BYD Receives Subsidies of 10.4 Billion Yuan, Accounting for 35% of Net Profit, Amid 21% Decline in Operating Cash Flow

![]() 03/31 2025

03/31 2025

![]() 695

695

Author: Cheng Rui

Produced by: Five Star Car Review

BYD (002594.SZ, 01211.HK), the world's largest new energy vehicle company, has unveiled its annual report for 2024, revealing a mixed bag of financial results.

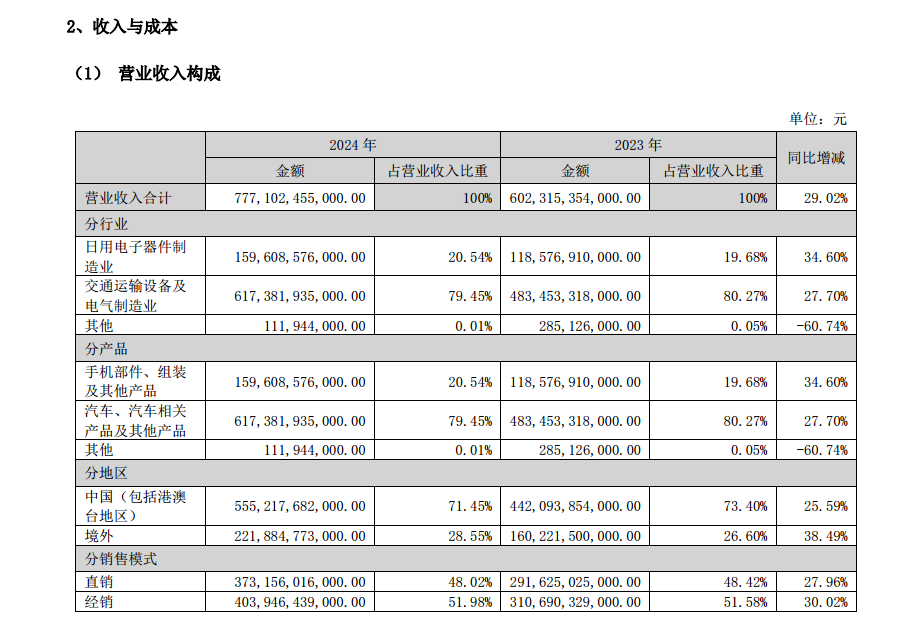

In 2024, BYD reported operating revenue of 777.102 billion yuan, marking a 29.02% year-on-year increase. Net profit stood at 40.254 billion yuan, up 34% from the previous year.

Notably, BYD's government subsidies accounted for a significant portion of its profits. In 2024, the company received 3.78 billion yuan in subsidies included in current profit and loss, a 72.84% increase from 2.187 billion yuan in 2023. Additionally, subsidies related to daily activities amounted to 10.406 billion yuan, a 125.28% jump from 4.619 billion yuan in the prior year.

Overall, BYD received subsidies totaling 14.186 billion yuan in 2024, accounting for roughly 35% of its net profit. This represents a net increase of 7.28 billion yuan, or about 108%, compared to the 6.806 billion yuan received in 2023.

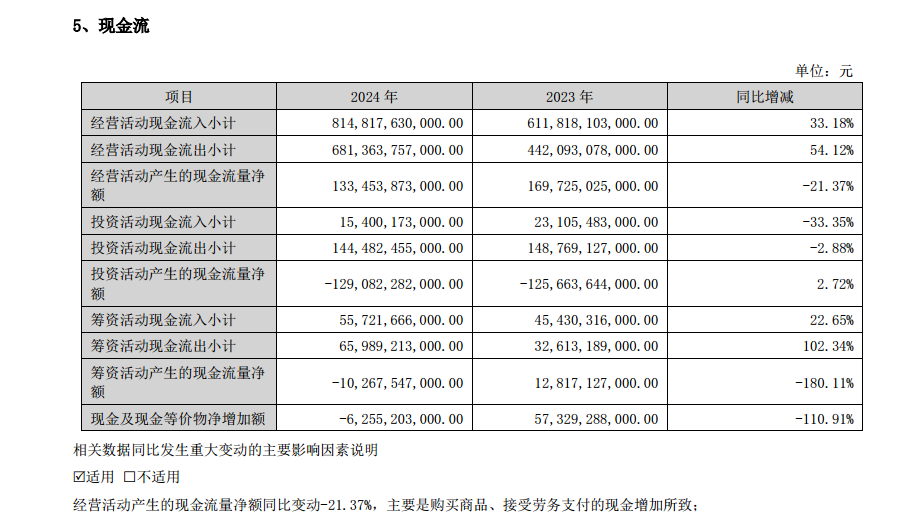

However, the company's cash flow from operating activities declined by more than 21%. Specifically, the net increase in cash and cash equivalents was -6.255 billion yuan, a stark contrast to the 5.733 billion yuan recorded in the same period last year. Net cash flow from operating activities was 133.454 billion yuan, a 21.37% decrease from 169.725 billion yuan in 2023.

Some industry insiders have expressed concerns about BYD's financial fundamentals, given these developments.

Recently, BYD released what it called its "strongest ever" annual report. Data showed that in 2024, the company achieved operating revenue of 777.102 billion yuan, up 29.02% year-on-year, with a net profit of 40.254 billion yuan, a 34% increase. Non-deducted net profit was 36.983 billion yuan, up 29.94%.

While news spread that BYD's 2024 revenue surpassed Tesla for the first time, this statement is somewhat misleading. Tesla's operating revenue in 2024 reached 97.69 billion dollars (equivalent to 710 billion yuan at the current exchange rate), indicating that BYD did surpass it in this regard. However, BYD's business encompasses not just automotive but also mobile phone components and assembly, secondary rechargeable batteries, and photovoltaic operations.

The 2024 annual report revealed that BYD's revenue from automotive, automotive-related products, and other product businesses was approximately 617.382 billion yuan, a 27.70% increase year-on-year, accounting for 79.45% of total revenue. Revenue from mobile phone components, assembly, and other product businesses amounted to 159.609 billion yuan, a 34.60% increase, accounting for 20.54% of total revenue. Other revenue totaled 112 million yuan, a 60.74% decrease, representing 0.01% of total revenue.

Tesla's business is divided into three main parts: automotive, energy and storage, and services and other businesses. In 2024, Tesla's automotive revenue was approximately 77.1 billion dollars, energy and storage revenue was 10.1 billion dollars, and services and other business revenue was 10.5 billion dollars.

While Tesla's focus is primarily on "automobiles," BYD's automotive business also includes "automotive and battery business." Thus, a simple comparison of "automobiles" versus "automobiles" does not accurately reflect BYD's overall revenue picture.

Objectively, BYD has outpaced Tesla in vehicle sales. In 2024, BYD sold 4.2721 million vehicles, a 41.26% increase year-on-year, compared to Tesla's 1.789 million vehicles, a 1.1% decrease.

It's worth noting that BYD's net profit growth exceeded its operating revenue growth, while non-deducted net profit growth was comparable to that of operating revenue. This is closely tied to the substantial government subsidies the company received.

In 2024, BYD's government subsidies included in current profit and loss (excluding subsidies closely tied to normal business operations) amounted to 3.78 billion yuan, a 72.84% increase from 2.187 billion yuan in 2023. Additionally, BYD received 10.406 billion yuan in subsidies related to daily activities, a 125.28% increase from 4.619 billion yuan in 2023.

Furthermore, BYD's request for suppliers to reduce prices could positively impact its profitability. In November 2024, an email circulated widely requesting a 10% price reduction from suppliers starting January 1, 2025, aimed at enhancing the competitiveness of BYD's passenger vehicles.

Despite robust growth in key operating data, BYD faces challenges. The negative net increase in cash and cash equivalents (-6.255 billion yuan) and the 21.37% decline in net cash flow from operating activities indicate potential financial pressures.

BYD attributed the decrease in cash flow primarily to increased cash payments for purchasing goods and accepting services. While this may reflect the company's growth and investment, it also highlights the need for careful financial management.

A negative net increase in cash and cash equivalents suggests that cash outflows exceeded inflows during the period, resulting in a net consumption of funds. This could be related to changes in operating, investment, or financing activities, indicating either short-term financial pressure or the phased nature of long-term development investments.

Moreover, BYD's short-term solvency indicators, with a current ratio of 0.75 and a quick ratio of 0.47, appear less optimistic. However, industry insiders caution that while these metrics may raise concerns, they do not conclusively indicate fundamental issues.

BYD's 2024 annual report details that cash payments for purchasing goods and accepting services amounted to 489.866 billion yuan, a 56.29% increase year-on-year. The company did not specify what these payments entailed or why they increased significantly.