EU May Scrap Tariffs on Chinese EVs, Introduce Minimum Pricing

![]() 04/14 2025

04/14 2025

![]() 653

653

Recent reports indicate that after imposing steep tariffs on Chinese-made electric vehicles (EVs) for several months, the European Union (EU) and China have agreed to explore setting a minimum price for Chinese EVs as an alternative to the tariffs imposed by the EU last year. As early as October 2024, when the EU hiked tariffs on Chinese EVs to 45.3%, both parties proposed eliminating tariffs through potential minimum price commitments (i.e., import car price commitments), with rumors circulating around a minimum price of 30,000 euros. However, no definitive agreement was reached at that time.

It's worth noting that the EU's policy of scrapping additional tariffs and introducing a minimum price for Chinese EV exports is still under discussion and has not been finalized. Yet, what prompted the EU and China to revisit this issue just a few months later? What are the potential impacts on both parties?

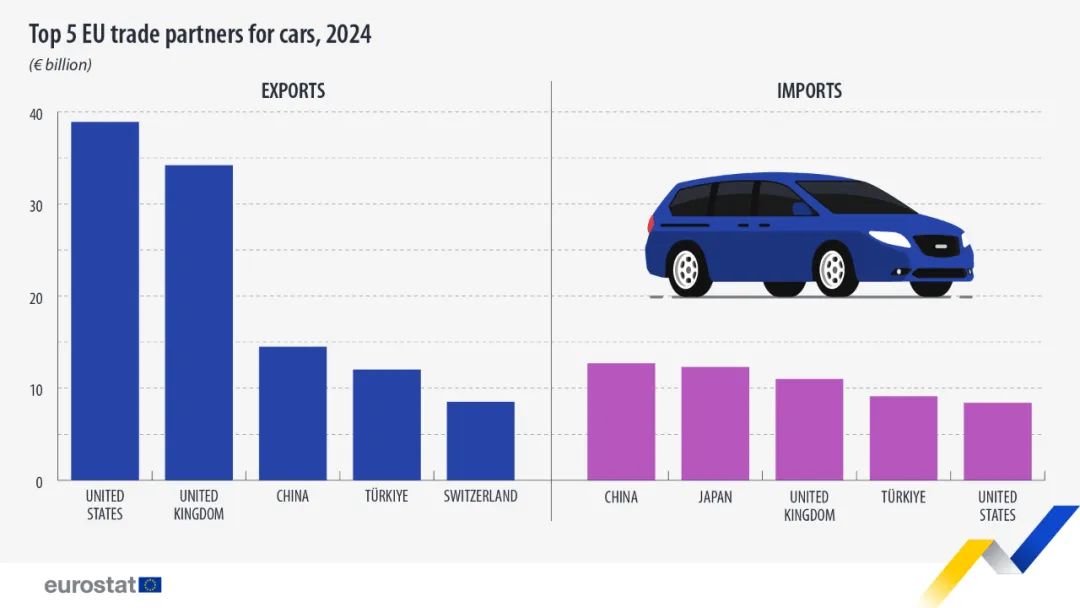

One significant factor is US President Trump's "Reciprocal Tariffs," which have escalated global trade uncertainty this month. The automobile industry, as a major player in international commodity trade, has borne the brunt. As discussed in our previous article, "Trump's Tariffs Pose Significant Impact on Global Auto Industry," in 2024, automotive OEMs headquartered in the EU not only produced nearly 830,000 vehicles in the United States but also exported around 760,000 new vehicles to the US, worth 38.9 billion euros ($43.3 billion). Notably, most of these exports were luxury and large vehicles.

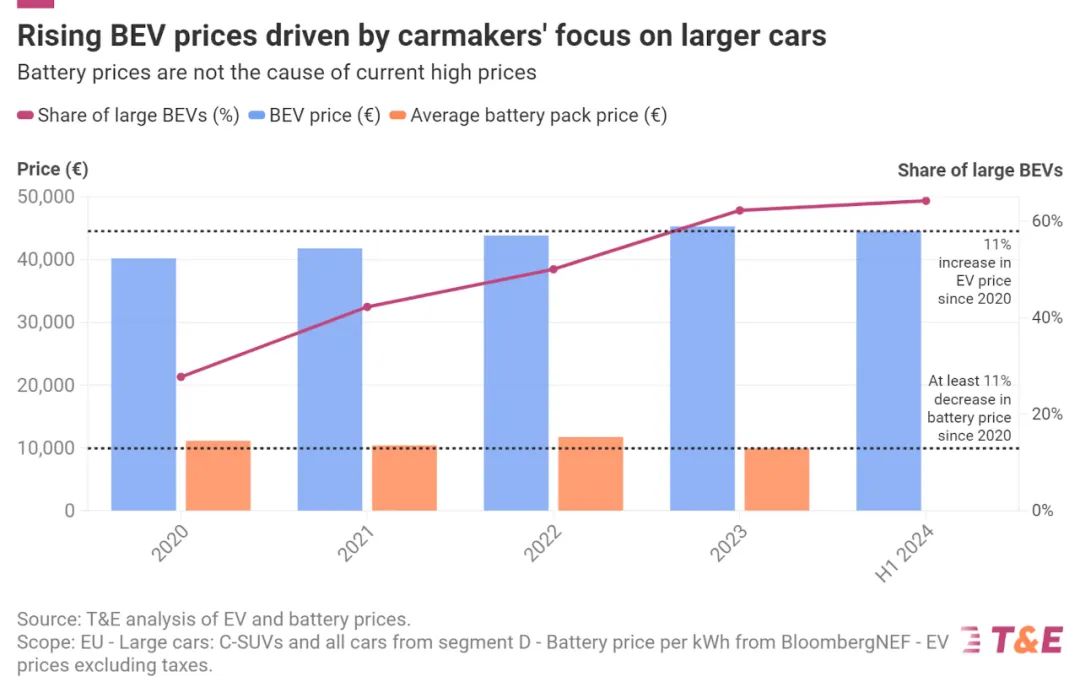

Despite President Trump's recent decision to suspend tariffs on dozens of countries for 90 days, the uncertainty remains, prompting stakeholders to explore multiple response strategies. Another consideration is the high price point of European EVs. According to Transport & Environment (T&E) analysis of EU car sales in 2024, the average selling price of EVs in the EU is approximately 45,000 euros (excluding taxes), predominantly for C-class SUVs and D-class and above models.

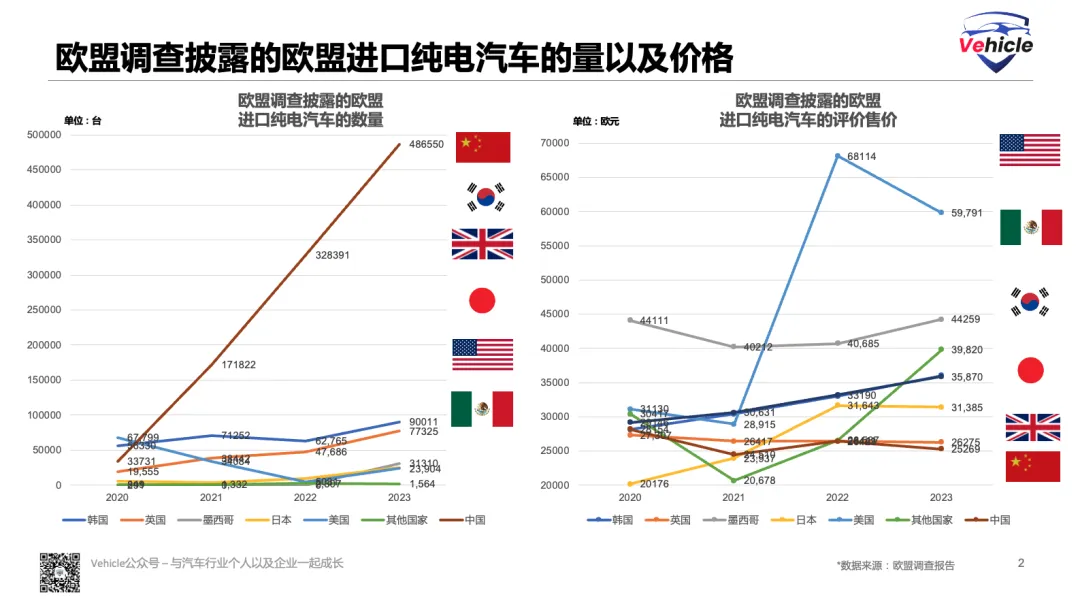

In contrast, most of the cheaper models (priced around 20,000 euros) under development are not expected to hit the market until 2025 at the earliest, with Volkswagen aiming for a 20,000-euro model by 2027. Chinese EVs, on the other hand, offer a more affordable option. As highlighted in our previous article, "Seeing from the EU Anti-Subsidy Investigation Report: Why the EU Imposes Tariffs on Chinese Cars Exported to Europe," China's EV exports to the EU exceed those of other countries combined, with an average price of only 25,000 euros—less than half of US prices and 10,000 euros lower than Japanese and Korean models.

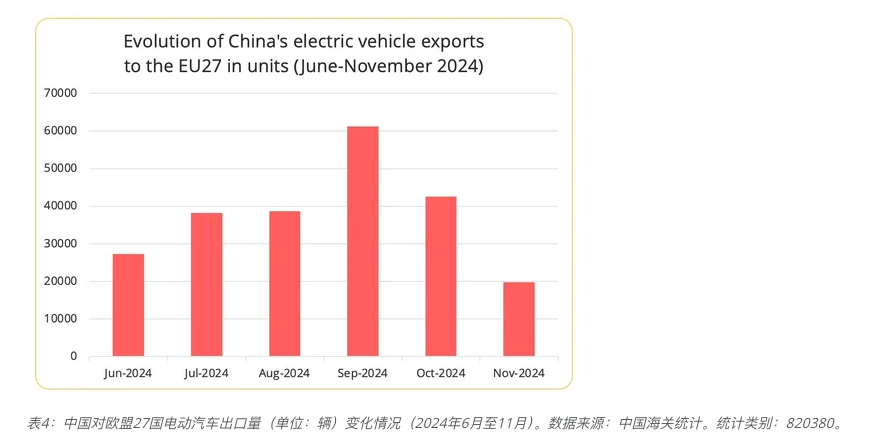

The influx of such inexpensive EVs into the EU market through trade poses a significant challenge to local automakers. Customs data reveals that while the EU's tariff policy initially impacted Chinese EV exports, over 50,000 battery-electric vehicles were shipped from China to the EU in January and February 2025. Moreover, sales of plug-in hybrid vehicles, unaffected by EU tariffs, surged by an astonishing 892% to 25,900 units during the same period, demonstrating the resilience of Chinese automotive exports.

In terms of impacts, raising trade tariffs is akin to economic warfare, fraught with risks. The EU's proposed policy of scrapping additional tariffs and introducing a minimum price for Chinese EV exports holds significant benefits for both the automotive industry and Sino-European trade. It allows Chinese EVs to enhance profitability and competitiveness through product improvements and better services, fostering healthy industry development. Simultaneously, European automakers benefit from healthy competition, accelerating the growth of local manufacturers. If successful, this policy could forge closer ties between China and Europe, paving the way for even more favorable bilateral automotive trade.

Reproduction and excerpts are strictly prohibited without permission. Join our knowledge platform to access a vast array of first-hand information in the automotive industry, including the materials referenced above.