, currently the most advanced ATAS platform system among Japanese automakers.

Sweep Energy Storage System (Toyota China's official Weibo)

According to foreign media reports, Toyota is accelerating the independent research and development of large models of generative AI technology through collaborations with world-leading AI enterprises such as NVIDIA and the purchase of technology chips, striving to narrow the substantial gap with competitors like Tesla, NIO, and Li Auto in the field of smart cabins. Through tripartite cooperation with Mazda and Subaru to develop small hybrid and electronic fuel engines, Toyota ensures that the profit cow of ICE internal combustion engines can continue to fund transformation efforts. Although Toyota's revenue declined in the first half of fiscal year 2024, its cash flow remained robust, with operating income exceeding $200 billion, surpassing the combined revenue of Honda and Nissan, which are on the verge of merging, over the same period.

Analysis of information retrieved in 2024 reveals that Toyota's hidden strengths in the coming years, besides solid-state batteries, largely bypass the main battlefields of electric vehicles and intelligent driving, taking an unconventional approach. For instance: First, it focuses on the intersection of hydrogen fuel cell and commercial vehicle markets, having currently developed three fuel cell systems. Among them, the TL Power300 fuel cell system (dual system) with a rated power of 300kw, which made its global debut, has been first mounted on a 49t fuel cell tractor truck. Additionally, the TL Power150 and 260kw+ fuel cell systems have also been launched, suitable for short-haul transportation of heavy trucks and heavy-duty trunk logistics scenarios, respectively, featuring high efficiency, low hydrogen consumption, and long service life, capable of continuous operation for over 30,000 hours. Toyota has also signed a memorandum of cooperation with BMW to jointly develop the third-generation hydrogen fuel cell, primarily supplied to the commercial vehicle market.

Second, in anticipation of the next three years when battery life will concentrate on expiration, it vigorously promotes battery recycling and reuse technology, aiming to capture the largest share of the aftermarket pie. During the 2024 Import Expo, Toyota declared, "In today's era of electrified vehicles, there are increasingly more waste batteries on vehicles, becoming an unavoidable social issue. Toyota not only focuses on the use stage but also conducts numerous attempts throughout the entire life cycle of the battery, especially in battery recycling and reuse, hoping to propel the progress of battery 3R (Reduce, Reuse, Recycle)."

Third, it seeks new profit points through the reserve and commercialization of peripheral technologies. At the end of 2024, Toyota announced that its Sweep energy storage system, which debuted in China, can store renewable energy such as solar photovoltaic and wind power. After being connected to the grid, the energy storage system can play a role in peak shaving and valley filling, voltage regulation, and frequency modulation, significantly improving the efficiency of renewable energy use. Additionally, this system is compatible with retired batteries of different types and varying degrees of attenuation, enabling batteries of different capacities to be used evenly, improving the service life of power batteries and reducing resource waste.

Toyota's step aligns with Tesla's goal of building energy storage facilities in Shanghai, hoping to feed excess electricity back into the grid in the Chinese market where the penetration rate of new energy vehicles exceeds 50%. By constructing and renting energy storage facilities, it seeks more commercial benefits through an alternative path. Of course, in this regard, Chinese enterprises such as Contemporary Amperex Technology Co. Limited (CATL) and GAC are also actively making layouts.

▍The Troubled Path of Honda-Nissan Merger

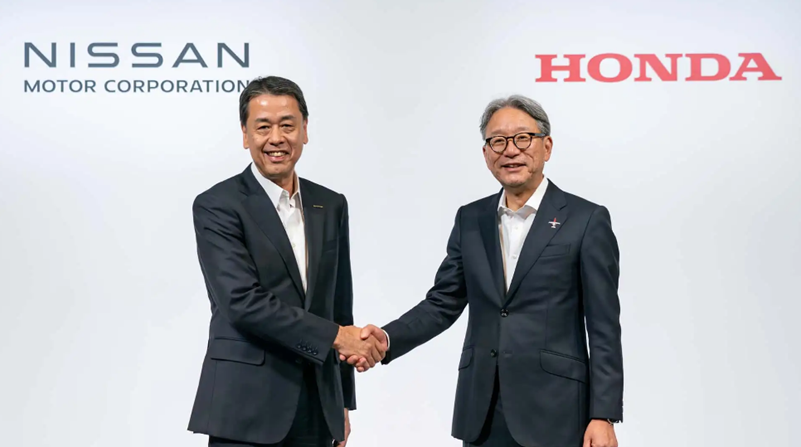

On December 23, 2024, Honda and Nissan signed a memorandum of understanding, officially announcing their intention to form a new group, aiming to reach a final merger agreement by June 2025 and complete the merger steps by 2026. Nissan CEO Makoto Uchida stated, "The merger is necessary because new players have entered our market, and economies of scale are becoming increasingly important." Honda CEO Toshihiro Mibe emphasized that "both parties have entered into negotiations because they are facing a rapidly changing business environment and need to maintain global competitiveness."

The outline plan in the merger memorandum requires the two companies to be incorporated into a holding company and listed on the Japanese Exchange in 2026. Based on current market value estimations, this merger will be worth $54 billion, and if Mitsubishi Motors is added, it will reach $58 billion. However, the automotive industry is no longer as glorious as it once was. Even with such a substantial amount of funds, there is still a notable gap compared to Disney's offer to acquire 20th Century Fox in 2024 (over $90 billion).

Image source: Honda's official website

On the surface, it appears to be a merger between two companies, but it actually involves four entities: Honda, Nissan, Renault, and Mitsubishi. Among them, the Nissan-Renault alliance has a complex cross-shareholding relationship with Mitsubishi, with Nissan and Renault holding 65% and 15% of each other's shares, while Mitsubishi is 27% owned by Nissan.

The collaboration between Honda and Nissan will form a behemoth with an annual revenue of $220 billion, beneficial to Honda. However, in terms of management structure, investment, and establishing a brand-new business model, traditional solutions cannot resolve the underlying issues. Analysts generally believe that the Japanese business community lacks innovative management thinking.

From a positive perspective, Honda and Nissan, along with possibly Mitsubishi Motors, will have an annual production capacity of approximately 8 million vehicles in the future. This will enable them to rank fourth globally, not far behind Toyota, which is expected to sell about 10 million vehicles in 2024.

The challenges and disadvantages lie in the fact that in the current global automotive competition, Honda lags significantly in electric vehicles and autonomous driving sensors. At the beginning of this century, the author participated in a test drive of the Honda Insight electric vehicle. At that time, Honda's engineers stated that contemporary battery technology could not meet the requirements of winter endurance and low-temperature startup.

In the ensuing 20 years, there has been no substantial progress in Japan's battery technology and Honda's electric vehicles, causing them to fade from public view. It is evident that Honda has never made significant efforts in this regard. In 2022, the collaboration between Honda and Sony aimed to fill the gaps in autonomous driving technology and in-vehicle entertainment, but so far, the new models have not demonstrated promising market performance. Although Honda announced that it would launch its solid-state battery technology one to two years later than Toyota, it currently appears to be more talk than action, with low expectations.

Nissan's situation is also not optimistic. The Leaf was once the first electric vehicle model for the mass market. However, this pioneering edge has vanished, and the electric vehicle technology owned by the company can barely assist Honda. Mitsubishi Motors, in which Nissan holds a 26.7% stake, also possesses plug-in hybrid technology, but it has no commercial advantage compared to Chinese competitors like BYD.

In terms of time cost, the gap between Japanese cars and Chinese brands is even more challenging to bridge. Even if they merge, along with the previous small engine plan of Toyota, Fuji Heavy Industries, and Mazda, they still cannot catch up with Chinese competitors. In the automobile manufacturing field, the development cycle of traditional models is approximately 5-7 years, with a full production cycle of 14 years. However, Chinese brands can develop cars in just 18 months, with facelift updates taking even less than a quarter, while the update and scrapping time for pure electric vehicles will be shortened to 6 years.

Japan's Nihon Keizai Shimbun reported that even if a full merger agreement is reached by 2025, new Honda vehicles utilizing Nissan battery technology or Mitsubishi hybrid systems may not be available until 2030. Toshihiro Mibe stated at the merger press conference, "To remain competitive on the battlefield in 2030, we all need to have the right artillery." But in reality, neither Honda nor Nissan has found a suitable weapon yet.

Relevant personnel from Dongfeng Nissan emphasized during discussions on the merger that the union would not swiftly reverse the two companies' declining market share in China. Dongfeng Nissan aims to introduce a novel self-owned brand vehicle in 2025, anticipated to feature Huawei's HarmonyOS ADS3.0 system on its intelligent driving platform, though it will continue to rely on gasoline engines, hinting at resource constraints. Local analysts concur that substantial layoffs and cost-cutting measures are essential for the merged entity to achieve its initial objective of generating a 3 trillion yen operating profit. However, the combined operating profit of both automakers in the first half of fiscal year 2024 stands at less than 800 billion yen.

Upon assessing the financial health of the three companies, Toyota appears relatively robust, maintaining strong cash flow. Using EBITDA (Earnings Before Interest, Taxes, Amortization, and Depreciation) as a metric, Toyota's fiscal year profits, while projected to decline, still exhibit significant competitive prowess. Even if its product lineup falls short, the automotive market is a long-distance endurance race reliant on robust technology and capital. If solid-state batteries prove successful, Toyota could turn the tide; otherwise, sustaining stable performance over the long term appears feasible. Toyota's strategic positioning evokes mixed emotions, yet it holds numerous hidden strengths.

The optimal scenario for the Honda-Nissan merger would be achieving the scale and profitability of the Stellantis Group, though this may not lead to a rapid enhancement of competitive edge. The worst-case outcome could mirror that of the former DaimlerChrysler Group, which dissolved due to irreconcilable corporate interests. Such an outcome would not only squander investments but also exacerbate existing weaknesses, consuming valuable time and leading to unpredictable consequences. Carlos Ghosn, former co-CEO of Nissan and Renault, remarked, "The merger lacks meaning due to excessive structural redundancy and insufficient complementary factors."

In 2024, Toyota's Satoshi Sato, Nissan's Makoto Uchida, and Honda's Toshihiro Mibe, the three industry leaders, acknowledged, "The automotive market is undergoing a transformational shift akin to a once-in-a-century event, and we admit to lacking the necessary tools for this battle." Whether these established Japanese multinational automakers can surmount the formidable challenges ahead hinges critically on the stabilization and recovery of the Chinese market. Currently, much remains uncertain, and the adage "a way will always present itself when the car reaches the mountain" no longer holds true. This time, the car has indeed reached the mountain, but a viable path is far from guaranteed.

Typesetting | Yang Shuo