AMD Exceeds Expectations in Q1 2025 Financial Report: Surpassing Intel in PC Market, AI GPU Breakthrough on the Horizon

![]() 05/09 2025

05/09 2025

![]() 831

831

Produced by Zhineng Zhixin

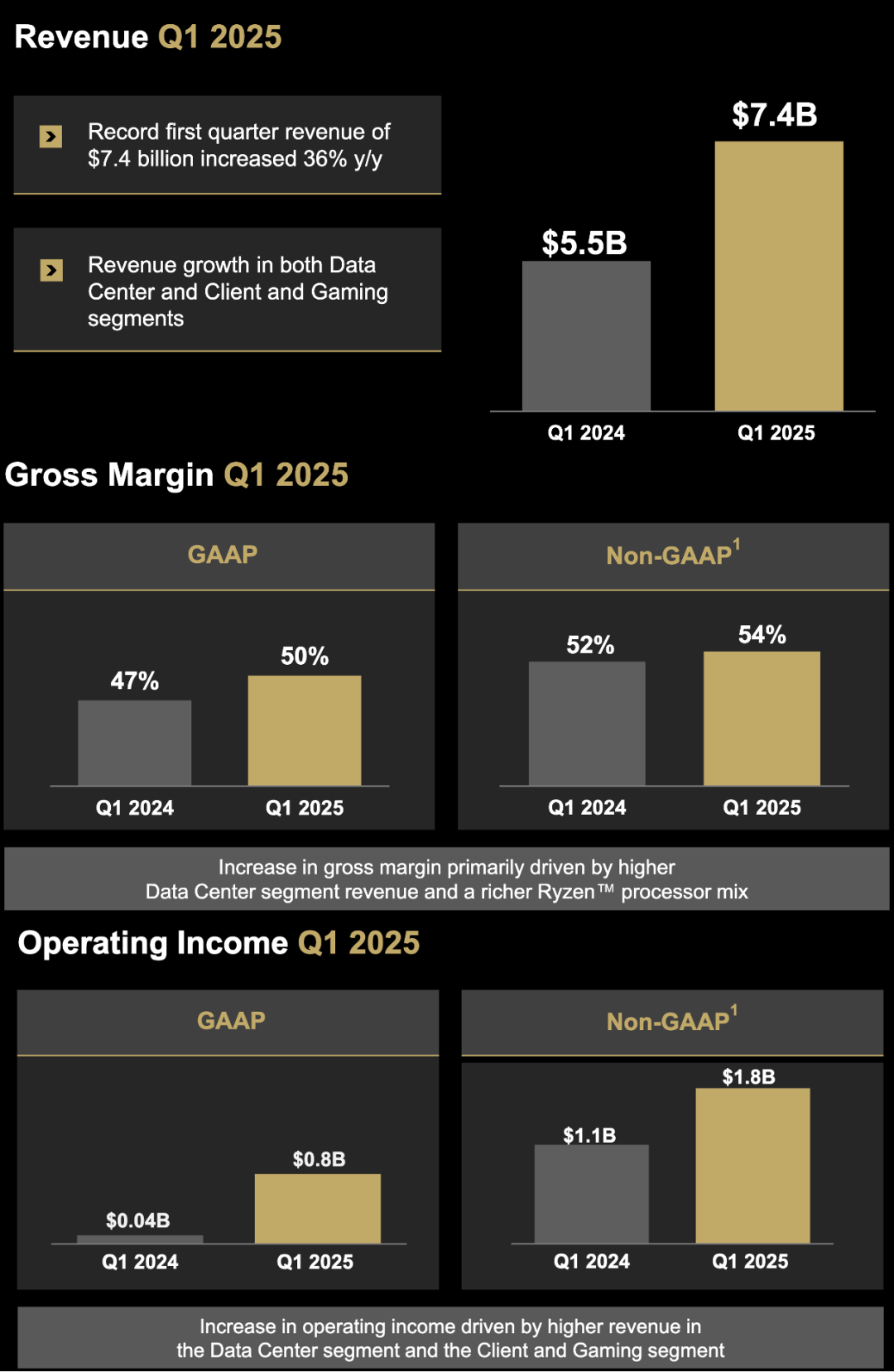

AMD's Q1 2025 financial report revealed exceptional results: revenue soared to $7.44 billion, marking a 35.9% year-on-year increase, with core operating profit surging 170% year-on-year.

Behind these robust figures lies AMD's continued capture of market share from Intel in the client CPU sector and steady expansion in the data center CPU market.

While AMD has firmly entrenched itself in the x86 CPU market, its AI GPU business is transitioning, with MI350 and MI400 anticipated as pivotal breakthroughs. However, sales disruptions due to export restrictions on MI308 will pose challenges in the coming quarters.

In the strategic game of competing with Intel internally and NVIDIA externally, has AMD discovered a path to breakthrough?

Part 1

AMD's Core Performance Analysis

In Q1 2025, AMD achieved revenue of $7.44 billion, surpassing expectations of $7.1 billion. With a net profit of $710 million (up 476%) and a core operating profit of $1.12 billion (excluding impacts), the company posted a 170% year-on-year increase, demonstrating strong fundamental resilience.

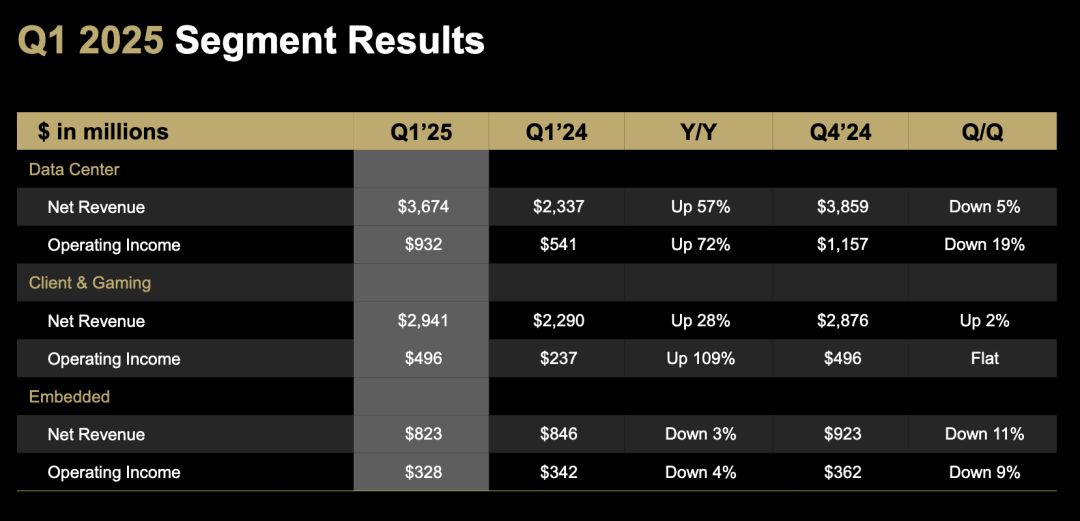

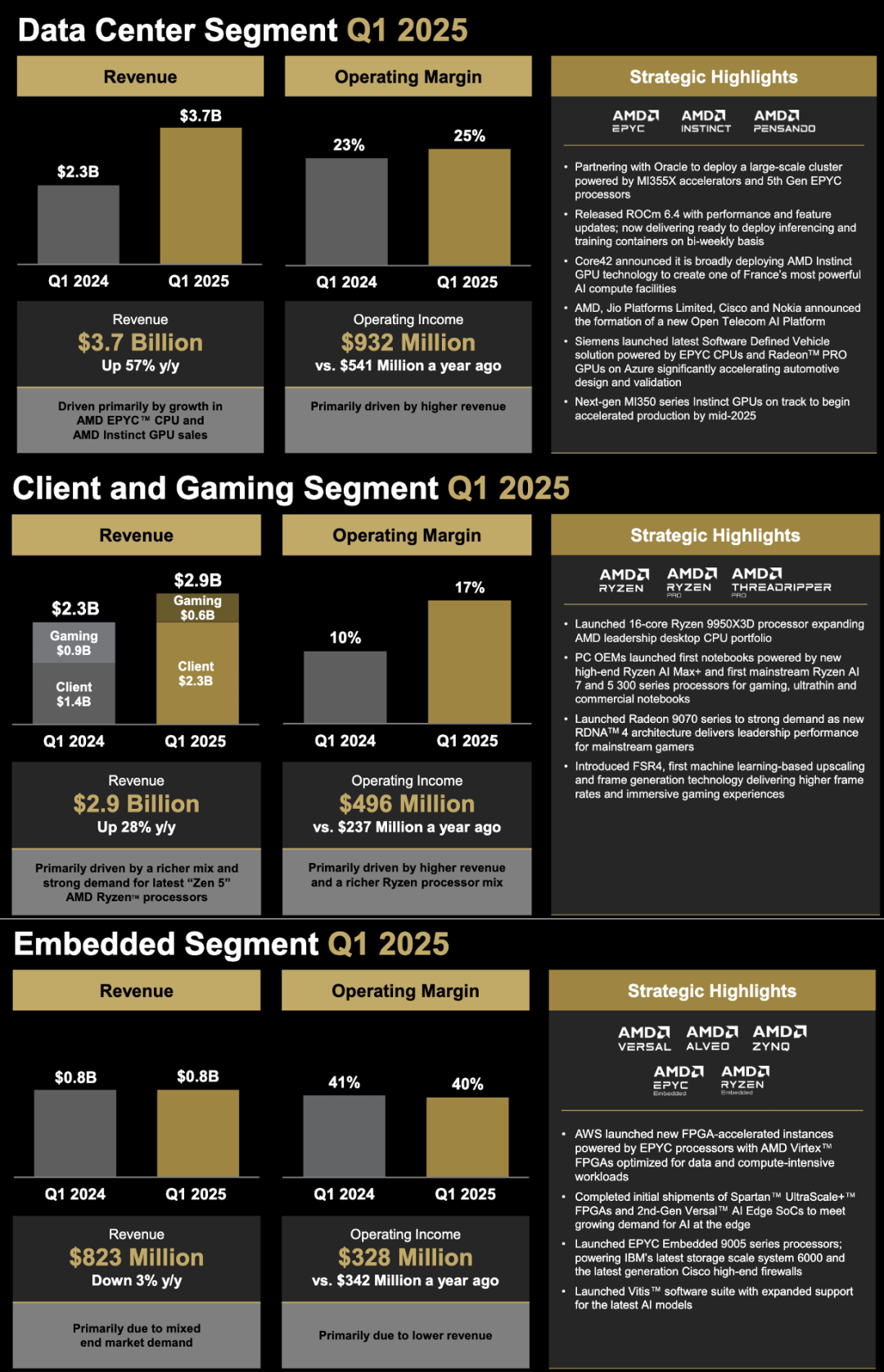

The primary drivers of this growth stem from the client and data center businesses, which collectively accounted for 80% of total revenue.

The client business excelled, with revenue jumping 67.7% year-on-year to $2.29 billion. Amidst the global PC market's recovery (5% year-on-year shipment growth), AMD significantly increased its market share in desktops and laptops, thanks to the continuous advancement of its Ryzen series CPUs, achieving a "partial overtaking" of Intel.

Data center business revenue reached $3.67 billion, up 57.2% year-on-year. Benefiting from the rising volumes of EPYC server processors, data center GPUs experienced a slight sequential decline compared to the sustained CPU growth. The market eagerly anticipates MI350 and MI400 to pave new avenues for AMD in the AI market.

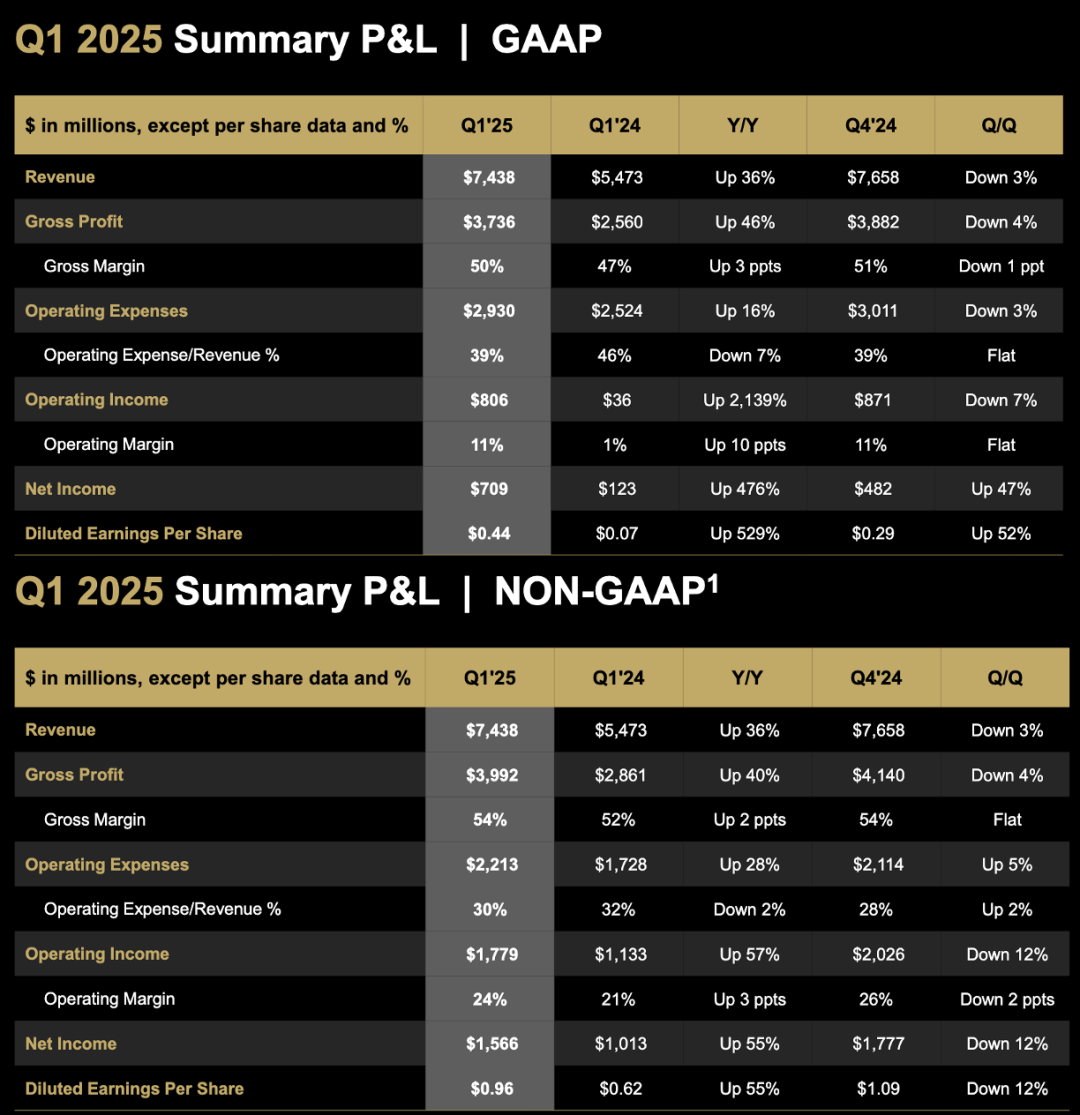

AMD's gross profit for the quarter stood at $3.74 billion, up 45.9% year-on-year, with a GAAP gross margin of 50.2%, an increase of 3.4 percentage points from the previous year but still below market expectations of 52.2%.

However, excluding the impairment impact on MI308 inventory due to trade restrictions, the company noted that the non-GAAP gross margin could reach 54%, indicating actual operating efficiency exceeds market expectations.

In terms of expenses, R&D expenditures amounted to $1.73 billion, up 13.3% year-on-year, while sales and administrative expenses were $890 million, up 42.9% year-on-year.

Collectively, operating expenses increased by 22% year-on-year, lower than the growth rate of gross profit, pushing the overall core profit margin to 15.1%.

Restrictions on the export of advanced AI chips have emerged as an unstable factor for AMD's short-term growth. MI308, a "special edition" for the Chinese market, currently requires additional licenses. AMD disclosed that approximately $800 million of inventory will be affected by these restrictions, equating to approximately $1.5 billion in sales impact at a gross margin of 47%, posing an "implicit" shock to Q2 performance.

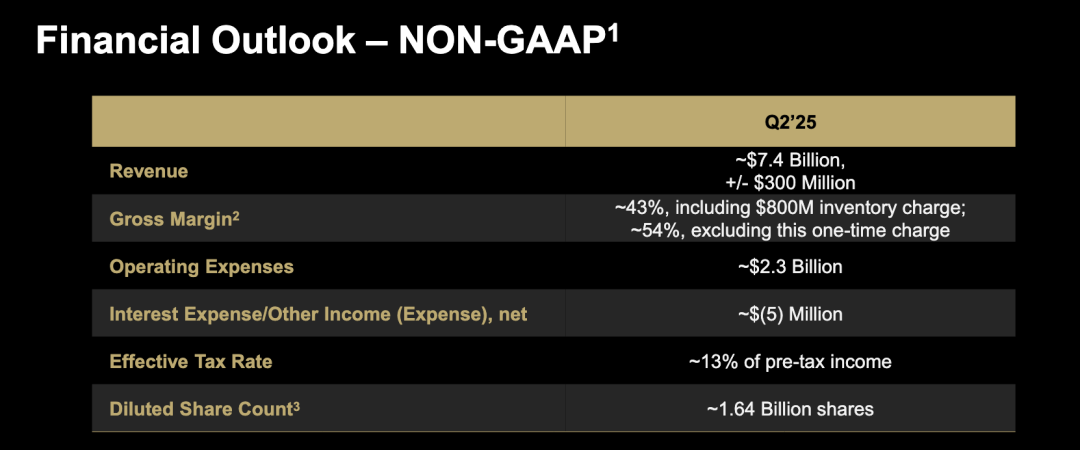

AMD set its Q2 revenue guidance at $7.1-$7.7 billion (midpoint of $7.4 billion, flat with Q1) and accounted for a negative impact of $700 million. Without export restrictions, actual revenue could have reached $7.8-$8.4 billion, representing a sequential growth of 5%-13%.

Revenue is estimated at approximately $7.4 billion, with a fluctuation of $300 million. Gross margin is approximately 43% including $800 million in inventory costs, or approximately 54% excluding this one-time cost.

Part 2

Evolution of Business Structure: CPU Expansion, GPU Breakthrough Pending

The client business was the fastest-growing segment this quarter, with a 67.7% year-on-year increase, significantly outpacing the global PC market's 5% growth. This surge was fueled by AMD's increased shipments in the mainstream market, indicating widespread recognition of its CPU cost-performance advantage among OEM manufacturers and consumers, particularly in niche markets like AI PCs and high-performance gaming laptops.

In the desktop CPU market, AMD has overtaken Intel, while in laptops, AMD is narrowing the gap and is expected to continue consolidating its advantage, maintaining its offensive against Intel.

The data center business remains AMD's largest revenue contributor, with a 57.2% year-on-year increase in this quarter, driven by robust CPU performance.

The EPYC series (Genoa, Turin) continues to erode Intel Xeon processor market share, with AMD's market share expected to have risen from around 10% to over 20%. However, the market is keenly focused on AMD's AI GPU product line.

MI325X has achieved mass production but still faces challenges competing directly with NVIDIA's H100 and H200 in both training and inference markets. The next-generation products, MI350 and MI400, are expected to enter mass production ahead of schedule in mid-2025 and 2026, respectively.

This implies that during the accelerated AI infrastructure development period, AMD will need to endure a short-term "GPU vacuum period."

AMD has taken decisive steps in its GPU product layout. The recent acquisition of server vendor ZT Systems lays a solid foundation for its AI GPU system solutions (like MI400 supporting systems), expected to enhance its end-to-end delivery capabilities for AI products.

Summary

AMD's Q1 2025 financial report reaffirms its transformation from a traditional PC chipmaker to a full-stack semiconductor platform company. Not only has it steadily surpassed Intel in the x86 CPU field, but it is also challenging NVIDIA in AI acceleration.

On the CPU front, AMD has firmly established itself in the high-end market, with future product upgrades and the rise of AI PCs expected to further bolster its market share. On the GPU front, despite being in a "strategic investment period," the upcoming launches of MI350 and MI400 could be pivotal turning points for AMD's breakthrough in the AI GPU market.

To compete effectively in the AI server market, AMD must address shortcomings in software ecosystems, GPU compatibility, and HBM supply chains to deliver a powerful "combination punch."