Intelligent, All-in-One: The Evolution of Automotive Intelligence

![]() 01/16 2025

01/16 2025

![]() 465

465

Introduction

If you can't make it to the leaderboard, you'll end up on the menu. Last year, joint venture brands' primary fuel vehicle models raced to catch up with the lack of intelligence at an unprecedented pace.

After integrating DJI's intelligent driving system, the Tiguan L Pro was officially launched for sale in May 2024. By the end of December, its monthly sales surged to 26,663 units, marking the third-highest monthly sales figure since its launch.

The 2025 Tharu follows a similar trend. As a new model with a significant exterior redesign, sales have been on the rise since its launch in August 2024, reaching 18,581 units in December. This figure represents the fourth-highest monthly sales since its debut in October 2018.

Image | The intelligent driving system of the Tiguan L Pro and even the current intelligent fuel vehicles of joint venture Volkswagen brands adopt a pure vision solution. Shown is its front-view tri-camera sensor.

SAIC Volkswagen's total sales for 2024 amounted to 1.148 million units, a year-on-year decrease of 5.51%. However, the magnitude of this decline significantly narrowed compared to 2023. In an era where joint ventures are generally on the decline, this achievement can be considered commendable. Besides various marketing and profit-sharing measures, the full embrace of "intelligence" by models like Tiguan L, Tharu, and even SAIC Volkswagen's best-sellers like Passat in 2024 is clearly a key factor.

The intelligence mentioned here can be divided into two parts: "cockpit" and "driving".

Tiguan L Pro and the new Passat, among others, are based on upgraded Volkswagen Group models, featuring human-machine interaction interfaces such as a new liquid crystal multi-function instrument panel and a 15-inch new-generation infotainment system. They go a step further based on localization factors, equipping an entertainment screen in the co-pilot position.

Image | The cockpit configuration of the new Magotan is consistent with its southern sibling model, slightly cluttered, but the number of information interfaces is acceptable.

Tharu's cockpit continues with the old model but, like the first two, is equipped with DJI's Level 2 intelligent driving system.

This transformation can be seen as a practical action to eliminate the previous stereotype in the market that "fuel vehicles can't handle intelligence." In fact, it's not just SAIC Volkswagen; its sibling brand FAW-Volkswagen also invested heavily last year to promote the intelligent upgrade of its fuel products.

Simultaneously, Toyota in the north and south, Dongfeng Honda, Guangqi Honda, and all automakers that have been lacking in intelligence over the past two years promoted the intelligent upgrade of their primary fuel vehicle models with unprecedented efficiency in 2024.

All of this conveys a clear message: whether it's new energy or traditional fuel vehicle models, "intelligence" is shifting from a bonus item in previous years to the most basic entry threshold for subsequent competition in the domestic passenger vehicle market.

From New Energy to Intelligence

First half: new energy, second half: intelligence. This prophecy, attributed to Wang Chuanfu, accurately describes the changes in the domestic automotive industry in recent years.

As we enter 2024, despite automakers complaining about the endless and intensifying price war, the harsh reality is that while the market is "convoluting" prices, it is also raising more requirements—intelligence. In short, the intelligent cockpit or intelligent driving system of new products launched by automakers at this stage must meet at least one of these criteria to earn the right to "sit at the table." If a new model can handle both and do them well, it has the potential to become a hit.

In this regard, Thalys' experience in 2024, or its journey over the past three years, can be considered a model.

Image | Thalys' rapid rise in the past three years contrasts sharply with competitors overly obsessed with the "soul".

Thalys' predecessor, Dongfeng Xiaokang, although not exactly unknown among Chinese automakers before 2021, was indeed a relatively marginalized automaker. In the era of new energy and the subsequent wave of intelligence, the fate of such enterprises can be imagined.

However, relying on the technological transfusion from local powerful ICT enterprises in automotive intelligence, Thalys fought back with the AITO series and achieved leapfrog development for the enterprise.

What the market or car owners value in Thalys is actually its level of intelligence.

For example, in the current online environment, it's a basic operation for automakers to hire water armies to smear each other, with different brands or models having their own jokes and special jargon. When it comes to Thalys' AITO, especially its best-selling M7 model, there's the stem "Xiaokang minibus chassis".

Image | Although a clever approach was taken, the HarmonyOS cockpit can indeed achieve an "explosive" number of in-car screens.

This smear jargon is widely circulated online and often seen in confrontations between fans and water armies on online platforms, but it has almost no impact on reality. Because car owners who choose the AITO M7 are actually coming for the HarmonyOS cockpit and Kunlun intelligent driving system. As for whether the car is born from a "minibus," in the words of a car owner I know, "It drives fine, so what's the problem?"

Changan Deep Blue is also a typical example of achieving market breakthroughs through intelligent technology research and development and continuous vehicle integration.

As early as 2018, Changan established Wutong Auto Connect through a joint venture with Tencent and used this as a path to independently develop a smart cockpit system. In the field of intelligent driving, in March 2024, Changan Deep Blue officially announced its joining of Huawei's Huawei Inside, or HI mode.

The result is that in the more competitive year of 2024, Changan Deep Blue not only held onto the ground it had painstakingly gained in the previous two years but even expanded its market share against the trend, step by step.

Image | In terms of the driver information interface of the smart cockpit design, the Deep Blue S05 adopts a highly radical strategy of eliminating the instrument cluster and completely replacing it with HUD. However, the overall performance is good, not causing inconvenience to drivers but instead demonstrating a high sense of technology.

Especially in September and October 2024, with the launch of the new B-segment sedan Deep Blue L07 and the compact SUV Deep Blue S05, the monthly sales of the entire brand quickly surpassed 20,000 units from the original 10,000 units, reaching 27,382 units in December. It has already evolved from a "rookie" shape from the previous year and the year before last into a force that cannot be ignored.

Here, I can only briefly list two brands, because if I briefly mention all domestic independent brands such as Geely's Yinhe and Zeekr, BYD and FANGBIAO, NIO, etc., as well as various new forces, this paragraph alone would exceed 5,000 words. In fact, in the past year, all automakers and brands that aspire to remain at the table this year and beyond have fully implemented the basic principles of playing the "second half" as described above.

There is no doubt that those who cannot cross this hurdle will be eliminated. And those who survive, whether they are currently top-level in sales rankings or struggling to maintain, will have the opportunity to share the market released through elimination, as well as... the currently squeezed share belonging to joint venture brands.

Joint Venture Brands Catch Up

As the era of joint ventures inevitably fades, the market share they hold has also become like a "lost deer," coveted by increasingly powerful competitors from all sides.

Domestic joint venture brands, regardless of how sluggish or numb they may have been in 2023 or even earlier, can basically be considered to have recognized the reality after experiencing last year's market conditions.

Image | For joint venture brands, 2024 was arduous, but 2025 may be even more difficult.

Standing at the beginning of last year, the annual targets of each brand were already very pragmatic, focusing on how to maintain the current share or sales. To achieve this goal, there are only two strategies—improving existing products to adapt to the current market while developing highly competitive products.

Highly competitive products are nothing more than new models that adapt to the current new energy trend and have a very high level of intelligence.

But there is a serious problem here—time.

Some brands, such as the local teams of Volkswagen in the north and south, also have strong capabilities in research and development and even design. But it's one thing to develop localized models based on existing platforms, and quite another to start from scratch with a whole vehicle platform or even deeply modify an excellent existing platform from foreign and capital partners. The latter is by no means an achievable goal within a one-year cycle.

For Volkswagen in the north and south, they currently have development plans for new-generation intelligent hybrid models. But whether SAIC Volkswagen or FAW-Volkswagen can launch new products as scheduled will not be known until at least early 2026.

How should joint venture brands cross the blank period before the launch of new vehicles in 2025 and even 2026? The answer is, as said at the beginning of this article, improving existing products means at least keeping up with the basic needs of the current market.

For example, Volkswagen in the north and south can carry out localized upgrades and transformations for the intelligent cockpit systems they possess. For parts that cannot be mastered in the short term, referring to intelligent driving, finding local suppliers is obviously the optimal solution.

It should be noted here that the choice of DJI Automotive, one of the four giants in domestic intelligent driving "DiDaHuaMo," by Volkswagen in the north and south is actually the result of weighing various practical issues. The essence is that the solution provided by the company is "light" enough, with very low requirements for the platform.

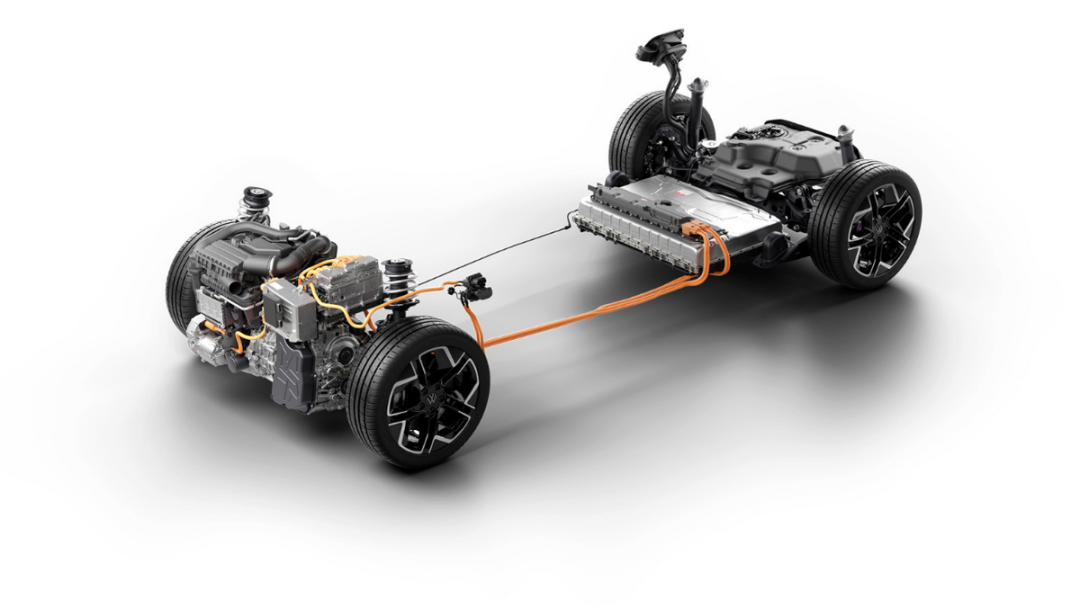

Image | MQB evo

Whether it's the Tiguan L Pro, the new Passat, or even the new Magotan, they all rely on the Volkswagen Group's MQB evo platform, which is claimed to be a major upgrade of the MQB platform in terms of underlying electrical control. But no matter how significant the upgrade is, the MQB itself, born in 2012, is already a bit old.

Although the improvement work adds multiple CAN-FD buses on the original basis and increases the number of control modules and control interfaces, there is still a gap compared to the newly developed intelligent platforms of domestic competitors. The technical difficulty and risk of adapting high-level intelligent driving solutions are too high.

Of course, it's helpless, but DJI Automotive's solution wins in low cost and short integration cycle. In fact, L2 is basically enough at this stage, after all, current domestic laws and regulations do not allow enterprises to open L3 or higher-level intelligent driving services.

Compared to Volkswagen in the north and south integrating low-cost L2 intelligent driving systems with fuel platforms, a strategy that solves the problem of having or not having it in the shortest cycle and at the lowest cost, Toyota joint venture brands' strategy is relatively much "heavier".

According to news from the Guangzhou Auto Show at the end of last year, whether it's the Bozhi 3X planned by GAC Toyota or the bZ3C of FAW Toyota, both Toyotas also revolve around the four giants of "DiDaHuaMo" in their intelligent driving solutions, but they choose Momenta.

Image | The bZ3C has an "intelligent" appearance, but it is still based on the e-TNGA architecture (bottom), and the same is true for the Bozhi 3X.

The solution brought by Momenta to the two Toyotas sets a high standard, both utilizing the currently popular "end-to-end" large model, claiming to achieve the integration of perception and planning, enabling "human-like driving" without relying on high-definition maps.

Guangqi Honda and Dongfeng Honda, catching up at the end of last year, launched the Accord and Inspire facelifts equipped with the Honda SENSING 360+ system in September and December. According to Honda, it can also meet L2-level driving assistance functions. In addition, Honda plans to equip its new brand "Ye" with Huawei's intelligent driving system, running in parallel with the Honda SENSING 360+ system.

As for Nissan, although its L2-level ProPILOT system was installed on the Altima facelift as early as 2022, despite relatively average reviews from the outside, Dongfeng Nissan equipped it on its latest mid-to-large-sized flagship SUV, the Terra, last March.

In contrast to Toyota's embrace of large-size center consoles and innovative liquid crystal instrument layouts in their new models, Honda remains notably more conservative, evident in both the new Inspire and Accord.

The aforementioned observations primarily pertain to intelligent driving systems. Regarding intelligent cockpits, however, both Toyota and Nissan are vigorously competing in the domestic market. While it may seem unattainable for German and Japanese offerings to rival the latest HarmonyOS and HyperOS in terms of fluidity, usability, and OS logic, the technological hurdles in this realm are significantly lower than those in intelligent driving. Establishing a hardware framework first and subsequently fine-tuning the software through adaptation and optimization poses no significant challenge.

By the close of 2024, joint venture brands have definitively phased out analog instruments and split LCD screens in their flagship models, replacing them with center console systems adorned with large LCD screens...

Many perceive the "competition" in China's automotive market as a mere price war among automakers. However, in recent years, the rivalry has become all-encompassing, encompassing ever-escalating demands for novel features, configurations, and innovative concepts year after year.

Both automakers and consumers concur that "product development transcends mere feature accumulation." Nonetheless, the aspiration for more, better, and additional features when purchasing vehicles has increasingly become the norm for the majority.

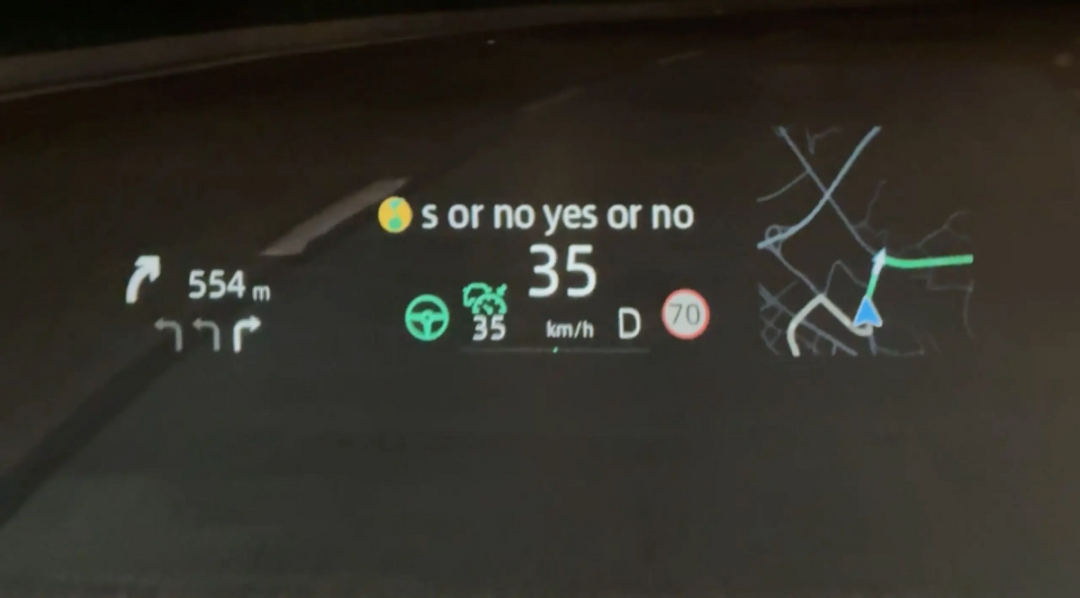

Volkswagen's latest in-car OS boasts AR-enhanced navigation, a testament to this trend.

In 2024, intelligence—particularly in the form of intelligent cockpits and intelligent driving—became a standard feature across all mainstream products in the market. So, what fresh developments can we anticipate in 2025?