Is Honda Slowing Down Its Electrification Push with Investment Cuts and Hybrid Focus?

![]() 05/22 2025

05/22 2025

![]() 544

544

Introduction

Honda's unveiling of its new 2025 plan can be seen as a strategic recalibration based on the evolving market landscape.

"Honda never gives up."

On May 21st, Honda China's official WeChat account emphasized the brand's unwavering commitment to future growth with this headline. The release of Honda's 2025 global business plan underscores the company's growing awareness in China that enduring the pain of industry transformation and Chinese competition cannot be sustained indefinitely.

In this industry-wide battle, as consumers increasingly question foreign brands and make more autonomous purchasing decisions, Honda's adherence to its market and brand confidence seems out of step with the current Chinese automotive market.

Regarding electrification, Honda has outlined several plans in recent years. Even in overseas markets, it has leveraged the GM Ultium platform for the Prologue and partnered with Sony for the highly anticipated AFEELA 1.

However, divergent market perceptions of electrification have not only rendered Honda's efforts ineffective but also caused hesitation in crucial technology decisions.

Honda's new global business plan for the next stage represents a reassessment of the industry's future and a realignment of its technical direction. However, for the Chinese market, the focus is on whether Honda can deliver a compelling answer to the concerns of Chinese users.

Last year, Honda embarked on a new electrification journey with "Ye" as its starting point, aiming to reshape its image in China. Yet, this determination alone is insufficient. Regardless of how the new plan showcases Honda's technological prowess and capital advantages, decisions must translate into action amid the chaotic Chinese market.

In this fiercely competitive environment, the Chinese auto market remains as enigmatic as Honda's current situation in China. To truly address its challenges, plans, no matter how novel, are just that—plans. To keep pace with market evolution, it hinges on Honda's subsequent actions.

01 Divergent Trends: Separate Strategies for China and Overseas Markets

In the new plan, Honda reaffirms that developing pure electric vehicles (EVs) is the optimal path to carbon neutrality. With this understanding, Honda will continue to advance its electrification transformation.

However, considering global market shifts, such as fluctuating environmental regulations slowing the EV market's growth and economic and trade policy uncertainties impacting business development, Honda must weigh multiple factors to ensure its electrification investments yield desired results.

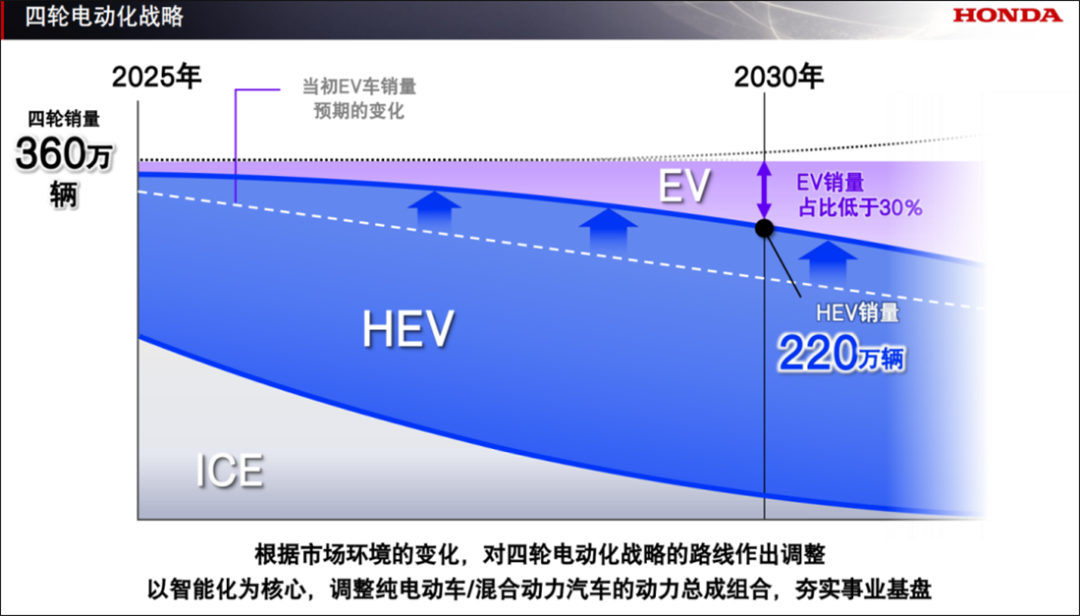

Given the current market slowdown, Honda's new plan estimates that the sales share of EVs in 2030 will fall short of the previously targeted 30%. To address this, Honda plans to enhance the competitiveness of EVs and hybrid vehicles with intelligence at their core, while adjusting its powertrain product matrix to solidify its business foundation.

Put simply, amid weaker EV market growth, Honda aims to continue exploring the potential of engine-powered vehicles. Simultaneously, it will invest more in intelligence-related technologies to stay competitive.

From 2027 to 2030, Honda will globally launch 13 new-generation hybrid models to diversify its product lineup and meet growing market demand, further demonstrating its unique perspective on EV prospects.

Regarding Honda's product line changes in China, while the new plan doesn't specify, clues emerge from Honda China's actions over the past year.

Especially at the April Shanghai Auto Show, where Honda stated it would strengthen cooperation with Chinese enterprises to navigate the new cycle, it hinted at a shift from its previous stubbornness.

Honda's commitment to local production and sales, strengthening the supply chain for effective policy change responses, remains a precautionary measure. However, its plan to jointly develop a new-generation ADAS suitable for Chinese roads with Momenta, and equip all future Chinese models with this technology, signals a significant shift.

While Honda publicly states it's independently developing a new-generation ADAS for widespread use in its main products like EVs and hybrids in North America and Japan by 2027, it's willing to relinquish some autonomy in intelligent R&D in China. If implemented as planned, Chinese consumers may soon see Honda EVs akin to Toyota BZ3X and Nissan Ariya.

Ultimately, entering 2025, Honda's declining sales in China and struggles to gain recognition for its existing EV products have forced it to make concessions.

The Chinese auto market is no longer easily dominated by introducing mature products. Volkswagen and Toyota understood this long ago, leading to numerous localized EVs. For Honda, this reality, however unpalatable, must be accepted.

02 Is Honda Finally Focusing on China?

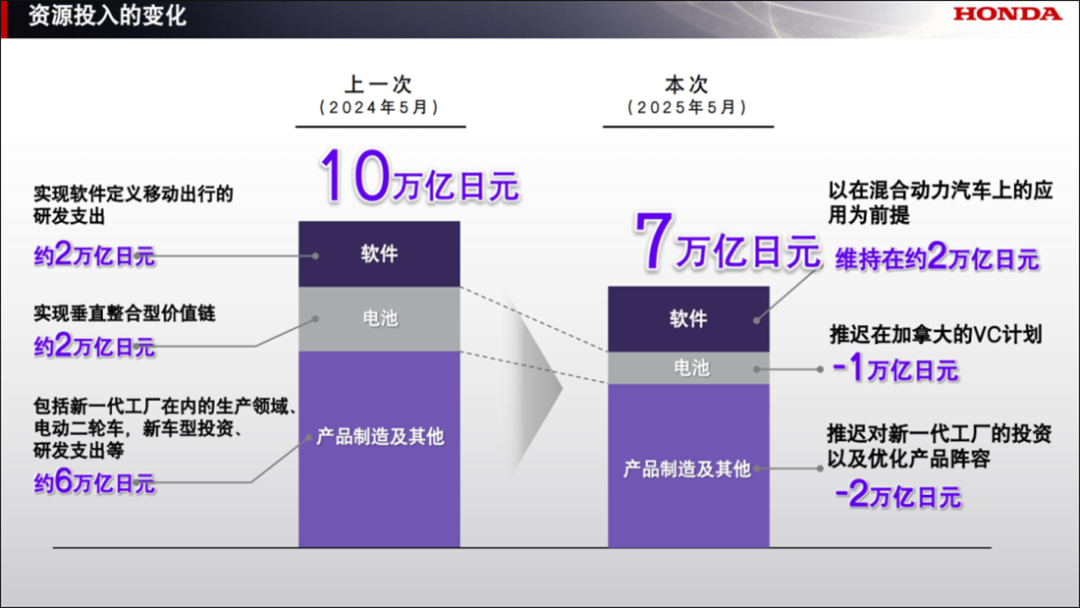

Given the global slowdown in EV demand, Honda has reduced its electrification investment from 10 trillion yen to 7 trillion yen by fiscal year 2031. The adjusted strategy prioritizes hybrid research and production, aiming for more efficient energy use through technological upgrades of existing fuel vehicle platforms—a understandable move.

However, the Chinese auto market's uniqueness remains significant.

Within Honda's business, motorcycles have always been its primary profit source, unlike its automotive division. This means that between market expansion and profit-making, Honda's automotive business naturally chooses the latter, perhaps explaining its reluctance to sacrifice profits for regional market development.

In China, over the past few years, whether shifting away from sports labels to focus on family use with new Fit, Civic, and Accord models, or adopting Honda's familiar EV development approach, the essence has always been pursuing better profit returns.

Through strategic adjustments, Honda hopes to sell over 3.6 million four-wheelers by 2030, with hybrid sales reaching 2.2 million. This approach aims to align with market trends while avoiding irreversible harm from radical reforms.

However, looking at foreign automakers' experiences in China, simply aligning with money won't suffice in this ruthless market.

Unlike deep-pocketed giants like Volkswagen and Toyota, even Mazda, another Japanese company, has leveraged Chinese automakers' advantages to create the EZ-6 and EZ-60. Not wanting to follow Mitsubishi's footsteps and be forced out of China due to lack of clarity, partnering with Chinese enterprises is the best solution.

Don't foreign automakers understand the completeness of China's EV supply chain and its obvious cost advantages?

Their adherence to self-centered car-building amidst this critical juncture might stem from the glittering foundation laid over the past 20+ years. Companies accustomed to dominance often believe Chinese consumers' brand loyalty can withstand significant market changes.

By actively collaborating with Chinese technologies like Momenta and CATL, and planning to produce local EVs suited to Chinese users, Honda has seen the writing on the wall. Will it make new adjustments before then?

Perhaps. Honda China's new plan includes these key sentences:

"Beyond electrification, Honda believes that strengthening innovation in intelligence and promoting it widely at more competitive prices will be the key."

"Honda will leverage its own advantages... and scale benefits to create competitive, low-cost products, providing users with high-value mobility at competitive prices."

While unclear which global market Honda's declaration targets, the phrase "more competitive prices" is indeed exciting given China's market reality.

Amid industry-wide fierce competition and price wars raging for over a year, since participants can't change it, Honda's focus on price suggests its interest in price wars.

In summary, Honda has its unique electrification transformation understanding and timeline. From global to China, different markets lead to varying development scenarios. It's hoped Honda can deliver solutions meeting everyone's expectations and navigate this challenging period.

Editor-in-Charge: Li Sijia, Editor: He Zengrong