Will Repair Costs for the Renewed Model Y Double After Warranty Expires?

![]() 01/26 2025

01/26 2025

![]() 758

758

On the last working day before the 2025 Spring Festival holiday, Tesla China announced two significant developments: firstly, the offering of a 30-day free trial of Enhanced Autopilot (EAP), with an optional buyout price of RMB 32,000, to eligible owners; secondly, the official unveiling of the renewed Model Y. As for the new vehicle's external and internal updates, they are widely known, so I won't delve into them here. What's more intriguing is that, excluding the RMB 10,000 discount for the final payment of the 2024 model, the price of the renewed Model Y's rear-wheel-drive standard range has increased by RMB 13,600, and the all-wheel-drive long-range variant by RMB 12,600. Is this price hike justified from a technical standpoint? Or, what modifications have been made to the battery, motor, and chassis, these three core components, in the new model?

The rear-wheel-drive range has been extended by 39 kilometers, but will this translate into higher repair costs in the future?

Let's first explore what the renewed Model Y offers: 1. An additional camera has been added to the front; 2. The center console screen size has been increased by 0.4 inches, and an 8-inch multimedia screen has been incorporated into the rear; 3. Ventilation has been added to the front seats (fabric has been changed to perforated), electric adjustment has been added to the rear seats, and the trunk now includes electric control for the seat back; 4. The rear cushion has been thickened by 15mm and the headrest widened by 17mm; 5. The panoramic roof has been silver-plated for sun protection, but the rear half remains uncoated to ensure in-car signals; 6. The battery capacity of the rear-wheel-drive standard range has been boosted by 2.5kWh, resulting in a 39km increase in CLTC range; 7. With the new vehicle's March launch, it's plausible that Full Self-Driving (FSD) might be released simultaneously.

Now, let's examine what's been omitted in the renewed Model Y: 1. The gearshift mechanism is absent, but the steering lever remains; 2. The resolution and pixel density of the center console screen remain unchanged; 3. The number of speakers in the rear-wheel-drive standard range has been reduced by 5, while the all-wheel-drive long-range variant has gained 2 (the 2024 model comes standard with 14 speakers across the range); 4. The body length has been extended by 47mm, but the vehicle height and wheelbase remain the same, with no upgrade to the second-row legroom and headroom; 5. To cut costs, the 19-inch tires of the rear-wheel-drive standard range have been switched from Goodyear to Hankook; 6. The motor employs older models, with 3D6 and 4D3 mixed-model delivery. Despite a price increase of over RMB 10,000, besides a newer look and additional features, it seems the renewed Model Y has also seen downgrades in several areas. Regarding the much-anticipated cabin space, the new vehicle hasn't been locally elongated this time. Therefore, previous rumors about a 6-seat version for the Chinese market can now be deemed unfounded and no longer worth anticipating. So, let's focus on the battery, motor, and chassis.

Regarding the battery, Tesla officials have scarcely released any information. Earlier, there were rumors that the new vehicle would feature a 95kWh battery pack, and this possibility still can't be ruled out. On one hand, only two first-edition versions have been launched in China thus far, with no news about the Performance version, so there's still a chance this battery pack might appear. On the other hand, considering that the chassis structure hasn't been adjusted in the Y-axis direction, the likelihood of replacing it with a high-energy-density battery is almost certain. As for the rear-wheel-drive standard range with just a 2.5kWh capacity increase, the new vehicle still uses a lithium iron phosphate battery from Contemporary Amperex Technology Co. Limited (CATL), while the all-wheel-drive long-range variant continues to employ LG's 78.4kWh ternary lithium battery, which has been in use for over three years. However, the battery cell supply system has been switched to LG's domestic AEL, and reducing transportation costs is also part of controlling the overall vehicle cost.

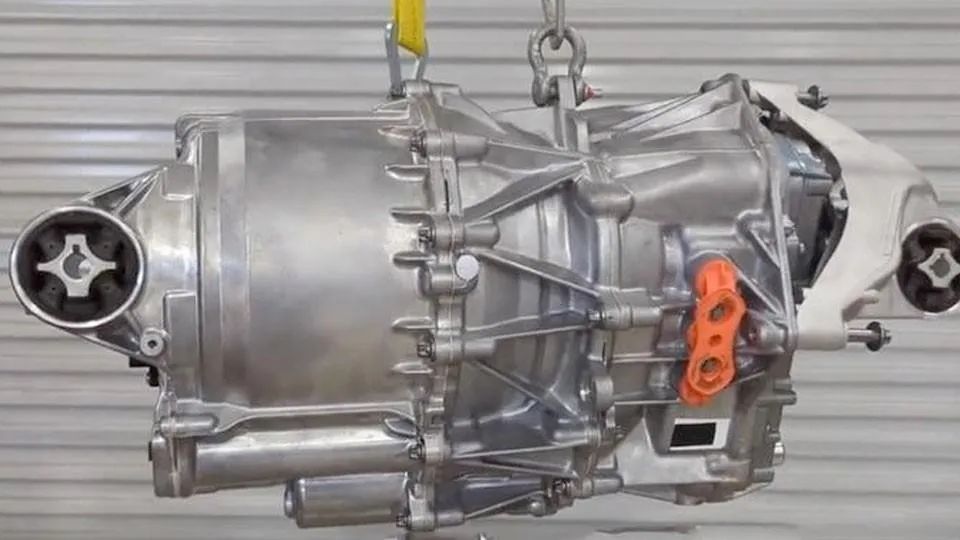

When it comes to Tesla's cost control, what comes to mind isn't integrated casting, but rather the mixed-model operation of the motors for the renewed Model Y in China. As early as in the information submitted to the Ministry of Industry and Information Technology, we noticed that the rear-wheel-drive version of the new vehicle is equipped with two models: 3D6 and 4D3. Among them, 3D6 is the third-generation motor used in the 2024 Model Y, and the fourth-generation motor 4D3 makes its debut in the Y series, with identical power and torque data. What's the difference? From a technical standpoint, the 4D3 primarily makes adjustments in three areas: the inverter process, oil filter, and stator coil. Firstly, the inverter has been changed from the previous screw connection to stir welding, simplifying the assembly process and naturally reducing costs. Secondly, the removable oil filter of the third-generation motor (a shared lubrication system for the motor and gearbox) has been transformed into a non-removable, maintenance-free design.

Oil-cooled flat wire winding is a relatively advanced technology for drive motors, but the stator coil has been reduced from 10 layers to 8 layers. It's crucial to note here that more layers of flat wire winding aren't always better. Its primary role is to dissipate heat from the motor. By stacking copper strips in a rectangular shape, flat wire winding can maximize the slot space, thereby distributing the current and reducing heat generation. Therefore, overall, the core logic of 4D3 is to minimize costs and maximize efficiency. However, on the flip side, the integrated design of the 4D3 motor will directly lead to increased repair costs. Once the motor fails, it's no longer a single part that needs to be maintained; the solution is to replace the entire set of components. Thus, the conclusion is that in the future, car owners with 4D3 motors will face higher repair costs compared to those with 3D6 motors. Behind a series of cost reductions, there's likely room for future price reductions of the renewed Model Y.

Apart from the battery and motor, the chassis is also a noteworthy aspect of the renewed Model Y. According to the official description, the optimized suspension system reduces the bumpy feeling. From a technical perspective, the front double wishbone and rear five-link design, without the support of CDC solenoid valve damping technology, can only be optimized by adjusting the elastic elements. Unsurprisingly, the so-called optimization technique involves reducing the support stiffness of the shock absorber top and the stiffness of the coil spring. Additionally, from the real vehicle images, we can observe that the extension part connecting the lower end of the rear wheel bearing seat and the connecting rod is significantly closer to the ground compared to the 2024 Model Y. This implies that besides the softer rear suspension spring stiffness, even the bushings have been replaced with materials offering stronger cushioning properties. After all, the new vehicle's ground clearance is 46mm lower than that of the 2024 model. This also means that the entire suspension system will become more conservative in controlling the vehicle's attitude, resulting in relatively noticeable pitch during sudden acceleration or braking. Therefore, the upgraded Model Y is suspected of having a regression in handling performance. After all, the primary issue to be addressed this time is to reduce suspension bounce. To achieve both handling and comfort, it would be necessary to incorporate dual-valve CDC or smart chassis functions, but given Tesla's cost-reduction philosophy, this isn't likely to happen.

Buying out domestic leading technology for RMB 30,000, will the price of FSD in China necessarily decrease?

The launch of the renewed Model Y coincides with the impending introduction of the FSD plan in China. According to previous news, Tesla plans to introduce FSD to markets including China in the first quarter. It's uncertain whether it will be launched alongside the new vehicle, but it's almost certain that if FSD is to be scaled up in China and even increase revenue, its current price of RMB 64,000 won't be maintained for long.

While offering a free EAP trial to all Tesla owners in China, Tesla also rolled out the FSD V13.2.5 version overseas. Compared to V13.2, there are almost no significant technical optimizations, with changes mainly in details and processing scale. From a general perspective, domestic technologies such as Huawei's ADS 3.2, Lixiang's E2E+VLM 7.0, Xiaopeng's XNGP, and Momenta's end-to-end technologies essentially cover the functions of the new FSD version. Interestingly, when the head of Xiaopeng's autonomous driving team tested the V13.2 version in the US two weeks ago, they found that the system wouldn't avoid China's unique three-wheeled electric bicycles, which highlights the challenges FSD will face upon entering China. The domestic traffic environment is complex, and the mixture of people and vehicles poses a greater challenge to the learning effect of end-to-end systems. Therefore, regarding the comparison of actual levels, it needs to be discussed in conjunction with the performance of FSD after its launch.

From the perspective of end-to-end chips, only Tesla and Huawei currently use self-developed chips. Lixiang and Xiaopeng, which plan to self-develop but have already mass-produced end-to-end chips in vehicles, are both tied to NVIDIA. NIO, which stacks four Orin X chips, boasts the highest computing power in vehicles currently (1016TOPS), skipping segmented end-to-end and directly making a world model. The specific effects can be further anticipated. As for the reason behind its delay, it doesn't rule out the possibility that it's related to the self-developed chip manufacturing process or the accumulation of cloud deductions. Lixiang and Xiaopeng, which are equipped with two Orin X chips, have a computing power of 508TOPS, while Huawei's MDC810 has a single computing power of 400TOPS. For comparison, HW4.0 has a computing power of 500TOPS. Therefore, a vehicle-end computing power of 400-500TOPS is generally sufficient for end-to-end applications, which also implies that FSD doesn't have a significant advantage over several mainstream domestic intelligent driving technologies.

Let's do the math. NIO's NOP+ costs RMB 380 per month, with an annual fee of RMB 4,560. Huawei's Kunlun Intelligent Driving Basic Version costs RMB 100 per month and RMB 5,000 for a buyout, while the Advanced Version costs RMB 30,000 for a buyout. Xiaopeng and Lixiang include intelligent driving in the vehicle price, essentially offering a high-level intelligent driving function for RMB 30,000, which is markedly cheaper than Tesla. Referencing Tesla's FSD prices in other countries and regions, it's evident that the price in Japan is the lowest, equivalent to approximately RMB 41,000, while it's approximately RMB 49,000 in South Korea, RMB 47,000 in Australia, and around RMB 58,000 and RMB 60,000 in France and the UK, respectively. In other words, except for the highest price in the US, the FSD in other countries is cheaper than in China. Of course, there are several possibilities: either the vehicle price will decrease, or the FSD price will decrease, or both the vehicle price and intelligent driving price will decrease. In summary, as domestic intelligent driving technologies have already reduced prices to a certain extent, FSD will face competition in both technical and price dimensions, leaving little confidence in maintaining the original price.