Li Shufu's premium dream, shattered at which intersection

![]() 05/22 2025

05/22 2025

![]() 537

537

Original by New Energy Outlook (ID: xinnengyuanqianzhan)

Full text: 3185 words, reading time: 10 minutes

Recently, Geely released its first-quarter financial report: sales reached 703,800 units in the first quarter, a year-on-year increase of 48%, with an annual target achievement rate of 26%; at the same time, Geely achieved operating revenue of 72.5 billion yuan, a year-on-year increase of 25%; net profit attributable to shareholders was 5.67 billion yuan, a year-on-year increase of 264%.

Image/Partial data from Geely's first-quarter financial report 2025

Source/Screenshot from New Energy Outlook on the Internet

This "high-growth" report card may seem glamorous, but it hides an awkward reality—the models that sell well for Geely are still low-priced.

Specifically, among Geely brands in the first quarter, models such as Yinhe E5, Xingyuan, Dihao, Xingyue L, Xingrui, priced below 200,000 yuan, contributed over 80% of sales; while models priced above 200,000 yuan, such as Lynk & Co Z10, Zeekr 7X, and Zeekr 001, accounted for less than 20% of total sales combined.

Even more distressing is that Lynk & Co and Zeekr, which once carried Geely's ambition to compete in the premium market, have not alleviated the deep-seated anxiety of Zeekr's premiumization strategy after the merger; Zeekr, which has been listed for less than a year, delisted from the US stock market and was fully integrated into Geely; and Geely's grand "multi-brand" strategy has now contracted to "One Geely".

On one side, the financial report data is booming, and on the other side, high-end brands are struggling. Where did Li Shufu go wrong on the path to premiumization?

1. Zeekr from "capital darling" to "strategic discard"?

As a crucial step in Geely's premiumization strategy, Zeekr's development journey dates back to March 2021, when it was spun off from Lynk & Co to develop independently.

At its inception, Zeekr quickly attracted consumer attention with its premium and differentiated positioning.

"I chose Zeekr 001 at the time because I was attracted by its stylish appearance and rich technological configuration. Among models of the same price range, Zeekr's product strength is very prominent."

"The exterior of the 001 is too unique, rarely seen on the market at the time. The body lines are smooth, with a zero-to-hundred acceleration of 3.8 seconds, frameless doors and hidden door handles, giving it a strong sense of technology, and a high turnaround rate on the road."

"I think the level of intelligence of Zeekr 001 was far beyond its peers at the time. Its ZEEKR AD full-scenario highly intelligent driving system uses 7nm Mobileye EyeQ5H dual chips, combined with the Eagle Eye Vision Fusion Perception System, making daily driving easy and safe. Features like adaptive cruise control are particularly useful on highways."

Image/Zeekr 001

Source/Screenshot from New Energy Outlook on the Internet

Thus, in the new energy vehicle market at that time, Zeekr precisely targeted the 300,000 yuan market segment with its unique design language, advanced technological configuration, and luxurious driving experience, becoming a dark horse in the market.

In May 2024, Zeekr's three-year IPO deployment was finalized, successfully listing on the US stock market, becoming the fastest carmaker from inception to listing.

However, behind this seemingly glorious listing lurked huge hidden dangers. To ensure a smooth listing, Zeekr made certain compromises in terms of valuation, etc. On the day of its listing, its total market value of $6.9 billion was nearly halved compared to its valuation of $13 billion after completing the A-round of financing, planting a ticking time bomb for its future development.

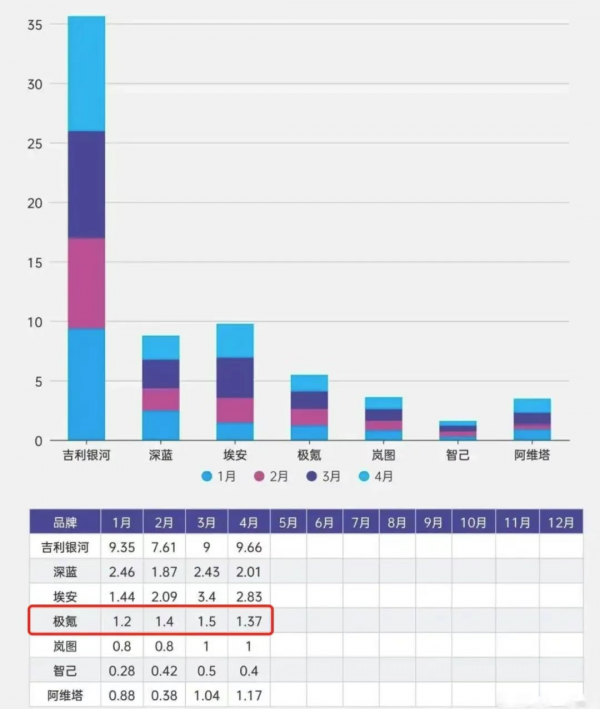

In 2025, although Zeekr's sales performance showed slight growth, its cumulative sales of 56,000 units from January to April were still far from its annual sales target, achieving only 17.2% of the annual target.

Image/Zeekr sales data from January to April 2025

Source/Screenshot from New Energy Outlook on the Internet

On May 4th, Zeekr's personnel adjustments seemed to indirectly confirm that Zeekr's current market performance is not as ideal as it appears on the surface. Lin Jie, Vice President of Zeekr Technology Group and General Manager of Lynk & Co Sales Company, took charge of the overall domestic marketing service work of the Zeekr brand, directly managing the brand marketing center, user growth center, and user delivery center.

On May 7th, Geely announced that it would acquire all issued shares of Zeekr. If the privatization proposal is implemented and completed, Zeekr will become a wholly-owned subsidiary of Geely Automobile, achieving privatization and delisting from the NYSE.

Shen Meng, Executive Director of Centaur Capital, believes that the deep-seated reason for Zeekr's privatization may be that after its independent listing, Zeekr did not form an independent development path and did not meet the expectations of the initial spin-off listing. And in recent times, against the backdrop of increasing invisible pressure on Chinese concept stocks, continuing to retain the identity of a US Chinese concept stock does not align with the maximization of interests for both Geely and Zeekr.

2. Why did Geely abandon the "multi-child" strategy?

Zeekr's privatization seems to be the first step in Geely's implementation of the "One Geely" strategy.

However, looking back at Li Shufu's car-making journey, five years ago, he firmly adhered to the multi-brand strategy of "the more children, the better the fight", so why has he suddenly changed direction now?

From sales data, in recent years, although Geely has continued to expand its market share in the new energy field with an extensive brand layout covering different market segments, its cumulative sales of new energy vehicles from January to April were 465,000 units, and its domestic new energy penetration rate of 54% hit a record high, which largely benefited from the market dividend of rapid industry development.

Image/Geely April sales bulletin

Source/Screenshot from Eastmoney.com and New Energy Outlook

Breaking it down by brand, it is not difficult to find that not all is favorable behind the multi-child strategy. As market competition intensifies, its costs are gradually emerging—brand internal friction, vague positioning, scattered resources, and other issues have plunged Geely's path to premiumization into a quagmire.

Taking Zeekr and Lynk & Co as examples, both face young consumer groups and focus on technology and sports within Geely's brand matrix, and some models are built on the same SEA vast architecture.

In terms of technology, Lynk & Co initially transitioned from fuel to new energy, with most of its models being hybrids. But last year, facing the increasing benefits of the pure electric market, Lynk & Co also began to launch pure electric models such as Z10 and Z20. Zeekr, on the other hand, was initially a pure electric brand and began to deploy hybrids this year, with the Zeekr 9X expected to be launched in the third quarter of this year.

Image/Zeekr 9X

Source/Photographed by New Energy Outlook

It is worth noting that Zeekr and Lynk & Co not only exhibit a high degree of convergence in target customer groups, technical parameters, etc., but also have highly similar logo designs, with only solid and hollow differences.

Undoubtedly, this homogenized competition not only Scattered the R&D and marketing resources of the enterprise , but also weakens its brand competitiveness to a certain extent, making it difficult to further expand market share. At the same time, in terms of marketing, due to each brand fighting its own battle and lacking a unified marketing strategy, marketing resources are wasted, and the effect of brand promotion is greatly reduced.

Most consumers believe that although Geely has many new energy brands, their positioning is very confusing, and the discernibility between models is getting lower and lower, making it difficult to distinguish who is the main player.

Image/Lynk & Co Z10-Lynk & Co Z20

Source/Screenshot from New Energy Outlook on the Internet

"I used to think Lynk & Co was very sporty and Zeekr was very premium, but now the two brands feel about the same, and I don't know how to choose."

"I originally wanted to buy a Geely new energy vehicle, but after looking around, I found that the models of Zeekr, Lynk & Co, Yinhe, and other brands were dazzling, and I didn't know which one to choose, so I gave up the purchase plan altogether."

Gui Shengyue, CEO and Executive Director of Geely Automobile Holdings Limited, said that facing fierce market competition and an increasingly complex economic environment, Geely Automobile can only change its past image of small and scattered brands, conduct in-depth integration, and concentrate the company's resources into one fist to have a chance of winning in the fierce competition.

3. Does Li Shufu's premium dream still have a chance?

As Gui Shengyue said above, the current competition in the new energy sector is almost white-hot. New forces and traditional automakers have unsheathed their swords, seizing market high ground with an endless stream of new products and technologies.

From April this year to date, multiple new energy vehicle models such as the AITO M8, AVATR 06, SL09, Lixiang L6 Smart Renewal Edition, and Weilai Gaoshan 8 have been launched intensively, forming a "saturation attack" on the price band above 200,000 yuan.

Thus, the challenges faced by Geely on its path to premiumization are undoubtedly severe.

However, this does not mean that Geely has no turning point under the predicament.

On May 15th, Geely launched the "One Geely" strategic integration plan, indicating that it has already recognized its shortcomings and is actively adjusting its strategy to try to find a way out of the predicament.

Image/Scene of the "One Geely" strategic integration plan briefing

Source/Screenshot from New Energy Outlook on the Internet

According to the information currently disclosed by Geely, the "One Geely" strategy will break the situation where its sub-brands fight their own battles and integrate resources such as research and development and supply chains to enhance overall competitiveness.

It should be emphasized that this is not the first time Geely has proposed "returning to one Geely". As early as 2014, the Geely Group proposed implementing the "One Geely" strategy due to the blurry positioning of its three brands—Englon, Dihao, and Global Eagle—which made it difficult to seize the market.

The next year, Geely Dihao won first place in the sales ranking of Chinese brand sedans with a performance of over 200,000 units.

Therefore, for Geely's integration strategy once again, the market feedback is still positive.

At the same time, looking at Geely's product matrix, some of its models currently already possess premium characteristics to a certain extent, demonstrating market competitiveness that cannot be underestimated. For example, the Zeekr 009 Guanghui, with its core strength, made Zhou Hongyi choose it over a Maybach; the Zeekr 9X, with its unique design style, was crowned by the consumer market as the "Hangzhou Bay Cullinan".

Image/Zeekr 009 Guanghui Edition

Source/Photographed by New Energy Outlook

In addition, judging from the real feedback of many consumers, although Geely's future path to premiumization needs repair, it also has a clear outline.

"The Zeekr 009 Guanghui Edition has given me a new understanding of domestic MPVs. The comfort of the airline seats and the energy replenishment efficiency of 5C supercharging are not inferior to million-yuan imported cars. However, if some differentiated upgrades can be made to the rear intelligent interaction system, the premium attributes will be more prominent."

"The mech-style design of the Zeekr 9X is unforgettable. The door handle-free electric door design, which is only found in million-yuan SUVs, does have the style of a 'small Cullinan'. However, compared to the NIO ET9 and Zenith S800, Geely's marketing to high-end car owner circles is not precise enough. I hope it can be further refined in the future."

Image/NIO ET9-Zenith S800

Source/Screenshot from New Energy Outlook on the Internet

In addition to potential customer groups, the evaluations of Zeekr and Lynk & Co owners towards their own vehicles and brands also seem highly persuasive.

"I've been driving my Zeekr 001 for almost a year now, and I'm very satisfied with both its range and smart configuration. I feel it fits well with our young group, but it would be better if it had higher visibility. That way, when I drive out, the elders around me won't always ask me what kind of car this is."

"I feel that Lynk & Co balances fashion and technology very well. If only the after-sales service could be improved, optimizing the service process would be great. Sometimes the waiting time for vehicle maintenance is too long."

Based on this, in the future, if Geely can further clarify and distinguish its brand positioning, optimize marketing strategies, and at the same time increase investment in innovation in core technologies such as the three-electric system and intelligent driving, accurately breaking through the market, Li Shufu's premium dream still has the potential to be realized.

However, in terms of the current industry competition pattern and Geely's own development rhythm, whether its "One Geely" strategy can truly help the brand move up still needs to withstand the test of time.

[Header image generated by AI]