National Team Steps In: Lianchuang Electronics Set for Major Transformation!

![]() 12/25 2025

12/25 2025

![]() 439

439

On December 25, Lianchuang Electronics made a significant announcement. Its controlling shareholder, Jiangxi Xinsheng Investment Co., Ltd. (hereinafter referred to as "Jiangxi Xinsheng"), entered into a Share Transfer Agreement with Nanchang Beiyuan Intelligent Industry Investment Partnership (Limited Partnership) (hereinafter referred to as "Beiyuan Intelligence"). According to the agreement, Beiyuan Intelligence will make staggered payments totaling RMB 900 million to acquire 70,866,100 non-restricted tradable shares of Lianchuang Electronics currently held by Jiangxi Xinsheng. These shares represent 6.71% of the total outstanding shares of the listed company.

Once the aforementioned share transfer is completed, Beiyuan Intelligence will assume the role of the company's controlling shareholder. Consequently, Jiangxi State-owned Assets Venture Capital will become the company's indirect controlling shareholder. Furthermore, the company's actual controller will shift to the Jiangxi Provincial State-owned Assets Supervision and Administration Commission.

On the same day, Lianchuang Electronics also revealed that it had signed a Conditional Share Subscription Agreement with Jiangxi State-owned Assets Venture Capital. Under this agreement, Jiangxi State-owned Assets Venture Capital plans to subscribe for up to 189 million shares that the listed company will issue to specific investors, with the subscription to be settled via cash payment.

Following the completion of this share issuance, and without accounting for potential share number variations due to other factors, and based on the maximum proposed share issuance, Jiangxi State-owned Assets Venture Capital will directly hold 189 million shares of the company. This will account for 15.19% of the total outstanding shares of the listed company post-issuance.

Upon the completion of both the aforementioned share transfer and stock issuance, Jiangxi State-owned Assets Venture Capital will directly and indirectly hold a combined 20.89% of the total outstanding shares of the listed company post-issuance. As a result, the company's controlling shareholder will transition to Jiangxi State-owned Assets Venture Capital, with the Jiangxi Provincial State-owned Assets Supervision and Administration Commission remaining as the actual controller. Thus, the company's ultimate controller will continue to be the Jiangxi Provincial State-owned Assets Supervision and Administration Commission.

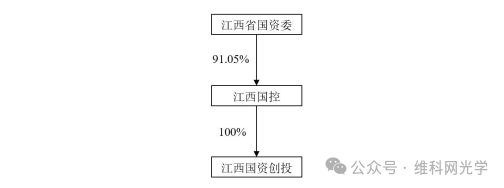

As of the announcement's disclosure date, the equity control structure of Jiangxi State-owned Assets Venture Capital is depicted in the figure below:

Regarding the purpose of this fundraising initiative, Lianchuang Electronics clarified that after deducting issuance expenses, all proceeds will be allocated to bolster working capital and settle interest-bearing liabilities.

Lianchuang Electronics reiterated its unwavering commitment to the optical industry. The company is actively pursuing innovation and transformation, continuously refining and adjusting its product portfolio, expanding product offerings, and enhancing product quality. This share issuance is poised to strengthen the company's financial position, support its high-quality development trajectory, and establish a robust foundation for its strategic pivot towards the automotive optics sector.

Financial data indicates that in the first three quarters of this year, Lianchuang Electronics reported revenue of RMB 6.489 billion, reflecting a 16.20% year-on-year decline. However, the net profit attributable to the parent company surged to RMB 50.9202 million, marking a substantial 210.26% year-on-year increase.

In early December, reports emerged that Lianchuang Electronics achieved another pivotal strategic milestone in the automotive optics domain in 2025, successfully securing its inaugural PGU mass production project, which boasts industry-leading performance parameters.