Asian Auto Market | Indonesia March 2025: The Ascendancy of Chinese Brands

![]() 04/27 2025

04/27 2025

![]() 660

660

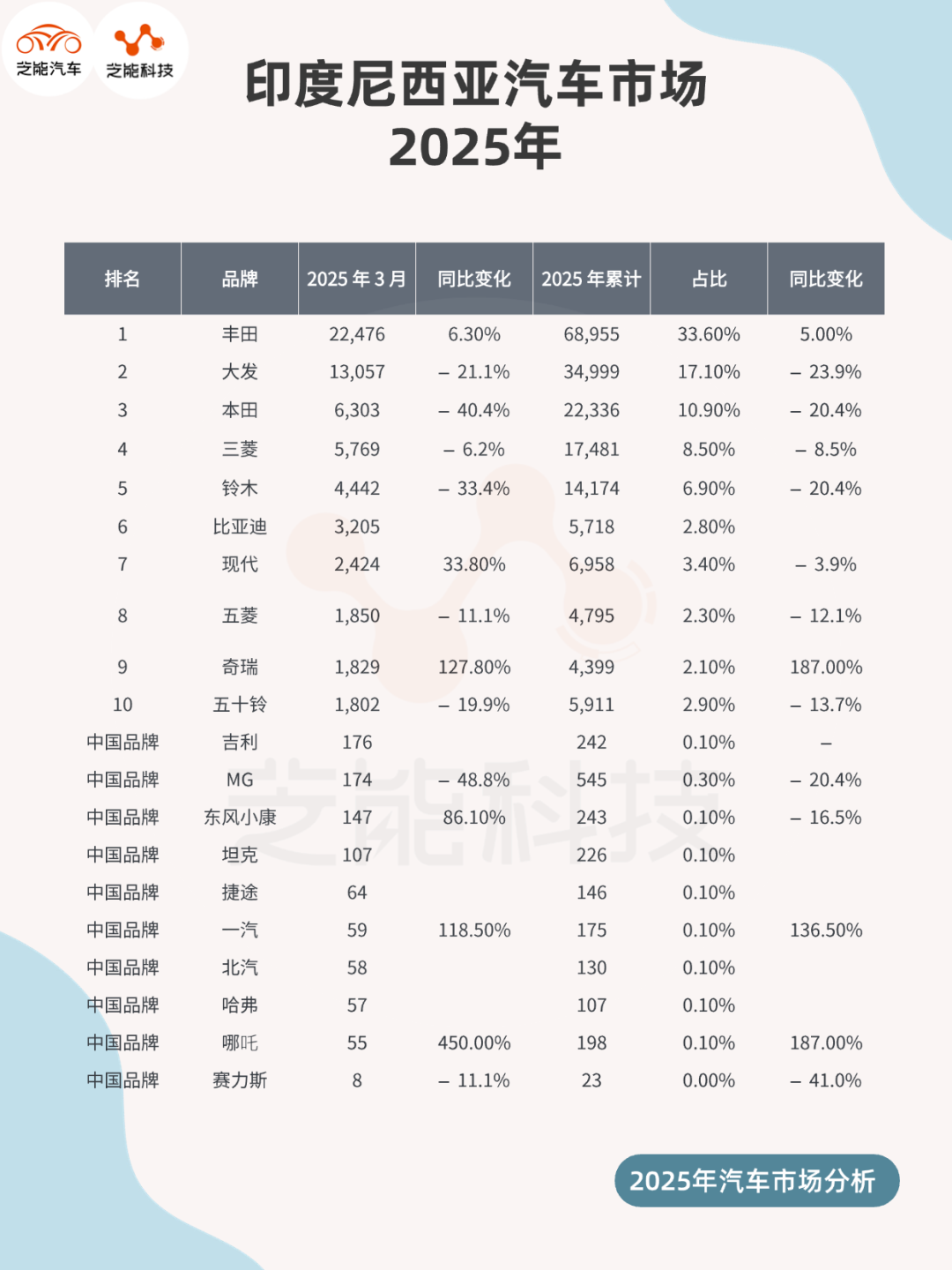

In March 2025, Indonesia's new car market continued its downward trajectory, with wholesale sales declining 5.1% year-on-year to 70,892 units and retail sales falling 6.7% to 76,582 units. This downturn was driven by Indonesia's economic slowdown and weakened consumer sentiment.

Toyota maintained its market leadership, yet Chinese brands shone brightly. BYD achieved a record-high market share of 4.5%, and Denza D9 ranked among the top 10 best-selling models. Brands like Chery and Geely also recorded significant growth.

New energy vehicle (NEV) models swiftly gained market share in the MPV and SUV segments, signaling a growing acceptance of electrification among Indonesian consumers.

01

Indonesian Market Sales Overview:

Powertrain Differentiation and Brand Performance

In March 2025, Indonesia's new car market logged wholesale sales of 70,892 units, a 5.1% year-on-year decrease, with cumulative sales of 205,160 units in the first quarter, down 4.6%. Retail sales stood at 76,582 units, a 6.7% year-on-year drop and an 8.8% year-to-date decline.

The overall market downturn was primarily attributed to the slowdown in macroeconomic growth, declining consumer purchasing power, and the high base effect from 2024.

● Powertrains:

- Traditional Internal Combustion Engine (ICE) Vehicles: Still dominated, accounting for approximately 85% of wholesale sales but down about 10% year-on-year.

- Hybrid and Pure Electric Vehicles (NEV): Accounted for around 12% of total sales, up approximately 30% year-on-year, primarily due to the electrification of the MPV and compact SUV segments.

- Plug-in Hybrid Electric Vehicles (PHEV) and Battery Electric Vehicles (BEV): Each contributed half of NEV sales, with BEVs growing particularly rapidly, up around 50% year-on-year, reflecting the accelerating acceptance of electrification in the Indonesian market.

● Brand Performance:

- Toyota: Remained the wholesale sales leader with 22,476 units (31.7% market share), up 6.3% year-on-year, thanks to robust demand for MPV models like the Kijang Innova and Avanza.

- Daihatsu: Ranked second with 13,057 units (18.4%) but experienced a 21.1% decline.

- Honda: Ranked third with 6,303 units (8.9%) but saw a 40.4% drop, indicating pressure on Japanese brands in the low-end market.

- Mitsubishi: Declined 6.2% to 5,769 units (8.1%).

- Suzuki: Fell 33.4% to 4,442 units (6.3%).

● Chinese Brands:

- BYD: Surged to sixth place with 3,205 units (4.5% share), a record high and a significant year-on-year increase.

- Chery: Sold 1,829 units (2.6%), up 127.8% year-on-year, ranking ninth.

- Denza: Sold 1,587 units (2.2%), ranking twelfth and entering the mainstream brand sequence for the first time.

- Geely: Sold 176 units (0.2%), ranking eighteenth, showing initial market penetration.

- Other Chinese Brands: Tank (107 units), Haval (57 units), Beijing Auto (58 units), Jettour (64 units), and Neta (55 units) all achieved positive growth, despite smaller sales volumes.

● Retail Rankings:

- Toyota: Maintained the top spot with 24,514 units (32%), followed by Daihatsu (13,111 units, 17.1%) and Honda (8,165 units, 10.7%), all experiencing significant year-on-year declines.

- Chinese Brands: BYD (2,870 units, 3.7%), Denza (1,801 units, 2.4%), and Chery (1,521 units, 2%) ranked sixth, eleventh, and thirteenth, respectively, with Geely (103 units) ranking twenty-third, indicating the rapid rise of Chinese brands in the end market.

02

Model Sales and Competitive Landscape:

Breakthrough of Chinese Brand NEVs

In March 2025, Indonesia's model sales rankings underscored the breakthrough of Chinese brands in the NEV field.

- Toyota Kijang Innova: Led with 5,353 units (7.6%), up 15.4% year-on-year, consolidating its dominance in the MPV market.

- Toyota Avanza: Followed with 5,069 units (7.2%), up 33.6% year-on-year.

- Daihatsu Sigra: Ranked third with 4,309 units (6.1%), but experienced a double-digit decline.

- Honda Brio: Ranked fourth with 4,000 units (5.6%), also seeing a double-digit drop.

- Daihatsu Gran Max Pikap: Ranked fifth with 3,727 units (5.3%), declining similarly.

Outstanding Performance of Chinese Brand Models

- Denza D9: Entered the top 10 for the first time, ranking tenth with 1,587 units (2.2%), up 13 places from February, indicating strong demand for high-end MPVs.

- BYD M6: Ranked thirteenth with 1,293 units (1.8%).

- BYD Sealion 7: Ranked fourteenth with 1,182 units (1.7%).

- BYD Atto 3: Ranked forty-first with 388 units (0.5%).

- BYD Dolphin: Ranked sixty-fourth with 108 units (0.2%), highlighting BYD's diversified layout in the electric MPV and SUV markets.

- Chery iCar: Ranked twenty-second with 987 units (1.4%).

- Chery Tiggo 8: Ranked forty-third with 355 units (0.5%).

- Chery Tiggo Cross: Ranked forty-fourth with 308 units (0.4%), demonstrating its competitiveness in the compact electric SUV segment.

- Aion Hyptec: Ranked twenty-fifth with 886 units (1.2%).

- Geely EX5 Max: Ranked fifty-fifth with 176 units (0.2%), indicating that GAC and Geely's NEV models are gradually gaining market recognition.

● Competitive Landscape:

Indonesia's market exhibits a transitional characteristic with both traditional ICE vehicles and NEVs coexisting.

- Toyota and Daihatsu: Dominate with their brand heritage in MPVs and pickup trucks, but the increasing penetration of NEVs is reshaping the market landscape.

- BYD: Successfully attracts young consumers who value technology and environmental protection by targeting the mid-to-high-end MPV and SUV segments with electric vehicle models like the M6 and Sealion 7.

- Denza D9: Entered the high-end MPV market with a luxurious positioning, directly challenging traditional fuel models like the Toyota Alphard.

- Chery: Caters to the needs of urban families with compact electric SUVs like the iCar, offering a significant price advantage.

- Japanese Brands: Have been slower to respond to the transition to NEVs, with Honda and Suzuki's electric models yet to gain scale. While Hyundai (2,424 units, 3.4%) has made breakthroughs in electric SUVs (such as the Ioniq 5 and Ioniq 6), its market share still lags behind BYD.

The focus of market competition is shifting from price wars to technology and brand differentiation. Chinese brands are swiftly eroding the low-end and mid-range market share of Japanese and Korean brands, leveraging their advantages in electrification, intelligence, and localized production.

However, the high-end market is still dominated by Toyota, Lexus, and BMW, and Chinese brands need to further enhance brand awareness and after-sales service networks.

Summary

Chi Energy Technology believes that the March 2025 data from Indonesia's automotive market underscores the robust rise and immense potential of Chinese brands in the NEV field. BYD, Denza, and Chery have successfully breached the barriers of Japanese and Korean brands through differentiated products and price advantages. The rapid penetration of NEV models has injected new vitality into the market. However, sluggish demand and fierce competition in the Indonesian market also pose challenges, and Chinese brands must continuously optimize localized production, improve after-sales networks, and enhance brand awareness.