BMW Sales Plummet in Q1, Hit Hard by China Market Decline

![]() 04/15 2025

04/15 2025

![]() 966

966

Recently, BMW Group released its sales figures for the first quarter of 2025. According to the data, from January to March, BMW Group delivered a total of 586,149 vehicles globally, marking a slight year-on-year decrease of 1.4%. Notably, the Chinese and German markets are the only two where BMW has experienced a setback globally. Specifically, in the Chinese market, BMW delivered 155,195 vehicles in Q1 2025, a significant year-on-year decline of 17.2%, making it the market with the largest drop in BMW's global sales.

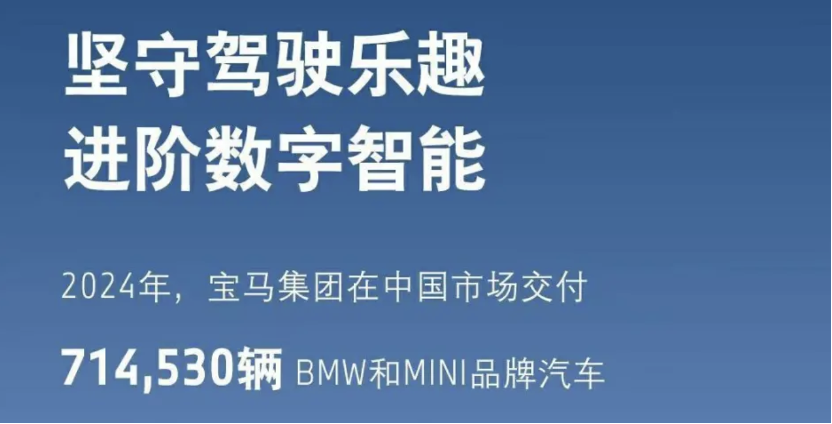

It's worth mentioning that this is not the first time BMW has faced a sales decline in China. As early as 2022, BMW sold approximately 792,000 vehicles in the Chinese market, recording a year-on-year decrease of 6.4%. After a brief rebound in 2023, sales in China fell dramatically by 13.4% to 714,500 units in 2024, making BMW the luxury brand with the largest decline among BBA (BMW, Benz, Audi).

The current Chinese auto market is witnessing an intense "price war," with major automakers resorting to direct price cuts to capture market share. BMW is no exception. According to multiple 4S dealerships, the entry-level 5 Series model, the 525Li M Sport Package, has seen its price drop to as low as 293,000 yuan when financed, representing a discount of nearly 150,000 yuan from the official guidance price of 439,900 yuan. Compared to prices three years ago, this represents a significant reduction. Data indicates that in Q1 2025, the average price reduction for new energy vehicles in China was 12%, while for fuel vehicles, it was 10.1%. However, BMW's price cuts typically exceeded 20%, with some models even approaching 50%, far surpassing industry standards. For dealers, these price cuts translate into losses as they promote sales for the manufacturer. The higher the sales, the greater the losses incurred. Conversely, not selling makes it impossible to meet sales targets, and the costs associated with stores, personnel, and other aspects become unsustainable. Faced with substantial losses, many dealers have been forced to exit the market. Over the past year, numerous BMW dealerships have closed, including the BMW 5S store Xingdebao.

Behind BMW's willingness to sacrifice dealer profits through price cuts lies the profound transformation of the Chinese auto market. In recent years, the electrification of automobiles has emerged as an irreversible trend in the Chinese market, with several local automakers growing significantly by riding the wave of new energy. Among them, autonomous brands like Geely's Zeekr and Great Wall's WEY have continued to make breakthroughs, fully impacting the high-end market and posing a significant challenge to BMW. Simultaneously, new force brands such as Li Auto, Wenjie, and NIO are already positioned as high-end luxury, and their rapid rise has further compressed BMW's market space.

Under the strong influence of local new energy vehicle companies, BMW's electric transition pace is noticeably lagging. Industry insiders point out that there is a "technological intergenerational gap" between BMW's existing products and independent competitors. Data reveals that BMW's pure electric models sold in China account for only 15% of total sales, and main models like the iX3 and i3 are still based on modified fuel vehicle platforms, with endurance and smart cabin performance trailing far behind local competitors. Moreover, while Huawei's ADS 3.0 has achieved mass production of advanced city intelligent driving on domestic competitive models, BMW's main models are still stuck at basic L2-level assisted driving, lacking the ability to integrate localized intelligent ecosystems. This industry insider noted: "This technological gap has caused BMW to degenerate from a 'driving machine' to an 'electric antique' in the eyes of young consumers."

Intensified competition and the challenge of electric transition have caused BMW to lose the momentum of sales growth in the transformation of the Chinese auto market. However, to better adapt to the Chinese market, BMW is constantly making adjustments. In 2025, BMW will officially launch its new Neue Klasse platform architecture and plans to introduce 10 new heavyweight models. In addition to the already launched new BMW X3 long-wheelbase version, the new BMW M235L four-door coupe, and new-generation models will also be introduced to consumers. Furthermore, BMW recently announced its collaboration with Huawei. It is understood that BMW will deeply integrate with the HarmonyOS ecosystem in China and launch digital services including BMW Digital Key, HUAWEI HiCar, and MyBMW App, developing more diverse smart applications and functions based on HarmonyOS NEXT. Notably, the BMW Digital Key function developed on HarmonyOS NEXT will be available within the year, and the deeply integrated HUAWEI HiCar will be first equipped on locally produced BMW new-generation models in 2026. Apart from Huawei, BMW has also partnered with Alibaba Group. The two parties will jointly develop an intelligent cockpit system based on Alibaba's Tongyi large model technology, planning to first equip it on BMW's new-generation models produced in China in 2026.

Clearly, BMW is striving to address its weaknesses. However, even if it gains an "entry ticket" in the field of intelligence, it doesn't mean there are no challenges ahead. After all, the once prestigious luxury brand has gradually lost its allure, and its electric products have even become "no-name brands" in the eyes of consumers. Breaking consumers' ingrained impressions has become a formidable challenge that BMW must face. Against this backdrop, it remains to be seen whether BMW's new models can help reverse its decline.

(Images sourced from the internet, remove if infringing)