Japanese Automakers: A Late Realization Amidst a Panic

![]() 01/15 2025

01/15 2025

![]() 604

604

Is Nissan's Time Running Out?

Author | Huashang Taolue Liang Liang

On December 23, months of speculation regarding a Honda-Nissan merger finally came to fruition.

The two major Japanese automakers officially announced merger negotiations: they will jointly invest to establish a holding company, integrate as subsidiaries, and plan to incorporate Mitsubishi. If this cooperation is finalized, the trio is expected to create the world's third-largest automotive group after Toyota and Volkswagen.

Behind this highly anticipated grouping lies the decline and anxiety of Japanese automakers in the era of new energy.

[Price Cuts Fail to Save the Day]

At a 4S store, the latest bare car quotation for the Honda Accord 2025 fuel luxury edition stands at 108,800 yuan.

Under the official guidance price of 197,800 yuan, consumers can not only apply for a cash discount of 72,000 yuan but also enjoy a 7,000 yuan trade-in subsidy provided by the dealer. If the car purchase invoice is issued in a foreign province, an additional 10,000 yuan government trade-in subsidy can be obtained, bringing the total bare car price down to the 100,000-110,000 yuan range.

For this "legendary car" that once dominated the Chinese car market for over 20 years, such a price is indeed lamentable. Twenty-five years ago, when Guangzhou Honda introduced the Accord to China, its selling price was as high as nearly 300,000 yuan, almost equivalent to the cost of a house in Beijing.

However, even with such a steep discount, sales remain sluggish.

"It's really difficult to sell Japanese cars now," lamented the sales manager of a Guangzhou Honda 4S store in Beijing. Despite unprecedented promotional activities, half-price promotions, and 0 down payment car purchases, the store still sees very few customers.

The Accord's plight is a microcosm of the collective decline of Japanese cars in the Chinese market.

Data shows that from January to November 2024, Honda's cumulative sales in China were approximately 740,400 units, a year-on-year decline of 30.7%.

Nissan, Honda's compatriot in misfortune, has also experienced continuous sales declines in the Chinese market since 2022. Its cumulative sales for the first 11 months of last year were approximately 621,700 units, continuing to decline by 10.5% year-on-year.

Moreover, these sales figures were achieved through significant price cuts.

According to reports, the bare car price of Guangzhou Honda Hao Ying has dropped from 200,000 yuan to around 110,000 yuan, and the starting price of Dongfeng Nissan Xuan Yi is only 94,000 yuan.

"The more you sell, the more you lose," a sales manager at Dongfeng Nissan helplessly pointed out that many stores are now selling cars at a loss.

This vicious cycle is directly reflected in the financial report. In the first half of fiscal year 2024 (April-September), Nissan's net profit plummeted by 93.5% year-on-year to only 19.22 billion yen (about 900 million yuan).

Even Toyota, the world's largest automaker, is not immune to the difficulties faced by Japanese cars. In the third quarter of last year, its operating profit experienced its first decline in two years, dropping by up to 20%.

The chain reaction brought about by declining sales and plummeting profits is plant closures, layoffs, and business contraction.

In July 2024, Guangzhou Honda announced plans to close its fourth production line with an annual capacity of 50,000 units in October.

In October of the same year, Mitsubishi Motors made a difficult decision - to officially withdraw from the Chinese market, terminate its joint venture cooperation with GAC Group, and shift its focus to relatively underdeveloped markets such as Southeast Asia.

Immediately afterwards, Nissan announced that it would lay off 9,000 employees globally and cut 20% of its production capacity. Its CEO Makoto Uchida voluntarily gave up 50% of his monthly salary from November, and other executive committee members also voluntarily reduced their salaries accordingly to demonstrate their determination to face the crisis.

An insider from Guangzhou Honda revealed that starting from May 2024, the company initiated a large-scale layoff plan that is expected to affect more than 1,000 employees. The shutdown and adjustment of production lines have also left many remaining employees feeling uneasy, wondering if they will be included in the next wave of layoffs.

Despite a series of adjustments, the survival crisis of Japanese automakers amidst the new energy wave remains unresolved.

According to the Financial Times, Nissan is urgently seeking new investors and desperately needs funds to maintain the company's operations. Even after selling a 10% stake in Mitsubishi for 68.64 billion yen, the money in its account can only support it for 12-14 months.

The chill in the market has also spread to the terminal sales of Honda and Nissan.

One dealer lamented, "In the past, saying that buying a Honda was buying an engine with a car thrown in; now, I'm afraid no one even wants the engine."

[Glory and Stagnation]

In China, B-segment cars have always been regarded as a touchstone for measuring an automaker's comprehensive vehicle manufacturing strength, with a saying that "whoever wins the B-segment car market wins the world." In this battlefield, Japanese automakers such as Honda, Nissan, and Mitsubishi have all enjoyed immense popularity.

Twenty-five years ago, the first domestically produced Accord rolled off the production line and immediately became a favorite in the Chinese market. With its spacious and comfortable cabin, stable and reliable power, extremely low fuel consumption, and a reputation for being "indestructible," it quickly became popular nationwide.

"At that time, driving an Accord was definitely a symbol of status," recalled one car owner. In 2004, he took out a loan to buy his first Accord. At that time, the Accord was the "star" among its peers and became the first choice for many middle-class buyers.

Honda CR-V and Civic, Nissan Teana and Xuan Yi, and Mitsubishi Pajero and Outlander - these classic models have also propped up the rapid advancement of Japanese cars in the Chinese market.

Behind the glory lies the unshakable technological advantage of Japanese cars in the era of fuel vehicles.

At that time, Japanese cars were almost synonymous with "fuel-efficient and durable." Honda gained a reputation with its i-VTEC engine technology, which provides both strong power and fuel economy; Nissan was known as the "moving sofa" for its CVT transmission and comfortable chassis tuning; Mitsubishi relied on its four-wheel drive system and off-road performance to occupy a place in the hardcore SUV market.

On this basis, Japanese automakers also actively deployed hybrid technology, achieving innovation in traditional fuel power.

Honda launched the J-VX hybrid concept car as early as 1997 and subsequently developed the i-DCD and i-MMD systems, which are widely used in models such as the Accord and Fit. Nissan, on the other hand, launched its first-generation hybrid system, Fuga Hybrid, in 2010.

Low fuel consumption, low failure rates, and high resale value - these labels have shaped the solid reputation of Japanese cars and made them a reliable choice for consumers.

In 2009, Honda Accord led the mid-to-high-end car market with annual sales of 175,361 units, becoming the first mid-to-high-end car brand in China to exceed 1 million units in production and sales. That year, Nissan Xuan Yi underwent an upgrade and quickly joined the club of 100,000 annual sales.

"Selling cars was faster than selling vegetables. Orders were already lined up for the next month before the cars even arrived at the store," recalled an old employee who once worked in the sales department of Guangzhou Honda about the past glory. "Many customers didn't even ask about the configuration when they entered the store; they just made a decision and placed an order."

During that period, Guangzhou Honda and Dongfeng Nissan consistently ranked at the top of the sales list and became the hottest joint venture automakers. Honda's annual sales in China once approached the 2 million mark, while the Chinese market was Nissan's largest single market globally.

However, this proud technology and brand faith also gradually led Japanese cars to form a path dependency. At the crossroads of the global automotive industry transformation, Japanese cars remained immersed in the comfort zone of hybrid technology, ignoring the rapid rise of pure electric vehicles.

In 2014, Tesla Model S entered the Chinese market, igniting a wave of pure electric vehicles, while BYD opened the market with plug-in hybrid models such as Qin and Tang. In just a few years, new energy automakers relied on pure electric technology and intelligent configurations to quickly expand their territory, leaving Japanese cars behind.

In 2019, Guangzhou Honda's first pure electric vehicle, the Everus VE-1, was launched but suffered a setback due to insufficient range and excessively high pricing.

In 2021, Model 3's global annual sales exceeded 500,000 units, setting a new record and topping the global electric vehicle sales chart, while Nissan's Leaf, the world's first mass-produced pure electric vehicle, had already fallen out of the top ten on the list and may be discontinued in 2025.

In 2024, Li Auto showcased the intelligent voice system and panoramic driving assistance functions of its L9 model at a press conference, causing a sensation in the market. However, Nissan's ProPILOT system has been criticized for its low recognition rate and complex operation.

On one side, BYD's Blade Battery is globally leading, while on the other side, Tesla's FSD (Full Self-Driving System) continues to evolve, and domestic new energy automakers are constantly innovating in user service and smart cabins. Against the background of "double losses" in new energy and intelligence, Japanese automakers have gradually lost their market advantage.

What consumers are concerned about is no longer "fuel efficiency" but "intelligence" and "range."

Not long ago, Andy Palmer, known as the "godfather of electric vehicles" and a former CEO of Aston Martin and senior executive at Nissan, said in an interview with Business Insider that delaying the transition to electric vehicles in favor of hybrid vehicles is a "stupid path."

He said, "Hybrid vehicles are a dead end. They are a transitional strategy, and the longer you stay in this transitional phase, the slower you will enter the new era of electric vehicles. If you delay the transition to electric vehicles through hybrid vehicles, you will be at a disadvantage for a longer time."

[An Uncertain Future]

2019 is recognized as the year of transformation in the automotive industry. In this year, new carmakers such as NIO and XPeng took pure electric vehicles as a breakthrough, completed the delivery of mass-produced models, and officially entered the market.

At that time, the Japanese government, out of concern for protecting the local automotive industry, attempted to broker a business integration between Honda and Nissan but was rejected by both sides.

In addition to considerations of operational independence, borrowing the words of Nissan at that time, due to Honda's unique engineering design, both parties could not use common parts and platforms, and thus could not achieve economies of scale and cost savings.

Five years later, the drastic changes in China's new energy market have forced Nissan and Honda, who once operated independently, to put aside their differences and join forces to break through. Especially with the "divine assist" of Foxconn's intention to acquire a controlling stake in Nissan, the pace of integration between the two sides has greatly accelerated.

"This is a historic turning point for the Japanese automotive industry, highlighting the threat that Chinese electric vehicle manufacturers currently pose to some of the world's most renowned automakers," Reuters commented on the merger.

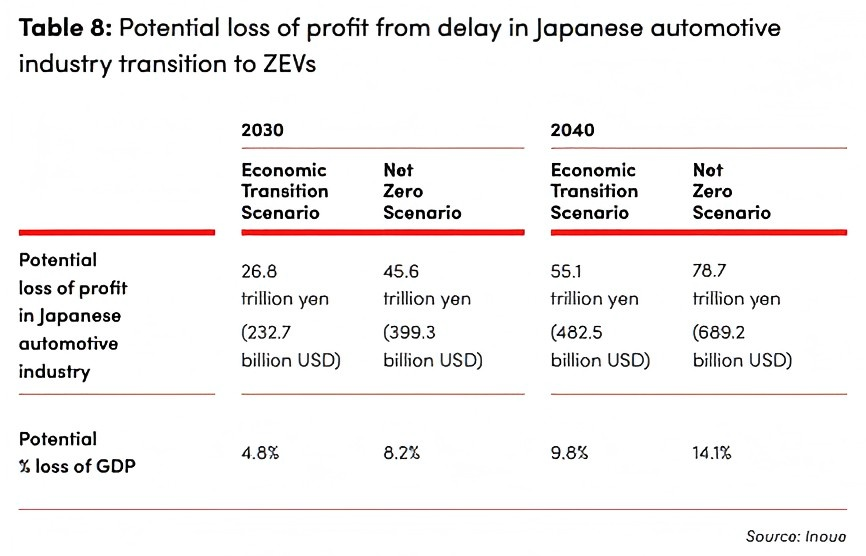

In 2022, an independent report released by the international nonprofit climate organization Climate Group stated that if Japan's automotive industry fails to promptly shift its focus to pure electric vehicles, it will lose half of its automotive exports and over 1.7 million jobs by 2030; by 2040, it will lose 14.1% of its GDP and nearly 80 trillion yen in profits.

But can the merger really solve the problems? Industry opinions are divided.

Supporters believe that the economies of scale brought about by the merger can help the two automakers reduce research and development costs, optimize supply chains, and achieve resource integration in the fields of new energy and intelligence. Sharing platforms, production lines, dealer networks, and technology research and development resources can accelerate the development and launch of new products.

From the perspective of complementary advantages, Honda's mature experience in hybrid technology, combined with Nissan's accumulated experience in the field of electrification, may become an important weight for both to break through the new energy market.

Theoretically, this grouping can enhance their market competitiveness, but it is difficult to achieve in practice.

Carlos Ghosn, the former CEO of Nissan, bluntly stated, "The merger between Nissan and Honda is a desperate move. It's not a pragmatic deal, and it's difficult to find synergies between the two companies. There is almost no complementary relationship between the two companies; they are in the same market, produce the same products, and have very similar brands."

Industry insiders pointed out that products and technology are the key. Even if the integration is completed, without groundbreaking new energy products, it will still be difficult to change the market landscape.

Despite Nissan's pioneering stance in electric vehicles, it struggles with sustained momentum. Post-merger, Nissan and Honda will encounter numerous hurdles, including the development of electrification technology and technical cooperation. To rival Tesla and BYD, both companies must escalate investments and collaboratively advance electric vehicle platforms, battery technology, and in-car systems, particularly focusing on high-performance, long-range, and safe battery solutions.

However, platform integration is not a simple process of assembling parts. Nissan and Honda possess distinctly different chassis and power systems, which could necessitate several years of unified research and development.

Additionally, both parties confront substantial challenges in market strategy and managing existing partnerships. Cultural disparities alone present an issue, with Nissan's "alliance" culture contrasting sharply with Honda's philosophy of "independent research and development," potentially hindering integration efficiency.

The costs and timeline for integration remain uncertain.

An analyst noted that reconfiguring production lines, transforming supply chains, and reallocating staff demand substantial time and resources, but the market is unforgiving. Chinese new energy automakers are already advancing towards the next generation of battery technology and autonomous driving algorithms. "By the time they finalize their integration, the market landscape may have dramatically shifted."

The executives of both automakers are acutely aware of the obstacles ahead. Honda CEO Toshihiro Mibe stated, "We must establish competitiveness by 2030 or face defeat." Similarly, Nissan's President and CEO Makoto Uchida candidly admitted that persisting with old methods could jeopardize their survival.

The Nikkei reported that the collaboration between Honda and Nissan "is not a guarantee of success but merely a pass to the new era."

It must be acknowledged that Japanese automakers have secured this pass rather tardily.

[Reference Materials]

[1] "Honda and Nissan to Team Up and Explore Integration? World's Third-Largest Automotive Group on the Horizon" - Beijing News

[2] "Honda Accord Now Selling for Just 110,000 Yuan" - Cyberpreneur

[3] "Honda and Nissan Officially Announce Merger, Nissan's Former CEO Calls It a 'Desperate Move'" - Economic Observer

[4] "Japanese Corporate Executive: 'We Have Only 12 to 14 Months of Survival Time'" - Global Times

-END-

Welcome to follow [Huashang Taolue] to recognize influential figures and delve into tales of strategy.

All rights reserved. Unauthorized reproduction is prohibited.

Some images are sourced from the internet. If infringement is suspected, please contact us for removal.