Volkswagen Group's 2024 Business Performance and Strategic Outlook for 2025

![]() 03/13 2025

03/13 2025

![]() 559

559

Volkswagen recently unveiled its 2024 business performance and outlook. This article delves into Volkswagen Group's financial and operational achievements for 2024, alongside its strategic direction for 2025, based on the presentations from the company's 2024 annual conference.

I. 2024 Business Performance and Financial Metrics

1. Global Market Highlights

Deliveries:

The Group delivered 9 million vehicles throughout the year, marking a 2% year-on-year decline. As noted in our previous article, "Top 10 Global Auto Companies in 2024, with Two Chinese Entries!", Volkswagen maintained its second-place ranking globally, trailing Toyota but ahead of Hyundai Motor Group by nearly 2 million units.

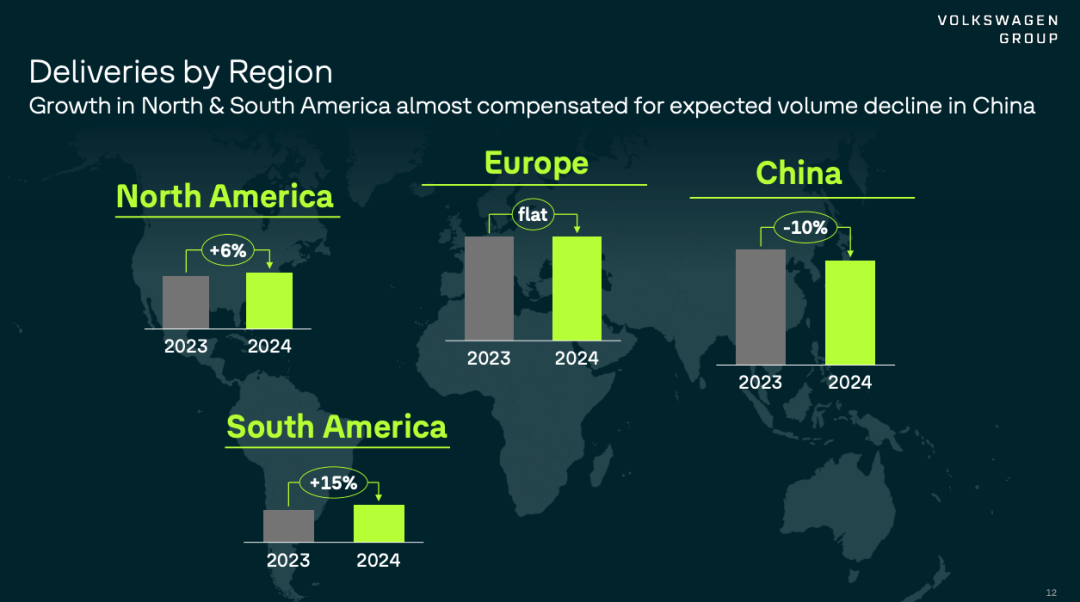

Regional Dynamics:

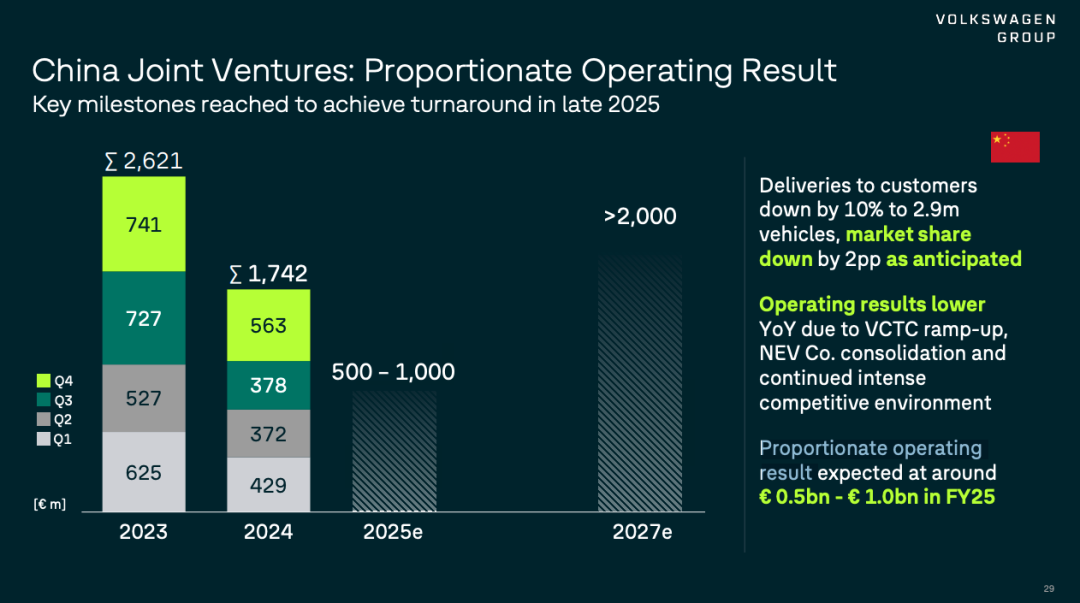

China: Deliveries fell by 10%, accompanied by a 2-percentage-point drop in market share, reflecting intense local competition.

North & South America: Saw growth of 6% and 15%, respectively, partially compensating for the weakness in the Chinese market.

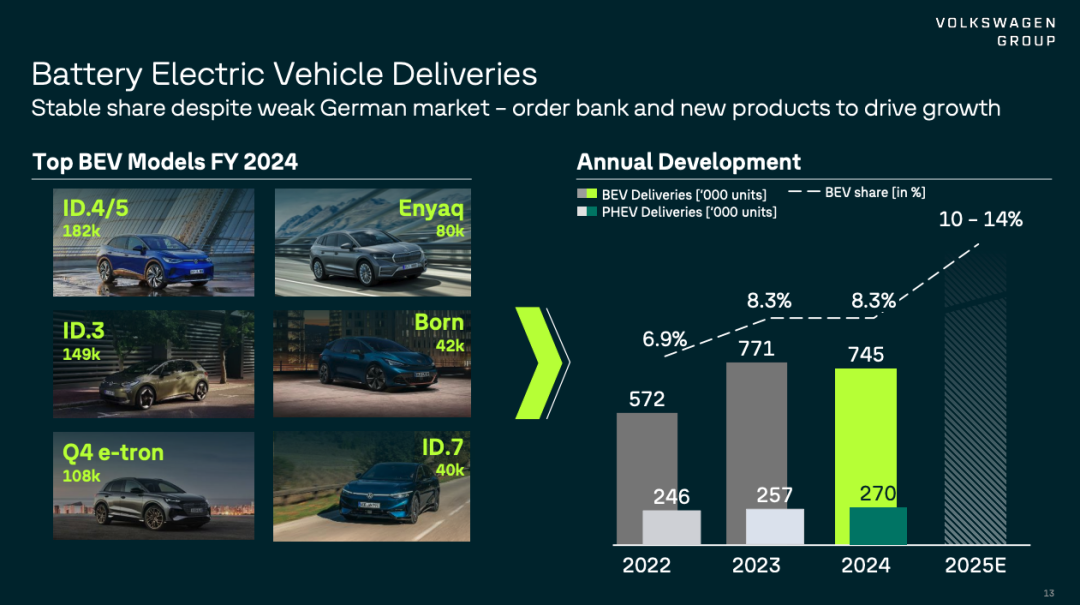

Electrification Progress:

Battery Electric Vehicle (BEV) deliveries remained stable, accounting for 8.3% of global sales, with the ID series (ID.4/5, ID.3) as the mainstay. However, Plug-in Hybrid Electric Vehicle (PHEV) deliveries declined significantly.

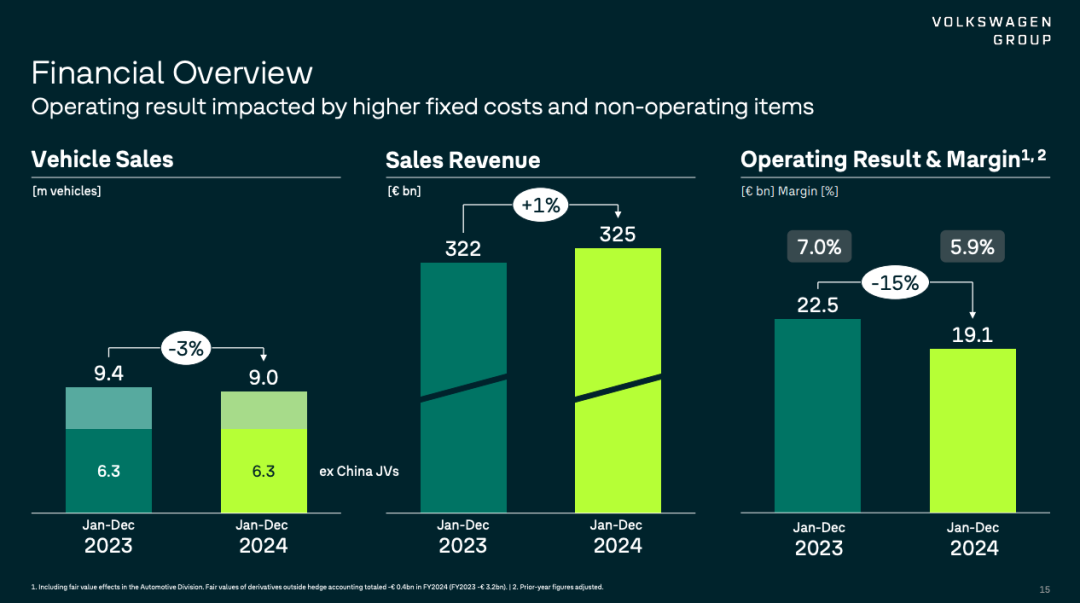

2. Financial Overview

Revenue:

Volkswagen Group reported revenue of €324.7 billion, marking a slight 1% increase year-on-year. This modest growth was attributed to higher sales in North and South America, where favorable pricing conditions sustained revenue levels.

Profit Under Pressure:

Operating profit stood at €19.1 billion (-15%), with a profit margin of 5.9% (compared to 7.0% in 2023). Net profit was €12.4 billion (-31%), primarily due to restructuring costs (involving over 35,000 layoffs in Germany and technology capacity reductions) and supply chain pressures.

Cash Flow:

Net cash flow declined to €5 billion (-53%), and net liquidity stood at €36.1 billion (-10%), reflecting increased investment and restructuring expenses.

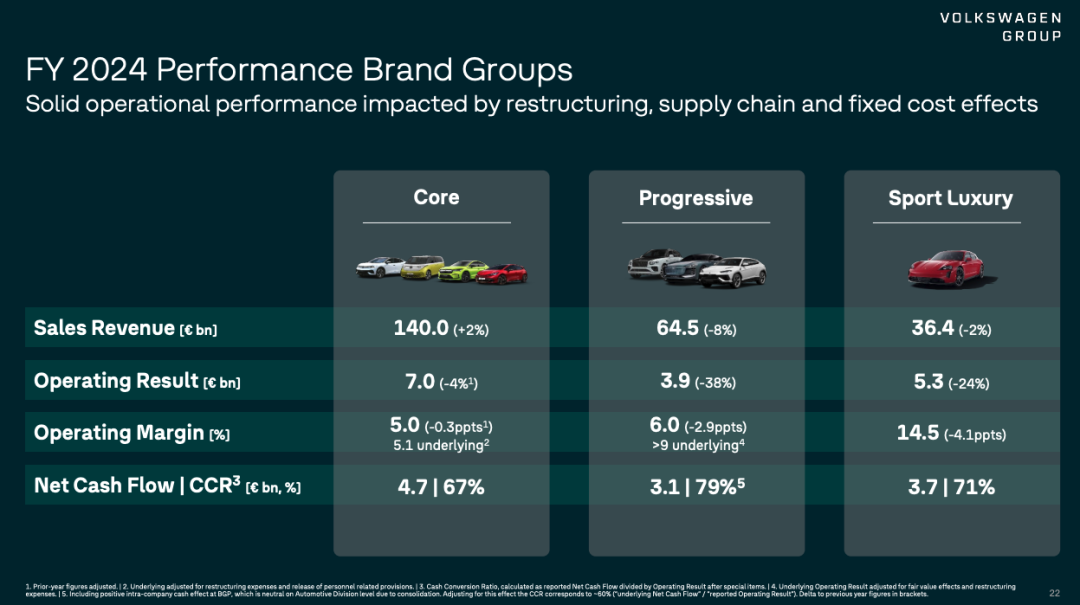

Among Volkswagen Group's segments, the luxury brand series faced the most significant impact. For those unfamiliar with Volkswagen's luxury brand classification, please refer to our previous article, "Understanding Volkswagen's Brand and Product Strategy Positioning," for more details.

3. Cost and Efficiency Adjustments

Restructuring Plan:

Technical capacity at German plants was reduced by 730,000 units, and the workforce was cut by over 35,000 (through a combination of natural attrition and layoffs), aiming to save over €4 billion annually in the medium term.

R&D and Capital Expenditure:

Investment accounted for 14.3% of revenue, focusing on electrification and software, with plans to gradually reduce this to below 13% starting in 2025.

II. 2025 Product and Technology Strategy

1. Product Offensive

30 New Models:

The lineup will include BEVs, PHEVs, and ICE vehicles, featuring Audi models developed in collaboration with SAIC, Scout brand pickup trucks/SUVs for the North American market, and the upgraded ID.7.

Electrification Core:

BEV: Expanding the ID series and developing entry-level electric vehicles (such as the ID. EVERY).

Hybrid Technology: Optimizing the energy efficiency of PHEV models (e.g., Passat R eHybrid with a range of 118 km).

2. Technology Layout

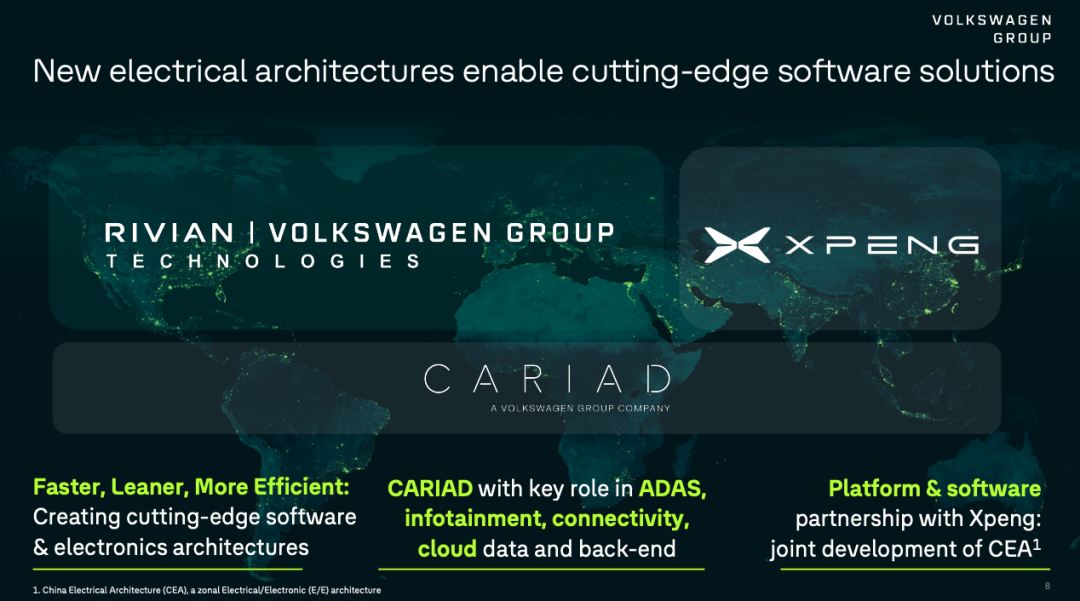

Software and Electronic Architecture:

Collaborating with Xpeng to develop a China-exclusive electric architecture (CEA1), accelerating the implementation of intelligent features, anticipated to be unveiled at this year's Shanghai Auto Show.

CARIAD leads in ADAS, connected vehicle, and cloud platforms, enhancing in-house software development capabilities.

Battery Strategy:

PowerCo expands capacity, promotes standardized battery cells and fast-charging technology, reducing costs and increasing efficiency.

III. Regional Strategic Adjustments

1. Chinese Market

In China, for China:

Focus on local R&D and supply chain to achieve cost parity with local brands.

Deepening collaboration with tech companies like Xpeng and Horizon Robotics to enhance intelligent driving and cabin experiences.

Risk Response:

Profits of joint ventures are expected to remain under pressure in 2025, with 2024 revenue down 33% year-on-year. However, Volkswagen anticipates a rebound by year-end, driven by numerous product launches in 2025.

Volkswagen has set a pragmatic sales target of 2.9 million units for its joint ventures in China, marking a further 10% decrease. Operating performance is projected to be around €500-1 billion in 2025, a roughly 50% decline compared to the previous two years. Volkswagen estimates that by 2027, revenue could exceed 2024 levels, reaching approximately €2 billion.

Based on Volkswagen's own forecasts, it is evident that the "good old days" are gone, and even established players must tighten their belts.

2. North American Market

Scout Brand Momentum:

The first model will debut in 2025, targeting the high-margin pickup truck and rugged SUV markets.

Flexible Product Mix:

Combining BEVs with fuel-extended range vehicles to meet diverse consumer needs.

3. European Market

Efficiency First:

Optimizing production capacity at German plants, advancing the "Future Volkswagen" plan, and reducing labor and manufacturing costs.

Policy Response:

Remaining vigilant against potential changes in CO2 regulations impacting the ICE vehicle business. As discussed in our previous articles, Europe's stringent emission policies, including fines and bans, pose significant challenges for Volkswagen.

For Volkswagen's home market in Europe, maintaining the status quo is crucial while also contending with competition from Chinese electric vehicles.

IV. Challenges and Risks

1. External Environment

Chinese Market: Pressure from local brands (e.g., BYD, new entrants) and ongoing price wars.

Geopolitics: Trade tariffs and supply chain localization requirements increase cost uncertainty.

Electrification Transition: Fluctuations in battery raw material prices and the progress of charging infrastructure affect market acceptance.

2. Internal Pressures

Software Weakness: CARIAD continues to incur losses, necessitating accelerated technology implementation and synergy.

Profit Margin Recovery: The increasing proportion of electric vehicle models may temporarily lower gross margins, requiring a delicate balance between scale and profitability.

V. 2025 Outlook

Financial Targets:

Revenue growth of up to 5%, operating profit margin of 5.5%-6.5%, and investment ratio reduced to below 13%.

Strategic Focus:

Releasing cost space through restructuring, relying on new models and localization strategies to regain growth momentum, particularly in North America and China.

Long-term Vision:

Launching premium electric vehicle models in 2028, achieving full-system coverage of software platforms by 2030, and consolidating its position as a global leader in electrification.

VI. Conclusion - Volkswagen's 2024 and 2025 Keywords

"Transformation Pain": This was the keyword for Volkswagen in 2024. Beneath the surface of slight revenue growth and profit contraction, Volkswagen is laying a solid foundation for medium- and long-term competitiveness through aggressive restructuring, a focus on electrification, and regional flexibility. 2025 will be a pivotal year for testing strategic execution.

"Foggy Landscape": This will be the status quo for Volkswagen in 2025. Uncertainties in the Chinese market, European economic development, and North American policy will require the automotive giant to navigate forward in a challenging environment.

Unauthorized reproduction and excerpts are strictly prohibited.

References:

Volkswagen AG Investor & Analyst Conference Call Speech

Volkswagen AG Investor & Analyst Conference Call FY 2024 ppt