The Evolutionary Strategies Unveiling Automakers' Future Potential

![]() 01/15 2025

01/15 2025

![]() 697

697

Introduction

Strategy dictates success or failure, with people holding the key to that outcome.

Periods of significant industry transformation often give rise to prominent companies. In the automotive realm, from Mercedes-Benz pioneering the automobile era, Ford mass-producing cars via assembly lines, to Toyota diversifying vehicles through lean production methods, these historic shifts and strategic pivots have sculpted the extensive history of the automotive industry.

China's relatively nascent automotive industry, marked by fierce competition and numerous players, seems challenging for any automaker to swiftly attain the greatness enjoyed by Mercedes-Benz, Ford, and Toyota. However, it's undeniable that most automakers strive towards the goals of "being a great company" and "producing excellent cars," continually refining their path towards these objectives.

Each automaker's strategic adjustments are initially guided by their own development pace, market environment changes, and technological trends, aiming to propel the company's positive evolution.

Over the past year, amidst rapid advancements in electrification and intelligence, the shift towards pure electric and plug-in hybrid vehicles, and intensifying market competition leading to heightened pressure and thinner profit margins, many automakers have revised their strategic directions. Some did so for survival, others for growth, some to ascend further, and still others to reverse declining trends. Indeed, the majority of domestic automakers have adjusted their strategic paths.

Ultimately, relying solely on external impetus cannot extricate companies from difficulties; self-rescue is the harsh reality.

This can involve restructuring corporate organizations, with new management talent spearheading innovations in corporate governance and streamlining processes for greater efficiency and ease. Alternatively, in an era of intense competition, companies might abandon their sprawling past and embark on strategic contraction, focus on cost savings and revenue generation, or devise pricing and profit strategies, prioritizing market share acquisition...

Certainly, some of these strategies have already yielded notable results, providing a strong impetus for the company's further progression; some companies are still grappling with exploration and mistakes, gradually discovering new directions; others maintain a steadfast strategic focus. Despite the challenging market, they remain committed and resolute, choosing to concentrate on a specific aspect rather than spreading themselves thin.

Faced with an increasingly complex automotive market environment, strategic adjustments alone might not fundamentally and swiftly alter automakers' status quo. However, they can at least offer hope and direction for redemption.

Strategic Transformation: The Ever-Present Theme

Strategy serves as a company's compass, guiding the enterprise's giant ship towards its destination. In the ever-evolving automotive industry, strategic transformation accompanies a company's development from inception to maturity.

In 2024, leading companies' strategic adjustments garnered increased attention. For automakers holding significant discourse power and definition rights in the market, even a slight movement can spark a new wave. For instance, BYD's "price war" in early 2024, with the slogan "electricity cheaper than oil" and reducing the price of mainstream A-segment cars from 99,800 yuan to 79,800 yuan, showcased BYD's forward-looking market strategy and deep understanding of consumer needs, reflecting its strategic layout and determination to reshape the new energy vehicle sector.

The outcome is well-known: BYD successfully consolidated its leading position in the new energy market, continuously setting new sales records among Chinese automakers and ranking highly among global automakers in terms of sales.

For BYD, which has achieved scale, price reductions are indeed facilitated by its system. However, for long-term future development, low prices must not become BYD's defining label. Therefore, in 2024, BYD also made significant strides in its intelligence strategy, planning to invest 100 billion yuan in intelligent technology research for complete vehicles.

Simultaneously, BYD bolstered its intelligence field competitiveness by adjusting its management and organizational structure, introducing external intelligence talent, and refining its intelligent driving architecture through internal competitions, successively establishing the Tianxuan and Tianlang intelligent driving teams to drive a leap in intelligent capabilities. As the Tianshen Eye system gradually integrates into BYD's models, its intelligence will undoubtedly offer a distinctive experience and performance in the future.

Another Chinese automaker attracting considerable attention is Geely, which also underwent significant strategic adjustments in 2024. It released the "Taizhou Declaration," conducted large-scale business integration, merged Geometry into Yinhe, integrated Radar and E-Z into the Geely Automobile Group, and further optimized Lynk & Co and Zeekr's equity structures, clarifying brand positioning, reducing related-party transactions, and integrating resources to lay a solid foundation for synergistic progress and heightened competitiveness in the high-end market.

In fact, Geely's strategic focus is also built on the full bloom of its "Intelligent Geely 2025" strategy in 2021. Whether it's Leishen's breakthrough in hybrids or the empowerment of self-developed chips, supercomputing centers, Flyme Auto, and other hardware and software capabilities, all have propelled Geely to achieve a robust breakout in the new energy field. With this confidence, Geely has set the goal of transforming Yinhe into a new energy vehicle brand with annual sales of one million vehicles and Zeekr Technology Group into a high-end new energy vehicle group with annual sales of one million vehicles.

Apart from Geely's strategic integration, SAIC Motor also made significant strategic adjustments in 2024, further intensifying reforms and innovations around the "Comprehensive Deepening Reform Work Plan (2024-2027)," accelerating the launch of new products and technologies, optimizing business and product structures, and fully promoting the transformation and development of new energy and intelligence, encompassing various segments such as independent brands, joint venture brands, and overseas markets.

Due to the bumpy development of Roewe and Flyme under SAIC Passenger Vehicle, Flyme, originally spun off from Roewe, officially returned to SAIC Roewe and ceased being an independent brand. SAIC Volkswagen initiated the joint venture 2.0 model, optimizing business and product structures, and striving to gain a foothold in the fiercely competitive market through strategies of "simultaneous advancement of oil and electric vehicles" and "simultaneous intelligence of oil and electric vehicles."

Great Wall, as the last among the top five independent automakers, has also integrated and sorted out its brands, starting with the cessation of operations of the Ora Auto App and its migration to the Great Wall Motors App. Essentially, this move merges the five brands of Great Wall Motors, including Haval, Tank, and Ora, from the user service end, and in the future, it's conceivable that the Ora brand might be integrated into the Haval brand.

Certainly, after Huawei ventured into the automotive industry, integration has also been in the works. Besides the four divisions of Huawei that have already emerged, future negotiations between Huawei's Intelligent Automotive BU and HiHope, as well as between HiHope and automakers such as Thalys, Changan's Avatar, BAIC BluePark, Chery, JAC, etc., also represent the future trends and directions of Huawei's Intelligent Automotive BU.

Furthermore, several major domestic automotive groups have also made significant strategic adjustments. GAC Motor's "Panyu Action" comprehensively launched in November 2024 aims to further strengthen its "Great Independent Strategy" through organizational restructuring, focusing on "cost reduction and efficiency enhancement" to drive the company's sustained progress in the fiercely competitive market.

At the end of last year, Dongfeng also initiated adjustments to its headquarters functions, fully promoting the transformation of the company headquarters from strategic control to "operation + overall planning," deepening the "Leapfrogging Action 2.0" for independent passenger vehicles, further integrating group resources to operate the independent passenger vehicle business, and unwaveringly advancing the company's new energy transformation and upgrading.

If a company's strategic contraction is merely internal integration, then strategic integration between companies reflects even broader industry trends. The biggest industry integration event in 2024 was the announcement by the two Japanese automotive giants Honda and Nissan to initiate merger negotiations.

The rationale for the merger is not hard to discern. As Japanese cars face suppression in China, and the trend represented by Chinese new energy technologies is irreversible, future inter-company competition will intensify, forcing the two Japanese giants to seek mutual support, planning to integrate and optimize resources in various aspects such as joint technology development, production, corporate management, and brand marketing, in the hope of expanding scale, strengthening their anti-risk capabilities in response to market competition, and stabilizing their market positions.

Just as XPeng Motors initiated a new round of organizational restructuring led by President Wang Fengying at the beginning of 2024, involving multiple departments such as marketing, human resources, intelligent data, manufacturing, and product planning. The final results proved that effective adjustments can save automakers from dire straits, with XPeng Motors reporting a 61.2% increase in revenue and a 48.41% narrowing of losses in the first half of the year, while new products such as the M03 and P7+ in the second half also achieved good returns.

Personnel Adjustments: Adaptation and Renewal

Apart from strategic adjustments and corrections, people are indeed the core force supporting the advancement of strategies. Changing personnel essentially means transforming business ideas, strategic approaches, and execution efforts.

For the challenging year of 2024, the entire automotive industry inevitably underwent widespread personnel changes. According to incomplete statistics, more than 50 automakers announced personnel changes in 2024, with over 180 senior executive positions adjusted across automakers, involving more than 170 senior executives. The impact spanned traditional automakers, joint venture automakers, and new energy vehicle startups.

In fact, under fierce competition, the impact of personnel changes in new energy vehicle startups has become less pronounced. For instance, when Nezha Motors "ousted" Zhang Yong, and Jiyue investors were dissatisfied with Xia Yiping, the companies were already on shaky ground, and any brilliant move could hardly restore their vitality.

Certainly, for some non-critical core positions, such as the departure of some department heads at XPeng, Zero Run, Li Auto, and other related companies, the impact on the company is not too significant, and the introduction of new talent might even bring more surprises to the company after adjustments.

If the personnel changes in new energy vehicle startups are more superficial, then the top-level personnel adjustments in traditional automakers will definitely have a profound impact and will shape these companies' direction over the next 3-5 years.

One of the more impressive adjustments should be the personnel appointments at SAIC Motor, marking the company's largest personnel change in nearly a decade. In July 2024, Wang Xiaoqiu "took over" the role of SAIC Motor Chairman from Chen Hong, who retired at the end of his term, while Jia Jianxu assumed the position of SAIC Motor President. After the appointment of these two "helmsmen," in August of the same year, SAIC Volkswagen, SAIC GM, and SAIC Passenger Vehicle announced multiple personnel changes across multiple positions.

Overall, the new management teams of the three major segments show a trend towards youthfulness, possessing front-line business experience in technology, marketing, supply chain, and overseas expansion. This management adjustment will facilitate the company's acceleration in independent brand-led development and promote the transformation and upgrading of joint venture brands towards new energy.

Subsequently, SAIC's various brands rolled out innovative strategies such as "limited-time flat-rate deals" and "comprehensive purchase and replacement policies," rejuvenating channel confidence and bolstering dealer profitability. These strategic transformations and adjustments at SAIC Motor are grounded in the fresh perspectives and choices engendered by the new personnel landscape, solidifying the future prospects and direction for the company.

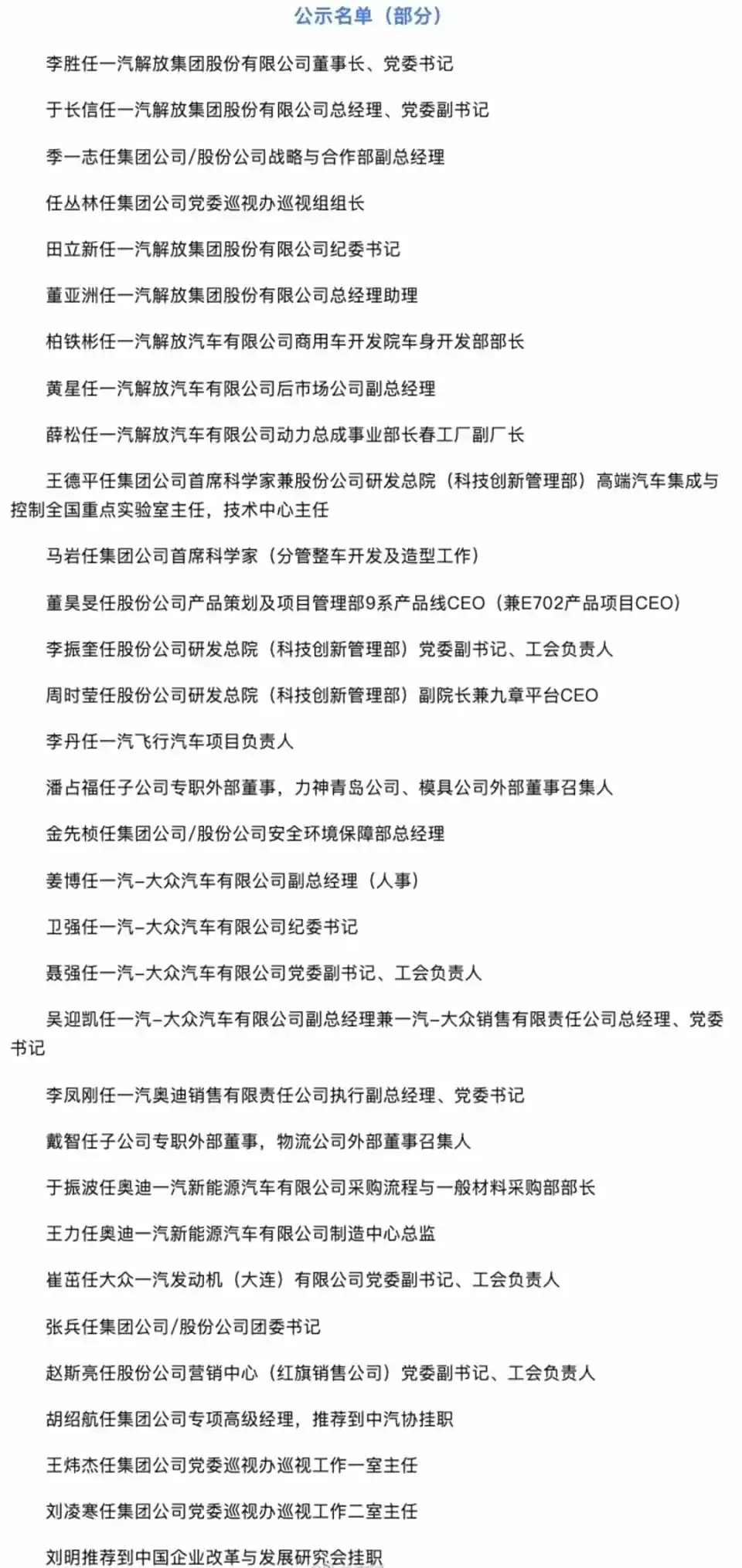

FAW Group finds itself in a similar predicament. Late last year, it announced a slate of personnel shifts involving numerous senior executives across subsidiaries like FAW-Volkswagen, FAW Jiefang, and FAW Audi. For instance, Pan Zhanfu, former Director and General Manager of FAW-Volkswagen, was reassigned to China FAW, while Chen Bin, Deputy General Manager of China FAW, concurrently assumed the role of General Manager at FAW-Volkswagen. Wu Yingkai replaced Nie Qiang as Deputy General Manager (Commercial) and Sales General Manager of FAW-Volkswagen, Wu Bilei took charge of the R&D Institute, and Li Sheng and Yu Changxin were promoted to senior management positions at FAW Jiefang.

Dongfeng Motor Corporation, too, witnessed personnel changes. During its organizational restructuring at the end of last year, six new senior executives joined the five key departments. A common thread among these appointments is that regardless of their previous positions, these executives now hold or have been transferred to roles with a managerial focus, and multiple departments now exhibit a clear emphasis on planning, commanding, and decision-making. Concurrently, many young leaders were brought to the forefront, undoubtedly infusing new energy into this long-standing automaker.

In March 2024, BAIC Group witnessed a significant shift as "old BAIC person" Zhang Jianyong succeeded retired Jiang Deyi as Chairman, followed by a substantial personnel reshuffle. Dai Kangwei, former General Manager of BAIC BJEV, was promoted to Deputy Chief Engineer of BAIC Group and concurrently appointed Chairman of BAIC BJEV. Zhang Guofu, the former Executive Deputy General Manager of BAIC BJEV, ascended to the position of General Manager, and Liu Guanqiao, former Minister of Operations and Management at BAIC Group, was transferred to serve as Executive Deputy General Manager of BAIC BJEV, overseeing the marketing segment.

The personnel shifts at FAW, Dongfeng, SAIC, and BAIC are unmistakably driven by the pressing need for transformation. For FAW, Dongfeng, and SAIC, which once thrived on joint ventures with Volkswagen, Nissan, GM, and others, they now confront the challenge of their joint venture markets being encroached upon by domestic brands. Furthermore, the ascendancy of private domestic auto companies has intensified the pressure on the independent expansion of central and state-owned enterprises. They must now deploy more innovative and decisive organizational structures, coupled with younger teams, to wage a desperate battle.

Multinational automakers, too, must consider adjusting their personnel structures in the face of the challenges posed by the new energy and intelligent transformation race and competition in the Chinese market.

In January 2024, Volkswagen pioneered senior management changes in China, with Bo Rui Wu succeeding Hans-Joachim Hannemann to oversee the group's R&D efforts in the country, further advancing the localization of its product portfolio technology. In October 2024, Stellantis Group made personnel adjustments across multiple positions, including the Chief Financial Officer and those within the China region.

At the close of 2024, Nissan announced the appointment of new management team members, with current Chief Financial Officer Ma Zhixin assuming the role of Chairman of the Nissan China Management Committee, reporting directly to Makoto Uchida. Shohei Yamazaki, the incumbent Chairman of the Nissan China Management Committee, will succeed him as Chairman of the Japan-ASEAN Regional Management Committee.

Ford and Lincoln have also embarked on similar paths. In April 2024, Zhu Meijun, the former President of Lincoln China, retired, and her position was taken over by Jia Mingdi, the former Executive Deputy General Manager of the Audi Marketing Division at SAIC Volkswagen. In May 2024, Ai Xiaoming, the former President of Whirlpool (China), was appointed President of Changan Ford, reporting to the Changan Ford Board of Directors.

Indeed, China's vast consumer base and the nurturing environment provided by multinational automakers have given rise to numerous outstanding automotive talents domestically. However, it's crucial to acknowledge that individual prowess does not outweigh the influence of the platform. The progression and swift implementation of corporate strategy are the culmination of the concerted efforts of a group of ambitious and goal-oriented individuals. Ultimately, the direction of corporate strategy and its catalytic effect in market competition are embedded in the strategic nuances and execution prowess of the enterprise.