Li Auto's Cautious Approach to Pure Electric Vehicles: Behind the Annual Target of 50,000 Units

![]() 04/15 2025

04/15 2025

![]() 579

579

New Energy Insights (ID: xinnengyuanqianzhan) Original

Full text: 2637 words, reading time: 6 minutes

This year could be aptly described as Li Auto's "year of pure electric" ambitions.

At the upcoming 2025 Shanghai Auto Show, Li Auto will unveil the upgraded version of its MEGA Ultra intelligent driving system and the MEGA Home family special edition. The previously announced Li Auto i8 is scheduled to hit the market in July, with the Li Auto i6 set to follow in the second half of the year.

With offerings such as the "best family MPV," mid-to-large SUVs, and "volume models," Li Auto logically should have high expectations for its pure electric sales this year. However, recent media reports revealed that out of Li Auto's announced annual sales target of 700,000 units for 2025, only 50,000 units are expected to come from pure electric models.

This disparity raises questions about why the usually confident Li Auto has suddenly taken a cautious stance towards pure electric vehicles.

Behind this conservative approach, which diverges sharply from Li Auto's past style, could lie the failure of last year's Li Auto MEGA sales, which even resulted in a class action lawsuit. Additionally, the simultaneous launch of many new cars during the same period has intensified competition, with Xiaomi YU7 posing the most significant pressure on Li Auto. Models like AITO M8, Tesla Model Y, Zeekr X, EXEED Star Century ES, and even revamped models from NIO and Xpeng have all brought considerable pressure to this veteran in the extended-range technology route and newcomer in the pure electric field.

1. Conservative Li Auto Pure Electric Strategy

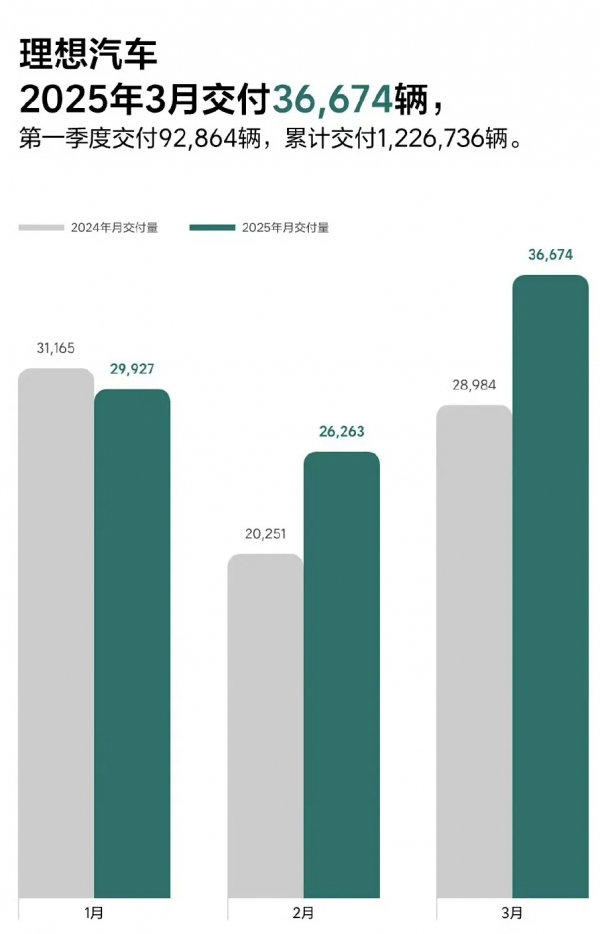

On April 1, Li Auto announced its March sales, reporting 36,674 units sold, a 26.5% increase year-on-year. Although it didn't top the new car brand sales chart, it remained firmly in the top three.

Image/Li Auto March 2025 sales

Source/Screenshot from New Energy Insights

In the first quarter of 2025, Li Auto delivered a total of 92,864 new vehicles, aligning with the first-quarter sales guidance of 88,000 to 93,000 units provided in the previous financial report. The results are commendable.

However, despite being a leading new-energy brand, Li Auto has become more timid when facing the pure electric market.

On the one hand, there have been repeated delays in the launch of pure electric products. On the other hand, after finally confirming the launch date of the pure electric i8, media reports revealed an annual sales target of only 50,000 units for pure electric models, clearly showcasing Li Auto's conservatism.

Especially when compared to early 2024, when Li Auto boldly proclaimed that its first pure electric MPV, the Li Auto MEGA, would sell 8,000 units per month, it's evident that Li Auto's "courage" has significantly diminished.

Subjectively, the failure of the Li Auto MEGA may have left Li Auto with "sequelae" in the pure electric field.

Image/Li Auto MEGA

Source/Screenshot from New Energy Insights

This experience has taught Li Auto that promoting pure electric models requires a more precise market entry point and a more flexible product strategy. If it continues to follow the "big single product" approach of the extended-range era, the pure electric target may suffer a similar fate.

From a more objective perspective, Li Auto's conservative strategy stems from its profound vigilance towards the risks of the pure electric market.

After all, Li Auto's core user group is dominated by extended-range models, and most of these consumers choose extended-range technology due to range anxiety, with low overlap with the needs of pure electric users.

On social media platforms, among the reasons why consumers choose to buy Li Auto vehicles, one of the most frequently mentioned is "the charm of extended range."

An owner who purchased the Li Auto L9 in March 2024 mentioned, "There is much controversy online about extended range. Some say its technology is outdated, while others see it as just a refrigerator, TV, and sofa. But I believe that the only way to know if a car is good is to drive it. There is no perfect car; only the one that suits you is the best car."

Image/Li Auto L9

Source/Screenshot from New Energy Insights

The owner also frankly said, "Driving at 120 km/h on the highway, Li Auto seems to cost more than a gasoline car. So if the only goal is to save money, then buying a pure electric car is a better choice."

Li Auto understands user psychology well. Based on this, the conservative pure electric strategy is both a reluctant move and a strategic buffer – by reducing the proportion of pure electric sales, Li Auto aims to gain more time for technology accumulation, market research, and user education while coping with the uncertainties of the pure electric track.

2. Surrounded in a Red Ocean Market

Li Auto's competition in the pure electric market stems not only from the failure of the internal Li Auto MEGA and the differences in the current consumer group profile but also from the harsh external competitive environment.

The Chinese new energy vehicle market has entered the "red ocean" stage, with the pure electric market being particularly "fiercely competitive".

Whether it's early entrants like Tesla, Xpeng, and NIO occupying a first-mover advantage or technology giants like Xiaomi and Huawei entering the market, every player is intensifying competition.

Tesla firmly holds the top spot in the pure electric market with its leading three-electric technology and autonomous driving system. Xpeng has shaped a "technological" brand image through its all-domain 800V high-voltage platform and city NGP function. NIO has established a differentiated advantage through its battery swapping model and user service system...

Image/Tesla FSD - Xpeng 800V High-Voltage Platform - NIO 4.0 Battery Swapping Station

Source/Screenshot from New Energy Insights

These "competitors" have already formed a certain moat in terms of core technology and brand influence in the pure electric market. As a latecomer, Li Auto still needs to make further efforts in areas such as batteries, electric drives, and electric controls.

Although Li Auto has increased its R&D investment in recent years, its pure electric models are still regarded by some consumers as "accessories of extended-range technology" and lack independent technology labels.

Cross-border entrants require even more vigilance from Li Auto.

Xiaomi SU7 targets the 200,000-300,000 yuan price range, which is precisely the target market for Li Auto's pure electric models. Huawei and multiple automakers have created automotive brands that quickly capture user mindshare through HarmonyOS intelligent cockpits and intelligent driving systems.

Image/Xiaomi SU7

Source/Screenshot from New Energy Insights

If new car brands bring more product-focused sieges to Li Auto, then cross-border players are also disrupting traditional automotive logic from an internet perspective, forming a "dimensionality reduction attack" on Li Auto.

3. Li Auto Needs a Comprehensive Strategy to Break the Impasse

"Internal and external troubles" are the root causes of Li Auto's cautious approach to its pure electric strategy.

However, new energy vehicles or pure electric models are an irreversible trend. To continue leading among new car brands, Li Auto must adopt a multi-dimensional strategy to achieve a transformation from "hopping on one leg" to "walking on two legs".

Reversing users' inherent perception of Li Auto's insufficient "three-electric" technology strength has become the key to breaking through.

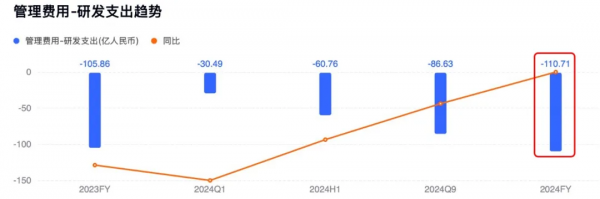

In fact, Li Auto has never been stingy with its investment in R&D. In 2024 alone, Li Auto's R&D expenses reached 11.1 billion yuan, an increase of 4.6% year-on-year, accounting for 7.7% of revenue.

Image/Li Auto's 2024 R&D expenses

Source/Screenshot from New Energy Insights

In the field of three-electric technology, Li Auto is also continuously making layouts. For example, since 2021, Li Auto has initiated an independent R&D project for automotive operating systems; jointly developed the industry's first mass-produced 5C ultra-fast charging battery with CATL; and assisted Sunwoda in the construction and operation of battery PACK production lines in Jiangsu.

Li Xiang, Chairman and CEO of Li Auto, also mentioned at the 1 millionth vehicle offline ceremony, "Since its inception, Li Auto has always regarded 'in-house technology development of core technologies' as an important cornerstone for the company's development."

However, for users, supply chain or technology investments are somewhat "irrelevant," and what users care more about is whether automakers can better alleviate range anxiety and refueling anxiety.

According to official data from Li Auto, its 5C ultra-fast charging network has begun to take shape. In 2025, Li Auto plans to achieve over 90% coverage of national highway trunk line mileage and over 90% coverage of core urban areas in tier 1-3 cities.

Image/Li Auto's 2000th supercharging station About to be connected

Source/Screenshot from New Energy Insights

In addition, Li Auto is continuously expanding its charging network and exploring energy models that combine gasoline-electric hybrid and ultra-fast charging to alleviate users' range anxiety.

If technology is the foundation for breaking through, then covering more target groups is another major challenge for Li Auto in its breakthrough battle. When the "family user" label becomes a double-edged sword, Li Auto urgently needs to break down barriers between different groups.

Industry insiders have pointed out that both Li Auto's extended-range powertrain and its announced pure electric models still give people the impression of being aimed at family users. "Perhaps Li Auto can learn from BYD's 'Dynasty + Ocean Dual Strategy' and launch sports car models targeting young users, intelligent cabin models for the business market, and even layout the micro-electric vehicle segment market."

The aforementioned industry insiders further stated that by covering users in more price bands through a differentiated product mix, "Li Auto can not only consolidate its basic market with the L series but also open up the Z-generation market with youthful designs and even tap into the business travel scenario with intelligent cabin technology."

Currently, it is not easy for Li Auto to find a second sales growth curve beyond its extended-range powertrain models, and facing the brutal competition in the pure electric track has become something that must be done.

Fortunately, although Li Auto is still a "newcomer" in the pure electric field, it already has a certain first-mover advantage in the current most fiercely competitive field of intelligent driving.

On March 18, based on a large amount of data accumulation, Li Auto took the lead in releasing the autonomous driving architecture MindVLA large robot model. With the ability to "understand, see, and find," Li Auto transforms the car from a mere transportation tool into a caring full-time driver.

Image/Li Auto MindVLA large robot model

Source/Screenshot from New Energy Insights

In the life-and-death race on the pure electric track, Li Auto needs to not only dispel doubts with core technology but also open up a broader market through product diversification, realizing the evolution from a "mobile home" to a "full-scenario technology carrier".