NIO Embraces the Challenge: A Resolute Path to Profitability

![]() 03/28 2025

03/28 2025

![]() 595

595

Li Bin has personally stepped down to demand operational efficiency, and NIO is steadfastly navigating through tumultuous waters.

Original Creation: New Entropy

'Now the entire internet is teaching me how to be a CEO.' As NIO faced challenges, Li Bin employed various strategies to boost team morale. It appears that NIO has reached a pivotal juncture.

From a timeline perspective, during the Spring Festival, particularly the New Year period, Ledao brand sales fell short of expectations, marking the inception of NIO's current predicament. The Ledao L60, priced between 140,000 and 200,000 yuan, was intended to be a high-volume model for NIO, representing a high-end brand's foray into a lower price segment. However, reality has been less than optimistic. Post-Spring Festival, Ledao's online sales showed a decline, at one point falling out of the top ten on weekly charts. Low prices failed to translate into sales, and a product once hailed as a 'sellout' has now become the fuse igniting NIO's difficulties.

Moreover, comparisons with peers seem to have exacerbated public doubts about NIO. After the Spring Festival, whether it was Xpeng's Mona03, Xiaomi, Zero Run, or even AITO's rapid sales increase (including pre-orders), all positioned NIO in an awkward situation. Li Bin candidly admitted that others had passed the prestigious university entrance exam, while NIO was still retaking it.

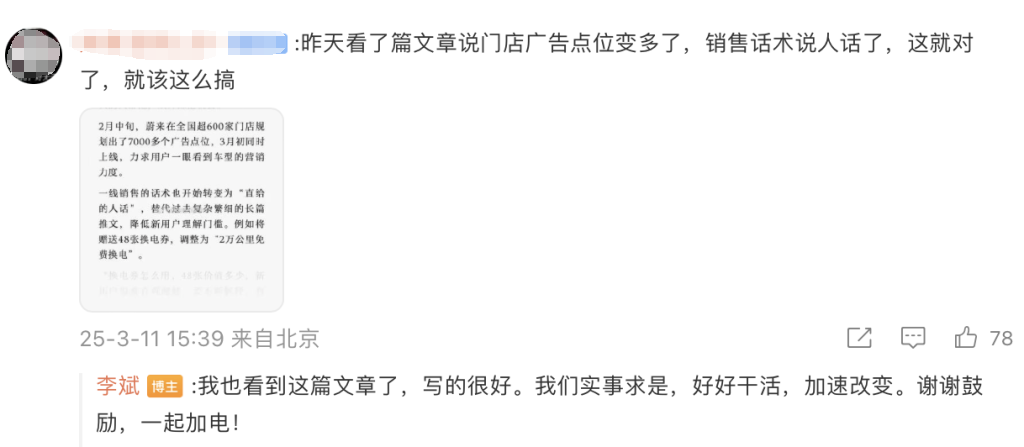

As negative feedback accelerated, Li Bin took decisive action. He first pinned an article by a departing employee, sending a clear signal to the outside world that 'every penny invested must produce a return.'

Subsequently, on March 23, a communication meeting was held, bolstering market confidence through various aspects such as operational cost reduction, profitability, and new product plans. NIO's share price surged by 17% in a single day.

From the dialogue, it is evident that Li Bin has accelerated NIO's profitability timeline, advancing from the initially set 2026 to this year's Q4. Physically, Li Bin is not the CEO out of touch with the front line, as rumored. He elaborated extensively on NIO's path to profitability, product planning, and its inherent strengths and advantages.

Interestingly, questions about 'Internet extra-curricular CEOs' seem to have been partially addressed. NIO and Li Bin are acutely aware of the problem's severity and have proposed solutions. Rationally, NIO still possesses considerable potential and uniqueness, such as its high market share in models priced above 300,000 yuan and its unique battery swapping service, which present significant barriers to some extent. However, NIO also faces numerous issues, including car sales, multi-brand compatibility, losses, and external competition. Contrary to external expectations, NIO is not developing haphazardly but making deliberate decisions after careful consideration.

NIO's transformation path is bound to be bumpy, and replicating Xpeng's success will require significant effort. Nonetheless, it is worth affirming that Li Bin is undoubtedly prepared.

NIO is stirring up a storm.

The pressure on NIO's public opinion is palpable, evident from Ledao's performance trend.

At the 2024 Guangzhou Auto Show, Ledao President Ai Tiecheng publicly stated that Ledao L60 would deliver over 10,000 units in December 2024, aim for 15,000 units in January-February 2025, and exceed 20,000 units in March. If these targets were not met, he would 'resign.' After an initial ramp-up, Ledao delivered over 10,000 units in December but then saw a downturn. According to public data, Ledao L60 delivered 5,912 units in January 2025, 4,049 units in February, and only 6,200 cumulative orders as of March 19, significantly short of the 20,000-unit target.

Public opinion criticism gradually intensified, encompassing management, product roadmap, finance, and competitors. 'Extra-curricular CEOs' almost listed NIO's problems one by one. These voices are not just external; a NIO salesperson said in a 36Kr report, 'Every day is fulfilling, but there's no time to sell cars.'

On February 25, accumulated emotions were ignited by a departing employee's message. According to reports, a departing NIO employee named 'Little Snail' posted a lengthy article on the internal NIO forum 'Speakout,' making ten suggestions and urging the company to swiftly transition from idealism to pragmatism, facing reality with a market-oriented approach.

Subsequently, Li Bin replied in real name in the comment section: 'Thank you for your suggestions. Enhancing everyone's operational awareness starts with me.' The comments were replete with harsh criticisms of NIO's current situation and even direct questioning of Li Bin.

This lengthy article was not only pinned in the popular section but also pushed to all employees through Feishu. A person close to NIO's management stated that Li Bin proactively pinned and pushed the article. 'He hopes to form a consensus and action. NIO must face challenges and accelerate change.'

Li Bin's actions actually began early, with accounting being the most notable feature. Since the beginning of the year, Li Bin has organized multiple internal meetings, emphasizing the situation's severity, reviewing work gains and losses, and requiring enhanced operational awareness. In terms of actions, implementing CBU (Customer Business Unit) assessment for the organization is a key point in NIO's current transformation.

In essence, CBU involves dividing the company's operational work into multiple 'basic operational units,' with each unit required to establish clear ROI (return on investment) indicators and performance reward and punishment systems. Practically, each department must separately settle costs, expenses, and upcoming costs. Compared to the previous 'budget system,' CBU represents finer granularity and improved management precision. As NIO insiders put it, 'the new mechanism requires that every penny invested must produce a return.'

Moreover, NIO's image seems to be undergoing a 180-degree transformation. A typical example is Li Bin's attitude towards subordinates using values to cover up operational issues during an internal report: 'Don't bullshit. Values are something to require of oneself. Don't use values to cover up poor operational performance. Why bring up values when talking about operations? What's the point?'

Another tangible indicator is Li Bin's consistent propaganda to the outside world that NIO will achieve profitability in the fourth quarter. In the dialogue, Li Bin candidly admitted, 'NIO's core task is to achieve profitability in the fourth quarter of this year. This year, NIO will successively deliver nine new products. By the fourth quarter, our sales service network and battery swapping station construction will also basically complete their phased layout. Under such circumstances, if we fail to achieve profitability as scheduled in the fourth quarter, it will be a severe test for the company's long-term development and business model. Therefore, we must achieve profitability in the fourth quarter.'

The method is determined, the goal is clear, and the founder is resolute. Although NIO is undergoing transformation, it has instilled strong confidence in the market. The secondary market feedback is evident, with a single-day increase of 17%. However, as people realize this change is a medium- to long-term project, NIO's share price gradually began to decline. From a broader perspective, perhaps today's high-profile transforming NIO is stirring up the largest-scale evolution among new energy vehicle manufacturers.

Abandoning the theory of quick victory and entering overtime.

From an external perspective, Li Bin's speech at NIO's 10th anniversary celebration in November 2024 marked a clear turning point. In public materials, at the end of this speech, Li Bin rarely mentioned, 'From the automotive industry's perspective, ten years is actually very short; those centennial enterprises are companies that have survived numerous crises and been screened out by the tide of history. Each company has very excellent aspects worth learning from.'

This differs markedly from NIO's previous preference for competing with traditional automakers. At the 2022 NIO Day, Li Bin claimed that the competition was against gasoline cars, and the internal goal for the next year was to surpass Lexus. Earlier, NIO claimed to surpass BMW in terms of experience.

The reason for this change is straightforward. NIO realizes that the balance between new energy and traditional automotive brands is shifting. 'Everyone has abandoned the theory of quick victory and turned to prepare for a more intense overtime game.'

Individuals with similar views are not uncommon among new forces. Xpeng's founder He Xiaopeng also stated in an interview that everyone thought he had gone from the ICU to the KTV, but that was not the case; he had only walked from the ICU bed to the door.

For new forces, they are confronting a 'positional war' head-on with mainstream automakers. Industry analysts have pointed out that 'when new forces step into the sphere of influence of mainstream automakers, their capabilities gradually level off. Relying on supply chain advantages, mainstream automakers will enter a counterattack moment without high-dimensional and low-dimensional distinctions.'

Returning to NIO itself, this overtime game seems more like an opportunity. First, looking back, NIO still occupies the mindset of a mid-to-high-end brand among new forces or even the entire new energy vehicle industry, with numerous models priced above 300,000 yuan, giving NIO a higher foothold. This market segment is BBA's core area from a market structure perspective. Compared to this, NIO is still performing relatively well among new forces.

Furthermore, whether it's battery swapping or Niuwu (NIO House), NIO has indeed achieved uniqueness and differentiation, earning a significant number of loyal fans.

However, NIO's early success also led to its organization expanding too rapidly. The industry consensus is that NIO is currently fighting too many battles simultaneously, from volume-oriented Ledao to the popularization of battery swapping, from the high-end flagship ET9 to the internationally aimed Firefly, as well as self-developed batteries, mobile phones, etc. These long battle lines have blurred NIO's focus and gradually made it lose direction. Being overwhelmed with battles has always made it challenging for NIO to concentrate its potential energy.

A typical example is the amplification of NIO's 'wasteful' procurement characteristics. On social platforms like Xiaohongshu, exaggerated figures such as a 300-yuan bottle of hand sanitizer, a 70,000-yuan chair, and a 40 million-yuan Niuwu cost, combined with huge losses and frequent financing, have caused NIO's brand image to plummet. However, from the recent responses of Li Bin and Qin Lihong, it is evident that these are merely amplified 'rumors.'

▲Image/NIO Niuwu

To halt the dissipation of this potential energy, what NIO must deliver is the profitability expectation for the fourth quarter. From Li Bin's logic, the macro perspective is clear: sales volume, gross margin, and expenses ultimately boil down to a simple accounting problem. Li Bin's explanation in the interview was even more concise, 'In terms of fourth-quarter sales volume, it can be expected that all new models will enter a steady state, and their sales volume can still be reasonably projected. In terms of gross margin, with cost reduction measures, the fourth quarter is also an opportune time to reflect. Cost control is the main challenge, and we must definitely reduce last year's expenses. In terms of research and development, we will remain stable, primarily reducing sales and management expenses.'

Despite numerous concerns, the next nine months can be described as a race against time for NIO. So, what are the key battles that need to be fought?

How to fight the key battles.

When Li Bin discussed his attitude towards extended-range vehicles, there was still a hint of 'dissatisfaction.'

'If you look at the past three years, large SUVs with extended range have sold particularly well. The logic is straightforward: China's tax system does not restrict the market from making extended-range or plug-in hybrid models larger. If it were a gasoline car, it would involve engine displacement and consumption tax issues. Making such a large displacement would make your consumption tax unrecoverable. But for extended-range vehicles, it's always a 1.5T displacement and only pays a small amount of consumption tax. The cars are getting bigger, and the layout of extended-range vehicles also requires larger cars.'

How to compete amidst the success of extended-range vehicles is a question that Li Bin must address. From a sales perspective, mid-to-high-end extended-range vehicles are currently NIO's primary competitors. According to the weekly chart, Lixiang and AITO significantly outpace NIO in sales, each occupying the new energy price bracket of 300,000 to 500,000 yuan. Despite NIO's numerous advantages, uncertainty remains. The new '5566' models and Ledao's large vehicles can mount a challenge to a certain extent. However, the foundation for success hinges on the breakthrough of one or more models.

From Li Bin's subsequent strategic moves, it seems he is confident in this competition. "At this year's Shanghai Auto Show, we will unveil a new vehicle that truly caters to the daily needs of Chinese large SUV users and leverages the full benefits of pure electric technology. It will also incorporate the advantages of our technological innovation and integration at NIO. Therefore, everyone can anticipate it with great excitement. I am highly confident in its sales potential."

Beyond the competition in extended-range vehicles, Li Bin emphasizes internal cost reduction, with the key seemingly lying in research and development. Observing NIO's public perception, it's widely believed that NIO would become profitable immediately if research and development ceased. Some media even claim that NIO's basic financial equation is: vehicle gross profit = management + marketing expenses, and loss = research and development expenses.

In Li Bin's response, the fruits of research and development are beginning to show. "NIO's self-developed chip can fully replace NVIDIA Thor and even surpasses it in certain aspects. It is the world's first automotive-grade 5-nanometer intelligent driving chip, boasting highly precise and advanced performance."

▲Photo/NIO's self-developed chip Shenji NX903

To some extent, NIO's ability to stage a comeback depends not only on strategic perseverance but also on the courage to confront internal challenges.

With the infusion of company-wide management awareness, from the "county-to-county connectivity" of battery swap stations to the granular breakdown of research and development expenses, and from supply chain transparency to the cost accounting of sales leads, NIO is redefining the logic of the automotive industry with internet-style precision management.

However, the market will not pause for NIO's narrative to unfold. Amidst the onslaught of extended-range SUVs and fierce competition from emerging players, NIO must achieve a triple leap within nine months: a substantial sales increase, a rebound in gross profit margins, and a halving of expenses. This is not only the ultimate test of Li Bin's "build a solid fort, fight a stubborn battle" strategy but also an extreme challenge to the ceiling of China's high-end new energy vehicle brands.

As the share price returns to rationality after a 17% surge, and as questions from "unofficial CEOs" gradually diminish, the outcome of this crucial race may hinge on the success or failure of each battle. Of course, in the realm of the new energy vehicle industry, there have never been a shortage of comeback stories. Whether NIO will be the next one remains to be seen.