Volkswagen's Two Major Challenges

![]() 01/10 2025

01/10 2025

![]() 614

614

One stems from its Wolfsburg headquarters, and the other from China, its second home.

On April 18, 2023, the Volkswagen Group, alongside top executives from Audi, Porsche, and CARIAD, engaged in an "open and frank" discussion at the Shanghai Shipyard.

At that time, the Group's transformation was fueled by a commitment to "go all in." Group CEO Oliver Blume was also quite confident, recalling his words: "We have never been the fastest, but we always strive to be first."

"Always first" was both a commitment and a goal. However, at that time, Volkswagen was yet to foresee the monumental changes that would unfold in 2024.

During the meeting, a Porsche executive posed a question: "Do you think people will continue to pay for car design and performance in the future?" The response from the media present was resolute.

"Always will."

Unfortunately, this answer was deemed "hollow" in 2024. For Volkswagen, 2024 was not a year of transformative success but rather one marked by mounting troubles.

Two significant challenges emerged, one in Wolfsburg and the other in China, its second home.

Loss of the Second Home

The decline in sales and market share in China, Volkswagen's second home, poses the most significant issue for the Group. This has directly led to problems at its headquarters.

For years, Volkswagen has maintained the top sales and market share in China, its most crucial global market, accounting for approximately 40% of its total market share at one point. It has been dubbed Volkswagen Group's "second home."

Recently, on the occasion of the 40th anniversary of the SAIC Volkswagen joint venture, Oliver Blume visited China and reiterated, "Over the past 40 years, China has become the second home of the Volkswagen Group."

The implication is clear: the importance of the Chinese market is a position that Volkswagen cannot relinquish. This stands in contrast to Toyota's "wide net" approach.

According to Volkswagen's data, global deliveries of the Volkswagen brand amounted to about 4.8 million vehicles, a year-on-year decrease of 1.4%. In the Chinese market, Volkswagen delivered 2.1989 million vehicles, a year-on-year decrease of 8.3%, yet it remained its largest market. Additionally, sales of other high-end brands under the Group, such as Audi and Porsche, are continuously declining.

It can be said that the "second home has been lost."

Before delving into the loss, it's essential to highlight some "achievements" for objectivity.

According to data, SAIC Volkswagen sold over 1.2 million vehicles in 2024, with sales of the Volkswagen brand exceeding 1.14 million vehicles, making it the sales champion of a single joint venture brand for many consecutive years. FAW-Volkswagen completed cumulative terminal sales of 1.659 million vehicles (including imported Audi vehicles) throughout the year, ranking first among domestic joint venture automakers.

These achievements are undeniable.

However, why do we still say "lost"? Because the Volkswagen brand, which once stood unchallenged at the top, now uses "qualifiers" when reviewing its achievements, and not just one.

The loss is primarily evident in two areas: the fuel vehicle market, known as the lifeline, and the electrification market, representing the future.

Once upon a time, the Volkswagen brand was far ahead in the Chinese market due to its undisputed dominance in the family car segment. Models like the Golf, Lavida, Passat, and Magotan ranked high in sales and were formidable competitors.

By 2024, these models, known for their strong foundation, were forced to fiercely defend their positions against numerous new energy vehicles, making the defense extremely challenging. This sends a dangerous signal: "Volkswagen is beginning to lose its edge in the core fuel vehicle market."

However, what still offers some solace to the Volkswagen brand is that FAW-Volkswagen has maintained its position in the fuel vehicle market, with market share increasing against the trend. This demonstrates to a certain extent that "outstanding product capabilities" will still be valued.

Volkswagen's electric vehicle strategy, which has been heavily invested in for a long time, has also struggled greatly. In 2024, Volkswagen's share of the electric vehicle market in China was only 1.5%, almost negligible.

Previously, to attract Chinese users, SAIC Volkswagen released a poster with the words "Don't call me a no-name electric car." Large banners also hung on the walls of Audi's 4S stores, reading "Audi also has pure electric new energy vehicles." The level of effort put in is somewhat poignant.

At a previous management meeting, Ralf Brandstätter, CEO of the Volkswagen passenger car brand, used the phrase "The roof is on fire, this is the final alarm bell" to express his sense of crisis towards the Chinese market.

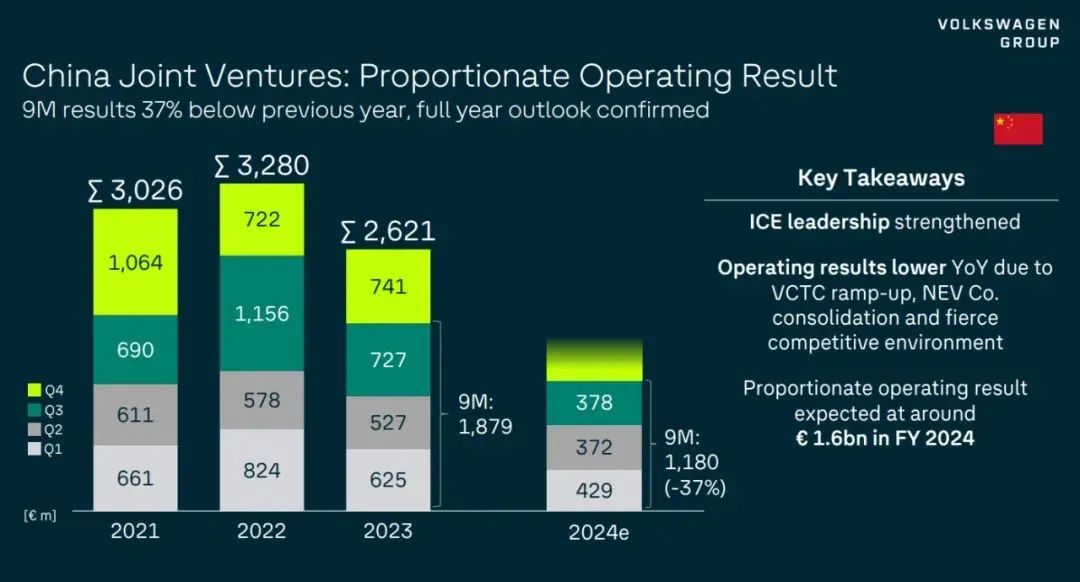

The continuous decline in sales has the most direct consequence of profit decline. According to statistics, in 2024, Volkswagen's sales in the Chinese market were 37.5 billion euros, or over 280 billion yuan, lower than its peak. This is undoubtedly a devastating blow to the Volkswagen Group.

As a result, factory closures and layoff plans have been proposed. With the shutdown of the first factory of SAIC Volkswagen, the veneer of "decency" was torn apart.

"It's Not the Most Dangerous Time Yet"

Marco Schubert, a member of the Volkswagen Group Executive Committee, bluntly stated at the third-quarter report meeting last year, "Competition in the Chinese market is particularly fierce, which is the main reason for our decline in global deliveries."

The loss encountered in China has also reverberated back to the headquarters, causing greater conflicts. When mentioning the most memorable event for Volkswagen Group in the second half of the year, many might choose the word "strike."

Indeed, transformation requires substantial long-term investment in funds and talent, but this contradicts the decrease in profits caused by the decline in market share. Layoffs and factory closures have become measures that Volkswagen Group has to take.

In fact, there are internal contradictions within Volkswagen Group. Some advocate for further cost reduction, closing more factories, and laying off employees, while others believe that investment should be increased to launch more competitive models as soon as possible.

However, launching competitive models cannot be accomplished overnight. For example, BYD, with complete vertical integration, has a development cycle of about 18 months for one model, while Volkswagen will need 2 to 3 years.

A difference of over a year means several rounds of market changes. However, the most embarrassing thing is that neither cost reduction nor the launch of new models can produce immediate results.

Being caught between a rock and a hard place is the current situation of Volkswagen Group.

Nevertheless, the results of cost reduction are easier to achieve than those of launching new models. For example, Mary Barra once closed multiple overseas factories and withdrew from multiple markets to alleviate General Motors' profitability dilemma, after which General Motors' profitability reached a new level.

Therefore, Volkswagen Group has also chosen to allocate funds in its annual budget to implement cost-cutting measures. This is a double-edged sword.

As Oliver Blume stated, there will be no gentle way to cut costs because Volkswagen Group's problems are not issues that have arisen overnight but are "structural issues accumulated over the past few decades."

Many years ago, when Volkswagen and Toyota began competing for the global number one spot, the pursuit of sales volume expansion planted the seeds of cost problems. To alleviate operational pressure, Volkswagen Group had to consider closing some German factories and simultaneously implement measures to reduce employee wages internally.

This less-than-gentle approach directly triggered large-scale strikes at nine factories involving nearly 100,000 employees. The strikes had a direct impact on production, with the main factory in Wolfsburg experiencing a two-hour shutdown, causing the production lines of models like the Volkswagen Golf to be interrupted, and hundreds of cars unable to be assembled.

The direct cause of this strike was a serious disagreement between the union and Volkswagen management over the cost-saving plan. The union believes that Volkswagen's sluggish response to the electrification transformation has led the company into financial difficulties, yet it requires ordinary employees to bear the consequences through wage cuts.

Emotions of dissatisfaction erupted, breaking the initial consensus established between Oliver Blume and the union. The union accused the leader, who emphasized "unity, fairness, and enthusiasm" when he joined, of betraying his promise.

Subsequently, several rounds of negotiations were held. The latest negotiation result was hailed as a "Christmas miracle" by union leaders, with both sides breaking the stalemate on the eve of Christmas. After all, it was the end of the year, and debts had to be settled.

Volkswagen Group compromised and decided "not to immediately shut down European factories." The Dresden factory in Saxony will cease production by the end of 2025.

Layoffs have also been reduced, with Volkswagen planning to cut over 35,000 jobs in Germany by 2030. In terms of salary adjustments, the Süddeutsche Zeitung reported that bonuses for Volkswagen management will gradually be reduced, facing a 10% decrease over the next two years.

Both sides took a step back. However, the blame for this was shifted to China by the German media.

"The reason for this crushing defeat lies elsewhere, and that is China."

Germany's WirtschaftsWoche stated that if Volkswagen's business in China had operated as ambitiously as promised in 2022, then the measures now formulated might have been unnecessary.

Unfortunately, there are no ifs.

Cost reduction is a temporary solution. What needs to be cautious at present is that Volkswagen Group has not yet reached the most dangerous time. To solve the fundamental problem, it is still necessary to launch competitive models.

This is a long-term strategy.

Does Oliver Blume Have a Solution?

The focus is still on the Chinese market. Oliver Blume understands this very well.

At the celebration of the 40th anniversary of the SAIC Volkswagen joint venture, he pointed out that the importance of the Chinese market to Volkswagen Group is self-evident.

He knows where Volkswagen lags behind in electrification. Previously, Oliver Blume spent a whole day test-driving multiple competing models, including some from Xiaomi and AITO.

This reveals a clear message: Facing the fierce competition in China's new energy vehicle market, Oliver Blume's strategy for Volkswagen Group has only one word: accelerate.

Acceleration is imperative.

In the past, during the Diess era, software delays led to the postponement of the launch of major models from Audi and Porsche, causing the Porsche and Piëch families to question Diess's ability to achieve strategic goals. Among them, the Porsche family was even more critical.

Therefore, in addition to stating his determination, Porsche also announced an important decision during this visit to China: it will establish a local research and development institution in China and must participate in the competition at the forefront.

Volkswagen Group is never afraid of competition.

Oliver Blume believes that with competition, China's new energy vehicles can reach a high level. "This competition is a positive signal for us, and it will make us become stronger and stronger."

However, the industry is concerned about whether the board of directors is willing to give Oliver Blume sufficient time.

Over the past decade, Volkswagen has had four CEOs, including Martin Winterkorn, Matthias Müller, Herbert Diess, and the current CEO Oliver Blume. The best results were achieved during Winterkorn's era.

During Winterkorn's era, Volkswagen's global sales surpassed Toyota to become the global sales champion. At that time, with the help of the TSI+DSG golden powertrain, Volkswagen's sales soared.

Later, Volkswagen encountered the diesel emissions scandal, leading to Winterkorn's resignation. Müller became the "firefighter captain" but did not hold the position for long before the global automotive industry began to undergo tremendous changes. Volkswagen's all-in electrification strategy transformation began, Müller stepped down, and Diess took over.

Later, Diess was abruptly dismissed due to his aggressive electrification transformation and continuous friction with the union, leading to a loss of trust. Oliver Blume, who was meticulously cultivated within Volkswagen and known for his teamwork skills, took over as the Chief Executive Officer of the Volkswagen Group.

Unlike Oliver Blume, who seemingly possessed unwavering power, Diess, despite his relentless drive for change, never truly attained authority. "Outsiders" like Diess, brought in from BMW, had little chance of ascending to the pinnacle of power within the Volkswagen Group. The Bavarian "outsider" once hovered on the fringes of the group's power core.

Blume, on the other hand, is a "homegrown Volkswagen man," a meritorious student of the company. As the newly elected CEO, he faces the crucial task of navigating the tension between management and labor unions. Unlike Herbert Diess, Oliver Blume has earned the favor of both the Porsche and Piech families.

When asked what legacy he hopes to leave behind, Oliver Blume responded:

"I prioritize teamwork immensely. I value and inspire every individual's contributions and unique roles, fostering a unified mindset and concentrated effort. This is my personal management philosophy."

After over a year in charge, employees have assessed Oliver Blume as "a team player who avoids the limelight but isn't afraid to make the final call when consensus fails."

This assessment reflects a time when "sharp confrontation" had not yet escalated. However, after 800 days under Blume's leadership, the Volkswagen Group remains entrenched in the "post-Diess era," with labor union confrontations finally erupting due to the current situation.

Initially, the industry wondered how Oliver Blume would make choices and maintain balance amidst conflicts with labor unions and the two families during the transformation. The answer, unfortunately, is that he has struggled to do so.

Currently, the Volkswagen Group is in the midst of a transformation that has spanned five or six years, entailing significant financial expenditures and numerous challenges to address. Nevertheless, Oliver Blume is acutely aware that the Chinese market remains indispensable.

"The Volkswagen brand has 40 years of successful accumulation in China. Our new strategy for the Chinese market will focus on three key aspects: a comprehensive product matrix, China-specific DNA in design and technology, and collaboration with powerful local partners to accelerate technological innovation."

Previously, Oliver Blume set a goal for 2030, aiming to maintain Volkswagen Group's position as the top international automaker in China and continue ranking among the top three in the Chinese automotive market. However, last April, he had to acknowledge that, given the fierce competition, maintaining a market share of over 10% in China is already a remarkable achievement for the group.

Moving forward, Oliver Blume must maintain this market share. Yet, guiding a behemoth like Volkswagen through its transformational challenges requires a long-term commitment, potentially spanning three to five years or even longer.

With over 30 years of unblemished experience, the 56-year-old Oliver Blume still has time to elevate Volkswagen to new heights. The success or failure of the Chinese market will determine whether his resume remains undefeated and is his top priority in turning the situation around.

He once likened the Chinese market to a "gym," emphasizing the need for intensity to keep up. How to increase this intensity and to what extent? In 2025, we will await Oliver Blume's next move.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.