Asia Auto Market | Malaysia March 2025: Battery Electric Vehicles Shine Brightly!

![]() 04/28 2025

04/28 2025

![]() 575

575

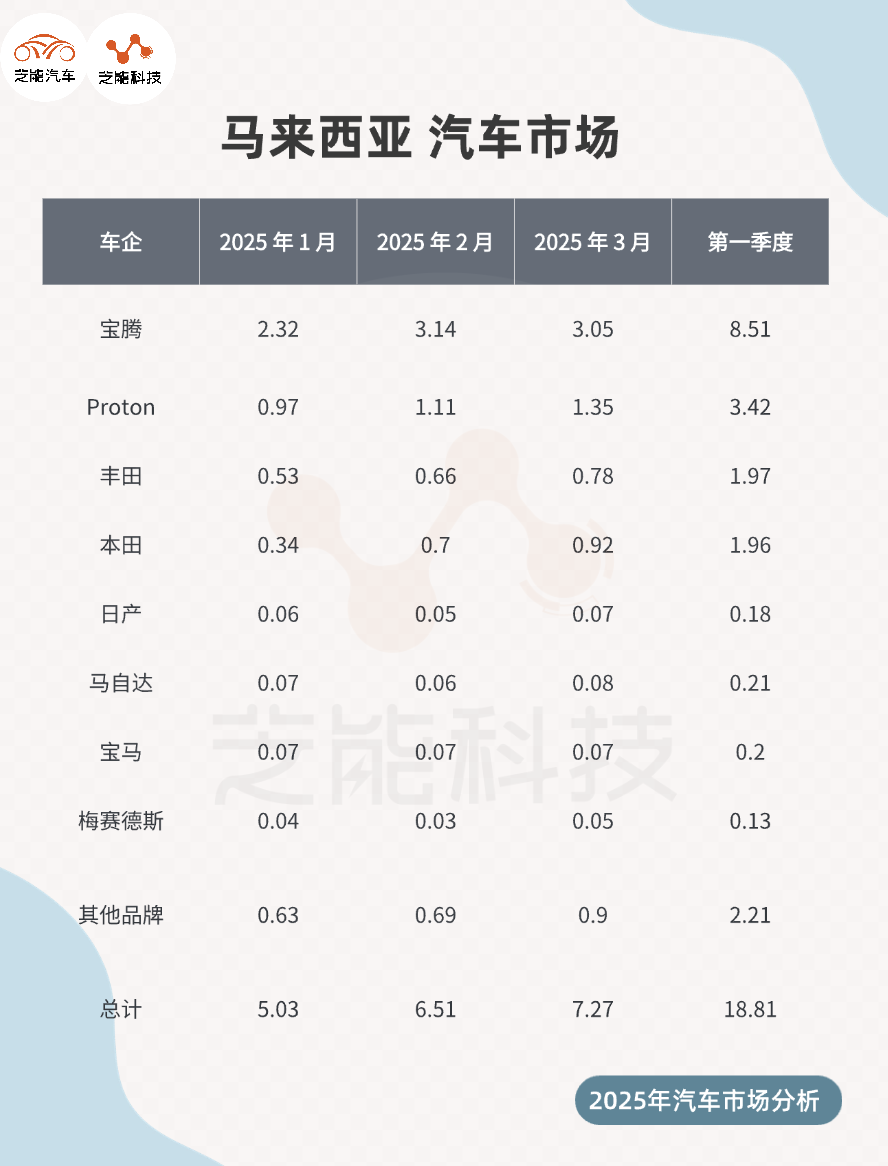

The Malaysian Automobile Association (MAA) reports that new car sales in Malaysia reached 72,704 units in March 2025, marking a 2% increase year-on-year and a 12% jump month-on-month, fueled by Hari Raya promotions and dealer discounts.

However, Total Industry Volume (TIV) for the first quarter of 2025 dipped by 7.4% year-on-year to 188,122 units, attributed to waning consumer confidence and a reduction in order backlogs.

Sales of battery electric vehicles (BEVs) surged by 46%, with Chinese brands BYD and Proton's e.MAS7 leading the charge. While Perodua maintained its market leadership, sales of UMW Toyota and Proton declined, and the commercial vehicle market witnessed a significant contraction.

Looking ahead to 2025, the market is anticipated to retract to 750,000 units.

01

Overview of Car Sales and Brand Performance

Malaysia's new car market exhibited short-term vitality in March 2025, yet the overall sales decline in the first quarter signaled a market correction trend. The following analysis delves into three aspects: overall sales, powertrains, and brand performance.

MAA data reveals that new car sales hit 72,704 units in March 2025, up 2% year-on-year and 12% month-on-month. For the first quarter, TIV stood at 188,122 units, a 7.4% year-on-year decrease from 203,137 units in the same period in 2024, indicating a rational regression from the post-pandemic rebound seen in 2024, which hit a record high of 816,747 units.

Passenger car sales dominated, totaling 176,470 units, down 5% year-on-year. Commercial vehicle sales plummeted by 33% to 11,652 units, largely due to the cancellation of diesel subsidies in June 2024, which dampened demand for pickup trucks and other segments.

In stark contrast, BEVs shone brightly, with sales reaching 6,827 units in the first quarter, a 46% year-on-year surge, driven by the strong performance of Chinese brands BYD and Proton's newly launched e.MAS7.

Brand Performance

Perodua continued to reign supreme, with domestic registrations reaching 85,091 units in the first quarter, accounting for 45.2% of TIV. Demand remained robust for entry-level models such as the Bezza, Axia, and Myvi.

While specific March sales data were not disclosed, Perodua's total sales for 2024 reached 358,102 units, an 8% year-on-year increase, solidifying its position in the economy segment. By leveraging tax incentives and low-price strategies, Perodua has firmly captured the hearts of the B40 and M40 income groups.

Proton's global sales in the first quarter dipped by 10.3% to 35,068 units, commanding a market share of around 18.6%. Sales of the flagship Saga model fell by 14% to 15,775 units, while the X50 (5,117 units) and S70 (4,465 units) ranked second and third, respectively. The newly launched e.MAS7 BEV sold 1,853 units, marking Proton's initial success in its electrification journey. Proton plans to expand exports to North Africa through its CKD plant in Egypt, with export volumes expected to rise in 2025.

UMW Toyota's sales in the first quarter declined by 15% to 19,944 units, securing a market share of about 10.6%. While demand for models like the Corolla Cross and Vios remained stable, it failed to offset the overall market weakness.

BYD, as a beacon for Chinese brands, stood out in the BEV market. Specific sales figures were not disclosed, but models like the Atto 3 contributed to the 46% year-on-year increase in BEV sales in the first quarter.

Other Chinese brands such as Chery (4,493 units sold in 2024) and GWM (2,128 units sold in 2024) are competitive in the SUV market, though specific 2025 data is currently unavailable.

The ascendancy of Chinese brands in Malaysia is primarily evident in the electric vehicle sector.

BYD swiftly captured market share in the BEV segment with models like the Atto 3 and a tax-free import policy.

Proton's e.MAS7, a locally produced gem based on Geely technology, is priced from RM120,000, targeting the low-to-mid-end market. Its sales of 1,853 units in the first quarter indicate strong market acceptance.

While Chery and Great Wall Motor have made strides in the fuel and hybrid SUV markets, their sales volumes still trail behind Perodua and Proton. Chinese brands will continue to expand their influence in 2025 through price advantages and electrified products.

02

Analysis of Market Competition Landscape in Malaysia

Perodua dominates the A-segment and B-segment markets with its low-price strategy and tax incentives. Models like the Bezza and Axia, priced below RM100,000, accurately target the B40 and M40 groups.

Despite not launching any new models in 2024, Perodua still achieved an 8% year-on-year increase, showcasing brand loyalty and channel advantages. In 2025, Perodua plans to launch its first BEV, priced below RM100,000, which will further solidify its position in the electrified market. However, profit margin pressures and the lack of high-end models may hinder its upward trajectory.

Proton ventured into the BEV market with the e.MAS7, leveraging Geely technology for local production and offering competitive pricing. Although sales of traditional models like the Saga declined, the launch of the e.MAS7 underscores Proton's commitment to transforming towards new energy vehicles.

The commissioning of the CKD plant in Egypt has breathed new life into Proton's export strategy, but short-term sales declines and rising production costs may impact profitability. Proton must strike a balance between fuel vehicles and electric vehicles to navigate market competition effectively.

Chinese brands such as BYD and Chery are rapidly penetrating the market with electric vehicles and SUV products. BYD's tax-free policy and robust charging infrastructure (3,171 charging stations nationwide as of September 2024) give it a head start.

UMW Toyota and Honda (85,273 units sold in 2024) are grappling with declining sales and a lagging electrification transformation. Japanese brands rely heavily on traditional models like the Corolla Cross but lack low-priced BEV products, which could lead to market share erosion in the future.

Commercial vehicle sales took a nosedive, plummeting by 33%, impacted by the cancellation of diesel subsidies and expectations of adjustments to RON95 fuel subsidies. Sluggish demand for pickup trucks has adversely affected Mitsubishi (21,719 units sold in 2024) and Isuzu (6,847 units sold in 2024).

In 2025, the government may introduce a two-tier fuel pricing system, with the B40 and M40 groups still receiving subsidies, which could mitigate the potential impact on Perodua and Proton.

Summary

Malaysia's automotive market witnessed a 2% year-on-year increase in March 2025, bolstered by Hari Raya promotions. However, TIV for the first quarter declined by 7.4%, suggesting that full-year sales will retract to 750,000 units. Perodua maintained its market leadership with its low-price strategy and 85,091 registrations, while Proton's e.MAS7 and BYD drove a 46% year-on-year surge in BEV sales. UMW Toyota and the commercial vehicle market struggled to keep pace.