Sustaining Zero-Running's Momentum: Navigating Challenges for Continued Growth

![]() 04/27 2025

04/27 2025

![]() 624

624

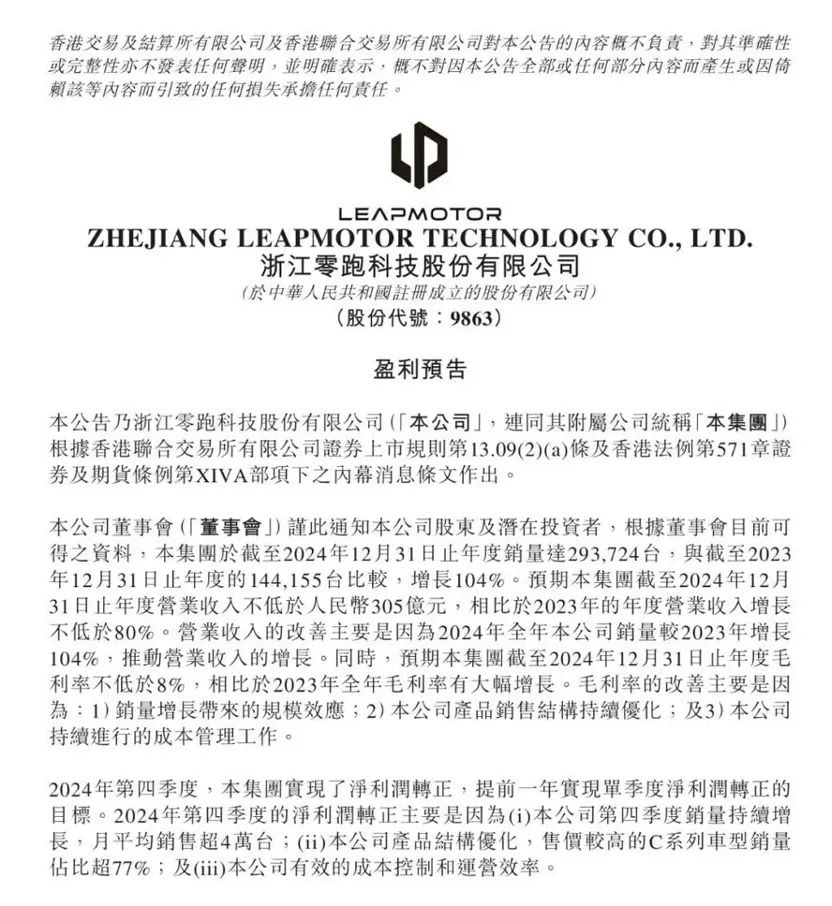

Currently, Zero-Running stands as one of the most successful automakers in the industry. In 2024, the company's sales skyrocketed, with a total of 293,724 vehicles delivered throughout the year—a year-on-year doubling that positioned it third among new-energy vehicle manufacturers. For most of 2024, Zero-Running consistently ranked among the top three, with monthly sales peaking at over 40,000 vehicles.

Since the beginning of this year, Zero-Running has demonstrated increasing prowess and resilience. In March alone, it delivered 37,095 new vehicles, securing the monthly sales crown among new-energy vehicle makers. This robust market performance has also translated into exceptional financial results. Official financial reports indicate that in 2024, annual revenue reached 32.164 billion yuan, marking a 92.06% year-on-year increase. In the fourth quarter, Zero-Running achieved a single-quarter profit of 80 million yuan with a gross margin of 13.3%, becoming only the second new-energy vehicle maker to attain quarterly profitability. Due to its stellar performance, Zero-Running has garnered significant favor from major banks. In JPMorgan's recent report on the preference ranking of Chinese automotive stocks, Zero-Running ranked second, trailing only BYD. In terms of sales, financial reports, and external evaluations, Zero-Running's future appears exceptionally bright. However, within the industry, the surging Zero-Running still faces notable challenges.

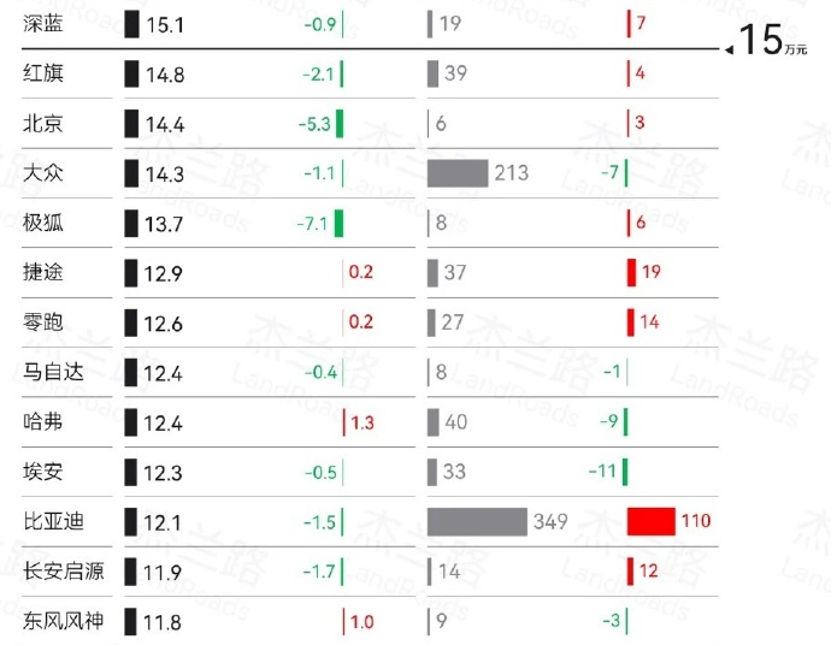

The reason is straightforward: while Zero-Running's sales figures are impressive, its actual revenue does not mirror this success. Horizontally comparing, in 2024, Thalys' revenue amounted to 145.176 billion yuan, topping the list among new-energy vehicle makers, closely followed by Lixiang with 144.5 billion yuan. Even NIO and XPeng, whose sales were lower than Zero-Running's, reported revenues of 65.73 billion yuan and 40.87 billion yuan, respectively. Zero-Running's annual revenue stood at merely 32.164 billion yuan. Simply put, Zero-Running's commitment to a cost-effective strategy is the direct cause of its relatively low revenue. Data from professional consulting firm JLR on the average transaction price per vehicle in China's passenger vehicle market in 2024 reveals that AITO's average transaction price was as high as 402,000 yuan, while NIO and Lixiang's both exceeded 300,000 yuan. XPeng's average transaction price, though slightly lower, still reached 178,000 yuan. In contrast, Zero-Running's average transaction price per vehicle was only 126,000 yuan, slightly surpassing BYD's.

Currently, Zero-Running's lineup includes the T series, C series, and S series. Analyzing the sales composition in 2024, of the nearly 300,000 vehicles delivered, the Zero-Running T03 contributed nearly 70,000 vehicles. The C series, priced between 130,000 and 210,000 yuan, sold a cumulative total of 230,000 vehicles. Additionally, public data indicates that in 2024, the Zero-Running C11 led sales, accounting for nearly 30% of the total, while the Zero-Running C10 also contributed more than a quarter of sales. Public opinion suggests that Zero-Running, with its focus on a cost-effective strategy, is deeply entrenched in the fiercely competitive mass consumer market. The intensifying market competition poses a challenge to Zero-Running's cost-effective strategy for acquiring customers. It is undeniable that Zero-Running has garnered recognition from an increasing number of consumers with its high cost-performance strategy and agile product definition capabilities, positioning itself as a leading enterprise in the sales rankings of new-energy vehicle makers.

However, it is crucial to note that competition in the mass consumer market has intensified over the past two years. Amidst escalating price wars, traditional automakers like Changan, Chery, and Geely have increased their investment in technology, stacking configurations and parameters, resulting in a continuous influx of new automotive products that balance product quality and cost-effectiveness. Currently, the market is flooded with small cars starting at 68,800 yuan (Xingyuan), compact SUVs starting at 119,800 yuan (Song PLUS), mid-size SUVs starting at 119,900 yuan (Deep Blue S07), mid-size sedans starting at 114,900 yuan (Deep Blue SL03), and large sedans starting at 140,800 yuan (Yinhe E8). It is certain that in the future, Zero-Running's products will encounter more competitors, presenting additional challenges on the path to sustained growth.

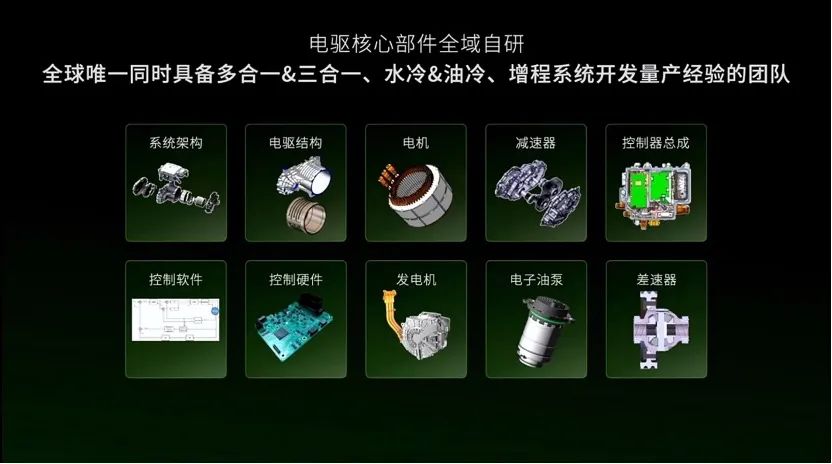

At the end of 2024, Zero-Running disclosed that it had achieved self-development and manufacturing of core components accounting for over 60% of the total vehicle cost, encompassing new energy vehicle architecture, electronic and electrical architecture, battery systems, electric drive systems, intelligent cockpit systems, intelligent driving systems, and other core technologies. However, Zero-Running's raw material costs accounted for more than 90% of its total costs in 2024. Data reveals that in 2024, raw material expenses amounted to 27.22 billion yuan, comprising 92.4% of total costs, with the raw material cost per vehicle reduced to 93,000 yuan, equivalent to 86% of the selling price. Some analysts point out that there is diminishing room for Zero-Running to further compress costs, making scale an essential strategy for cost reduction.

It is reported that Zero-Running's newly released LEAP3.5 architecture significantly reduces the vehicle wiring harness length to 996 meters, decreases the number of ECUs throughout the vehicle to 22, and integrates the thermal management module into 27 in one, thereby reducing the number of components by 60% and energy consumption by 10%. Furthermore, Zero-Running's C10, C11, and C16 are all built on the same platform, with a shared component ratio of up to 80% or more for each model. The B series models are expected to achieve an 88% component sharing rate. In the future, increasing sales and achieving economies of scale will serve as the foundation for Zero-Running to maintain its price competitiveness. (Images sourced from the internet, remove upon infringement)