Is the Golden Age of NIO, XPeng, and Li Auto Really Coming to an End?

![]() 12/08 2025

12/08 2025

![]() 559

559

The rapid expansion of Huawei essentially reflects the contraction of new energy vehicle startups.

Regardless of the statistical method used, the results remain consistent. According to Hongmeng Intelligent Automotive Solutions' statistics, Huawei emerged as the so-called champion in new energy vehicle sales for the latest November, delivering 81,900 units. The combined sales of its five brands surpassed Leapmotor's 70,300 units and naturally exceeded those of NIO (36,200), Li Auto (33,100), and XPeng (36,700) in November.

When calculated using a different method, the figures become even more striking. For instance, the total sales of Huawei's Qiankun partner brands in November exceeded 180,000 units. Based on the current market landscape, it is evident that the growth of new energy vehicle startups is unlikely to surpass 100% again. This is normal, considering they initially entered the automotive market with an internet-based mindset, creating a highly differentiated competitive environment compared to traditional automakers.

NIO achieved a 92.6% year-over-year growth in October. XPeng, which gained momentum in the latter half of 2024, saw its highest year-over-year growth of 570% in the first 11 months of this year. However, by November, its growth rate had slowed to 19%. Li Auto, on the other hand, experienced growth in only four out of the 11 months.

Moreover, new developments are emerging as traditional automakers undergo value transformations, intensifying pressure on new energy vehicle startups in 2026. This has led to speculation about whether the golden age of new energy vehicle startups has passed.

Intelligent Moat: Geely and BYD Are Catching Up Fast

The speculation that the golden age is ending is largely supported by three viewpoints:

First, by 2026, the number of new models equipped with Huawei technology and facelifts of existing models will exceed 100.

Second, the pricing trends of mainstream new energy vehicle startups are becoming increasingly polarized. Leapmotor and XPeng are increasing their share of models priced below 200,000 yuan, while NIO is increasing its share of models priced above 300,000 yuan. Li Auto, which focuses on the 200,000-300,000 yuan price range, is facing growing pressure.

Third, automakers like Geely and BYD, as well as multinational giants like BMW and Mercedes-Benz, are launching new rounds of intelligent technology counterattacks at a rapid pace. With decades or even centuries of experience, they can easily innovate further. For example, Geely and BYD have achieved economies of scale, with monthly sales often exceeding 300,000 units, driving down the cost-effectiveness of new technologies. Additionally, in terms of upper-layer technologies, Mercedes-Benz recently unveiled its electric CLA with an energy consumption of 10.9kWh/100km. BMW plans to launch its new-generation iX3 in 2026, featuring a superbrain that will translate BMW's over 100 years of driving experience into algorithms.

In addition to these three overt competitive factors, there is a fourth point related to intelligence. The pursuit by automakers like Geely and BYD, as well as companies like Horizon Robotics and Momenta, combined with the capabilities demonstrated in the latest round of OTA updates, is narrowing the intelligence advantage that was once the strongest selling point of new energy vehicle startups.

For example, the breakthroughs in intelligent driving assistance brought by OTA updates for new energy vehicle startups at the end of this year were not as significant as expected.

Instead, several traditional Chinese automakers have significantly improved their intelligent driving assistance capabilities through various means.

So far, the updates to intelligent driving assistance for mainstream new energy vehicle startups are as follows:

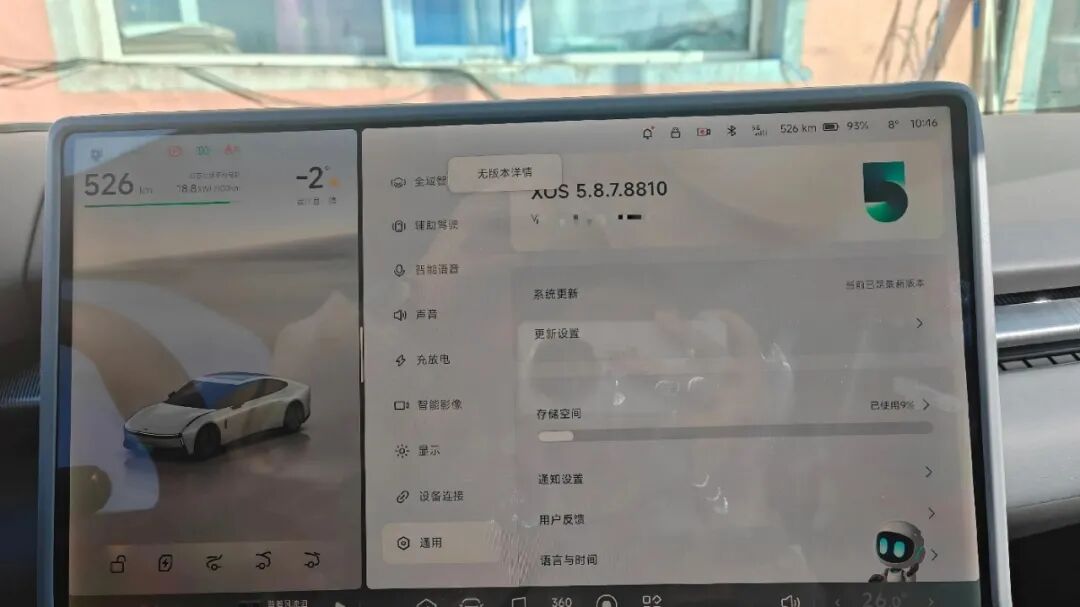

XPeng's XNGP version 5.8.5 was quickly rolled out to all users. Li Auto announced that OTA version 8.1 would begin rolling out in early December. NIO's focus is not on the immediate Cedar S 1.3.0 update but on the Banyan version based on NWM 2.0.

Additionally, new energy vehicle participants in the latter half of this year include Leapmotor, which currently has the highest single-brand sales. After a major update in October, its LiDAR system began to play a role in providing backup sensing capabilities.

However, user feedback after OTA updates from leading new energy vehicle startups has been underwhelming. In version 5.7.8, due to the switch from VLA to VLA+world model, many owners reported that the lane-keeping assistance on highways and expressways often deviated significantly to the left or right. Additionally, the vehicles often failed to reach the speed limit on open roads, such as driving at 60km/h on an 80km/h road with no preceding vehicles, frequently prompting honking from following vehicles. There were also issues with not slowing down when entering ramps and sudden acceleration. Fortunately, urban driving assistance improved compared to version 5.7.6.

In the latest updated version 5.8.5, the issue of lane departure correction on highways and expressways has not been fully resolved. Urban driving assistance has seen more sudden braking, but the benefit is that version 5.8.5 is available in all scenarios, albeit requiring users to readapt to its boundaries.

Li Auto's OTA 8.1 has not been updated yet. Whether it can achieve a technological breakthrough by the end of the year depends on whether version 8.1 can optimize the issues in version 8.0. The switch from VLM to VLA resulted in some initial regression in capabilities. While safety performance remained good, the smoothness regressed compared to version 7.5. There were also instances where the vehicle remained stationary or the system exited in certain scenarios.

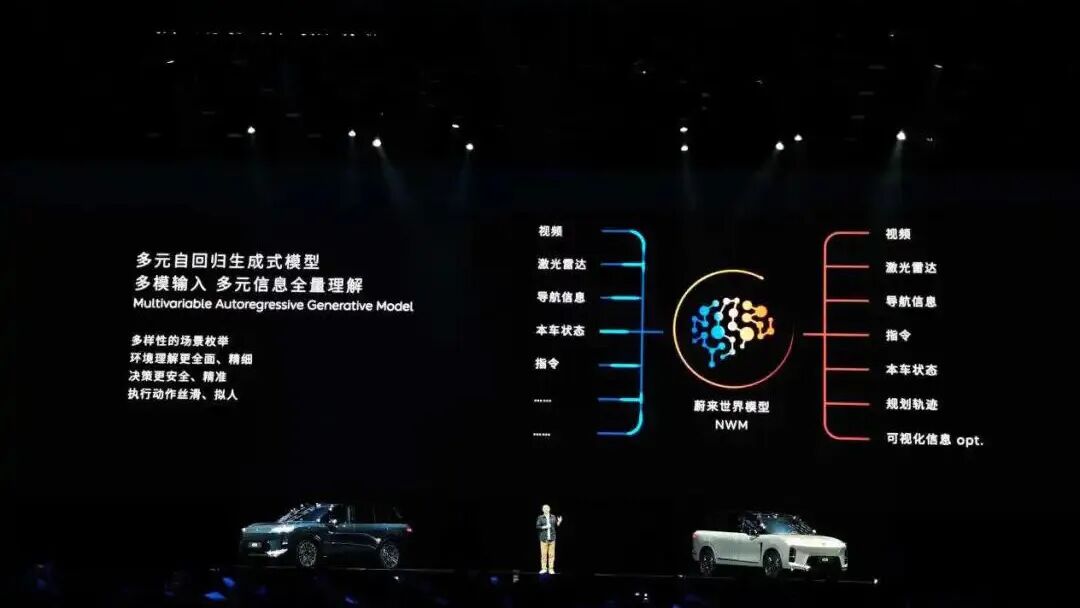

As for NIO's OTA, expectations are relatively higher. After the first implementation of NWM, NIO's intelligent driving assistance finally reached a usable level in multiple scenarios without requiring manual takeover. However, NIO users clearly expect a more user-friendly version for daily commuting.

This is why our conclusion above is that the performance of leading new energy vehicle startups is no longer impressive compared to the entire industry. The reference points are Geely's Qianhao H7 enabling parking spot-to-parking spot navigation, BYD's numerous models updating to include this feature, Great Wall Motors introducing VLA, and Chery embracing Horizon Robotics' HSD and Momenta's latest flywheel large model.

The Elimination Race Is Not Over, but New Energy Vehicle Startups Still Have a Chance

At the Guangzhou Auto Show, BYD announced plans to roll out parking spot-to-parking spot navigation soon. The Han L and Tang L models will soon be capable of passing through ETC gates and entering and exiting parking lots. Currently, BYD has invited some media outlets for early internal testing, and we understand that the smoothness is commendable.

When compared in this way, BYD's parking spot-to-parking spot navigation clearly surpasses many models priced below 200,000 yuan, as they typically require manual takeover near the destination, while BYD's system covers the entire journey.

As for Geely's models, their sales performance has been improving recently. For models priced above 200,000 yuan, the main technological reason is the large-scale (large-scale) rollout of the Qianhao H7's parking spot-to-parking spot navigation feature since the latter half of this year. Next, Zeekr OS 6.7 will soon be updated on models like the Zeekr 007, and Zeekr OS 7 will be rolled out in the first quarter of 2026.

Great Wall Motors recently updated its VLA model with new technology and quickly followed up with parking spot-to-parking spot navigation. Based on relevant test drives, the advantages include responsive control for instructions like starting, accelerating, and lane changing to the left. Sudden acceleration and deceleration are rare, providing a comfortable experience. Given that it is the first major version, the starting speed at intersections is conservative, and overtaking maneuvers are not decisive enough.

In summary, based on the actual performance mentioned above, it is evident that traditional Chinese automakers have caught up with new energy vehicle startups in terms of capabilities and even surpassed them in many detailed aspects.

Therefore, based on this, from a historical perspective, the golden age of new energy vehicle startups has indeed passed. However, new actions are shaking this conclusion.

Currently, NIO and Li Auto are changing industry perceptions through two actions.

NIO is making efforts in its battery swap network, while Li Auto is relying on charging and smart glasses to form new moats.

Leapmotor's new move is to plan the addition of 8,000 batteries to its national battery swap network by mid-January 2026, with 4,500 of them having an 85kWh capacity. This means that the number of batteries in Leapmotor's battery swap network will triple. Several years ago, NIO introduced strategies like free battery swaps during holidays, significantly enhancing its brand recognition and attracting many new users.

Additionally, Li Auto has introduced a new card by holding a dedicated launch event for smart glasses. The deep integration of smart vehicle control and smart glasses is seen as innovative, eliminating the need to retrieve keys or phones and making vehicle use more seamless. Moreover, in specific scenarios, it indeed enhances the driving experience, such as when parked in a narrow spot and using voice control to exit the parking space.

Of course, there is another viewpoint suggesting that this mainly stimulates existing Li Auto owners, but this seems narrow-minded based on current purchase performance.

In conclusion, from the series of actions mentioned above, it is evident that while traditional automakers are catching up aggressively, new energy vehicle startups also have their backup plans. Li Auto is adopting an All-in-AI approach, including recently reverting to an entrepreneurial mode to accelerate AI development. NIO, on the other hand, is adopting a system-wide approach, with technologies like NT3.0, 900V, and self-developed seats in place, combined with its unique battery swap network as a moat, giving it an initial competitive edge.

Of course, a more crucial factor is brand value. Establishing a luxury or high-end brand in the Chinese market requires either the support of companies like Huawei or Xiaomi or the passage of time and consistent sales performance. NIO has largely established itself, Li Auto has seen some fluctuations, and XPeng has shifted its focus to the market below 200,000 yuan as its core segment.

Written at the End

In recent forums, some have predicted that we are just at the beginning of the knockout stage, and the next five years will witness a new round of reshuffling.

Some predict that it will take the next ten years to complete the initial reshuffling. Of course, previous statements such as CR3 or CR5 have also been repeatedly overturned.

That is to say, just considering technology, no one can easily replace another. It is just a matter of scrambling and counterattacking.

What truly influences the fate of a brand is reputation, existing car owners, and fulfillment of commitments. All of this brings us back to the most fundamental market laws.