Aion Embraces Change, Rebuilding from the Ground Up

![]() 01/15 2025

01/15 2025

![]() 753

753

Introduction

In the fierce competition of the automotive landscape, Aion must accelerate its transformation by focusing resources on achieving greatness.

The Chinese auto market in 2024 was abuzz with activity. From the price wars that erupted at the start of the year to successive waves of public opinion battles, the rivalry among automakers and shifts in consumer perception never ceased.

Particularly in the new energy vehicle market, it was widely anticipated that the pace of electrification would continue to accelerate. However, the emergence of a range of plug-in hybrid/extended-range vehicles has dramatically altered the industry landscape. As the market penetration rate of pure electric vehicles stagnated, it became almost a given that "if new energy vehicles want to sell well, they must be able to run on gasoline."

Given this environment, it's no surprise that brands like Tesla, NIO, and Aion, which focus on pure electric vehicles, experienced suppressed market vitality last year.

Interestingly, despite being a brand that exclusively sells pure electric vehicles and having accumulated sales of nearly 400,000 vehicles throughout the year, Aion was virtually absent from all monthly sales rankings of its competitors in terms of corporate promotion.

Some argue that, from the perspective of new forces, Aion, backed by GAC, doesn't belong to this camp. From the angle of consumption channels, since Aion delivers new vehicles to "major customers," it hinders the fairness of data statistics.

But honestly, when they thus treat Aion differently from new forces like Lantu, Zhiji, and Deep Blue, or brands that only thrive in green-plate hybrid vehicles, who can simply dismiss the former as a mere trend-rider?

In 2024, as market competition became the norm and "making money from selling cars" became a corporate aspiration, regardless of external evaluations, Aion did make every effort to compete with its rivals.

In the first few months of last year, due to changes in market demand, Aion's monthly sales did experience a year-on-year decline, and the subsequent hybrid offensive from competitors also weakened the competitive edge of Aion's models at the source. However, this seemingly laid the groundwork for Aion's subsequent planning.

"Brand innovation has entered the 2.0 era," which is the deepest impression that Aion's changes in 2024 have left on the outside world.

Firstly, after a year of minor product launches, Aion finally embarked on a comprehensive product renewal. The successive introductions of the second-generation AION V, RT, and UT essentially cover several mainstream pure electric vehicle markets.

Furthermore, Aion has adopted a global development perspective and established factories at the forefront of overseas markets. In response to the topic of "Chinese automobiles going overseas," Aion has provided its own answer.

Secondly, after absorbing the remaining production capacity of GAC Mitsubishi, following a comprehensive system trade-off, Aion and Hyper have a more detailed division of labor, and the marketing strategies targeting young people have been revitalized. The corporate management also underwent a reorganization last year as the group headquarters "went to the countryside."

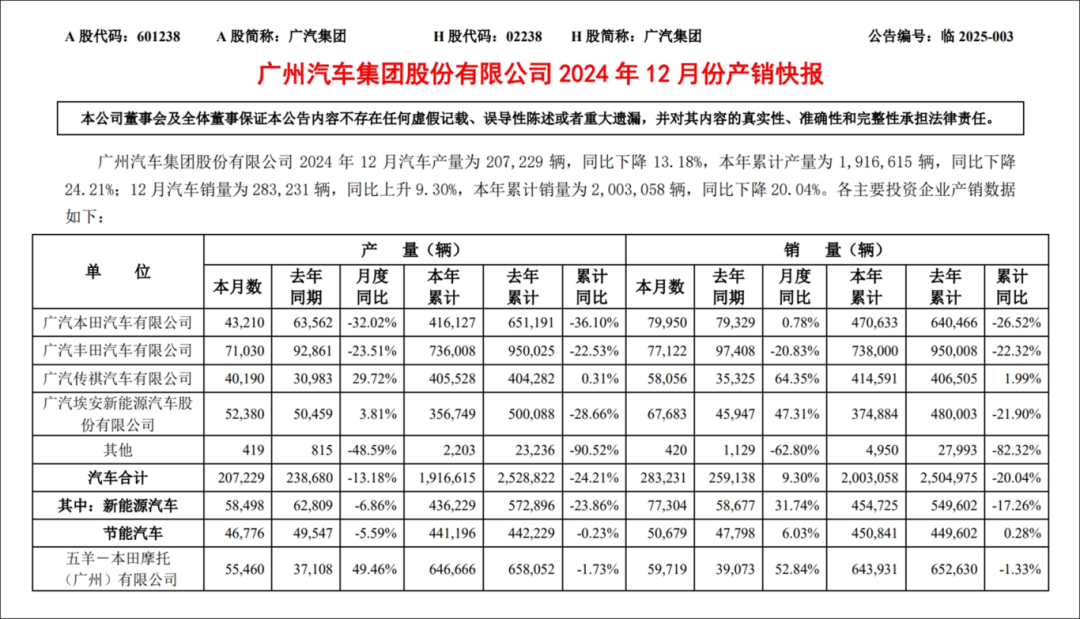

By the end of last December, through months of hard work, Aion significantly narrowed its year-on-year monthly sales gap, and its annual sales reached 374,884 vehicles. All this has paved the way for this year's revival. And now, with Aion UT aiming at the most dynamic and scalable pure electric vehicle market below 100,000 yuan, in 2025, we eagerly anticipate its performance.

Gathering Momentum for Better Reform

Under the combined influence of various factors, we deeply understand that the entire year of 2024 was permeated with the suffocating sense of "survive or die." The strong had their own anxieties, fearing that latecomers would surpass them; the weak felt powerless, and weak consumption power was issuing "death warrants" to their vital spots.

After years of rapid growth, Aion will also have its own considerations. When the pure electric vehicle market is no longer as buoyant as before, and when the price war forces everyone onto the path of selling cars at a loss, how to defend and how to break through?

"Without new cars and without PHEVs, we are missing a section of the technology roadmap, and the product line cannot be fully covered. It is normal to encounter difficulties." In the middle of last year, Gu Huinan, general manager of Aion, also candidly addressed Aion's situation. But the market is undergoing such an unreasonable transformation. Do you think Aion will accept it willingly?

Squatting is for a better jump. In the past, companies often used such rhetoric to embellish their market performance. However, for Aion, after years of market accumulation, a period of dormancy is inevitable.

And this year, when the product advantages of green-plate hybrid vehicles are placed alongside pure electric vehicles, what Aion has done most and is most worthy of mention is the expansion of its product line and the rebranding of its brand image.

The launch of the second-generation AION V signifies Aion's aspiration to make a mark in the 150,000-200,000 yuan SUV segment. In fact, with the concept of "high-level intelligent driving equal rights" also being placed on this vehicle, compared to the past, Aion's consumer base has a more concrete description.

In the family car market at this price point, automakers are always cautious about promoting pure electric vehicles. Especially after BYD entered this field, it's not easy to snatch a share from the lion's mouth.

Therefore, when the outside world began to judge that the market volume accumulated by Aion in the past could not withstand scrutiny, starting with the second-generation AION V, Aion aims to transform its brand image as swiftly as possible. And the attitude of Chinese users towards electric vehicles has already moved beyond the state of suspicion in the past, which means that there is great potential in the electric vehicle market in the price range of 100,000-200,000 yuan.

In other words, "popularizing intelligent driving" is the core demand of Aion's new product series, but a more practical point is that Aion wants to catch up with others and gain the recognition of ordinary consumers to the greatest extent by this means alone.

In the months following the launch of the second-generation AION V, the price war was still raging, and the positive feedback in the terminal market did give Aion confidence.

"Doing business is not afraid of encountering obstacles, but what is feared is that from then on, one cannot see clearly the path to take next." A long time ago, the title of "king of online car-hailing" made Aion laugh and cry. Until today, the several new product launches in 2024 have undoubtedly liberated Aion from the shackles of its past image.

From the second-generation AION V Tyrannosaurus Rex to AION RT Raptor, and then to AION UT Parrot Dragon, you can say that Aion is striking while the iron is hot, but I believe more that this is a brand new start for Aion to clarify its thinking.

"In December, sales of a single Aion RT model exceeded 16,000 units, and it has returned to the track of positive year-on-year and month-on-month growth."

On the one hand, at the communication meeting after the pre-sale of AION UT, Xiao Yong, deputy general manager of Aion, was very positive about the market performance of RT. On the other hand, from the absolute confidence he showed in the product strength of the new UT, it's evident that after a year of market honing, Aion has some understanding of how to proceed next.

Not long ago, as GAC Group moved its headquarters from the urban area of GAC back to Panyu, the group subsequently initiated a series of integration actions within the group. In particular, the establishment of the Independent Brand Marketing Headquarters (including: Trumpchi Marketing Headquarters, Aion Marketing Headquarters, Hyper Marketing Headquarters) aims to realize the transformation of the management mode of independent brands from strategic control to operational control, complete the unified scheduling of research, production, supply, and marketing of independent brands, promote the concentration of resources to the frontline, further reduce operating costs, and improve management efficiency. Ultimately, it achieves the goal of enhancing the overall combat effectiveness of the group's independent brands.

From Aion's perspective, since brutal market competition cannot be avoided, in addition to promoting the launch of new products, optimization around the system is definitely necessary.

Like on January 13, Ma Haiyang, as the new CEO of the GAC Hyper brand, gave a presentation with the theme of "Hyper, start again!" to launch a new journey for GAC Hyper and promote comprehensive reform!

Recognize Reality and Position Oneself Correctly

In 2025, how will the Chinese auto market evolve? In fact, the existing market environment has already hinted at the direction. Everyone is fighting against internal competition, and everyone is trying to rectify the price war. But in reality, at this stage where the entire industry is stabbing each other with bayonets, no one can stay unscathed.

Continuing the price war and launching public opinion offensives will still be the means by which companies compete with each other covertly. With such a prediction, if Aion wants to dispel the gloom of development this year, what it needs to consider must not be limited to the product itself.

From establishing technical labels to reshaping marketing techniques, from improving the system for the development of dual brands to changes in terminal markets such as channel optimization and user services, there is no room for Aion to make mistakes in any aspect.

Last year, in terms of the choice of technical paths, since Aion did not invest in plug-in hybrids/extended-range vehicles before they became popular, it eventually suffered a significant impact on sales and volume.

Although Gu Huinan, general manager of Aion, said in a media interview, "We are old hands at making extended-range vehicles." The fact is that when a large number of new energy vehicle companies turned to green-plate hybrid vehicles, Aion should have taken immediate action once it felt the pressure.

During the 2024 Guangzhou Auto Show, Aion unveiled its first extended-range power new vehicle - Hyper HL, attempting to compete with AITO M7, Lixiang L6/7/8, but to date, with competitors such as Deepal S09, Qiyuan Q07, and Lynk & Co 900 emerging one after another, if Aion wants to complete its main mission, it's not just about recognizing the deficiencies of its own product line.

In marketing, Xiao Yong once joked, "Investing 100-200 million yuan in the promotion of the Hyper brand is not as highly concerned as when 360's Zhou Hongyi accidentally got his hand caught in the gull-wing door of the Hyper HT."

In the new year, finding a marketing path that truly suits the brand's attributes is a top priority.

When Aion UT was pre-sold, Guo Qilin was announced as the brand's global image ambassador, which was Aion's marketing preview in this regard at the beginning of the year. In terms of effect, it was also commendable. But ultimately, good marketing is an ongoing topic. When the new energy market initiates a war around technology, brand, and reputation, adhering to long-termism is inevitable.

Unsurprisingly, Aion hopes to return to an annual sales level of 400,000 vehicles in 2025. With the help of three new vehicles, facing such a goal, Aion's confidence can be bolstered. That is even more of a new requirement for Aion, which must not only avoid making mistakes or frequently trying and erring but also truly immerse itself among user groups and abandon the pursuit of short-term gains.

Well, in the new year, we already know that for Aion, the fierce market competition and changing consumer trends are things that it must always pay close attention to when grasping the auto market share.

But on the other hand, from Aion's review of its own development last year, going overseas is also a sales growth point. This means that Aion must be fully focused on its export business.

Don't overlook GAC's export volume reaching 127,000 vehicles throughout last year, with a year-on-year increase of 67.6%. In terms of horizontal comparison, this figure still has plenty of room for improvement.

In the past two years, affected by local policies, Aion has indeed established overseas frontlines in various Southeast Asian countries. With the completion of the factory in Thailand, multiple models under AION have the capital to be launched and sold in countries such as Malaysia and Indonesia. In the future, Aion may establish seven production and sales bases in Europe, South America, Africa, the Middle East, and East Asia.

It is imperative to acknowledge that "automobiles going overseas" has essentially transformed into a strategic imperative for every automaker, positioned as a top priority for development in 2025. In the nascent stages of brand expansion internationally, a gradual, step-by-step approach can be employed. However, once the market indicators shift from favorable to challenging, Aion's path of expansion may no longer be as seamless as in past years.

A new era has dawned, wherein Chinese automakers now find fertile ground for self-advancement, fueled by the ascent of the new energy industry in the East. Having matured over seven years of growth, Aion has shed its initial inexperience. Now, having traversed the initial stage from 0 to 1, the journey to leap from 1 to a period that truly embodies Chinese automotive excellence remains a formidable one for Aion.