New Energy Vehicle Exports Soar 70%; China Association of Automobile Manufacturers: Record 10 Million Vehicles Produced and Sold in First Four Months

![]() 05/12 2025

05/12 2025

![]() 678

678

The current automobile market is experiencing a paradoxical yet promising phase—while price reductions lead to profit margins tightening, sales figures are on the rise. On May 12, the China Association of Automobile Manufacturers (CAAM) released the April market data, revealing an overall positive performance with steady year-on-year growth in production and sales. Notably, domestic demand potential accelerated, exports remained stable amidst global uncertainties, and new energy vehicles (NEVs) continued to surge ahead.

As the 'mid-year summary' looms for auto companies, CAAM, while refraining from predicting next month's market conditions, underscores the opportunity presented by the 'mid-year volume surge' for consumers considering car purchases or replacements.

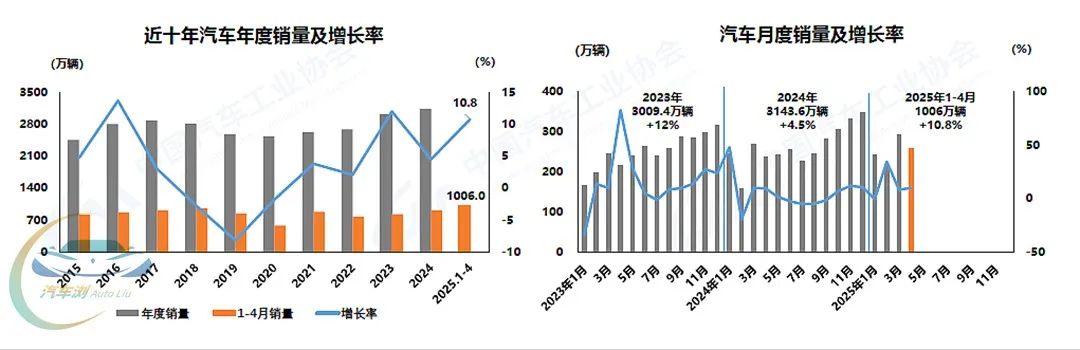

According to CAAM data, April witnessed automobile production and sales of 2.619 million and 2.59 million units, respectively, marking a monthly decline of 12.9% and 11.2% but a year-on-year increase of 8.9% and 9.8%. Cumulatively, from January to April, production and sales reached 10.175 million and 10.06 million units, respectively, up 12.9% and 10.8% year-on-year. Although the growth rates narrowed by 1.6% and 0.4% compared to the first quarter, the market hit a significant milestone: production and sales exceeded 10 million units in just four months for the first time ever.

Given the market conditions in 2024, this year's overall sales surpassing last year's figures is a foregone conclusion.

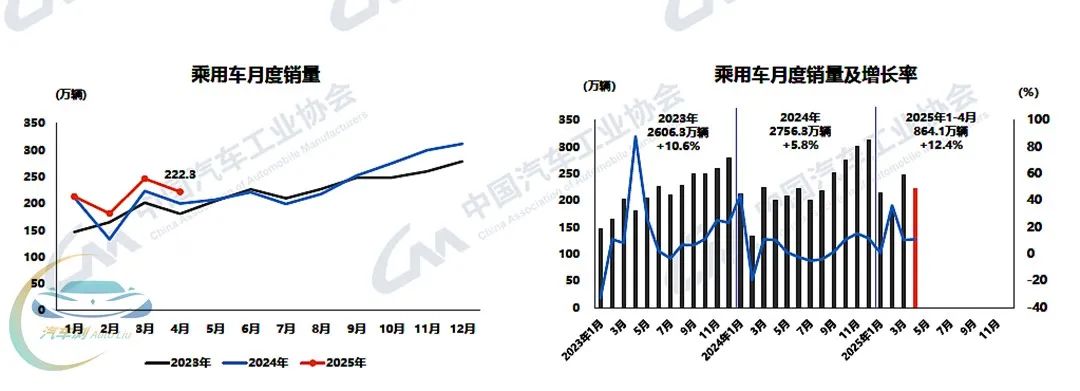

The commercial vehicle market, long in a downturn, is gradually recovering. However, passenger vehicles remain the backbone supporting the overall market data. In April, passenger vehicle production and sales amounted to 2.257 million and 2.223 million units, respectively, declining 12.4% and 10% monthly but increasing 10.2% and 11% year-on-year. From January to April, passenger vehicle production and sales accumulated to 8.765 million and 8.641 million units, respectively, up 14.5% and 12.4% year-on-year.

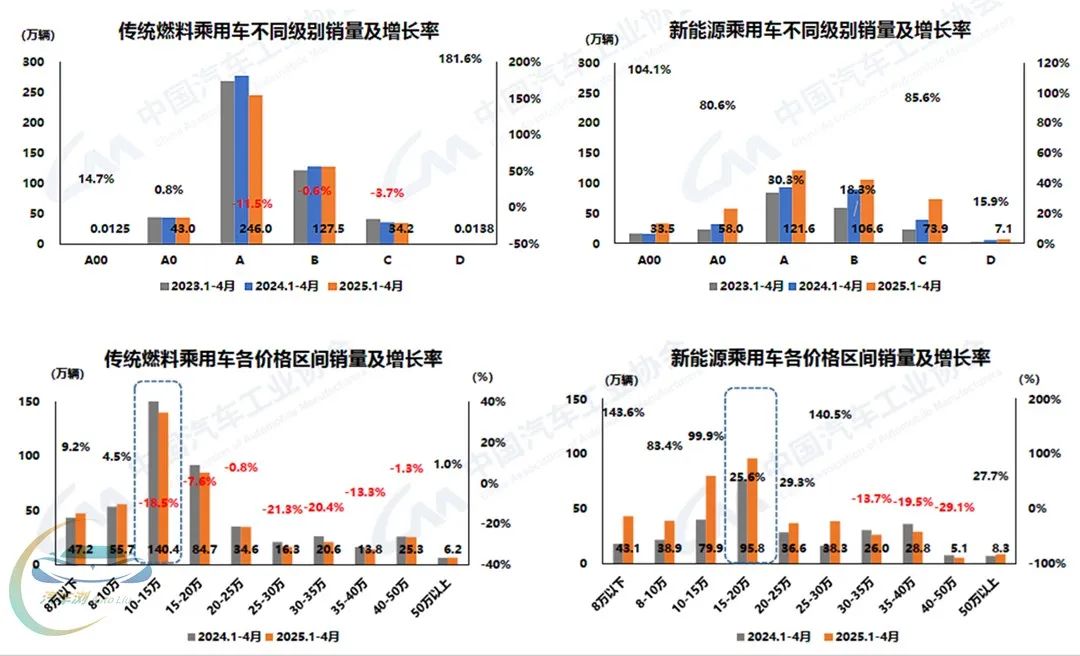

Traditional fuel passenger vehicle sales continue to decline, concentrated in the A-segment with cumulative sales of 2.46 million units, down 11.5% year-on-year. In contrast, NEVs show overall improvement, with sales concentrated in the A-segment and B-segment, totaling 1.216 million and 1.066 million units, respectively, up 30.3% and 18.3% year-on-year.

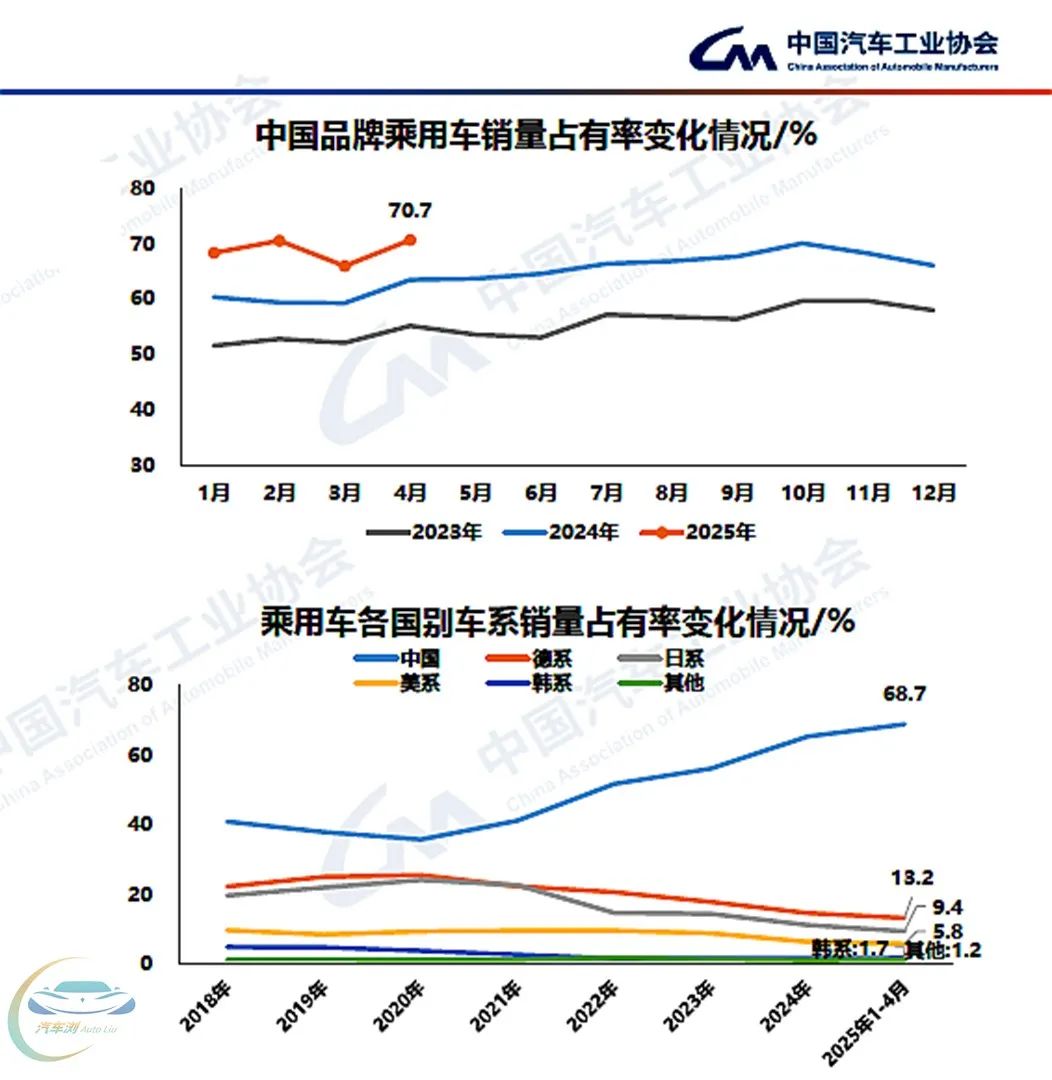

Chinese brands focusing on NEVs have continued to expand their market share. In April, Chinese brand passenger vehicle sales reached 1.571 million units, up 23.5% year-on-year, with a total market share of 70.7%, an increase of 7.1% over the same period last year. Cumulatively, from January to April, sales amounted to 5.94 million units, up 27.4% year-on-year, with a market share of 68.7%, an increase of 8.1 percentage points. Importantly, Chinese brands have achieved 'simultaneous growth in both volume and price.' CAAM highlights that 'China's high-end NEV brands have continued to develop rapidly, significantly increasing the share of high-end NEVs, leading consumption upgrades.'

Other country-specific vehicle lines have shown an 'arch' shape in sales. Except for minor improvements in German and American lines, other sales are near historical lows. However, given current market trends, joint venture brands have intensified efforts to introduce new NEVs this year, making market competition a relentless marathon.

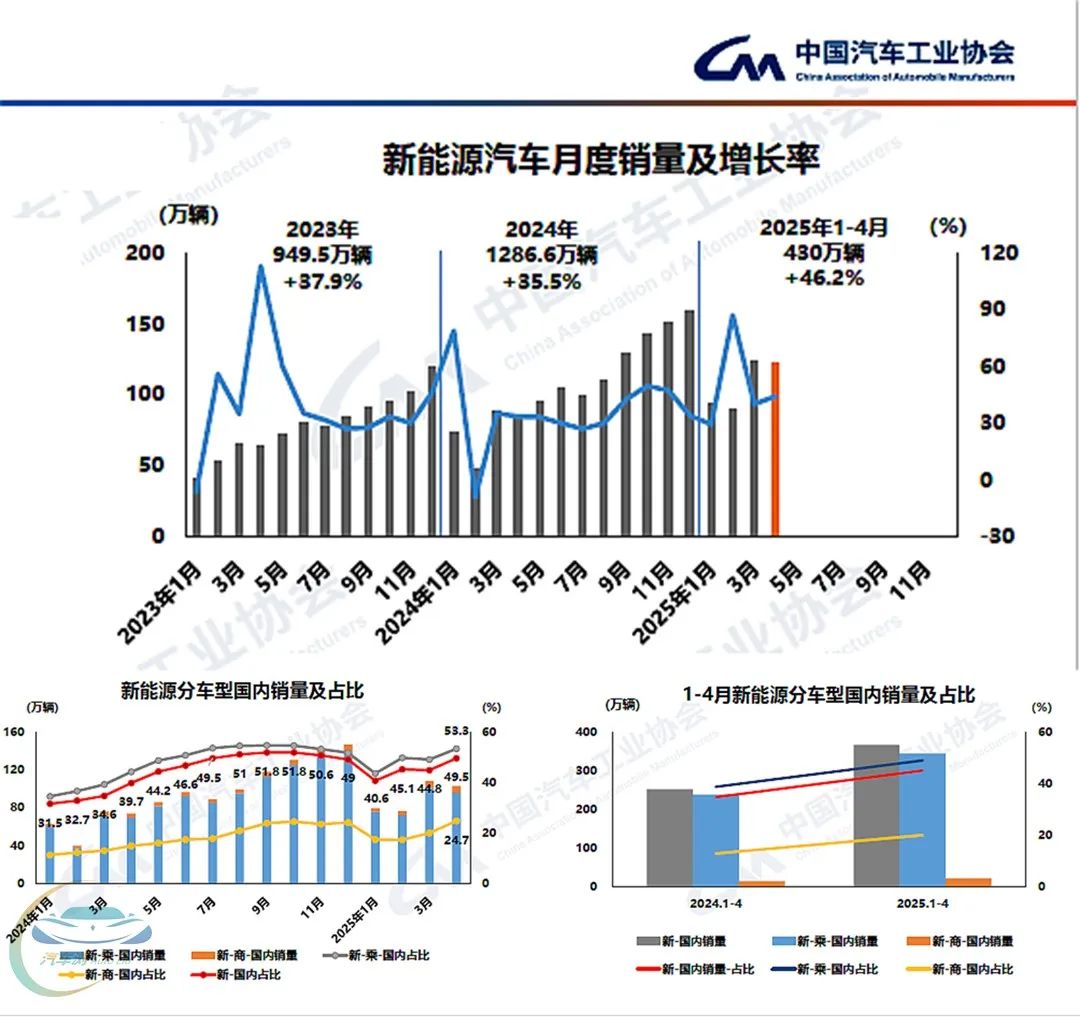

CAAM data indicates that in April, NEV production and sales reached 1.251 million and 1.226 million units, respectively, up 43.8% and 44.2% year-on-year. Combining passenger and commercial vehicles, NEV sales accounted for 47.3% of total sales.

Pure electric vehicle models remain the cornerstone of NEV sales: production reached 853,000 units, and sales hit 822,000 units, with a year-on-year sales increase of 58.4%. Plug-in hybrid models saw a notable decline in growth rate, with production and sales of 398,000 and 403,000 units, respectively, and a year-on-year sales increase of only 21.9%, a stark contrast to previous increases often exceeding 50%.

NEVs have also emerged as the driving force behind overseas exports. In April, domestic NEV sales reached 1.025 million units, down 5% monthly but up 39.3% year-on-year. Among these, domestic sales were 956,000 units, down 5.3% monthly but up 37.6% year-on-year. NEV exports stood at 200,000 units, up 27% monthly and 76% year-on-year, with 190,000 NEV passenger vehicles exported, marking a 28.2% monthly and 70.6% yearly increase.

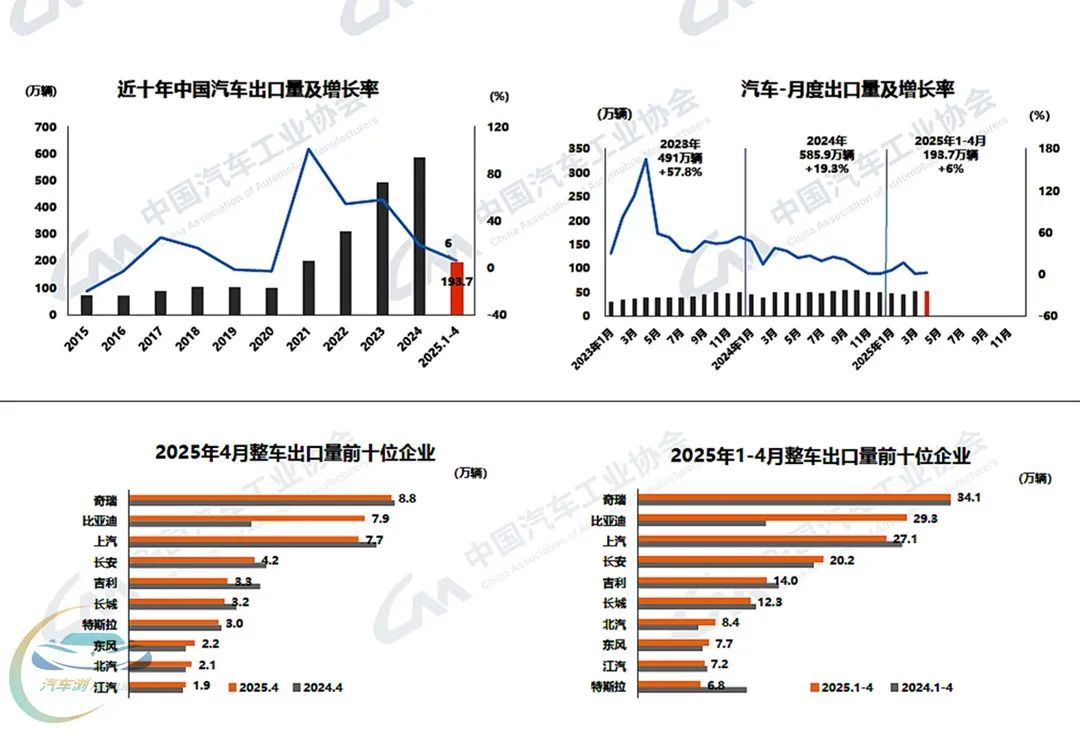

Correspondingly, in April, domestic automobile sales reached 2.073 million units, down 13.9% monthly but up 11.7% year-on-year; automobile exports totaled 517,000 units, up 2% monthly and 2.6% year-on-year. Traditional fuel vehicle exports amounted to 317,000 units, down 9.3% monthly and 18.7% year-on-year, whereas NEV exports reached 200,000 units, up 27% monthly and 76% year-on-year.

Cumulatively, from January to April, traditional fuel vehicle exports were 1.295 million units, down 7.9% year-on-year; NEV exports totaled 642,000 units, up 52.6% year-on-year. With Chinese auto companies shifting focus from traditional fuel vehicle exports to NEVs, China has not only become the world's largest exporter of complete automobiles but also the largest exporter of complete NEVs.