Tesla's Q1 2025 Deliveries Likely to Miss Expectations, With Annual Growth Potentially Below 5%

![]() 03/31 2025

03/31 2025

![]() 694

694

Tesla, the world's most valuable automaker by market capitalization, is set to announce its first-quarter 2025 deliveries this week. Given varying degrees of sales declines in its key markets during the quarter, it is virtually certain that the company's overall deliveries will fall short of market expectations.

According to the consensus estimate of 27 sell-side analysts released by Tesla's Investor Relations department last Friday, Q1 2025 deliveries are anticipated to be 377,592 units, marking a year-on-year and quarter-on-quarter decline. This forecast not only falls significantly below Wall Street's previous projections but also represents Tesla's worst quarterly delivery performance since Q4 2022.

Of these deliveries, the company's mainstay models, the Model 3 and Model Y, collectively accounted for approximately 352,000 units, while deliveries of other models are expected to total 21,000 units.

For the full year 2025, Tesla's deliveries are forecasted at 1.851 million units, lower than the 2.04 million units projected by the Q4 2024 delivery consensus. Based on this estimate, the company's annual delivery growth rate will stand at a mere 3.5%.

In 2024, Tesla's deliveries dipped 1.1% year-on-year to 1.789 million units, marking the first decline in over a decade. During the Q3 2024 earnings call, Elon Musk anticipated delivery growth in 2025 to be between 20% and 30%. However, during the Q4 earnings call at the end of January this year, he merely mentioned that the company would return to a growth trajectory for the full year.

Tesla does not disclose delivery data for individual markets. According to data released by national automotive industry associations, sales in the company's major markets have continued to decline since 2025.

Data released last week by the European Automobile Manufacturers' Association revealed that Tesla's new car registrations in the European market in February declined by 40.1% year-on-year to 16,888 units.

In the first two months of this year, Tesla's new car registrations in Europe fell by 42.6% year-on-year to 26,619 units. Over the same period, electric vehicle sales in the overall EU market grew by nearly 30%. The market generally believes that Musk's involvement in European politics has adversely affected Tesla's sales in the region to a certain extent.

In 2024, the Chinese market surpassed the US as Tesla's largest single market. However, according to data from the Passenger Car Market Information Joint Meeting of the China Automobile Dealers Association, Tesla China's wholesale sales, encompassing domestic retail and exports, amounted to only 31,000 units in February, a year-on-year decline of nearly 50%.

In the first two months of this year, Tesla China's wholesale sales dropped by 28.7% year-on-year to 94,000 units, while the wholesale sales growth rate of China's new energy passenger vehicle market over the same period was 48%.

Amid intensified market competition, Tesla's share in China's new energy passenger vehicle market declined by 6.3 percentage points year-on-year to 5.3%, sliding from second place in the same period last year to fifth. Chinese manufacturers ahead of Tesla include BYD, Geely, Changan, and Chery.

Tesla is also facing challenges in its home market of the US. Data from the automotive industry information platform Marklines indicates that Tesla's sales in the US market fell by approximately 5% year-on-year to 42,000 units in February, marking the fourth consecutive month of decline.

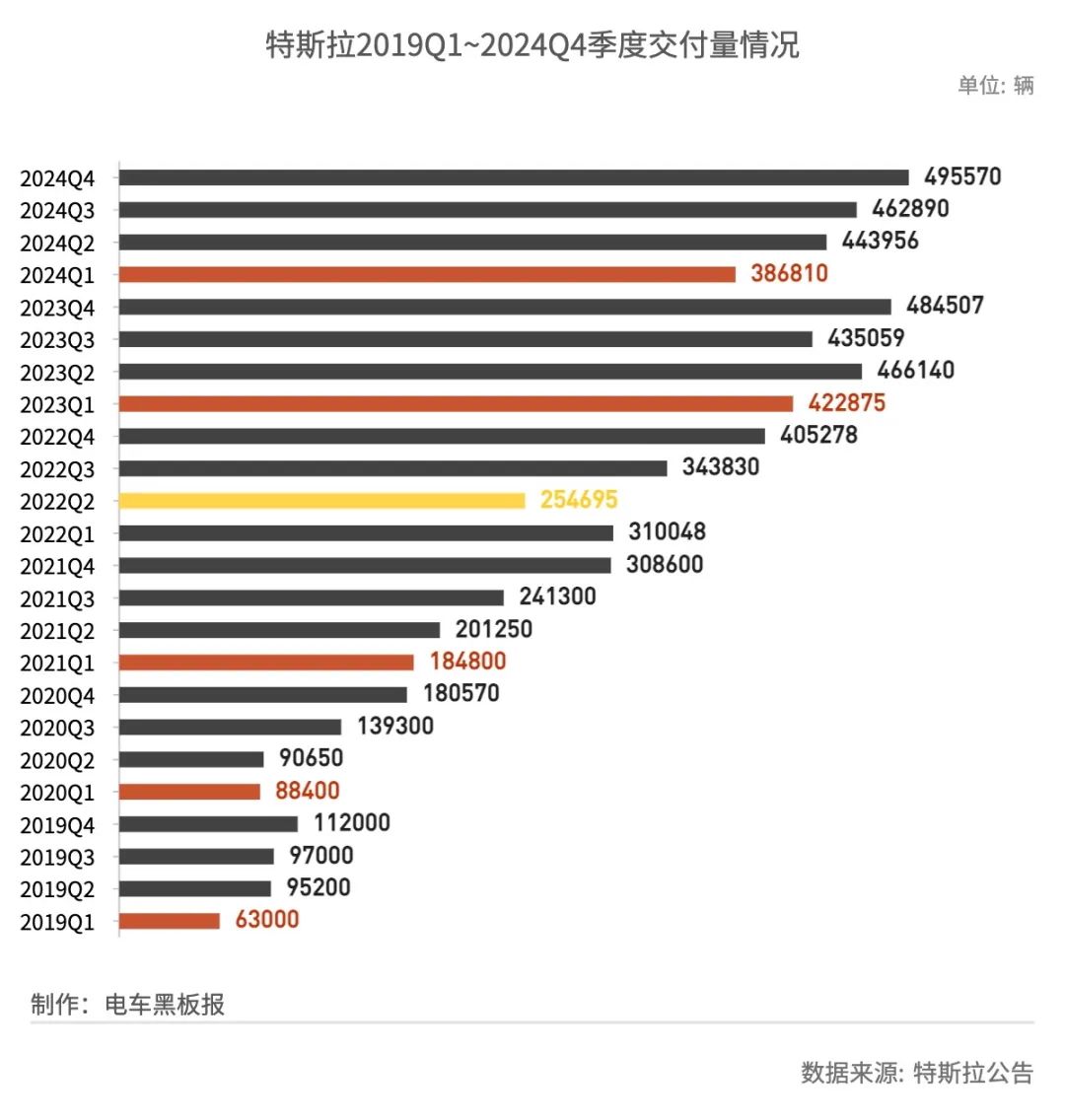

Historically, Tesla's first quarter following the year-end sales surge is typically the quarter with the lowest deliveries. Except for 2022, Tesla's Q1 deliveries since 2019 have consistently been the lowest among all quarters of the year.

Beyond seasonal factors and heightened market competition, Tesla's main delivery model, the Model Y, also impacted the company's overall sales after the launch of a refreshed version during this quarter.

In Q1, Tesla undertook large-scale factory renovations to produce the refreshed Model Y, which had a notable impact on vehicle production. Investment bank Baird previously issued a research report predicting that due to the production disruption, Model Y deliveries during the quarter would be approximately 300,000 units.

Concomitant with Tesla's declining sales, the company's stock price has also taken a hit. As of the close of US markets on March 28, Tesla shares fell 3.51% to $263.55, with a cumulative decline of nearly 35% year-to-date.

While major investment banks have been revising their price targets for Tesla downwards, some institutions remain optimistic about the company's prospects.

Cathie Wood, known as the "female Warren Buffett," recently reiterated her bullish stance on Tesla. She predicts that the company's stock price will reach $2,600 within the next five years, equivalent to nearly 10 times its current price, with the self-driving taxi Cybercab accounting for 90% of the company's value.

Last Friday, Tesla China announced that Cybercab will commence operations in Austin, Texas, in June this year.