European and American Manufacturers Dominate 80% of the Global Automotive Chip Market, with China's Self-Sufficiency Rate at Just 10%

![]() 01/29 2025

01/29 2025

![]() 646

646

Customs data reveals that China exported 6.407 million vehicles (including chassis) in 2024, marking a 22.8% increase. The value of automotive exports surged to $117.353 billion, up 15.5% year-on-year.

Currently, China stands as the world's largest producer, seller, and exporter of automobiles. It is undeniable that China's automotive industry has come a long way, rising from being over a century behind.

Particularly, the automotive industry is undergoing a monumental transformation, transitioning from fuel vehicles to new energy and intelligent vehicles, fueled by electrification, autonomous driving, and innovative mobility models.

China undoubtedly serves as the epicenter of this innovation drive, currently leading the electric vehicle sector, which is the linchpin and deciding factor in future automotive industry competition.

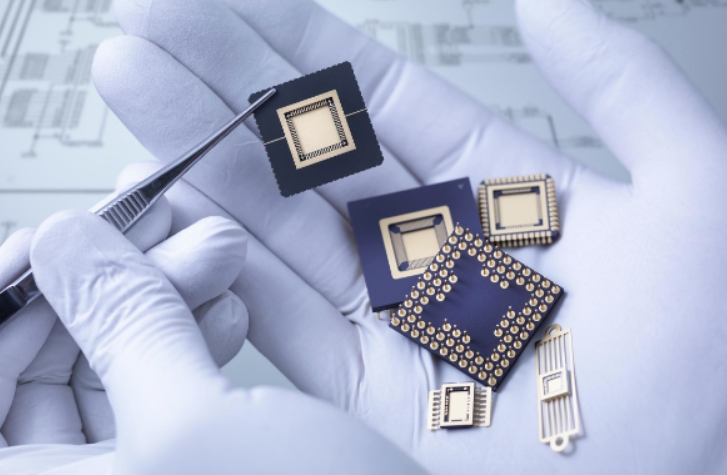

However, despite the rapid advancement of China's automotive industry, we must acknowledge that the global automotive chip market is nearly monopolized by European and American manufacturers.

According to 2024 agency data, the top five manufacturers—Infineon, NXP, STMicroelectronics, Texas Instruments (TI), and Renesas Electronics—account for over 50% of the global automotive chip market share.

When Qualcomm, NVIDIA, Bosch, ON Semiconductor, Broadcom, Micron, and other European and American companies are included, they collectively control more than 80% of the global automotive chip market.

As the automotive industry evolves towards electrification and intelligence, automotive chips are becoming increasingly crucial. Yole Group forecasts that by 2029, the average number of chips per vehicle will soar from approximately 450 in 2022 to around 1,200.

The market size of automotive chips is also projected to exceed $88 billion by 2027. With the development of the automotive industry, the demand for high-performance computing, GPUs, radar chips, and laser sensors will grow exponentially.

This poses a significant challenge for China's automotive industry. Agency data indicates that in 2023, China's automotive chip self-sufficiency rate was just about 5%, and by 2024, it had only reached about 10%, meaning that approximately 90% of automotive chips are imported.

What would happen if these European and American automotive chip manufacturers imposed restrictions? Can China truly afford to turn down these automotive chips?

Replacing domestic automotive chips is not an easy feat. As chip design advances, it becomes increasingly intertwined with computer science, semiconductor science, and mathematics, highlighting the critical importance of talent.

Automobile production lines can be established from scratch, and production capacity can be rapidly scaled with sufficient funding. However, chips are a different story. They are underpinned by the collective growth of the entire industrial chain, which is deeply rooted in scientific respect and continuous investment in research and development. Therefore, the domestic automotive industry still has a long way to go.