European Auto Market | Norway February 2025: Car Sales Surge 21.3%

![]() 03/12 2025

03/12 2025

![]() 615

615

In February 2025, Norway's automotive market witnessed a remarkable resurgence, with new car sales soaring 21.3% year-on-year to 8,949 units, effectively reversing the market downturn of recent years.

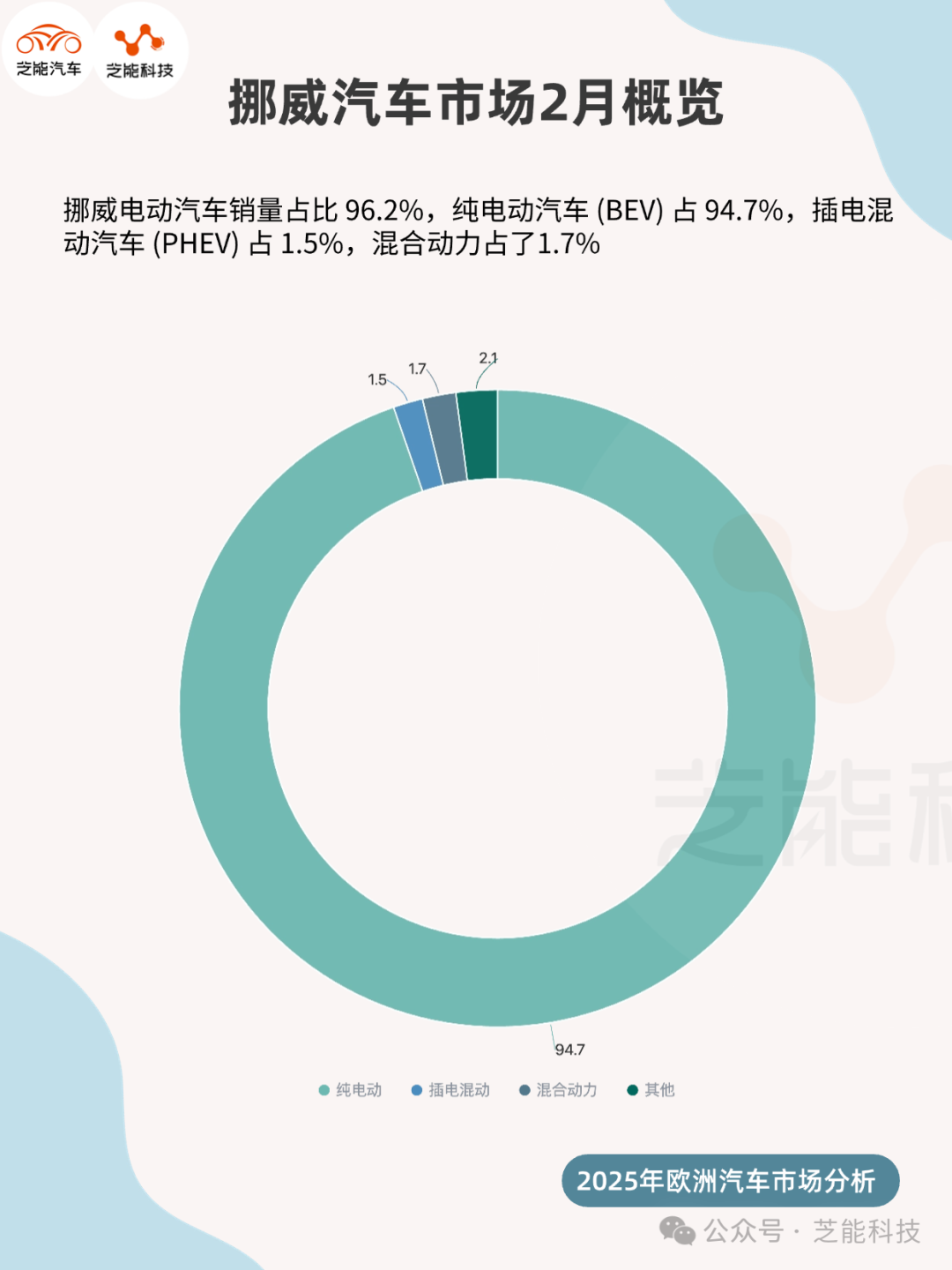

Year-to-date sales have surged by 46.3%, amounting to 18,292 units. Sales of Battery Electric Vehicles (BEVs) jumped 27.5% to 8,477 units, securing a market share of 94.7%, further solidifying Norway's pioneering role in the global shift towards electrification.

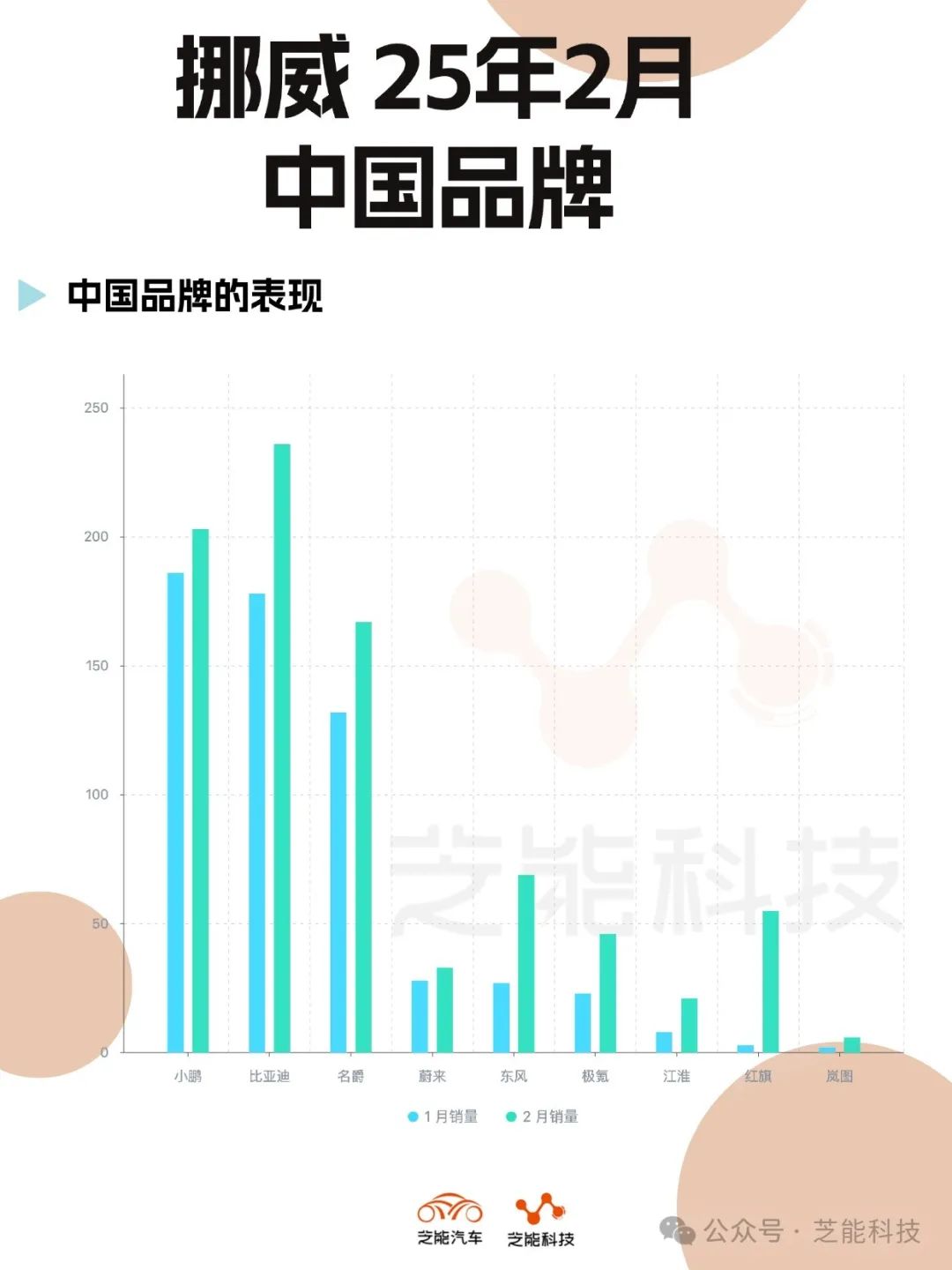

● Brand-wise, Volkswagen captured 14.8% of the market share, recording a growth rate of 122.7%, while Tesla's sales declined by 48.4%, reducing its share to 10.2%. Chinese brands shone brightly, collectively accounting for 11.7% of the market, with BYD and XPeng standing out.

● On the model sales front, the Nissan Ariya topped the charts for the first time, while Tesla's Model Y saw a notable decline. Multiple Volkswagen models featured prominently, signaling a profound shift in the competitive landscape.

01

Norway Auto Market Sales Overview

● February 2025 saw new car sales in Norway reach 8,949 units, a 21.3% year-on-year increase, marking a complete recovery from the market weakness of the past few years.

● Year-to-date sales have totaled 18,292 units, a 46.3% jump compared to the same period last year, reflecting the combined effects of improved supply chains, enhanced consumer confidence, and robust policy support.

This growth underscores that Norway's automotive market is entering a new phase of development.

● Norway's automotive market leads the world in electrification, with February's data further underscoring this trend:

◎ BEVs: Sales of 8,477 units, a 27.5% year-on-year increase, with a market share of 94.7%, significantly higher than the 90.9% recorded in the same period last year and the 79.8% in February 2023.

◎ HEVs: Market share of 1.7%, down from 4.2% in the same period last year, indicating a waning appeal for hybrids.

◎ Diesel Cars: Market share of 1.6%, down from 2.7% in the same period last year, as the traditional ICE market continues to shrink.

◎ PHEVs: Market share of 1.6%, slightly down from 2% in the same period last year, failing to reverse the trend of marginalization.

◎ Gasoline Cars: Market share of merely 0.4%, further down from 1% in the same period last year, nearly exiting the mainstream market.

The market share of 4WD vehicles reached 66.2%, up from 63.4% in the same period last year, reflecting the strong demand for 4WD models in Norway's mountainous and snowy terrains.

● February 2025 witnessed significant divergence in brand performance in the Norwegian market, reshaping the competitive landscape:

◎ Volkswagen: Sales surged 122.7% year-on-year, capturing a market share of 14.8%, and a year-to-date share of 17.6% (up 224.1%), positioning it as the market leader.

◎ Tesla: Sales declined by 48.4% year-on-year, with its market share dropping from 24.1% in the same period last year to 10.2%. Despite Tesla's large inventory of unregistered new cars in Norway, negative consumer sentiment towards its brand image (possibly due to Elon Musk's political actions) has impacted sales.

◎ Toyota: Sales increased by 0.3% year-on-year, maintaining a stable market share and moderate performance.

◎ Nissan: Sales grew by 41.1%, indicating steady improvement.

◎ Volvo: Sales increased by 33%, sustaining good momentum.

◎ Chinese brands collectively accounted for 11.7% of the market share, with BYD growing by 52.3% (ranking 13th) and XPeng by 160.3% (ranking 14th), demonstrating the ascendancy of Chinese electric vehicle brands. Other Chinese brands such as Hongqi (up 2650%) and Zeekr (new entrant) also performed impressively.

02

Model Sales and Competitive Landscape Analysis

● February 2025's model sales chart in Norway revealed fierce competition among new and established models:

◎ Nissan Ariya: Sales increased by 204.4%, securing a market share of 7%, topping the charts for the first time as the biggest dark horse.

◎ Tesla Model Y: Sales declined by 65.5%, with a market share of 6.7%, down significantly from 23.7% in the same period last year, ranking second.

◎ Toyota bZ4X: Sales grew by 47.6%, ranking third and maintaining its leadership position year-to-date.

◎ Volkswagen ID.4: Sales increased by 91.8%, entering the top six.

◎ Volkswagen ID.7: Sales surged by 693.9%, demonstrating strong performance for a new model.

◎ Volkswagen ID.3: Sales grew by 139.3%, reinforcing its market position.

◎ Tesla Model 3: Sales jumped by 1252.2%, ranking seventh, showcasing Tesla's support point amidst Model Y's decline.

◎ Kia EV3: The new model debuted in the top ten, ranking eighth, with rapid growth momentum.

● The competitive landscape in Norway's automotive market underwent significant changes in February 2025:

◎ Volkswagen entered the top six with its ID.4, ID.7, and ID.3 models, underscoring its success in the electrification strategy. Its product diversity and robust growth position it as a formidable competitor to Tesla.

◎ Tesla's Model Y sales plummeted by 65.5%, possibly linked to damage to its brand image. While Model 3 sales surged, the overall decline in market share highlights the complexity of consumer attitudes towards Tesla.

◎ BYD and XPeng swiftly gained a foothold in the Norwegian market with their cost-effective and innovative technologies. Their combined market share of 11.7% underscores the competitiveness of Chinese brands in the international market, particularly in the electric vehicle sector.

◎ Luxury brands such as BMW, Audi, and Mercedes maintained their market positions through electric models.

◎ Kia and Nissan captured market share with new models (e.g., EV3 and Ariya), showcasing the adaptability of traditional automakers. The emergence of new models (e.g., Kia EV3) and the decline of established models (e.g., Model Y) indicate that Norwegian consumers are demanding more diverse options, and market competition will continue to intensify.

Summary

In February 2025, Norway's automotive market stood out with a 21.3% sales growth and a 94.7% market share for BEVs, reinforcing its position as a global benchmark in the transition to electric vehicles. Volkswagen emerged as the market leader, fueled by its strong performance across multiple electric models, while Tesla faced challenges due to brand image issues. Chinese brands, such as BYD and XPeng, are rapidly ascending the ranks.