A Tenfold Revenue Disparity: Why Does DJI Regard Insta360 as a Significant Competitor?

![]() 12/26 2025

12/26 2025

![]() 398

398

In shopping malls, it's common to find Insta360 stores located in close proximity to DJI outlets.

These two Shenzhen-based firms, despite having a revenue difference exceeding ten times, have been locked in an intense competition over the past six months. Their rivalry has expanded from the Chinese market to the global stage. How did this situation come about?

DJI stands as the global leader in drones, reporting a revenue of 80 billion yuan and a net profit of 12 billion yuan in 2024.

It's important to note that DJI is not a publicly traded company, and the revenue and profit figures are sourced from a research institution. These figures, likely estimated based on market share and widely cited by the media, possess a certain degree of credibility.

Conversely, Insta360 is a global frontrunner in panoramic action cameras, yet its revenue for the same period amounted to only 5.6 billion yuan, with a net profit of 1 billion yuan.

Although they may not appear to be direct competitors at first glance, DJI clearly perceives Insta360 as a formidable opponent.

Following the launch of its panoramic drone, Liu Jingkang, the founder of Insta360, remarked, "The performance of our panoramic drone was achieved under the watchful eye of certain industry giants."

On December 15, the Economic Observer published an article titled "The Supply Chain Showdown Between DJI and Insta360," highlighting DJI's tight control over its supply chain, with some suppliers being pressured to choose sides.

As the year draws to a close, tensions between the two companies remain high. How did Insta360 emerge as such a formidable rival to DJI?

01

Comprehensive Siege

On December 4, Insta360 unveiled the world's first panoramic drone, the Insta360 A1, priced at 6,799 yuan after national subsidies.

The product's standout feature is that users can focus solely on the flight path without needing to adjust the camera orientation simultaneously. The perspective can be freely adjusted during post-production, significantly lowering the barrier to drone photography.

Image Source: AI Generated

Four days later, Liu Jingkang sent an internal memo stating that the Insta360 A1 had encountered "unconventional and intense attacks."

He emphasized that the panoramic drone generated over 30 million yuan in sales within 48 hours of its Chinese launch, countering numerous online claims that "sales were only in the hundreds of units, far below expectations."

A search for "A1 sales" on social media platforms indeed yields a substantial volume of related discussions.

Facing significant public opinion pressure during the initial sales period of the new product, it's understandable that Liu Jingkang was restless.

The internal memo also mentioned that over the past six months, as many as 33 core suppliers for Insta360's drones had faced "exclusivity" pressure, with even distributors being suppressed.

According to the Economic Observer, suppliers cited various reasons, but the core issue was DJI's larger order volume, making it a customer they couldn't afford to offend.

DJI employees, however, argued that many suppliers had grown alongside DJI and had been nurtured with resources, making it seem unfair for Insta360 to simply reap the benefits.

Insta360's panoramic drone project commenced in 2020 and took over five years to develop from scratch.

Liu Jingkang stated in the internal memo that over the past few years, the company had "prepared for the worst" by establishing a secondary supply system. This enabled them to switch suppliers within a limited timeframe, reconstructing a more autonomous and controllable supply chain structure, which he described as safeguarding the product's "lifeline."

Additionally, a "Supplement to Shop Lease Agreement" circulated online, stating, "No third-party brands with strong competitive relationships to DJI products shall be introduced or allowed to open brand stores in the 'Hunan Photography City.' It emphasized that brands with strong competitive relationships primarily referred to Insta360.

Image Source: Economic Observer

Li Qingci, Insta360's China sales head, stated that since 2023, they have frequently received feedback from distributors across the country about DJI's exclusivity tactics.

From the supply chain to the sales chain, DJI appears to have launched an "all-out war" against Insta360.

02

The Emergence of a New Challenger

The growth trajectories of DJI and Insta360 actually share many similarities.

DJI may see echoes of its own past in Insta360.

Firstly, both companies have pioneered untapped markets through cutting-edge technological innovation.

Wang Tao's early focus on flight control algorithms and gimbal-level stabilization technology enabled DJI to successively launch market-leading products such as drones, handheld stabilizers, and action cameras, particularly dominating the drone market with a 70% global share.

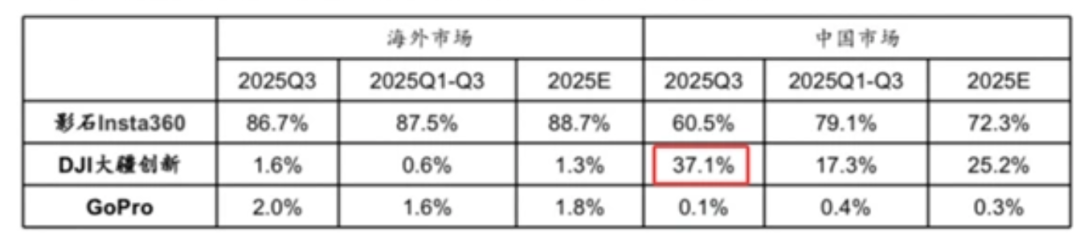

Liu Jingkang, on the other hand, based his approach on self-developed 360-degree panoramic stitching algorithms, expanding from panoramic cameras to panoramic action cameras and then to panoramic drones. By 2025, Insta360 is expected to hold over 85% of the global panoramic camera market.

Both companies also adopted a market strategy of targeting overseas markets before domestic ones, amassing a large overseas fan base.

However, the market conditions for their core products differ significantly.

According to BaiLian Strategy, the global drone market reached $5.445 billion in 2025 and is expected to grow to $10.96 billion by 2032, with a compound annual growth rate of 10.51%.

In contrast, the global panoramic camera market grew from 3.2 billion yuan in 2020 to 5.85 billion yuan in 2024, with an expected market size of around 6.61 billion yuan in 2025, indicating a slowing growth rate.

With their core businesses nearing saturation and their core technologies beginning to converge, both companies have chosen to venture into each other's territories.

Image Source: DJI Official Website

In July, Insta360 officially announced the Insta360 A1, entering DJI's drone territory. Just days later, DJI launched its first panoramic camera, the Osmo 360, priced lower than similar products from Insta360.

Additionally, DJI's panoramic drone is rumored to be launching soon.

After going public this year, Insta360's market value briefly exceeded 100 billion yuan, providing it with the capital to compete with DJI.

Insta360 has also attracted several key employees from DJI, including Zhang Bo, DJI's former vice president of sales.

According to Leiphone, Zhang Bo now serves as Insta360's China sales head, driving the development of its distributor network.

Doesn't the vibrant Insta360 resemble the early days of DJI?

03

Cross-Border Competitors Lurk in the Shadows

This year, Meituan's food delivery business faced significant competition from JD.com and Alibaba, clearly demonstrating that even in stable industries, disruptors can emerge.

Failing to eliminate disruptors means suffering the consequences.

Insta360 has entered DJI's drone territory, while DJI has ventured into Insta360's panoramic camera market.

What are the unresolved questions in this battle?

Who will dominate aerial panoramic photography? Who will become the preferred tool for content creators? Who will be the first to establish a growth model driven by both consumer and industrial-grade products?

Image Source: Frost & Sullivan

Of course, this year has also seen an increase in such horizontal expansions.

DJI has leveraged its algorithms and motor advantages to enter the robotic vacuum cleaner industry.

Dreame, which started as a robotic vacuum cleaner manufacturer, is not only planning to produce drones but also aircraft, automobiles, and smartphones.

OPPO, Vivo, and Honor are also eyeing DJI's strong gimbal camera market, with potential Pocket product launches next year.

Even in the relatively immature 3D printing sector, DJI has engaged in fierce competition with Bambu Lab, investing in Bambu Lab's competitor, Intelligent Projects.

Every sufficiently large niche market is being targeted by powerful cross-border competitors.

The ongoing "all-out war" with Insta360 may only be a prelude for DJI, as cross-border competition could become the new norm.