If the US Cancels Subsidies and China Follows Suit, Will Electric Cars Still Be Your Choice?

![]() 01/27 2025

01/27 2025

![]() 439

439

New Energy Outlook (ID: xinnengyuanqianzhan) Original

2930 words, 8-minute read

US consumers will lose up to $7,500 in incentives for purchasing electric cars. Notably, the starting price for the new Model Y in the US is $59,990, and $7,500 amounts to 12.5% of the vehicle's price.

However, Tesla CEO Elon Musk supports this move. He believes that while canceling subsidies may be a minor setback for Tesla, it will be devastating for competitors like General Motors and Ford.

Musk's viewpoint has garnered some recognition from US consumers. "Subsidies depend on tax returns. High-income individuals typically buy Tesla Model X and Model S, which originally didn't receive subsidies. Low-income individuals can't afford electric cars and prefer cheaper gasoline vehicles, so the impact is indeed insignificant."

Yet, for average working families, the $7,500 difference could be decisive in choosing between a gasoline car and an electric car. One US consumer remarked, "It's fine to cancel electric car subsidies, but car manufacturers need to lower prices. If they're much higher than gasoline cars, I won't buy electric cars."

Undoubtedly, with the withdrawal of subsidy policies, the US electric car industry is taking a step backward. What impact will this have on the global electric car industry?

1. Lifting a Rock Only to Drop It on One's Own Feet?

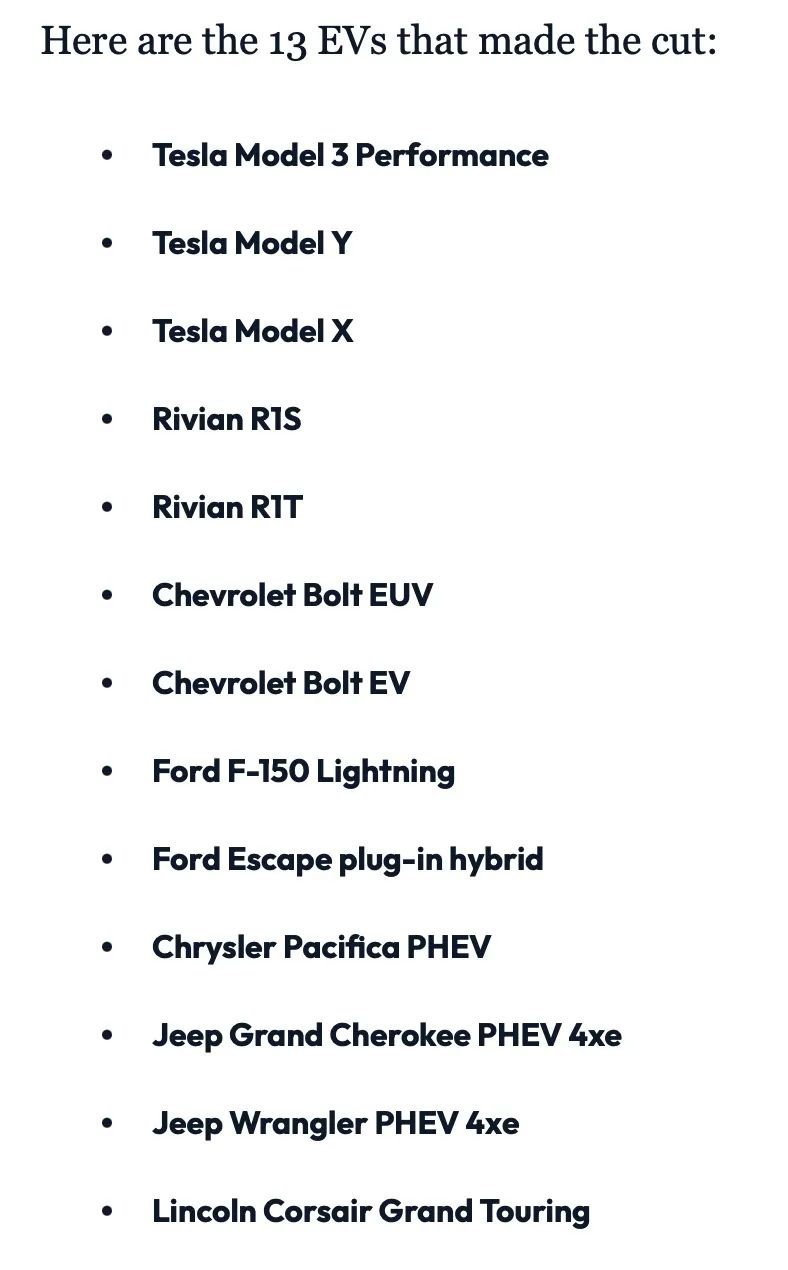

Looking back at the US new energy vehicle market over the past two years, under pressure from the rapid rise of the electric vehicle industry in China and Europe, the list of eligible electric car subsidies has shrunk from "brands from all countries" in the early stages to now covering only certain models from four American automakers: General Motors, Ford, Tesla, and Stellantis.

According to data from a US website, only 13 electric car models are eligible for the $7,500 subsidy in 2024, including the Chevrolet Bolt series, Ford F-150 Lightning, Tesla Model 3 Performance, and the entire Tesla Model Y series.

Image/List of 13 Models

Source/Screenshot from New Energy Outlook

A Chinese resident in Los Angeles stated clearly that if there are no tax credits in the future, he would not choose an American electric car. After all, a Tesla without subsidies costs $60,000, which is the same price as a Porsche, while BBA cars only cost $40,000.

In his view, most American families still prefer gasoline cars. On one hand, except for California, gas prices in other states are relatively cheap. On the other hand, there are concerns about range and refueling anxiety. The average temperature in the US is low, and the infrastructure is not as sound as in China, making it inconvenient to drive electric cars.

"My friends and I are all Moonlight Clan (spendthrifts who live paycheck to paycheck) and never save money. If we don't get paid for a month, it's hard to make ends meet. For larger expenses like buying a car, we generally choose the lower-priced option." Another Chinese American living in New York candidly said.

Mr. Zhou (pseudonym) from California revealed, "Last year, my family's income exceeded the limit, and the Model Y fell to a historic low of $47,000, so I bought it for fun. Otherwise, even in California, where electricity is slightly more affordable than gasoline, I would still choose a powerful car."

Through contact with many Chinese Americans, we gradually discovered that the cancellation of this "significant discount" in the US in the future is bound to have a certain impact on the sales of electric vehicles in the US.

Simultaneously, the loss of the "subsidy umbrella" will also mean that the US will face more pressure from electric car brands from various countries in the future.

Breaking down by country, taking Chinese brand cars as an example, in the first ten months of 2024, China's exports of light vehicles to the US grew to $2.9 billion, a record high. Among these, most of the vehicles purchased by American consumers were electric cars.

Image/Increase in Light Vehicle Exports to the US in the First Ten Months of 2024

Source/Screenshot from New Energy Outlook

A research report from Arthur D. Little, a management consulting firm headquartered in Boston, shows that 30% of Americans are interested in buying electric vehicles manufactured by Chinese automakers.

"Chinese electric cars offer high cost-effectiveness. The same configuration and performance come at a more advantageous price compared to American cars."

"I was fortunate enough to experience a Chinese electric car once. Some of the thoughtful designs are far more advanced than those produced by traditional American automakers." Many Chinese American consumers said so.

Thus, in the US market, it may be American cars that are first crushed by the cancellation of electric car subsidies. Trump's "iron fist" ultimately hits his "own people" first.

2. Who Will Be Affected by the US's "Historical Reversal"?

In recent years, while some consumers still insist on the view that "as long as gas stations haven't disappeared, I won't consider electric cars," the general trend towards new energy has subtly become a consensus among global consumers.

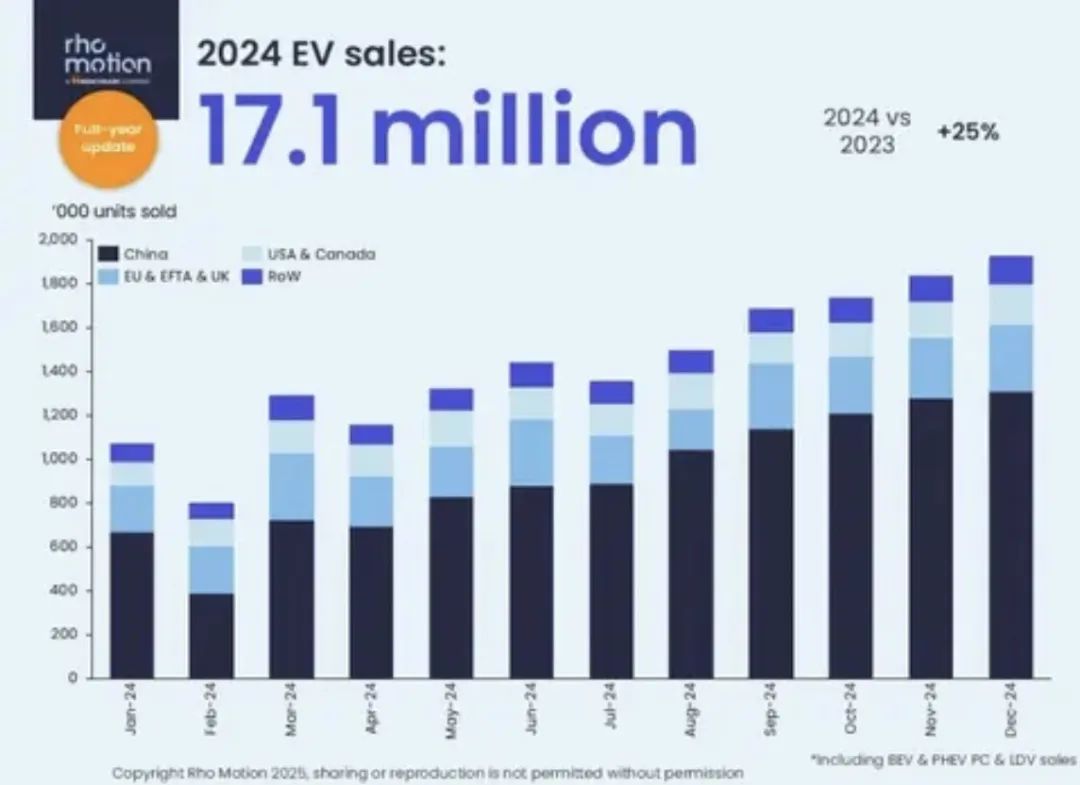

According to data released by the overseas research institution Rho Motion, global new energy vehicle sales reached 17.1 million in 2024, an increase of 25% year-on-year.

Image/Global New Energy Vehicle Sales in 2024

Source/Screenshot from New Energy Outlook

Against this backdrop, Trump has chosen to revoke the current electric vehicle subsidies to "feed back" internal combustion engine vehicles. This retrograde move has inevitably led Chinese American consumers to exclaim that it is like driving a "historical reversal".

"Americans already value horsepower in cars. Now that the subsidies have been canceled, fewer people will buy electric cars. After all, in many regions of the US, the prices of electricity and gasoline are similar."

"It's a bit out of place. Other countries are learning how to move forward, but the US is going backwards."

From a global perspective, the European Union has been continuously upgrading its carbon emission regulations for automobiles in recent years. The average emissions target for new passenger cars in 2025 is 15% lower than the 2021 baseline; China will continue to promote the construction of charging piles, battery swapping stations, and other infrastructure in 2025, striving to basically realize a charging infrastructure network along highways by the end of 2025.

Industry insiders believe that a country's industrial scale, technological strength, and market share in related fields are important influencing factors in the formulation of international market rules.

After the US cancels subsidies, not only will electric car sales be impacted, but the development of its upstream and downstream industrial chains will also be affected and slow down, gradually putting the US at a disadvantage in competition with the European Union and China.

Image/Trump Signs Executive Order to "Cancel Electric Car Subsidies"

Source/Screenshot from New Energy Outlook

Therefore, the US's "sudden brake" at this time may cause it to lose its voice in formulating international market rules in the future.

As Zhang Xiang, Secretary-General of the International Association of Intelligent Transportation Technology, said, "The proposal to cancel electric car subsidies in the US is more based on political and economic considerations rather than environmental protection. At a time when countries around the world are actively developing new energy, the current approach of the US will gradually erode its competitiveness and that of its automakers in new energy development."

Lin Boqiang, Dean of the China Institute for Studies in Energy Policy at Xiamen University, said that as a trend, electric cars are unstoppable. Although American automakers like Tesla will not stop developing electrification in the future, due to Trump's perception of climate change and policy implementation, the US electric vehicle industry will still encounter a short-term setback.

Discussions about this event on the internet have also sparked heated debate among Chinese consumers. They believe that while the US's retreat from electric cars will make it more difficult for Chinese automakers to further open up the US market, on the other hand, the US's brief hesitation in new energy development also reflects the forward-looking consciousness of the Chinese government, which will enhance China's position in the world.

3. If China Also Cancels Subsidies, Will You Choose an Electric Car?

As of press time, the cancellation of the $7,500 electric car subsidy policy has not been officially confirmed. It still requires final approval from the US Congress.

However, it is certain that many consumers in the US will find it difficult to afford a car after its price increases by $7,500.

In view of this, many netizens have raised their doubts online: If China also cancels subsidy policies in the future, will consumers abandon electric cars?

"I choose an electric car not just because of its low price, but more importantly for its high-tech performance. Therefore, as long as electric cars undergo greater upgrades in intelligence in the future, I will definitely choose to buy one even without government subsidies," said Wang Anran (pseudonym), the owner of a Deep Blue S05.

Image/Deep Blue S05

Source/Screenshot from New Energy Outlook

Li Song (pseudonym), the owner of a Xiaomi SU7 Max version, candidly said, "In the Chinese market, the cost of using an electric car is much lower than that of a gasoline car. My car's electricity bill for a month is around 300 yuan. When I used to drive a gasoline car, the fuel cost for the same commuting route was at least 1,000 yuan per month."

Image/Xiaomi SU7 MAX

Source/Screenshot from New Energy Outlook

Li Song also revealed that since the powertrain structure of electric cars is simpler than that of gasoline cars, only the battery and motor need to be checked, and there is no need to replace parts like oil and spark plugs, which reduces maintenance costs.

Through contact with many Chinese consumers, we gradually discovered that, unlike American consumers who focus more on affordability, in the Chinese market, besides price, many other factors also support consumers' firm choice of electric cars.

An undeniable fact is that the collaborative efforts of local governments and automakers in the new energy market in China have not only provided consumers with more car models to choose from but also made charging more convenient.

According to data released by the China Electric Vehicle Charging Infrastructure Alliance, the increment of charging infrastructure in China in 2024 was 4.222 million units, an increase of 24.7% year-on-year, with a ratio of charging piles to new vehicles of 1:2.7.

Image/Increment of Charging Facilities in China in 2024

Source/Screenshot from New Energy Outlook

In recent years, while some consumers still insist on the view that "as long as gas stations haven't disappeared, I won't consider electric cars," the general trend towards new energy has subtly become a consensus among global consumers.

According to data released by the overseas research institution Rho Motion, global new energy vehicle sales reached 17.1 million in 2024, an increase of 25% year-on-year.