Xiaomi's Regret: Exclusion from China's Top 5 Despite Missing Just One Quarter?

![]() 01/22 2025

01/22 2025

![]() 589

589

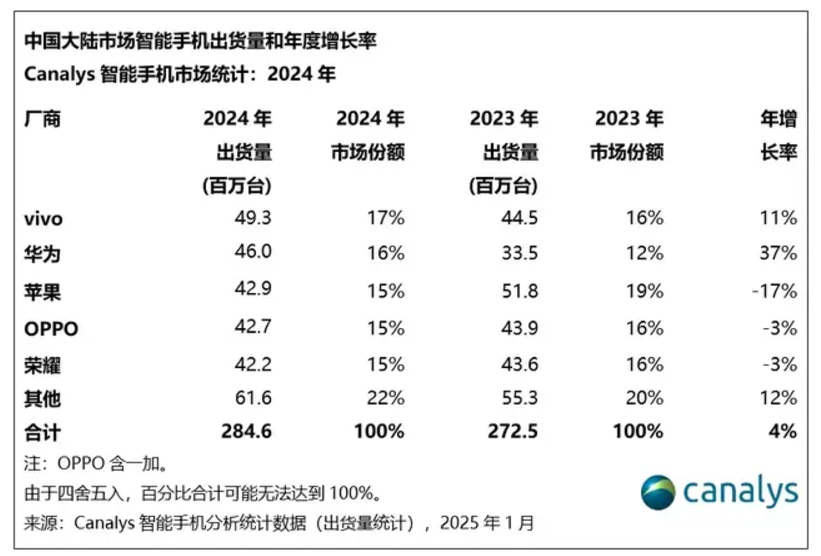

Recently, Canalys unveiled data on smartphone sales in China for 2024.

Specifically, as illustrated in the figure below, the Chinese market witnessed a total sales volume of 284.6 million units, marking a 4% year-on-year increase. This signifies the first growth resurgence in the Chinese smartphone market in recent years, indicating a gradual industry rebound.

The top five brands are VIVO, Huawei, Apple, OPPO, and Honor. It is indeed regrettable that Xiaomi fell short of the top five.

Nevertheless, the gap between the top five brands is narrow. VIVO leads with a 17% market share, while Honor, in fifth place, holds a 15% share, a mere 2% difference translating to approximately 5 million units in sales volume.

This underscores the fierce competitiveness in the Chinese mobile phone market, as noted by Apple CEO Tim Cook, who described China as the most competitive smartphone market globally.

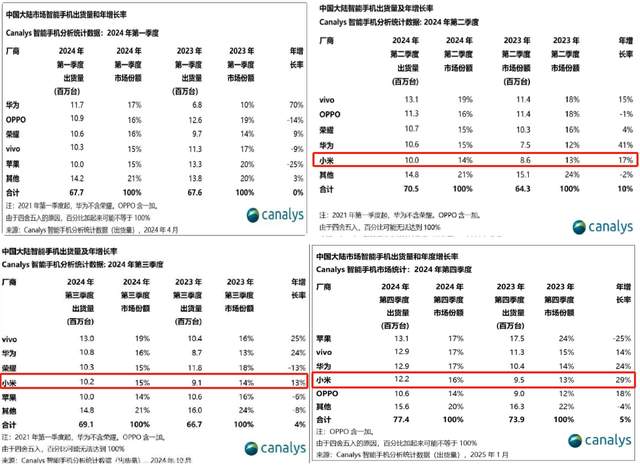

Many were taken aback by Xiaomi's absence from the top five for the entire year. Among the four quarters in 2024, Xiaomi missed the top five only in the first quarter yet failed to secure a spot for the year. Isn't that astonishing?

Here are the sales volumes and rankings of the top five brands in the Chinese market for the four quarters of 2024, as released by Canalys.

As evident, Xiaomi ranked fifth in the second quarter, fourth in the third and fourth quarters, and missed the chart only in the first quarter.

Clearly, missing the chart in just one quarter prevented Xiaomi from ranking among the top five for the entire year. Given its lagging performance in the other three quarters, the impact was substantial.

Brands such as Honor, Apple, and OPPO each missed the chart in one quarter but maintained their top-five status due to solid sales performance throughout the year.

These data underscore the intense competition in the Chinese market, where a single quarter of poor performance can significantly affect a brand's annual ranking.

Furthermore, these data reveal that Xiaomi's sales have been on the rise since its foray into the automotive industry. Sales grew by 17% in the second quarter, 18% in the third quarter, and 29% in the fourth quarter, marking three consecutive quarters of positive growth. Notably, the second quarter coincided with the launch of Xiaomi's cars.

It is apparent that Xiaomi's automotive venture has, to some extent, bolstered its smartphone sales, leading to three straight quarters of growth. As Xiaomi's automotive business continues to perform well in 2025, it remains to be seen how Xiaomi's smartphones will fare. Stay tuned.