BYD, Geely, and Chery: Who Reigns Supreme in Plug-in Hybrids?

![]() 04/14 2025

04/14 2025

![]() 490

490

After BYD's Han L and Tang L "made the world feel the pressure from Chinese technology," Geely and Chery have unveiled their significant moves.

On the evening of April 10, Geely's Galaxy Xingyao 8 officially opened for pre-sale with a minimum price of 139,800 yuan, not only targeting the market of BYD's Han DM-i but also being priced 70,000 yuan lower than Han L.

On the same day, Chery officially released its latest global hybrid technology, global hybrid technology standard declaration, and hybrid technology open source plan, announcing that it will introduce 39 hybrid models by 2025.

Among them, the flagship sedan Fengyun A9, the first to equip the Kunpeng Super Hybrid CDM 6.0, continued to accept blind reservations during Chery's "Hybrid Night." Fengyun A9 directly competes with BYD's Han L but at a much lower price.

Additionally, Chery announced that over 10 new energy vehicle models under the Jietu, Chery Fengyun, Xingtu, and iCAR brands will offer limited-time fixed prices, with the maximum price reduction exceeding 20,000 yuan.

To break BYD's dominance in the plug-in hybrid market, automakers are fiercely competing, driving down prices to unprecedented lows.

Can breaking BYD's dominance solely rely on price cuts?

In 2024, the market share of fuel vehicles (including oil-electric hybrids) fell below 55%. The share of plug-in hybrids (including extended-range) approached 19%, and compared to the 26.7% share of pure electric vehicles, the share of plug-in hybrids and pure electric vehicles in new energy vehicles has become increasingly close.

BYD, the largest player in the plug-in hybrid market, saw sales of its plug-in hybrid models rise from 946,000 units in 2022 to 2,485,000 units in 2024. In the past year, BYD's scale in the plug-in hybrid market far surpassed that of other automotive groups.

Three years ago, plug-in hybrids were not the main focus of mainstream automakers' new energy vehicle strategies. Taking Geely Auto as an example, in 2023, it caught up and focused on the hybrid route, launching the comprehensively upgraded Leishen hybrid series products and building the Galaxy series based on this technology, allowing Geely's plug-in hybrids to enter the mainstream 100,000-yuan market. In the same year, Chery launched the new energy product series "Fengyun," also targeting the mainstream price range.

Moreover, multiple mainstream automakers have achieved new milestones in plug-in hybrid technology, such as Great Wall's DHT hybrid and Changan's Blue Whale iDD hybrid. In 2024, domestic sales of plug-in hybrids (including extended-range) reached 4.47 million units, with BYD accounting for over 50% of the market share. In other words, BYD's dominant position in the plug-in hybrid market remains unchanged.

In terms of competing with BYD in the plug-in hybrid market, Geely and Chery have given similar answers—price cuts.

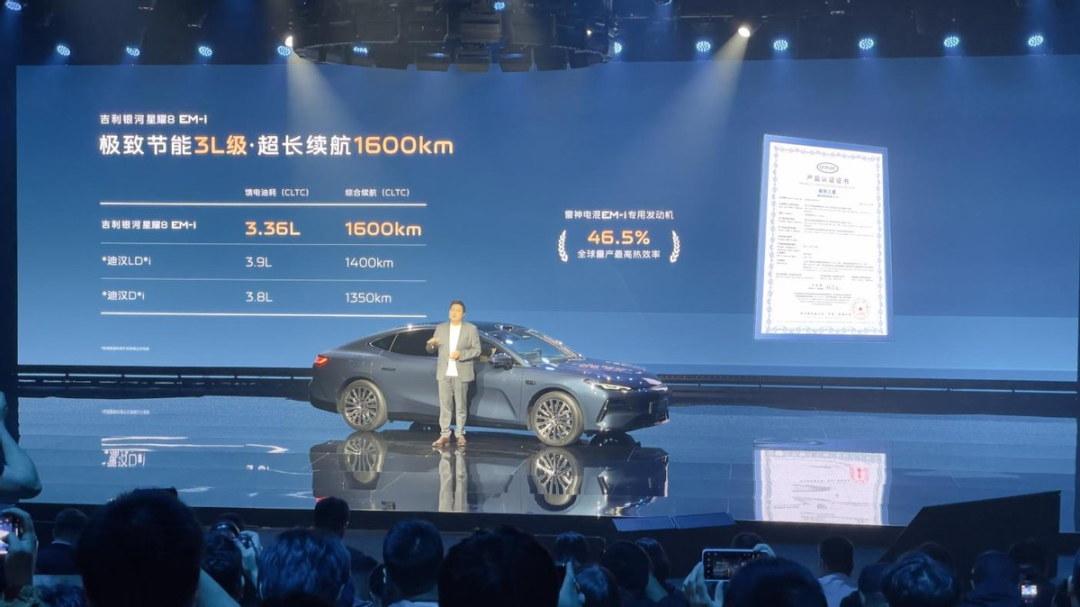

Taking the newly released Geely Galaxy Xingyao 8 as an example, based on the main parameters announced at the conference, the EM-i and EM-P hybrid systems of Galaxy Xingyao 8 outperform BYD's fifth-generation DM in terms of energy consumption and comprehensive range. Coupled with luxurious configurations and a price below 200,000 yuan, it is no longer in the same price bracket as BYD's Han.

Chery directly launched a "Global Hybrid Popularization Campaign," which, although unnamed, can be seen as a direct challenge to BYD.

More than 10 hybrid models, including Fengyun A8, T9, T10, Jietu Shanhai L6, L7, L9, T1, T2, icar 03, icar 03T, and Yaoguang C-DM, have witnessed significant price reductions, with an average reduction of 20,000 yuan and a maximum discount of 30,000 yuan.

Taking Fengyun A8 as an example, the starting price after the reduction is 89,900 yuan, slightly higher than its biggest competitor, BYD Qin PLUS DMi, by 10,000 yuan, but Fengyun A8 offers more space. Chery Fengyun T9, which competes with BYD Tang, starts at 119,900 yuan after trade-in, nearly 20,000 yuan less than the starting price of BYD Tang DM-i.

Who is the King of Plug-in Hybrids?

"Chery is the automaker with the earliest development of hybrid technology in China, the best hybrid technology, the fastest growth in the hybrid sector, and the most hybrid technology-equipped models," said Yin Tongyue, Party Secretary and Chairman of Chery Holding Group, at the conference. He added that a good hybrid requires perfect coordination of the engine, transmission, and motor control, which is why Chery independently develops engines, transmissions, and electronic control systems.

Chery stated that it has developed multiple technologies such as dedicated hybrid engines and 3-speed 11-speed DHT transmissions, leveraging its technological advantages in the internal combustion engine field.

In terms of the technical route of plug-in hybrids, BYD, Geely, and Chery each have their own focus. BYD and Geely use naturally aspirated engines, while Chery opts for turbocharging, balancing power and energy consumption. In terms of transmission structure, BYD prioritizes economy with a single-speed DHT simplifying the transmission path, while Geely and Chery achieve efficient power output across all scenarios through multi-speed DHT.

In simpler terms, Geely's EM-P and Chery's C-DM 3-speed DHT hybrid versions allow the engine to achieve direct drive across all scenarios. Due to their relatively complex structure, the cost is higher. Geely's EM-i, Chery's C-DM, and BYD's DM-i have more controllable costs due to their simpler structures. However, under conditions of battery depletion, power output will be significantly limited.

Furthermore, BYD has an advantage that other automakers cannot match—self-produced batteries, providing more room for cost reduction across its entire vehicle lineup. Thanks to its cost advantage, BYD can offer plug-in hybrids at the Qin PLUS's "798" price point and quickly occupy the market through low prices, thereby gaining significant influence.

When it comes to flagship models like Han L and Tang L, the powertrain is just a basic feature, not an added bonus. One of the biggest highlights of these two new cars is the support of the super e-platform, equipped with two "big weapons"—megawatt flash charging technology and a 30,000 RPM motor.

Both new cars are available in pure electric and plug-in hybrid versions, but the plug-in hybrid version cannot enjoy megawatt fast charging. The plug-in hybrid version is equipped with the fifth-generation DM-p hybrid technology and has upgraded the "full-speed wheel-end decoupling technology" to better balance energy consumption and performance.

Determining who will become the "King of Plug-in Hybrids" relies on more than just plug-in hybrid technology itself. Technical reserves are indeed crucial, but due to the absence of a perfect technical solution, automakers need to achieve the best product competitiveness through reasonable product definitions, thereby forming advantages in sales and scale.

Just as the once ridiculed "outdated technology" of extended range, Li Auto's success was not due to choosing extended range but to the popularity of extended range brought about by precise product positioning. BYD's success in the plug-in hybrid market is not because the plug-in hybrid technology itself is very advanced. Rather, it is through reducing costs that plug-in hybrids have gained an edge over fuel vehicles.

The same applies to Chery and Geely. When BYD is comprehensively ahead in user base, user perception, and influence, it is challenging for other automakers to shake BYD's position in the plug-in hybrid market solely through price wars.