Asian Auto Market | Philippines March 2025: Commercial Vehicles Surge, Passenger Vehicles Retreat

![]() 04/29 2025

04/29 2025

![]() 793

793

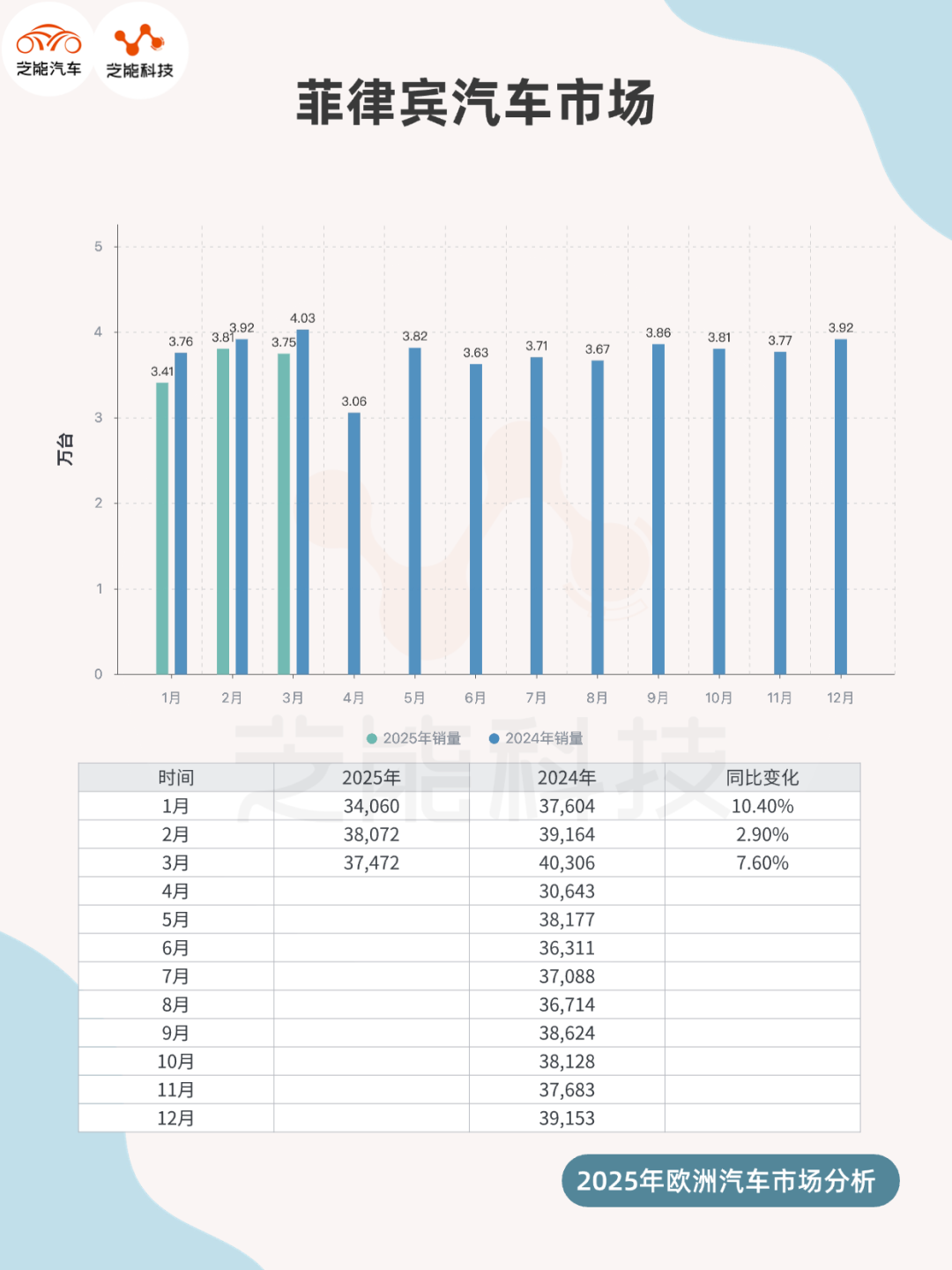

According to the latest data from the Chamber of Automotive Manufacturers of the Philippines (CAMPI) and Truck Manufacturers Association (TMA) for March 2025, automotive sales in the Philippines witnessed a 7.6% year-on-year increase, totaling 40,306 units.

Commercial vehicles emerged as the primary growth engine, surging 16.5%, while passenger vehicle sales declined by 16.6%, indicative of a shift in consumer preferences towards vehicles with higher ground clearance.

The new energy vehicle market shone brightly, with electric vehicle sales comprising 5.73% of the total market, fueled by the government's zero-tariff policy. Toyota retains its market leadership, while Chinese brands stealthily deploy their strategies through competitive pricing and product diversification.

01

Sales Overview, Powertrain & Brand Performance

In March 2025, total auto sales in the Philippines reached 40,306 units, marking a 7.6% year-on-year increase. Cumulative sales for the first quarter stood at 117,074 units, up 6.8% year-on-year.

● Sales Overview

◎ Commercial vehicles stood out with 31,857 units sold in March (up 16.5% year-on-year) and 92,742 units sold in the first quarter (up 13.9% year-on-year), accounting for 79.2% of total sales. Light commercial vehicles grew by 18.2% to 23,754 units, multi-purpose vehicles (AUVs) increased by 9.9% to 7,057 units, and light trucks and buses surged by 40% to 626 units.

◎ The passenger vehicle market languished, with sales of only 8,449 units in March (down 16.6% year-on-year) and 24,332 units in the first quarter (down 13.7%). Natural disasters towards the end of 2024 prompted consumers to favor SUVs and pickup trucks, thereby suppressing demand for traditional passenger vehicles. The new energy vehicle market emerged as a bright spot.

● Powertrain

In March, 1,895 electric-driven vehicles were sold, with cumulative sales of 5,311 units in the first quarter, capturing a 5.73% market share. Among them:

◎ 4,554 hybrid electric vehicles (HEV) were sold;

◎ 692 battery electric vehicles (BEV) were sold;

◎ 75 plug-in hybrid electric vehicles (PHEV) were sold.

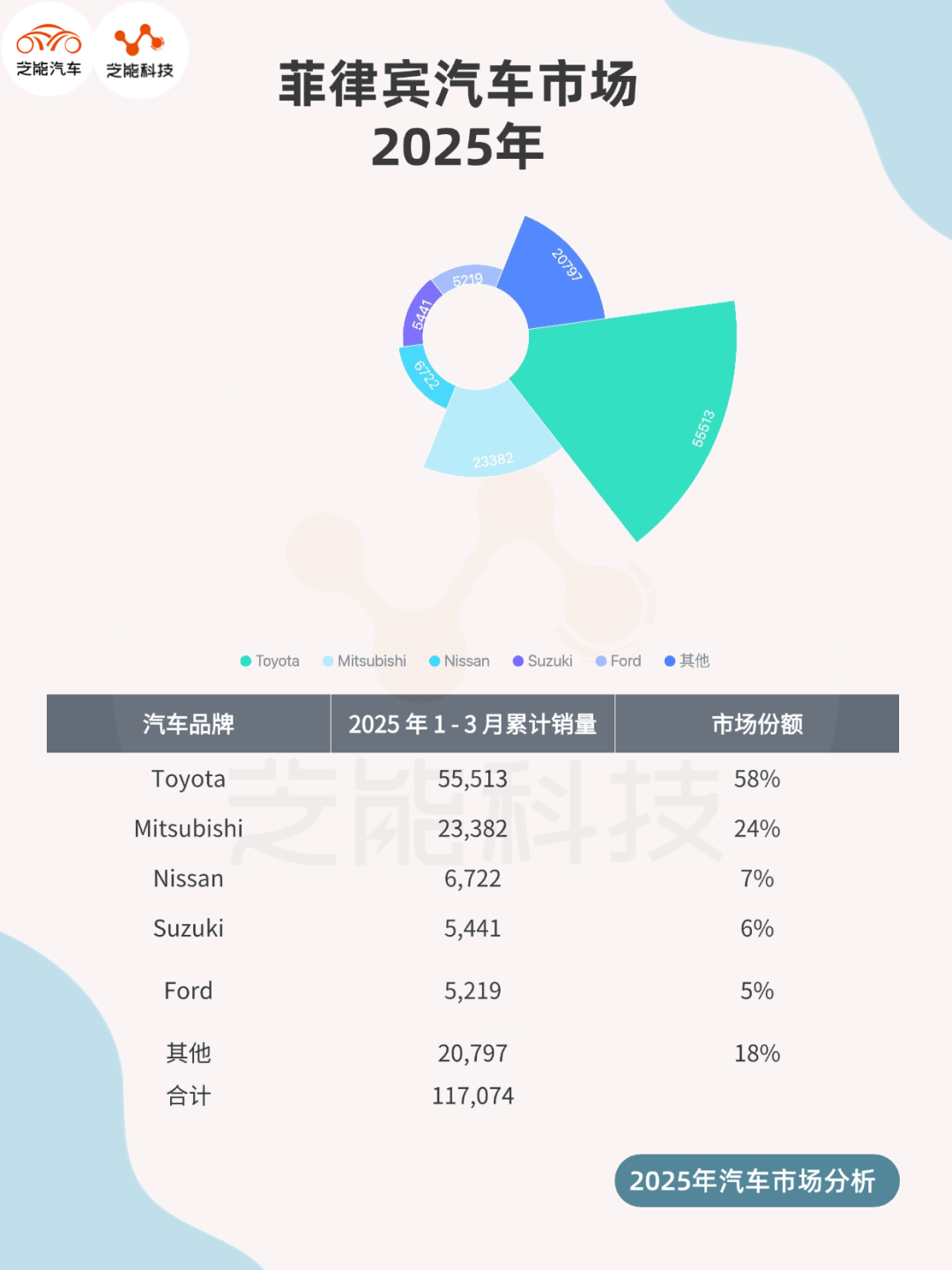

● Brand Performance

◎ Toyota Philippines continued to dominate with a 47.42% market share, selling 55,513 units in March (up 11.8% year-on-year) thanks to its diverse lineup of commercial vehicles and SUVs tailored to market demand.

◎ Mitsubishi ranked second with 23,382 units sold (up 12.1% year-on-year) and a market share of nearly 20%.

◎ Nissan placed third with sales of 6,722 units (down 15% year-on-year).

◎ Suzuki sold 5,441 units (up 23.8% year-on-year).

◎ Ford sold 5,219 units (a steep decline of 30.7% year-on-year), reflecting its lag in product updates.

Data for Chinese brands is pending disclosure.

02

Competitive Landscape Analysis

● The Philippine auto market exhibits a landscape characterized by "Japanese dominance with emerging players breaking through".

◎ Toyota firmly holds sway in both the commercial vehicle and passenger vehicle markets with its lineup of SUVs and pickup trucks like the RAV4 and Hilux, along with MPVs like the Innova. Its market share exceeding 48% is attributed to brand loyalty and an extensive dealer network.

◎ Mitsubishi maintains its second position, relying on the popularity of the L200 pickup truck and Xforce SUV.

◎ Suzuki experiences rapid growth fueled by the success of the Ertiga MPV and its low-price strategy.

◎ The decline of Nissan and Ford highlights aging products and sluggish market strategy adjustments, particularly Ford's lack of competitiveness in the commercial vehicle segment.

Competition in the new energy vehicle market is particularly intense. The government's zero-tariff policy has spurred demand for HEVs and BEVs, with Japanese models like the Toyota Corolla Cross HEV and Mitsubishi Outlander PHEV leading the market. However, Chinese brands such as MG4 EV and BYD (not yet part of CAMPI) are entering the market with low-priced BEVs.

RCBC observed that the low-cost EV strategies of China and Vietnam are exerting pressure on the Philippine market, compelling Japanese brands to accelerate their transition to new energy vehicles.

Furthermore, Ford intends to launch EV models in 2025 and establish training centers to enhance service capabilities, signaling its attempt to reverse its declining fortunes.

Summary

The Philippine market is transitioning between traditional fuel vehicles and new energy vehicles, with policy support and evolving consumer demand reshaping the competitive landscape. In the future, if Chinese brands can address their service deficiencies, they may emerge as formidable players. Meanwhile, Japanese brands must accelerate innovation to maintain their dominant position. While a sales target of 500,000 units in 2025 is achievable, natural disasters and economic fluctuations remain cautionary factors.